PaaS, IaaS and SaaS Providers…Moving Up and Down the Cloud Stack | Gaining Altitude in the Cloud

As the market for cloud services expands, the providers at each level of the stack are realizing various opportunities beyond their core solutions. They are also realizing that scale is absolutely critical for the success of cloud services. As a result, they’re starting to enter each others’ domain. Let’s take a look.

Platform-as-a-Service (PaaS) Providers

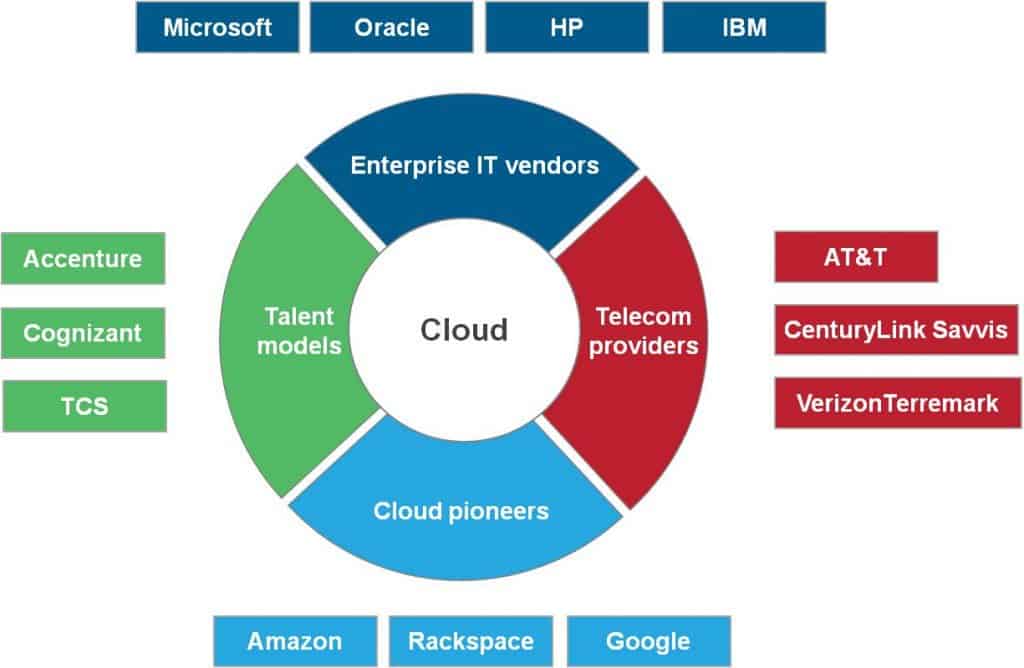

Large PaaS providers such as Microsoft and Google are moving down the stack to create Infrastructure-as-a-Service (IaaS) offerings. This may indicate not only that standalone PaaS is a difficult business to scale but also that IaaS is required to create a broader cloud footprint and higher degree of acceptance, as evidenced by Amazon’s runaway success with AWS. At the current stage of cloud adoption, PaaS may appear to be too futuristic, and many organizations may be unwilling to bet on it for the long term. Therefore, it makes sense for PaaS providers to offer IaaS solutions to their clients.

Most PaaS providers, and their respective platforms – think CloudBees, dotCloud, Salesforce.com’s Force.com and Heroku, Google Apps Engine, IBM SmartCloud Application Services, Iron Foundry Web Fabric, LongJump, Microsoft Windows Azure, Morphlabs, OutSystems, RedHat OpenShift, and VMware CloudFoundry – have preferred programming languages, e.g., .Net for Microsoft Windows Azure, Java for CloudBees, Python for Google Apps, and Ruby for EngineYards. These preferences bind clients to a specific platform offering, as they believe that a PaaS solution typically works best with its preferred or native language. However, to scale their business and appeal to a broader set of application developers, these providers are beginning to widely support multiple programming technologies.

Infrastructure-as-a-Service (IaaS) Providers

IaaS providers are desperately claiming agnosticism in running any application on their infrastructure. They believe as their offerings are pure infrastructure, developers are free to choose any programming mechanism and build applications. However, they also realize that the developer community finds value in a PaaS solution as it reduces their burden of handling various time consuming, nitty-gritty application development tasks. Therefore, many IaaS providers are moving up the stack and creating PaaS solutions on top of their infrastructure offerings, in partnership with leading cloud platform providers such as Iron Foundry or LongJump.

Indeed, many cloud infrastructure players are also partnering with cloud database companies and calling themselves PaaS providers. They are unable to decide whether they truly want to embrace the cloud or just rehash their existing offerings and cloud-wash them with marketing buzz. Regardless, their attempts are to at least make some noise around IaaS, SaaS, and PaaS and position themselves as “integrated” cloud providers.

Software-as-a-Service (SaaS) Providers

Large SaaS providers, such as Salesforce.com and NetSuite, have created their own versions of PaaS, and Workday partnered with Force.com to offer customers a platform on which to customize its solution. These moves not only allow extension of these companies’ basic offerings and integration with other applications; they are smart strategies to convert clients to their platforms. Therefore, these PaaS solutions end up being the “relationship builder” between a technology provider and the client.

Clearly, IaaS providers are realizing that cloud infrastructure is a low-profit, commoditized business and that they must move up the value chain. PaaS providers understand that they need to scale their offerings and that may require them to enter the IaaS market either organically or through partnerships. And SaaS players are already creating PaaS solutions to provide value added services.

The reality is…not all cloud service providers will be able to endure, and many will get consolidated or go belly up. The survivors, who aspire to be big, will be those that offer services across different cloud layers, either through in-house offerings or partnerships.