The Blind Side Blitz: How Business Users Impact Next-Generation IT Spend | Gaining Altitude in the Cloud

Seemingly out of nowhere, users hit enterprise IT spend on its blind side. Like a blitzing 265-pound football linebacker that the quarterback doesn’t see running up behind him to tackle him, business units and end users blitzed past the IT group and rapidly adopted cloud, mobile and other next-generation IT solutions wherever and whenever they could. Like the quarterback, enterprise management had a blind side and didn’t see or block the sudden force of the “consumerization of IT” coming to barrel through the sanctioned processes of purchasing IT. This blind side play changed the IT game in a profound way and has massive implications for all players.

In football, unblocked linebackers coming up on the blind side don’t just happen; several factors are necessary to create the right conditions for this disrupting phenomenon. The same is true for the recent blitz impacting enterprise IT spend.

Over the last few years, enterprises reacted to adverse and unpredictable economic conditions by reducing overhead wherever possible. This significantly constrained CIO budgets, forcing many IT departments to decrease their expenses year on year. The tactic reduced the IT group’s ability to drive change in the business and slowed the ability to respond to business needs.

Finally balance sheets improved and companies emerged from the belt-tightening period. Eager for growth, they now look favorably on business projects with strong ROI. However, IT is still slow to address new business needs, including the IT components of these initiatives. At the same time, business leaders and end users are exposed to, indeed inundated with, a new range of easy-to-access affordable, offerings that are readily available through channels other than their enterprise IT department. Voila — the right conditions for the blitz.

Implications

Let’s first consider the implications for the business stakeholders leading the blitz. Their new buying freedom combined with the easily accessible IT components creates refreshing and sorely needed agility and flexibility. Projects that, in the past, would have advanced slowly now race ahead at an ever-increasing pace.

Instead of detailed requirement documents and unending interdisciplinary team meetings, they can conceive, launch and evaluate pilots with minimal capital and time, allowing the business to experience the technology before making significant commitments. Business stakeholders’ perspective is that management’s forgiveness is easier than gaining up-front buying permission, and IT can work after deployment to address compliance issues.

Enterprise IT groups can’t deny the new reality and must lead, follow or get out of the way of the momentum and power of user-based IT buying. They cannot stand against the strong business cases for these business-driven initiatives. Many CIOs look the other way or add a team member to the program and claim victory.

Nevertheless, CIOs and top management eventually must address the complexity these solutions will add to the enterprise. We can only hope they start preparing for it more quickly than happened with the massive disruption caused by distributed computing, which took enterprise IT a decade to untangle.

The business users’ IT spending blitz also hit the blind side of IT providers, and the implications for providers are as significant as they are for consuming enterprises. Many traditional providers of IT and IT services are troubled by the fact that they are not reaping the significant growth opportunities resulting from the new spending on cloud, mobile and other next-gen IT products that other vendors are enjoying. Why not?

New game plan for IT providers

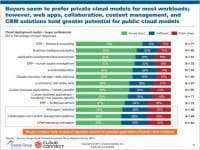

The enterprise IT market is obviously alive and well. But there are now two distinctly different markets for next-generation IT, so IT providers must change their marketing and sales tactics.

The first market segment accounts for 75 percent of the total spend and has all the traditional ROI buying characteristics. Value is tied to objectives such as as reducing enterprise cost.

To increase their share of the second segment (currently 25 percent of next-gen IT spend), enterprise IT providers must understand that the buyers’ perception of value has changed.

Although value is still wrapped in ROI, an important new criterion is whether the solution will meet the ROI objectives in a timely manner. In addition, the business stakeholder’s confidence in the solution’s success is more important than competitive pricing. These two characteristics drive business buyers to opt for pilots to learn more about the solution before they extend their commitment.

Clearly the ROI drivers differ for buyers in these two market segments. Therefore, IT providers seeking high growth must develop different marketing messages, pricing and delivery models for each segment.

Furthermore, as both segments often exist within an enterprise, it is unlikely that the same sales personnel can successfully sell to both markets.

IT providers that want to quickly move to capture the new opportunities in next-generation IT spend will be more successful if they fully understand buyers’ changed perception of value and approach the market in this fashion.