Tackling Technology Talent Management to Ensure Continued Enterprise Satisfaction | Blog

Post-pandemic, enterprises have given IT service and technology providers high marks for improving commercial models and customer-centricity, but talent management is emerging as a major concern. Customers want their providers to ensure resource availability, improve employee quality, and manage attrition – all during the Great Resignation and current labor shortage. Discover a framework for effective talent management in this blog.

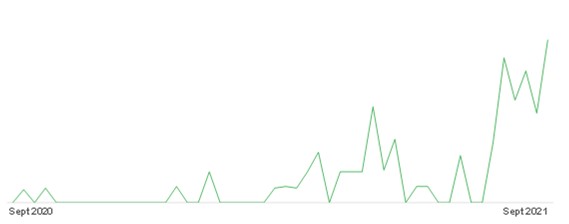

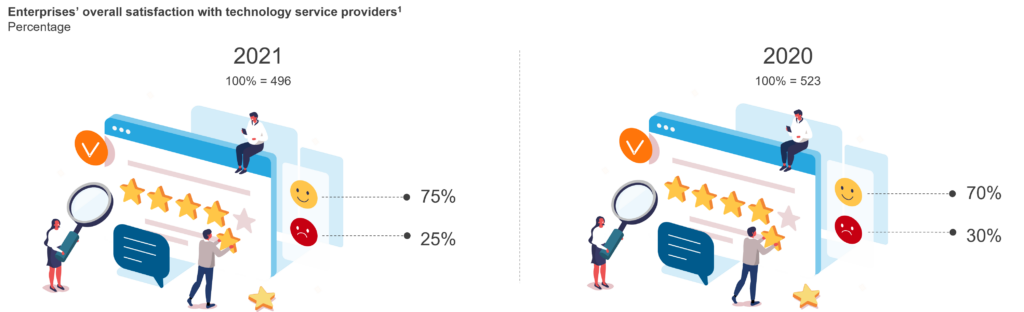

Emerging from the pandemic, IT service and technology providers’ enterprise satisfaction ratings increased for the second consecutive year, moving up from 70% to 75% last year, according to our IT Services Enterprise Pulse Report 2022.

After enduring the turmoil and uncertainty of the pandemic, enterprises surveyed said they valued IT service and technology providers’ efforts to adapt to sudden enterprise demand shifts, take a more customer-centric approach, and offer flexible and transparent commercial relationships.

However, talent management – or attracting, selecting, and retaining employees – has emerged as a key pain point for enterprises, along with the lack of value-add and innovation from providers.

Providers need to resolve their technology talent management issues to ensure continued growth in enterprise satisfaction levels going forward and prevent workforce issues from negatively impacting their customers’ project timelines, costs, and quality.

What do enterprises want from their IT service and technology providers?

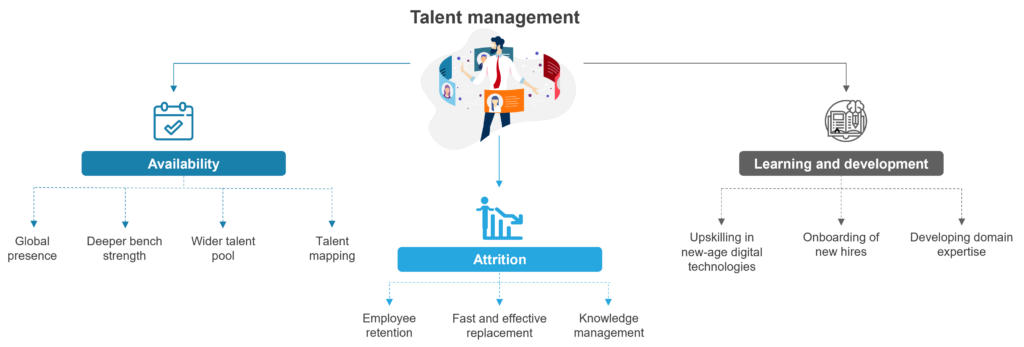

Most importantly, talent management and attrition have become key focus areas for enterprises, and they want their IT service and technology partners to ensure talent availability, invest in learning and development, and manage attrition. Enterprises surveyed said they expect their partners to ensure that the right talent with the right skills is available to them at the right time and place.

They also desire:

- Partnerships – Enterprises are looking for IT service and technology providers to transcend from being services and technologies providers to strategic partners they can have balanced and forward-looking relationships with

- Innovation and collaboration – They want partners to collaborate with them more often and bring new and innovative ideas to the table. Customers are looking for openness from providers about what they can and cannot do so they can jointly decide the best way forward

- Transparency – Customers seek transparency and flexibility in project management, delivery, and commercials. They expect their IT service and technology providers to showcase high levels of customer-centricity and be responsive and proactive

- Technology skills – As enterprises around the world pump up their technology modernization efforts, they want providers to combine their technical and domain expertise in delivering services powered by new-age digital themes like cloud modernization, automation, Artificial Intelligence (AI)/Machine Learning (ML), etc. contextualized to enterprises’ business landscape and challenges

Enterprise satisfaction state

These might sound like big desires, but providers have been doing a good job delivering on most of them. Let’s take a look at the current state of enterprise satisfaction.

IT service and technology providers have fared well in helping enterprises navigate through the post-pandemic world and meet their business objectives like cost reduction. Enterprises are satisfied with client management, commercials, and technical expertise and are increasingly viewing providers as strategic partners.

Here’s how the scores have improved:

Technology talent management – a key enterprise concern

Despite the many positives, IT service and technology providers are struggling to manage attrition and ensure talent availability and quality, making their partners unhappy. While enterprises recognize that IT service and technology providers are trying to improve their talent management, a lot more needs to be done.

Even before the pandemic and Great Resignation, enterprises were worried about their IT service and technology providers’ talent management initiatives, and the recent turn of events has made this lack of focus more glaring and detrimental to enterprises’ business objectives.

In our survey, companies said they expect their partners to ensure that the right talent with the right skills is available to them at the right time and place – and that’s no small feat.

While the talent management issue is impacting enterprises across industries and geographies, it is more prominent in Banking, Financial Services, and Insurance (BFSI), and manufacturing as resource availability and retention are major problems.

Enterprises in the Middle East and Latin America have been the most vocal about their dissatisfaction with providers over technology talent management. In a separate Everest Group study, Technology Skills and Talent: Reimagining Talent Acquisition and Management with Technology Platforms, we found that the project readiness quotient of the talent pool in skills such as Artificial Intelligence (AI), SAP HANA, Oracle Cloud, and security is considerably low with a significant spike in demand for critical roles in data and AI, security, and cloud.

Enterprises want their partners to ensure talent availability, invest in learning and development to improve quality, and manage attrition by ensuring employee retention and faster replacement of exiting talent, as shown below:

How to move forward

As IT service and technology providers struggle with managing attrition, ensuring resource availability, and improving the overall quality of talent, enterprises suffer because it affects project timelines, cost, and quality.

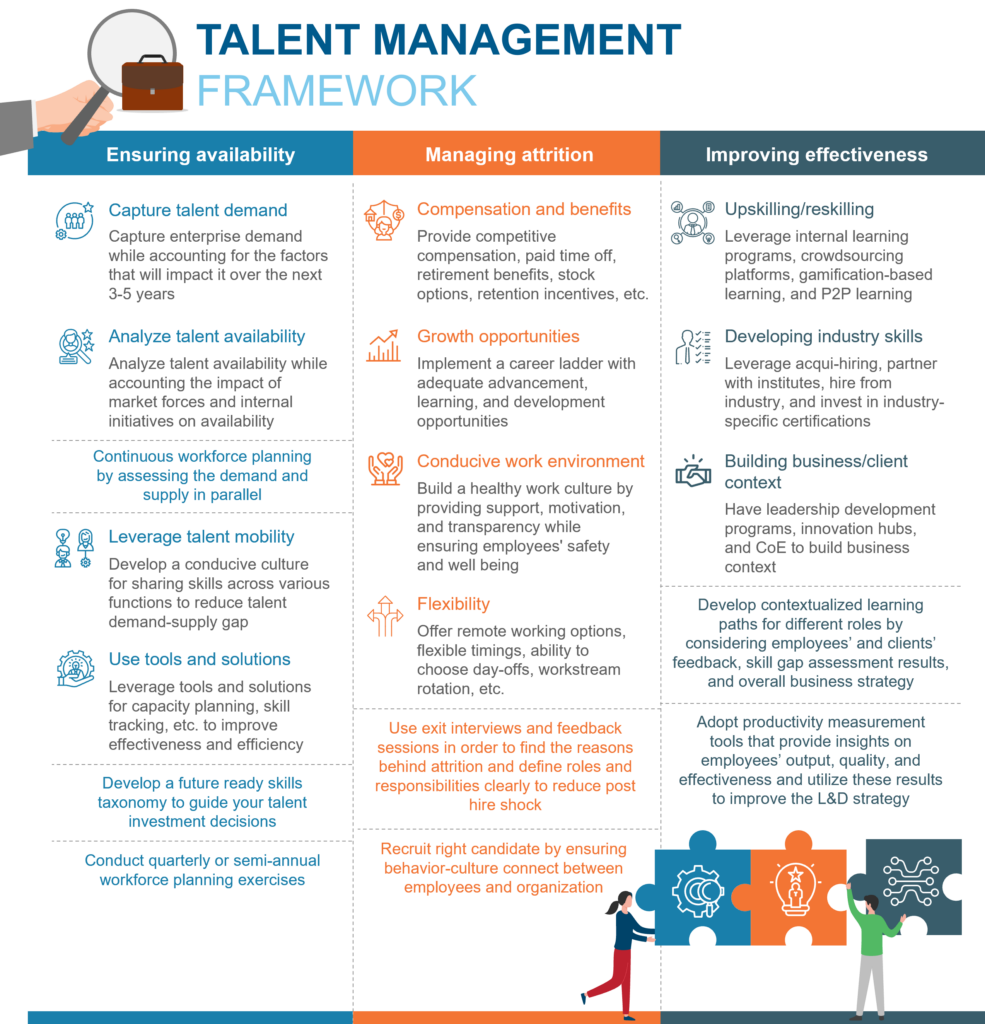

IT service and technology providers need to adopt a continuous workforce planning model keeping in mind the factors that impact talent demand and supply. They also must take a holistic approach to manage attrition by being employee-centric and investing in learning and development to improve employees’ effectiveness.

Talent management framework

With the framework illustrated above, IT service and technology providers can solve the talent availability, attrition, and reskilling conundrum and ensure the high levels of enterprise satisfaction seen post-pandemic last going forward.

To explore more on your talent management strategy, read our IT Services Enterprise Pulse Report 2022, or reach out to us at [email protected], [email protected], and [email protected].

You can also discover key strategies best-in-class companies are deploying to position themselves for success in our webinar, Planning for a Recession: Is the War for Tech Talent Finally Over?