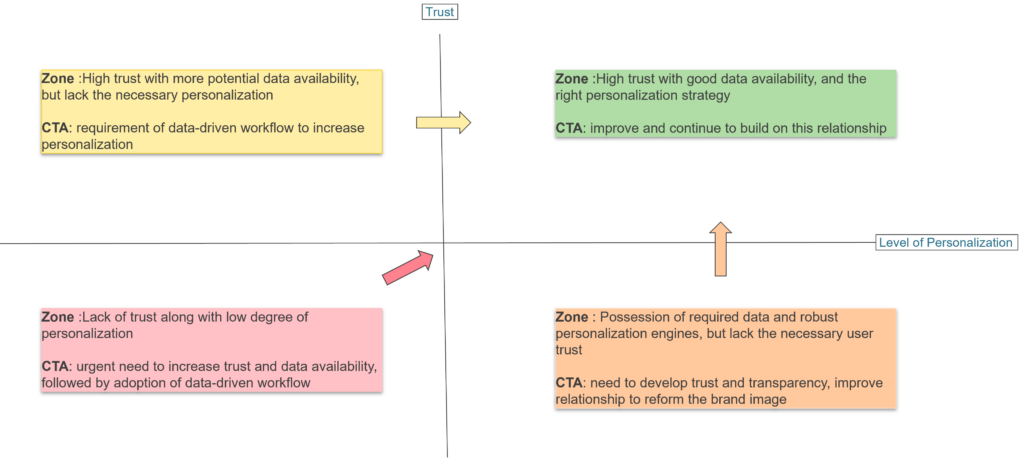

Investment Banking

Balancing experience with data and trust is essential to delivering engaging personalized experiences for customers and driving business success. Developing a robust and scalable automated process for data-driven personalization is critical for enterprises to win in the evolving personalization and interactive experience segment. Read on to learn more.

Customer experiences have become increasingly prevalent with the democratization of the internet, coupled with significant technological and data processing advancements over the past few years. Enterprises are now realizing the value of prioritizing the people side of business. Creating positive personalized experiences for customers can foster loyalty, increase customer satisfaction, and drive repeat business. On the other hand, negative experiences can damage a reputation and reduce customer loyalty. Let’s explore the importance of personalization.

Personalization is not a new concept. It has existed for decades. Enterprises must capture users’ attention and stand out to thrive. According to Everest Group estimates, more than 70% of consumers interact with a personalized promotional message.

Personalization, more commonly known as “persona-based personalization,” mostly involves grouping users into segments or personas based on common characteristics or behaviors. This approach can be effective in delivering relevant content or offers to a large group of users with similar interests or needs, based on demographics, purchase history, or browsing behavior.

Today, technological advancements have changed the landscape. Categorizing consumers is difficult because they don’t have just one interest area. The plethora of information available online has shifted the power to consumers who determine their preferences, disrupting brands that are no longer in charge.

As a result, brands now are also adopting “person-based personalization,” a form of personalization that considers the individual’s unique needs and habits instead of categorizing the user into specific buckets. Personality-based personalization is a 1:1 approach, where enterprises focus just on the customer as an individual. Everything revolves around the individual as a person, ranging from interactive experiences to advanced personalized marketing strategies. While persona-based personalization involves a large sample size, person-based personalization involves a sample size of just the individual.

Because person-based personalization has the potential to deliver high returns on investment (ROI) to enterprises, deploying an industrialized process for real-time person-based personalization is essential.

While most brands have invested in personalization, some remain reluctant to fully embrace real-time data-driven personalization at scale, which involves personalizing every touchpoint in the customer’s journey based on real-time context. This method requires a unique interplay of data, intelligence, and omnichannel strategies. Developing an industrialized process for delivering individual personalization beyond the required data analysis is essential for enterprises.

Data is the most critical requirement for delivering effective personalization. Personalization is driven by insights into individual preferences, behaviors, and needs that only can be obtained by collecting and analyzing data. Data collection needs to be well-thought-out. Enterprises require large volumes of data collected from multiple sources, and this data needs to be of good quality, accurate, and relevant because poor-quality data can lead to incorrect insights. Collecting diverse and up-to-date information is another important aspect.

The scope of data gathering has increased too. In the past, customer data was mainly collected via offline surveys, point-of-sales, and telecommunication, just to name a few. But the increased digitization supplemented with advancements in data and analytics has greatly impacted personalization by also allowing for collecting and analyzing vast amounts of data through digital channels. This has led to more seamless personalized experiences for users and has helped companies build deeper relationships with their customers.

An Everest Group study suggests that 78% of startups in the customer experience (CX) space leverage Artificial Intelligence (AI) to develop more relevant and engaging solutions for customer conversion, engagement, and retention. With the rise of AI, personalization has become even more precise and can consider a wider range of factors such as emotions, mood, and context.

However, significant investments are required if enterprises want to set up in-house industrialized data collection and analysis. This is where data platforms come into the picture. Data platforms can be thought of as purpose-built systems or infrastructures to collect, manage, and process large data amounts. It typically includes technologies and tools for data storage, data processing, data integration, data security, and data governance.

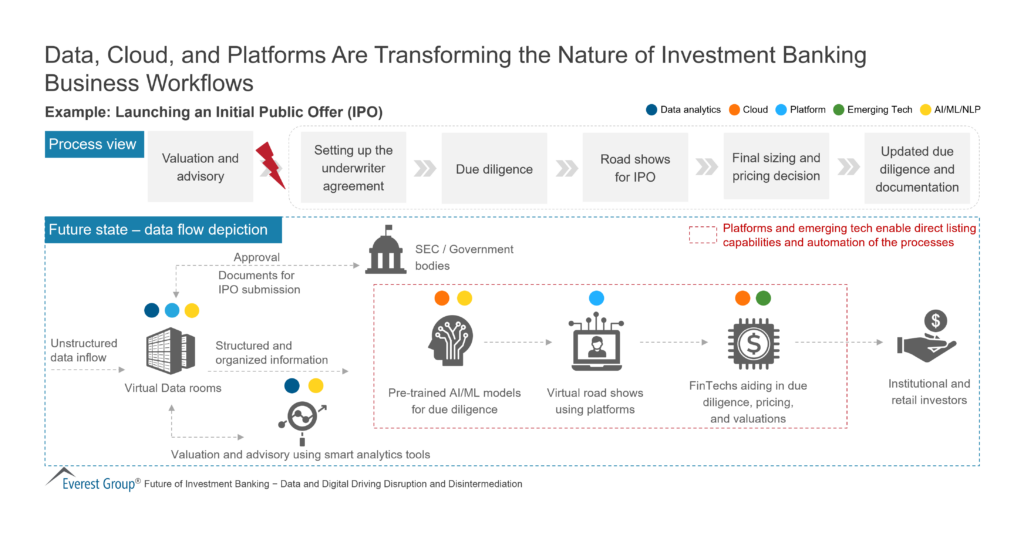

Data Experience Platforms (DXPs) offer a collection of tools such as Digital Asset Management (DAM), Customer Relationship Management (CRM), Customer Data Platforms (CDP), and personalization tools that can meet the needs of enterprises, as illustrated below.

Exhibit 1. Data collection tools for aiding personalization efforts

As discussed, data is essential to personalization. Clearly, the more data enterprises have, the better insights they can gain, and the better experiences they can provide. However, in today’s digital environment, user safety and trust are crucial. Consumer awareness is on the rise, with people growing increasingly skeptical about sharing their data. Concerns over how personal data is handled and safeguarded by enterprises are growing.

According to the United Nations Conference on Trade and Development (UNCTAD), 71% of countries today have some legislation around data protection and privacy, while 9% have draft legislation. Stringent data regulations such as the General Data Protection Regulation (GDPR) in the European Union, Nigeria’s Data Protection Regulation (NDPR), The California Consumer Privacy Act (CCPA), etc., have provisions to heavily penalize enterprises misusing consumer data.

Adding to this is the increasing push to eliminate third-party cookies. While browsers such as Apple Safari and Mozilla Firefox have already taken the step, market leader Google Chrome also has announced its intention to phase out third-party cookies by 2024, extending its earlier deadline. This has brought into focus the collection of voluntary data from users (Zero-party data) and first-party sources (1P data).

Zero-party data is a valuable information source for enterprises as it provides the best clarity to individual preferences. Developing a trust-based relationship with users and having total transparency about the use cases of zero-party data is essential for enterprises. Establishing a trust-based relationship might lead users to voluntarily provide more insights.

First-party data collection also needs to be transparent and strong security measures should be implemented to protect personal data. Sensitive data must be encrypted, security regularly audited, and effective access control measures adopted. Brands need to consider the needs of empowered users by honoring their “right to forget” and “untraceable” requirements.

As enterprises possess an enormous amount of users’ personal data, they also need to take the moral responsibility to protect that data. Customers who provide their data to enterprises understandably want their data to be protected and not misused without their knowledge. According to Everest Group estimates, more than 50% of customers are willing to share their personal data with companies but only with a clear understanding of how it will be used.

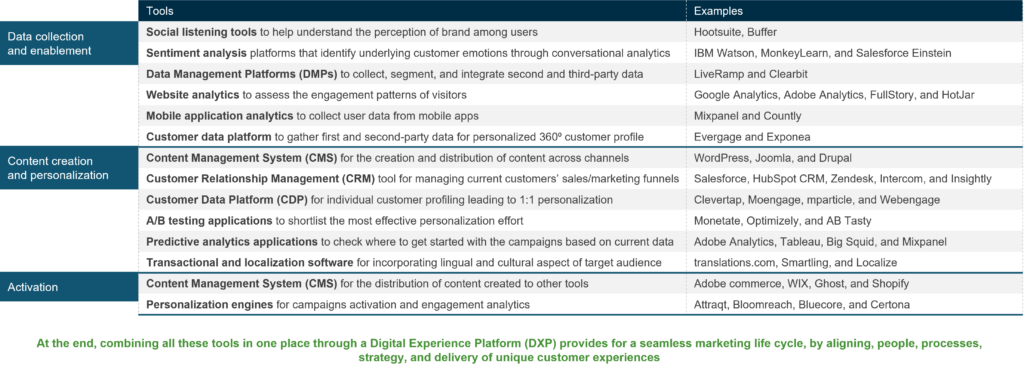

Winning user trust and gaining access to more voluntarily provided data is no doubt essential to achieving better person-based personalization. But this data needs to be utilized in the best manner by making use of tools (such as personalization engines and marketing automation tools) to set up an industrialized workflow for large-scale 1:1 person-based personalization. Without a robust and scalable automated process for large-scale person-based personalization, enterprises tend to lose.

Exhibit 2. The industrialized workflow for achieving data-driven 1:1 personalization

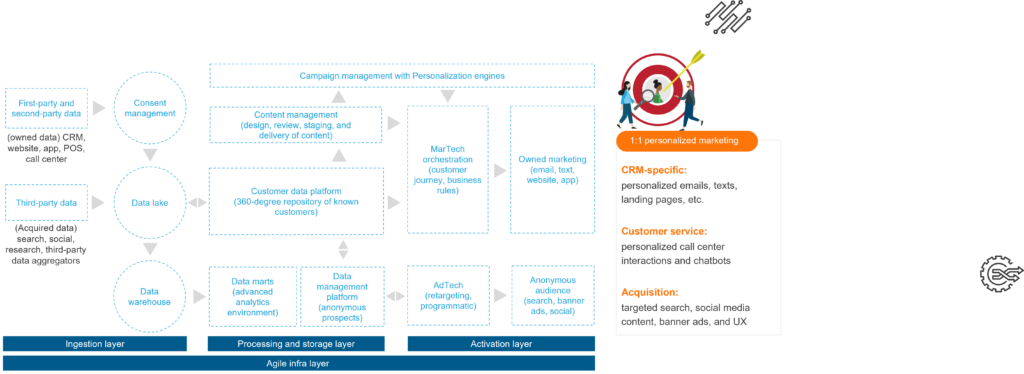

Personalization starts from a persona-based mechanism and, with an ever-increasing user base, shifts to person-based personalization. User data is the only way to go forward. User data and trust need to go hand in hand. To win customer attention, trust, and loyalty, enterprises need to know how to use the right data at the right time and how to go ahead with individual personalization without breaching the intrusion barrier.

Exhibit 3. Relationship between Trust and Personalization

Overall, the personalization and interactive experience landscape has become more complex and diverse, requiring brands to constantly adapt and stay up to date on the latest trends and technologies to reach and engage customers. However, even with increasing investments, the ROI might decline due to the heightened competition making it more challenging to stand out and generate returns, technical limitations, and privacy concerns, just to name a few.

Enterprises need to break down their user base into smaller, more targeted segments to achieve 1:1 person-based personalization and tailor products, services, and experiences to each individual user’s specific needs and preferences. The smaller the segments, the better enterprises can tailor their personalization efforts and achieve a more effective 1:1 experience.

In addition to the investment level, the strategy and implementation of personalization and experience efforts also needs to be considered. A well-designed and executed strategy can generate returns even with increasing investments. By balancing experience with data and trust, companies can deliver engaging personalized experiences that build strong relationships with users and drive business success.

If you have questions about selecting the right data platform or want to know more about personalization, interactive experiences, or discuss developments in this space, reach out to our analysts at the Adobe Summit, or get in touch with the Everest Group team at [email protected], or [email protected].

To learn about the comprehensive roadmap for enterprises to achieve business outcomes and mitigate challenges in their journey to accomplish truly industrialized 1:1 person-based personalization, see our report Emergence of CDPs: Charting the Path to Data-driven Personalization.

Check out our webinar, Strategies for Customer Experience (CX) Success in an Uncertain World, to learn key trends and hear recommendations on what to prioritize to deliver exceptional CX.

Access the on-demand webinar, which was delivered live on February 23, 2023.

Evolution in the IT function is inevitable. The very nature of technology is constantly shifting. Sourcing teams can better manage value from emerging technologies across the adoption cycle, from Research and Development (R&D) and exploration to scaled adoption.

In this webinar, we explored six things sourcing teams can do to stay ahead of new technology trends, including:

Who should attend?

Join Everest Group’s Ronak Doshi and other industry experts on this webinar to understand how modernized, efficient, and future-proof core systems can be created at organizations.

Key takeaways for attendees include:

As leading insurance organizations seek to be more data-driven in their business decisions, they are looking for solutions that can seamlessly integrate with their existing insurance technology stack. Technology providers have responded by building capabilities to offer plug-and-play solutions that align with carriers’ immediate priorities to extract more value from investments. With the industry landscape exploding with multiple solution providers offering carrier customization and commercial flexibility, we are witnessing a flood of SaaS solutions across the insurance value chain. Read on to explore the issue of SaaS sprawl which is quickly becoming one of the industry’s leading pain points.

At the turn of this century, the SaaS revolution shifted the paradigm of how technology could be deployed. The triad of quick deployment, timely upgrades with little/no inconvenience, and cost-effective solutions made SaaS solutions a force to be reckoned with.

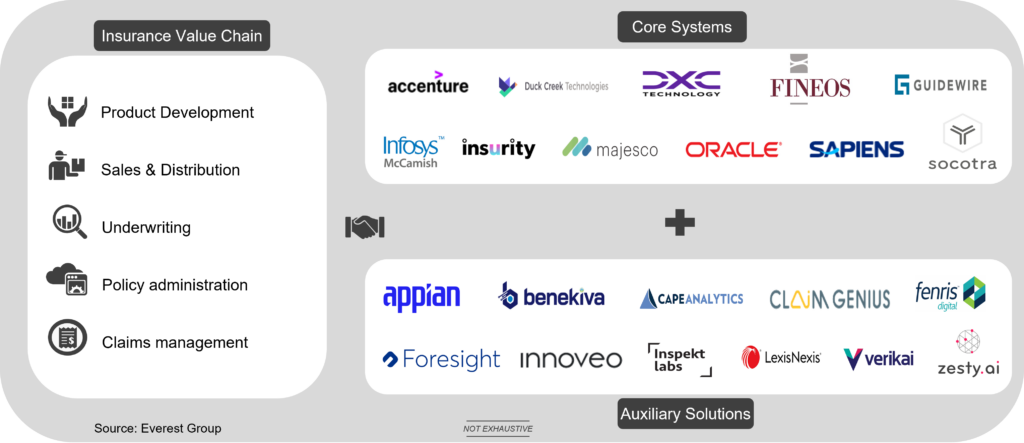

A massive influx of point solutions – tools that aim to address a single use case within a business – followed over the years. Today, an insurance technology stack has multiple point solutions assembled atop core systems to bridge gaps in existing capabilities as illustrated below:

Exhibit 1 – Technology stack in the insurance value chain

We are now seeing a massive explosion of SaaS applications in the entire insurance value chain that likely will reach a point where businesses start to see diminishing returns. Estimates suggest that organizations (with more than 1,000 full-time equivalent employees) use more than 100 applications on average at any given time.

This rapid expansion without any/sufficient oversight has led to SaaS sprawl, the unchecked proliferation of third-party applications that can impact the entire organization. Let’s look at this challenge further.

The huge availability of new technology solutions tops the list of contributors to this issue. The willingness to adopt newer solutions has grown exponentially in recent years with the success of cloud-based applications and services. Shadow IT is another contributor.

While the freedom for employees to use applications without explicit approval from a centralized department can boost productivity and drive innovation, it also can have undesirable complications. The growing clout of low-code/no-code capabilities is pushing this trend further.

Infusing intelligence throughout the insurance value chain requires specific capabilities in the five core areas of product development, sales and distribution, underwriting, policy administration, and claims management (as shown in the exhibit above).

Specialized players that focus on one or a few areas are emerging, making choosing from the many solutions and managing multiple applications for end-to-end technology solutions extremely difficult.

As more and more insurance companies turn to SaaS solutions to streamline their operations, they can quickly find themselves in a tangled web of different tools and platforms.

Put succinctly, dealing with compatibility issues among applications and the data interplay, and managing contract and upgrade cycles becomes a precarious juggling act. As a result, the great bundling of the entire insurance technology stack is needed!

Alternatively, it does not make sense to put the brakes on the development altogether. Restricting employees’ ability to build and buy applications may do more harm than it can potentially help.

Organizations need to provide the foundation for their teams to think about software applications strategically. Below are recommendations for enterprises to seize the multitude of opportunities:

IT service providers have an important role to play as solution orchestrators. Working with a core insurance technology provider can offer tight integration to third-party SaaS solutions to manage integration, risk, data access, and cost challenges.

If you have questions or would like to discuss SaaS sprawl, please reach out to [email protected], [email protected], and [email protected].

Explore our upcoming webinar, IT Service Provider 2023 Forecast: The Top 5 Themes for Growth and Wallet Share, for emerging themes, challenges, and growth pockets in the technology services market.

Since every past economic slowdown in this century has led to accelerated innovation and growth for FinTech firms, 2023 should be no different. We expect financial technology players to answer investors’ demands for increased profitability by tweaking business models and product innovation. To learn what FinTech trends will dominate in the coming year, read on.

FinTech firms have a history of responding to tough economic times by adapting and coming up with new business approaches. Looking back at the downturn in 2008, new FinTech trends emerged, including personal finance management (PFM), insurance aggregators and marketplace, robo-advisors, crowdfunding, challenger/neo/digital-only banks, and cryptocurrencies. Following the same pattern for innovation, the pandemic-led slowdown has resulted in buy now pay later (BNPL), metaverse payments, decentralized finance (DeFi), and Web 3.0.

Let’s explore the following FinTech trends on the horizon for 2023:

Rising interest rates and slow economic growth have pushed FinTech investors to demand profitability improvements. As a result, FinTech firms that were built to drive growth at the expense of profitability to scale and acquire customers are now forced to adapt their business models and investments. We expect FinTechs to find alternative monetization models. One such alternative that FinTechs are exploring is selling/licensing their technology, such as core systems and machine learning models (that they built and trained), to other financial services firms. Accessing already built and trained machine learning models will enable financial services to adopt AI at speed and scale without additional time and expense.

The last decade has seen FinTechs eat into the front-office surplus of incumbent financial services firms. Now, they are increasingly moving into mid-and-back-office processes to streamline these processes and data systems. We see FinTechs targeting the hard problems that incumbent financial services firms are slow to resolve because of legacy systems, data, and established processes. For example, eight of the top 10 retirement plan providers in the US are struggling with legacy mainframe-based technology and processes. Newer firms such as Retirable, Penelope, Smart, and Silvur have entered the market to provide better retirement experiences. Firms like Alto are bringing innovation from the Web 3.0 space to the retirement market by offering Individual Retirement Account (IRA) platforms. These IRA platforms simplify investing in alternative assets, such as start-ups and cryptocurrencies, by using tax-advantaged retirement funds. Beyond the retirement and pension segment, we see similar activity in the treasury, investment banking, group benefits, and specialty insurance markets

Wallets and super apps are becoming the foundational blocks for enabling ambient banking, which is focused on meeting the business and/or customer at the moment of their need, crossing other industries. Firms like Roostify and Ribbon want to orchestrate the end-to-end home-buying experience. Players such as Nomi Health and PayGround seek to simplify the end-to-end healthcare payments experience. We expect to see more vertically integrated FinTech firms at the intersection of financial services and industry experiences (e.g., car buying, small business invoicing and billing, supply chain, loyalty, and travel). Cloud and APIs are two technology components enabling the technical architecture necessary for embedded banking.

Environmental, social, and governance (ESG) is a major demand theme that represents a relatively untapped market by FinTechs. We expect areas such as carbon credit marketplaces, ESG data and analytics solutions, and ESG customer transparency solutions to dominate most FinTech activity in 2023. FinTechs that can offer support for ESG reporting and compliance for small- and mid-size financial services firms is a white space that should see significant growth in 2023.

We expect a slowdown in lending and BNPL and challenger banking because of profitability challenges, whereas segments such as cryptocurrency will see some slowdown due to the tightening of regulatory controls and the FTX collapse, which led to a crash in prices. Markets such as supply chain finance, crowdfunding, PFM, and robo-advisory are becoming saturated and remain highly competitive for new FinTech entrants. Wealth management is an attractive adjacent market for banks, lenders, Non-Banking Financial Companies (NBFCs), and insurance firms. These new entrants in the wealth management space are working with FinTech firms that are configurable and born in the cloud architecture to assemble their technology stack. Web 3.0 is an emerging space with a broad ambit across industries with possibilities to manage the entire asset lifecycle better. These assets could be physical assets, digital assets, media, identity, equity, bonds, or even virtual assets in the metaverse. Breaking down process complexity and reducing costs of operations across payments, treasury, and RegTech areas will drive the growth of FinTech activity.

In the upcoming year, we expect to see FinTech firms make deliberate moves to increase their profitability to meet investors’ demands. These actions will include firms selling/licensing their machine learning models, eliminating operational efficiencies through Web 3.0 innovations, focusing on the intersection of financial services and industry experiences, and making sustainability a priority.

If you have questions about FinTech trends or would like to discuss developments in this space, reach out to Ronak Doshi.

Also, watch our webinar, Key Issues for 2023: Rise Above Economic Uncertainty and Succeed, as we explore major concerns, expectations, and key trends expected to amplify in 2023.

View the event on LinkedIn, which was delivered live on Thursday, November 17, 2022.

Effectively building and scaling product management teams is a critical challenge most organizations face. While product management skills and roles are in high demand, they are also in limited supply. This requires significant change management and a shift to a product-based focus.

Enterprises are increasingly looking to successful technology companies and start-ups for best practices in product management. In this LinkedIn Live, Everest Group welcomes Diana Jouard, Product Manager at software company Ping Identity. Along with Everest Group’s analysts, Diana will provide insights into the emerging skills, roles, and challenges associated with best-in-class product management teams.

Our speakers will explore:

View the event on LinkedIn, which was delivered live on Thursday, October 20, 2022.

Have you ever wondered if there is a strategy behind how research firms allocate their analyst resources for each project👥?

Join this session to learn how Everest Group executes on its research projects and why it’s important for analyst relations teams to understand our approach. We’ll explore how we manage and apply our research teams, our methods of analyst collaboration, and how our approach affects the quality and credibility of the research we produce to ensure maximum value📈.

Our speakers will explore:

✅How Everest Group allocates its highly valuable analyst resources for research projects and studies

✅How Everest Group develops its talent pools and deploys them for various projects

✅Why analyst relations teams should pursue these questions with all research firms, and how Everest Group answers them

While the decades-old greenhouse gas emissions scopes are a ubiquitous tool for reporting carbon footprints, the reporting standard needs to evolve and extend. Organizations must also measure their impact on people to provide a holistic picture of their sustainability performance. Read on for our new model for extending the global standard of scope 1, 2, and 3.

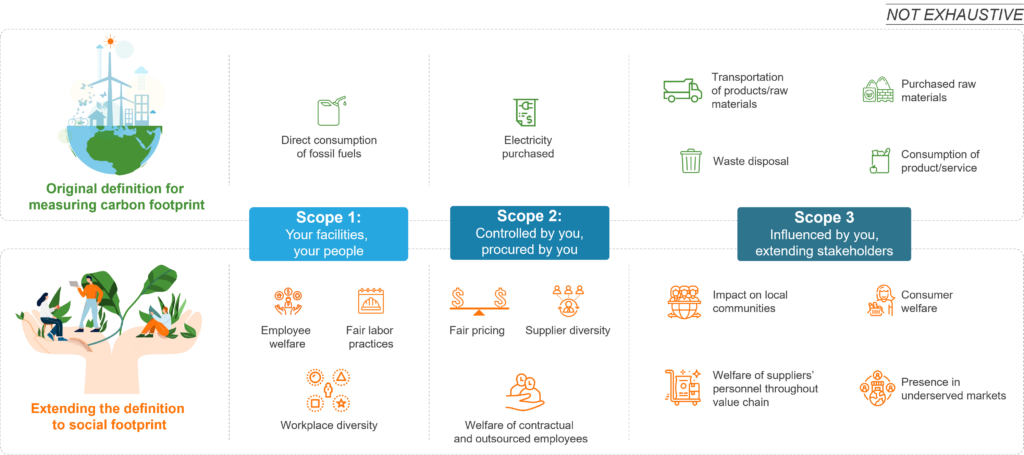

More than nine out of ten Fortune 500 companies use the following three scopes to measure, report, and manage their Greenhouse Gas (GHG) emissions:

Scope 1 – your facilities –emissions from fuel sources a company owns and controls

Scope 2 – controlled by you, procured by you –emissions through purchasing electricity

Scope 3 – influenced by you, extending stakeholders –emissions considered indirect to the company due to less control including the supply chain, transportation, and asset portfolios. For many industrial sectors, this is the largest scope

Sustainable Development Goals, which were adopted in 2015 by the international community, encompass both social and environmental aspects of sustainability. SDGs are witnessing a bigger global collaboration than the Millennial Development Goals (MDGs) and create more space for the private sector’s involvement in realizing the goals. Rooted in human rights, and weaving them with environmental issues, SDGs give a robust opportunity to the private firms to explore their role in slowing down the global warming and making the world a more inclusive space.

With SDGs being a comprehensive take on both social and environmental aspects of sustainability, enterprises need an equally comprehensive outlook on their role in realizing the goals. Enterprises have started zeroing down on their carbon footprint using GHG Protocol. However, they are still falling short on measuring their social footprint and generate the right insight using their social footprint data. While there are several metrices and global standards to measure the social footprint of an organization, these standards are diverse and lack comprehensiveness.

While GHG emissions protocols comprehensively capture an organization’s carbon footprint, a broader focus is required. Expanding these scopes to encompass sustainability’s social aspects will truly serve the aspirational SDGs the world wants to achieve under the United Nations’ 2030 Agenda for Sustainable Development.

With this set up, we can all agree the ubiquitous GHG emissions scopes can be extended to include a social footprint for a holistic approach. Using the same logic, we at Everest Group recommend including the following elements in your social scopes:

Scope 1 – your people – A company’s positive and negative influences on employees count towards the social scope 1 footprint. This includes workplace diversity, gender pay gaps, accessibility, employee physical and mental health, parental leave (including maternity, paternity, and adoption benefits), and job security

Scope 2 – controlled by you, procured by you – A company’s positive and negative influence on contractual and outsourced employees, customers (e.g., fair pricing practices), and supplier diversity programs broaden the social footprint.

Scope 3 – influenced by you, extending stakeholders – A company’s wider impact on its customers, supply chain, community, and other stakeholders. It can include:

Although these elements are covered in different national and international laws, standards, and company policies, developing a common definition for social footprints is necessary. Generating indices or scores is one way to measure and rank companies on their performance in these key areas.

In addition to taking into account the people aspects in consolidated ESG scores, the standards should also examine the impact companies have on the planet that goes beyond simply measuring aspects of environmental degradation like deforestation, waste production, and plastic production in siloes.

An international ESG standard should integrate all these elements. Having an integrated ESG score that consolidates the people and planet aspects of sustainability holistically would shed valuable light on a firm’s true sustainability-led values.

With diligence and global collaboration between businesses, governments, and international organizations to develop these standards, the environmental and people aspects of sustainability can be bridged.

What can’t be measured can’t be managed. Everest Group strongly advocates for a comprehensive indexing of enterprises’ social and environmental footprints. With just eight years until 2030, we need to begin evolving our measuring standards now to achieve SDGs in a true sense.

To have scope 1,2, and 3 model explained in greater detail, contact us at [email protected], [email protected], or [email protected].

Learn about Everest Group’s pledge to help organizations around the world increase the number of jobs provided to workers in marginalized communities through impact sourcing – while providing businesses with access to the best talent with high levels of reliability, productivity, and engagement. Our Commitment to Action is to grow the impact sourcing market from its current level of 350,000 FTEs to half a million in three years.

Despite the overall growth in the Customer Relationship Management (CRM) industry, the CRM platform market remains static. To achieve the business value enterprises desire, changes need to be made. In this blog, we share our CRM insights and three recommendations for CRM platform evaluation.

With the rapid proliferation of channels, products, and customer personas, the industrialization of personalized experience delivery poses the biggest challenge for all enterprises across industries. CRM is integral to enabling this experience transformation.

According to Everest Group research, the overall CRM market has increased approximately 15% year-over-year, primarily driven by the growth of Salesforce and other SaaS applications of SAP, Microsoft, and Adobe.

But let’s not confuse the industry’s top-line growth with customer success. The Solow paradox or productivity slowdown is still here. The bottom line: today’s CRM platform market is oversold and underdelivered. In a frenzy to meet YOY linear growth targets and bigger deal sizes, almost 30% of the licenses sold go unutilized by enterprises.

As we enter Dreamforce’s 20th year, below are our recommendations on fundamental changes that are needed in the CRM industry.

1- Bridge the customer experience and customer success disconnect: While most cloud CRM platforms are growing in high double digits, they are not achieving the same business value growth. Most customer success metrics are defined and managed by vendors and continue to have a singular focus on customer satisfaction. While an enterprise IT organization may be happy with completing implementations on time and within budget, our research suggests that almost 50% of enterprises are not satisfied with the business value realized from their platform investments.

Recommendation: CRM platform players need to evolve the definition of customer satisfaction (CSAT) and their customer success programs. These should be managed independently of the organization’s sales and marketing functions. Service providers must work closely with platform vendors and customers to proactively define and track IT-business metrics. Niche platform players such as Qualtrics stand to make a significant dent by putting experience and operational data side by side to wholistically define customer experience.

2 – Create data-driven and connected operations: Industry-specific cloud applications are a key investment area for most CRM vendors. However, our ongoing Salesforce industry cloud services PEAK Matrix assessment found CRM vendors are pushing these products rather than enterprises pulling for them. This is because these products need high customization and fail to make a dent in managing and integrating data for specific micro industries. Each micro-industry has a unique operating model that requires data architecture tailored to the context. These industry products need to get the data strategy right for each industry-specific operation and bring in the openness for ecosystem integration. Platform investments by Salesforce, Adobe, and others in the Customer Data Platform (CDP) space are a silver lining for the commerce industry. But these CDPs should eventually evolve into intelligent data hubs and provide a platform for enterprises to create dynamic and contextual applications.

Recommendation: Industry-specific cloud solutions need to be built by keeping data architecture and integration for the micro-industry at the core. Making such fundamental changes is difficult for platform giants, which creates opportunities for emerging platform vendors to compete and differentiate. Vendors such as Zoho have differentiated themselves in an almost monopolistic industry by taking a long-game strategy and changing products at the architectural level.

Service partners need to use their industry expertise and prioritize micro industries to closely innovate with both emerging and large platform vendors. Together, they need to build meaningful products for their customers rather than being caught up in the frenzy to fulfill license sale Key Performance Indicators (KPIs).

3- Expand and further simplify platform native workflow automation and low-code capabilities: As many as 60% of new application development engagements consider low-code platforms, according to Everest Group’s recent market study. Present workflow-building tools and low-code capabilities that are native to CRM platforms are still immature. This is pushing enterprises to spend hefty dollars on workflow and low-code platforms and then invest additional money on customization to integrate them with their CRM platform.

Recommendation: Salesforce has been a pioneer in this space and continues to lead the market, which has resonated well with its customers. Other CRM vendors who lack capabilities and focus here may give Salesforce inroads into their existing accounts. Service partners need to educate the market about low-code and workflow automation’s potential to transform industry-specific customer experiences.

We will be attending Dreamforce this September to share our CRM insights and would welcome hearing your views on CRM platform evaluation. To schedule a meeting, please reach out to [email protected] and [email protected].

Attend our webinar, How are Leading Organizations Delivering Exceptional Customer Experience?, to learn more about customer experience today.

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields