FinTech Partners

VIEW THE FULL REPORT

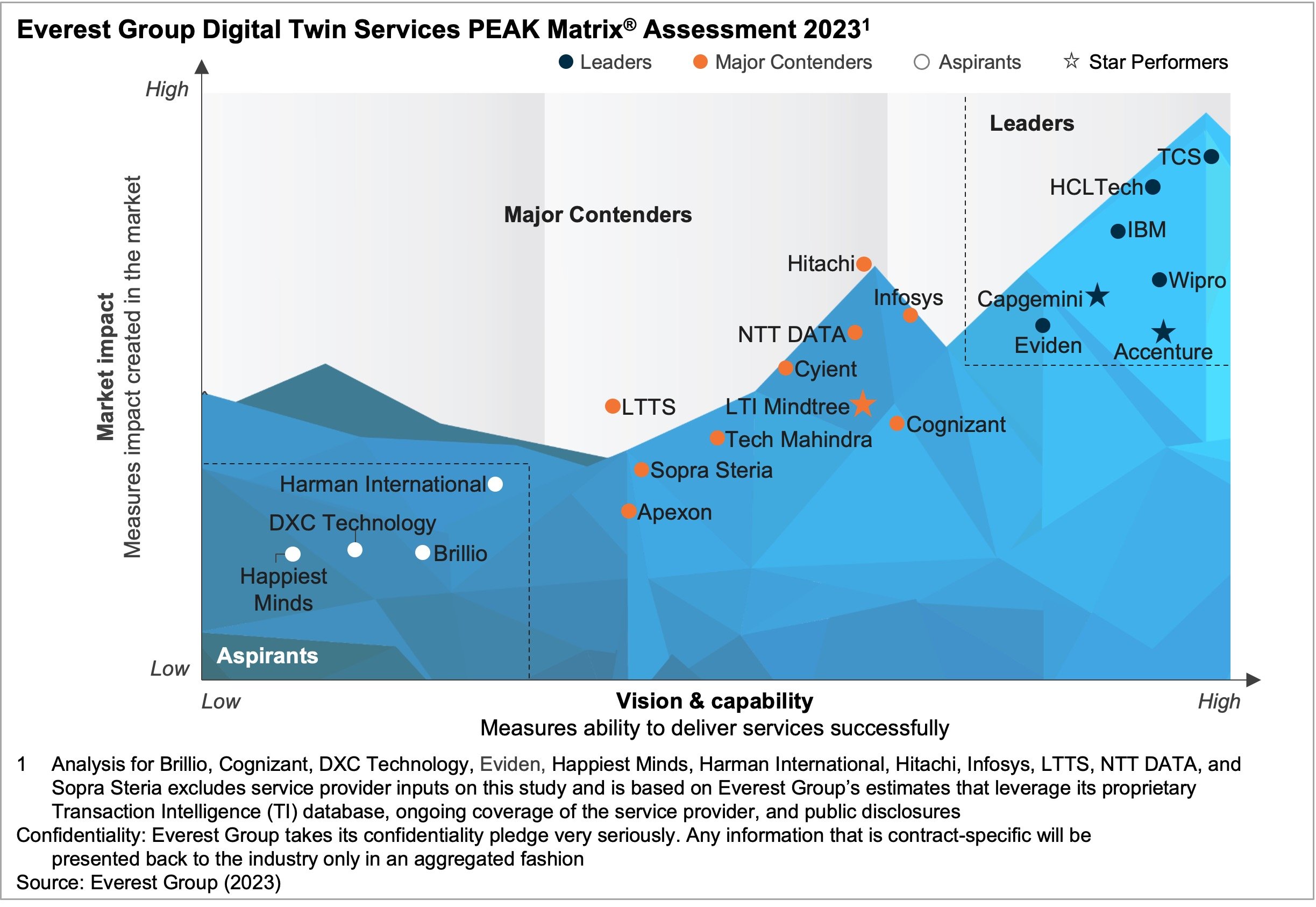

Digital twins, virtual replicas of physical products, processes, and systems, are playing an instrumental role in aiding enterprises to reduce downtime, improve product tracking and tracing, and closely monitor asset conditions by simulating diverse scenarios. The demand-driven digital transformations spurred by the pandemic have propelled digital twins to the forefront of innovation, even in industries with lower digital maturity. Enterprises have eagerly embraced these virtual counterparts to revolutionize their operations. Over the past year, a remarkable surge in adoption has broken down barriers across various sectors, propelling digital twins into the heart of transformation strategies. As organizations ramp up their investments, the benefits of this technology are becoming increasingly evident.

Enterprises are increasingly collaborating with providers due to the demand for swift digital twin deployment, seamless integration of IT/OT systems, enhanced data and infrastructure security, and the shortage of skilled professionals in the enabling technologies domain. Organizations leveraging the potential of digital twins would do well to carefully assess the capabilities of these providers before choosing their technology partner.

In this report, we assess 21 leading digital twin service providers and position them as Leaders, Major Contenders, Aspirants, and Star Performers based on their capabilities, vision, and market impact. These providers have been instrumental in empowering enterprises to unlock new levels of efficiency, insight, and success. The research will help buyers select the right-fit provider for their transformation goals, while providers will be able to benchmark themselves against their peers.

In this PEAK Matrix® report, we provide:

Scope:

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

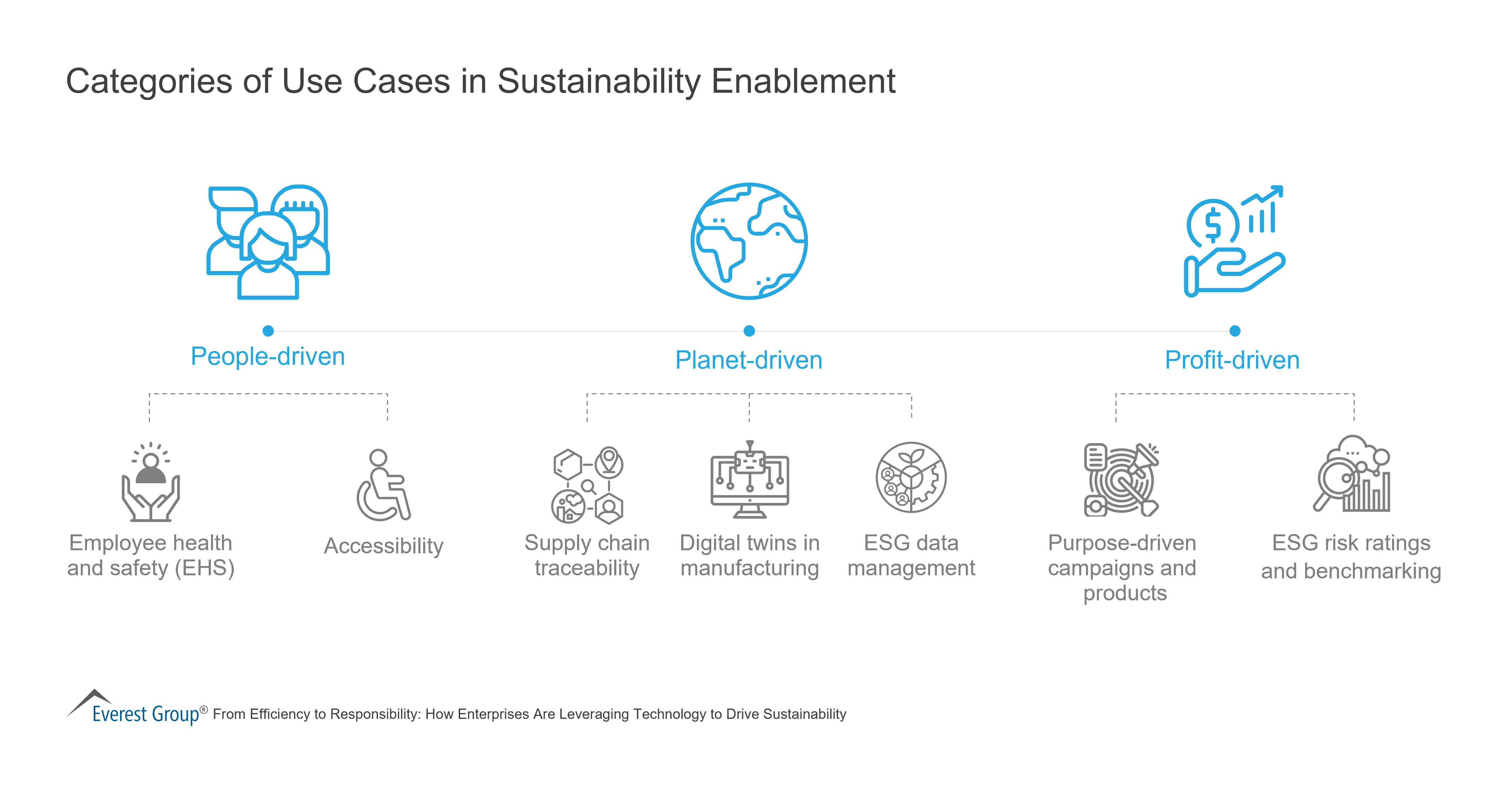

Use Cases in Sustainability Enablement

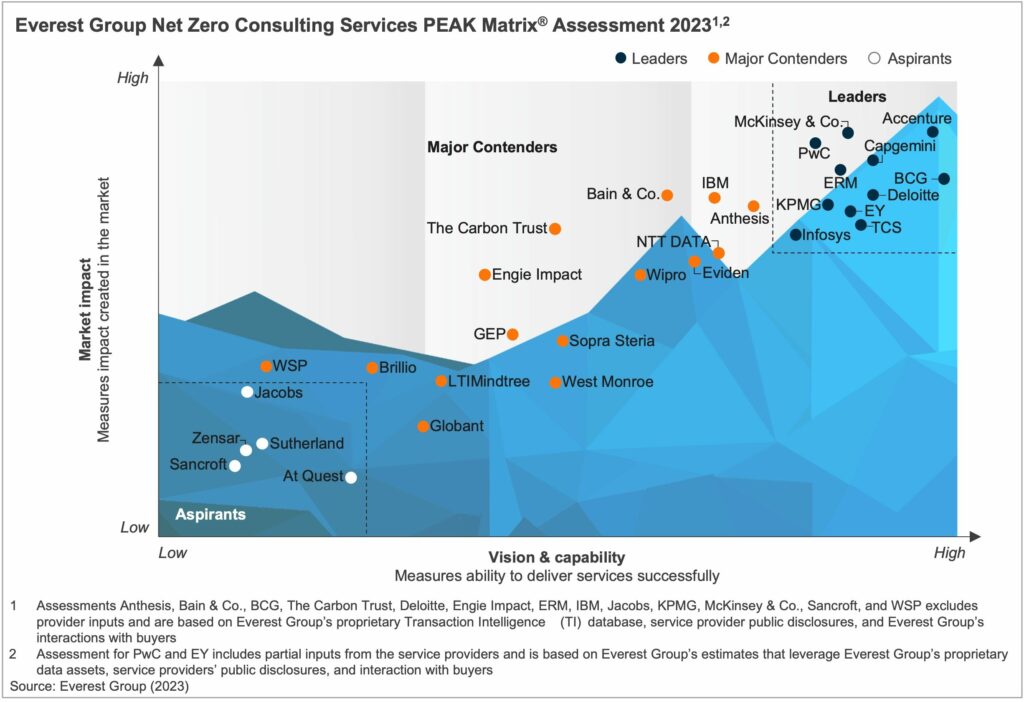

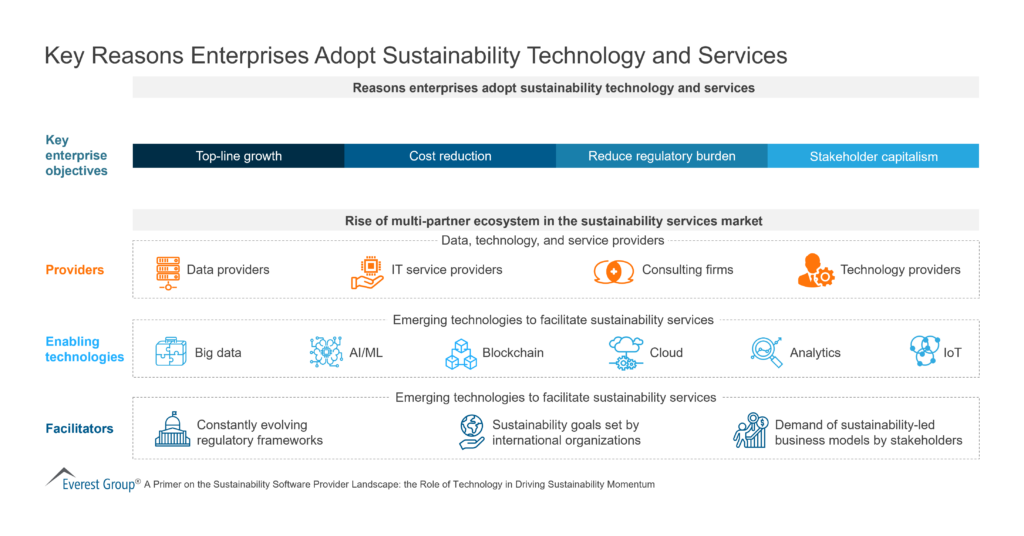

Climate change is the paramount problem of the decade, demanding urgent attention and action. Communities worldwide feel the consequences, such as rising sea levels, extreme weather events, ecological disruptions, and health risks. This underscores the need for immediate and concerted efforts to mitigate and adapt to this unprecedented crisis. In response, enterprises increasingly recognize the importance of embarking on their net-zero journey to address the climate crisis.

However, many enterprises face challenges that hinder their progress, such as limited resources, unclear roadmaps, siloed Environmental, Social, and Governance (ESG) data, and the complexity of transitioning their operations and supply chains to low-carbon alternatives. Additionally, boardrooms are divided between short-term budgetary constraints and long-term net-zero commitments and compliance mandates due to macroeconomic uncertainty and geopolitical tensions.

Net-zero consulting service providers play a vital role in helping enterprises navigate these challenges. They offer innovative data-backed solutions and technologies, such as AI, ML, blockchain, and IoT, to contextualize sustainability and drive maximum value. Furthermore, they assist enterprises in achieving the necessary behavioral shift through change management efforts.

This report captures the current state of the net-zero consulting services market, exploring trends and key drivers shaping the demand-supply dynamics. The report also provides a detailed view of the net-zero consulting capabilities of 31 providers based on their service focus, key Intellectual Property (IP) / solutions, domain investments, and demonstrated market proof points.

In this report, we:

Scope:

All industries and geographies

This assessment is based on Everest Group’s annual RFI process for the calendar year 2023, interactions with leading net-zero consulting service providers, client reference checks, and an ongoing analysis of the sustainability services market

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

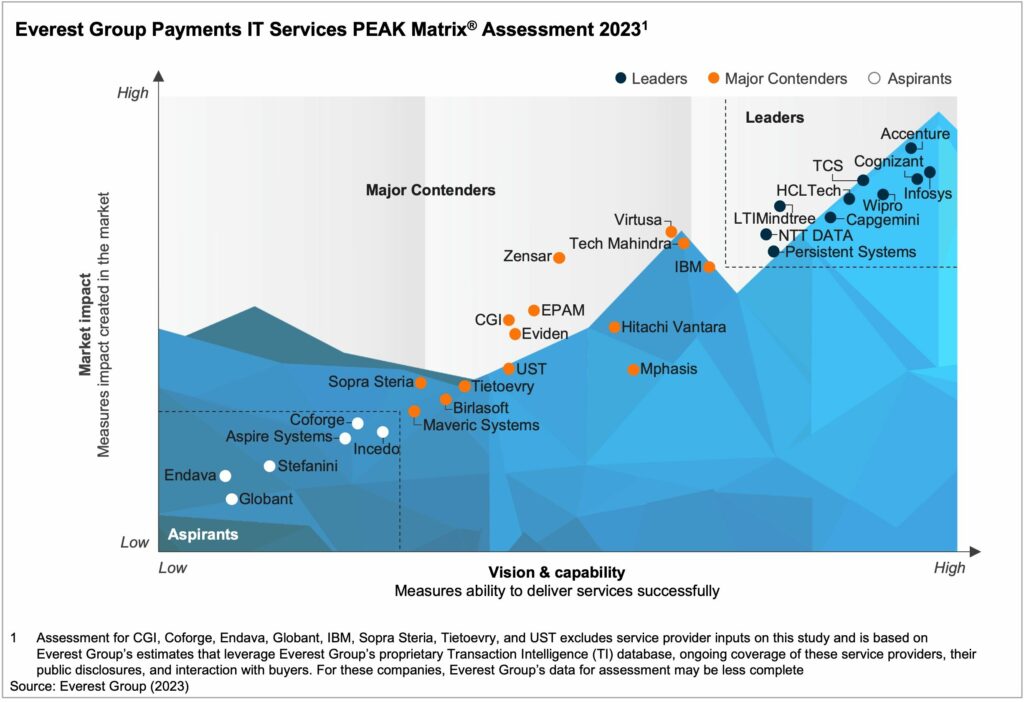

The payments landscape is changing rapidly. Today, consumers have more payment options than ever before. This is primarily due to the unprecedented rise of FinTechs, PayTechs, and neo-banks, which introduce faster, innovative, and convenient transaction methods such as Buy Now Pay Later (BNPL), digital wallets, Request to Pay (R2P), embedded payments, and digital currencies. The increasing prevalence of digital payments and the consumer demand for seamless instant transactions are driving the adoption of real-time payments systems.

New regulations and standards, such as ISO 20022, are paving the way for faster and more efficient payments. These new data standards create numerous opportunities for data monetization. Financial institutions are investing in modernizing payment infrastructure to support instant payments, leverage monetization opportunities, provide alternative payment methods, and launch digital currencies.

In this report, we examine the vision and capability and market impact of 30 payments IT service providers and position them on Everest Group’s proprietary PEAK Matrix® framework as Leaders, Major Contenders, and Aspirants.

In this report, we:

Scope:

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

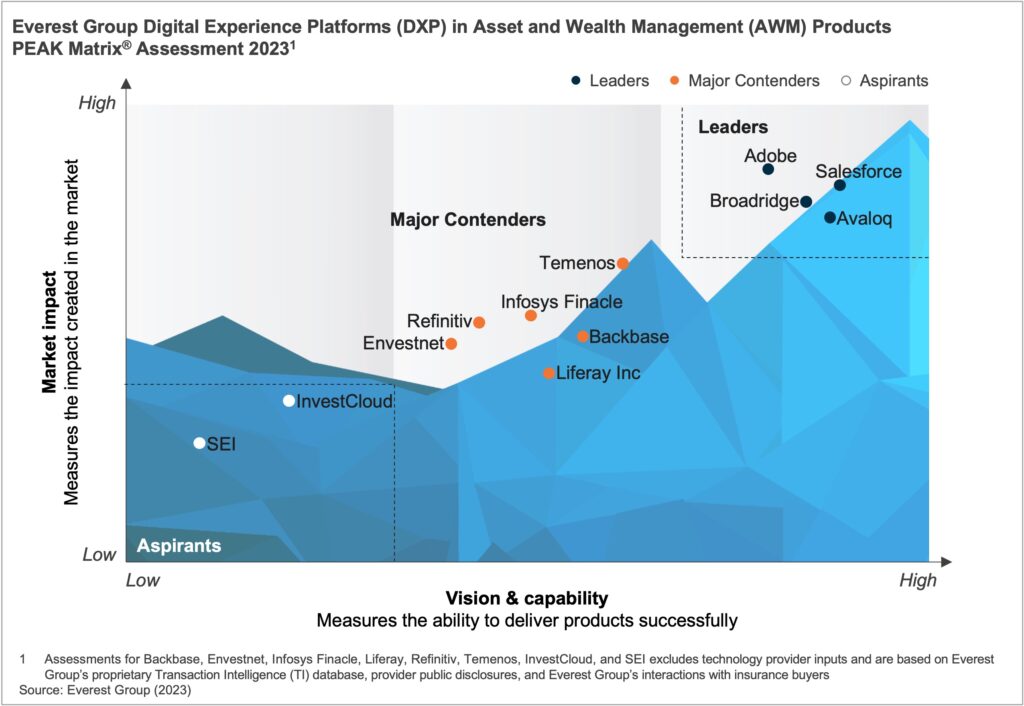

The Asset and Wealth Management (AWM) industry is seeing the democratization of finance, growing demand for personalized digital experiences, and the emergence of new products such as digital assets and ESG-compliant investments. To adapt to evolving customer preferences and meet regulatory requirements, AWM managers are increasingly turning to Digital Experience Platforms (DXPs) to revamp their operations, streamline costs, enhance data management capabilities, and deliver tailored client experiences. By leveraging DXPs, AWM firms aim to provide advisors with a comprehensive, real-time view of data through intuitive dashboards, enabling them to deliver better service.

The integration of DXPs empowers asset and wealth managers to optimize their processes, personalize client interactions, and create an enhanced advisor experience. DXP providers are plugging the gaps in functionality coverage through build, buy, and partnership investments, along with the infusion of emerging technologies in their current product offerings. They are also establishing a robust partnership ecosystem comprising FinTech point solutions, technology providers, WealthTechs, and consulting and implementation partners to drive commercial and GTM innovations.

In this report, we assess 12 leading DXP providers for AWM products and categorize them as Leaders, Major Contenders, and Aspirants. The research will help buyers select the right-fit technology providers for their needs, while technology providers will be able to benchmark themselves against the competition.

Contents:

Scope:

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

Sustainability Technology and Services

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields