Low-code Solutions

Low-code Solutions

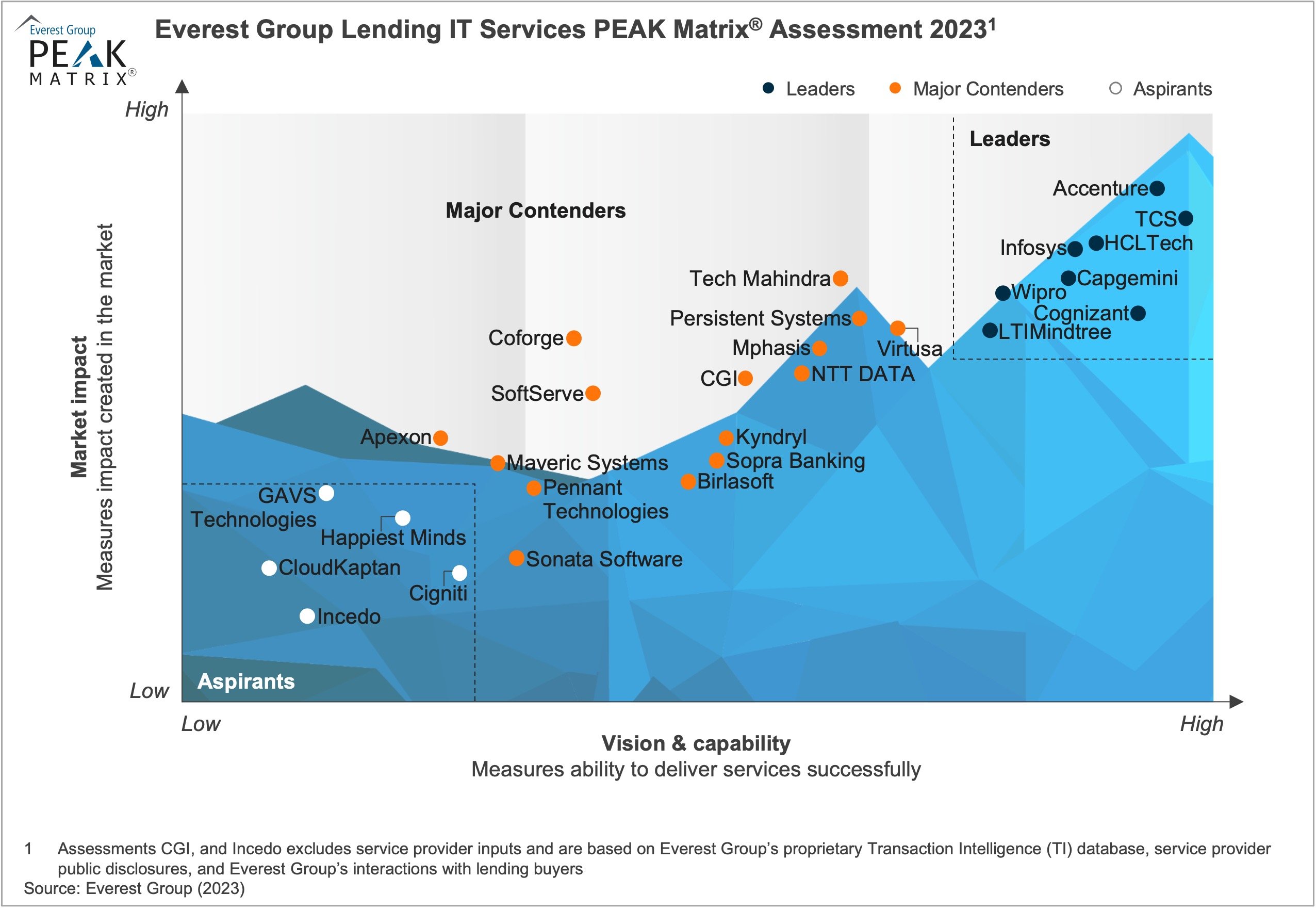

The lending industry is currently undergoing a significant transformation, propelled by the increasing demand for technological integration to enhance operational efficiency, user experience, and cost-effectiveness. This shift is largely driven by the widespread adoption of advanced cognitive tools, such as AI and predictive analytics, enabling lenders to improve automated approval rates and gain deeper insights into customer behavior. Additionally, the rise in delinquencies, stemming from a growing disparity between wage growth and expenses, is prompting lenders to embrace more user-friendly online tools for flexible payments.

In response to these challenges, lenders are leveraging cloud computing and alternative data to revolutionize underwriting and data management processes. The introduction of innovative products, such as green mortgages and Buy Now Pay Later (BNPL) options, addresses modern consumer demands within a framework aimed at consolidating products for improved efficiency. Moreover, the lending ecosystem is increasingly becoming API-driven, facilitating real-time integrations with third parties and offering flexible customer experiences without the need for costly in-house functionalities. This trend is evident across various sectors, with mortgage lending investing in technology and alternative products and auto financing transitioning toward subscription and shared ownership models. Particularly in commercial and SME lending, there is a noticeable shift toward streamlined online financing experiences and platform modernization.

In this report, we:

Scope

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

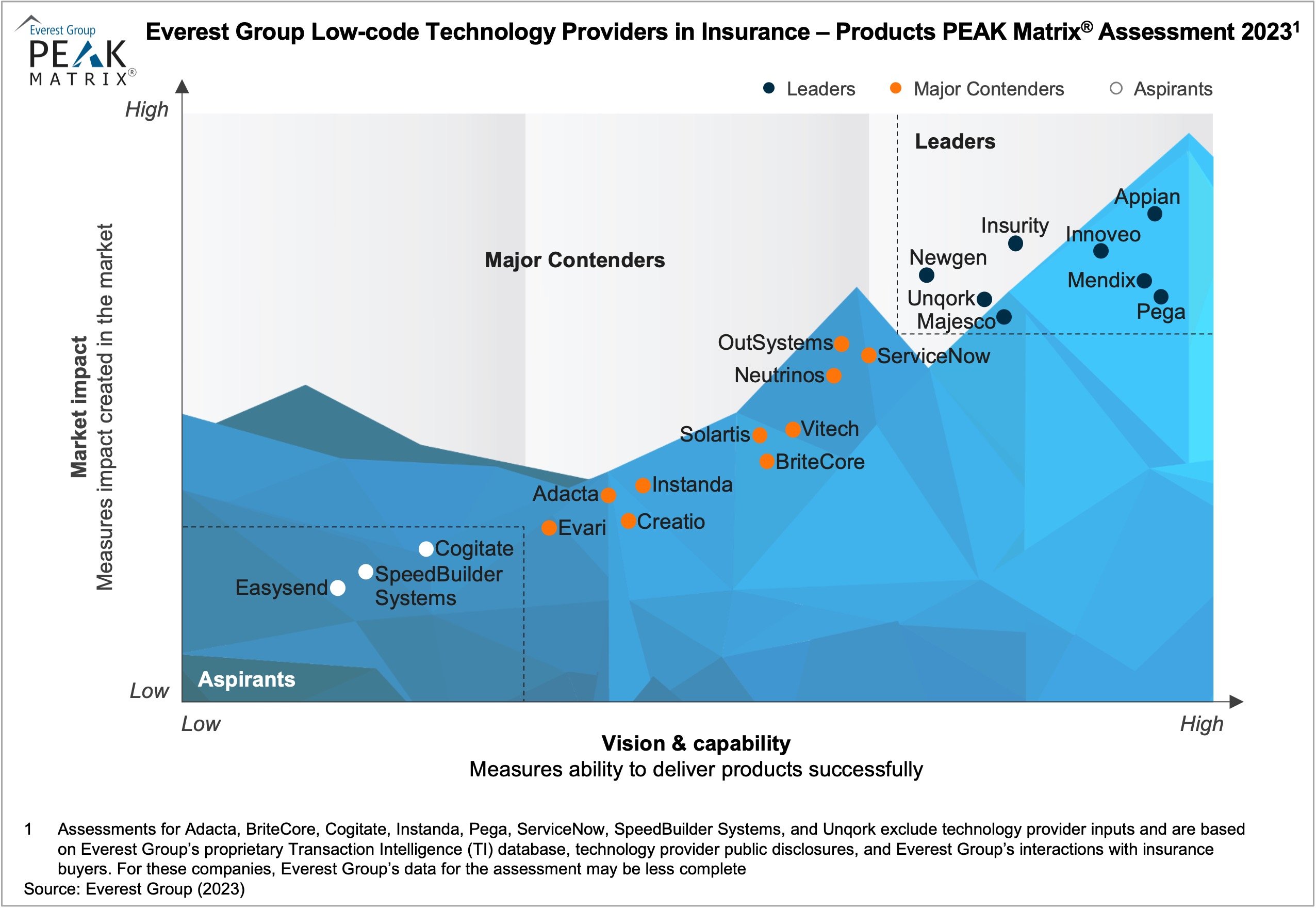

In recent years, insurance enterprises have embarked on a modernization spree to improve the experience for both customers and stakeholders. However, the significant surge in costs and unprecedented underwriting losses in these challenging times have intensified the need for an agile, scalable approach to modernization.

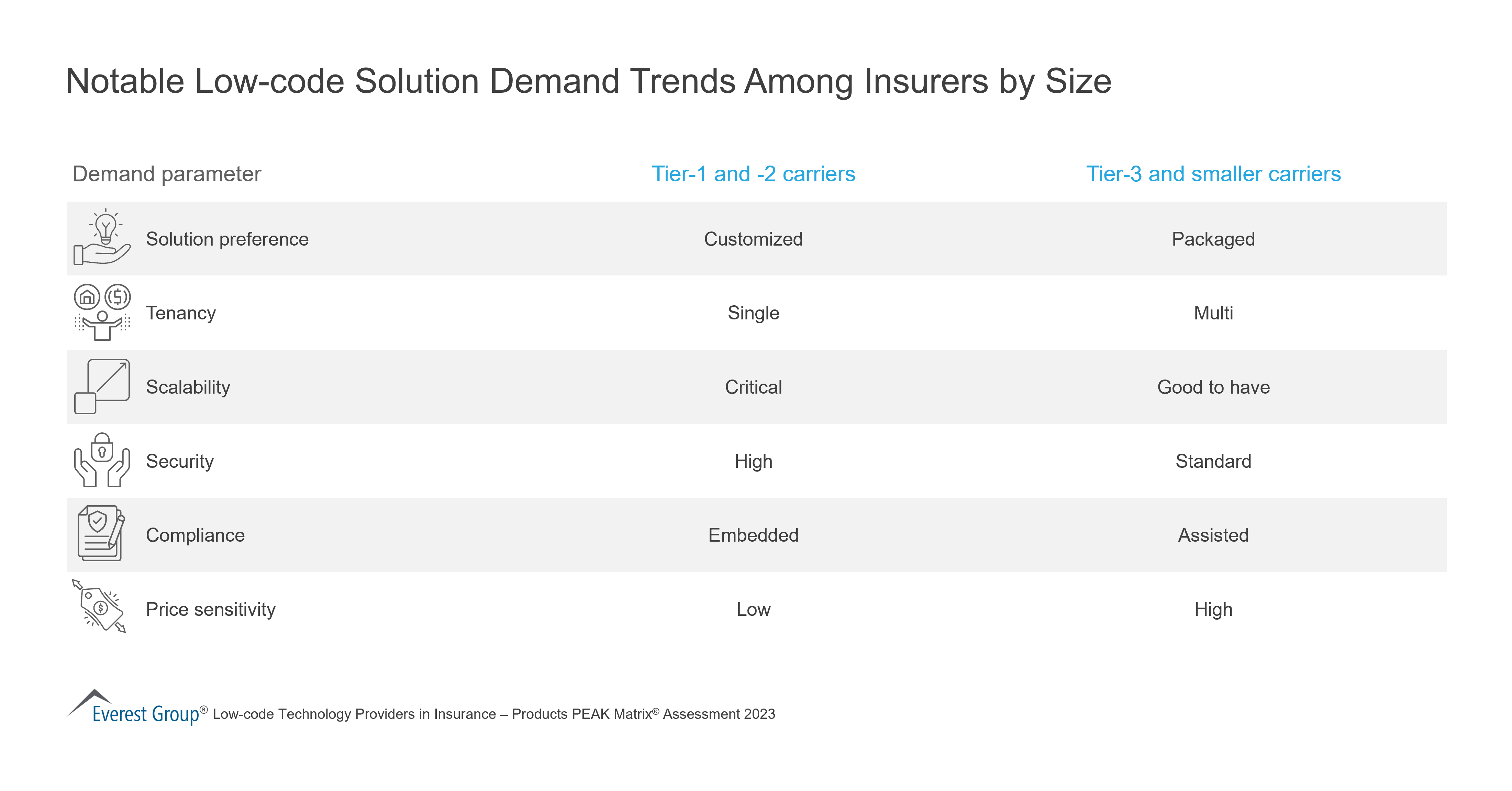

Leading insurance organizations are seeking support to manage the technology environment, address the talent shortage, and respond to changing market dynamics. They aim to realize value from existing investments quickly and with minimal complexity in integration or application development. Insurers are increasingly relying on low-code technology for rapid application development, integration, and meeting time-to-market needs. Low-code solutions offer insurers out-of-the-box integrations with their existing technology stack, enable rapid value realization from digitization investments, and eliminate the need for extensive transformation efforts.

In this report: Everest Group analyzes 21 low-code technology providers’ capabilities to serve insurance enterprises on its proprietary PEAK Matrix® assessment framework.

Scope

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

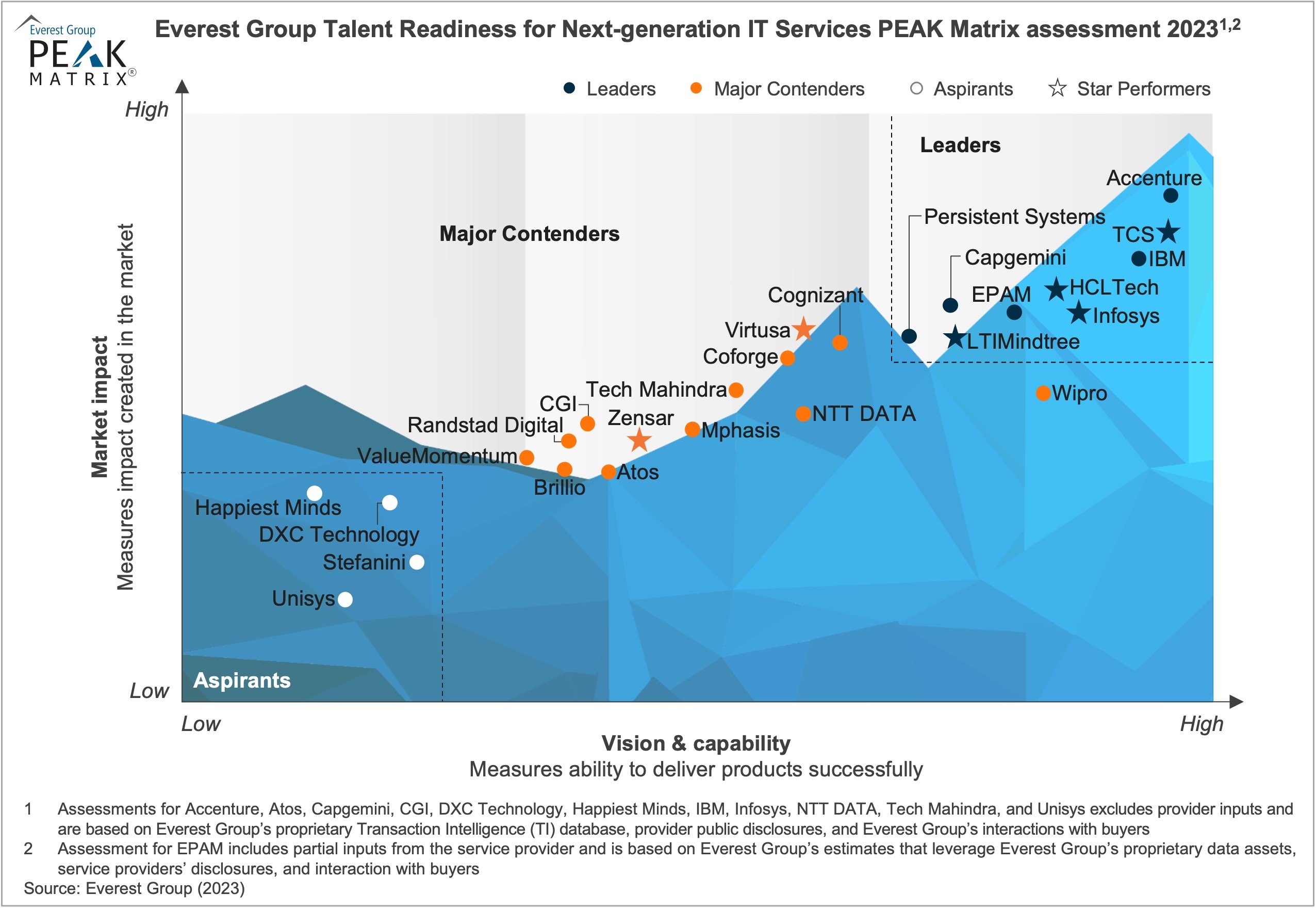

Amid the rapidly evolving technology landscape, enterprises face a primary challenge: the shortage of talent equipped with next-generation skills as they advance in their digital transformation endeavors. This challenge is further exacerbated by the shortening half-lives of skills and higher attrition rate in emerging skills within organizations. To address this challenge, enterprises are seeking IT service providers that have implemented robust talent development and management strategies. These strategies strive to acquire, nurture, and sustain a high-quality, productive, multi-skilled, and diverse workforce to meet evolving talent needs.

IT service providers are responding by investing in in-house talent development to gain a competitive edge and enhance their talent value proposition. Beyond traditional methods, they are exploring multiple innovative methods and incorporating themes related to the future of work in their talent development and management strategies. The goal is to develop and sustain a comprehensive portfolio of diverse resources equipped with next-generation skills.

In this report, we:

Scope

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

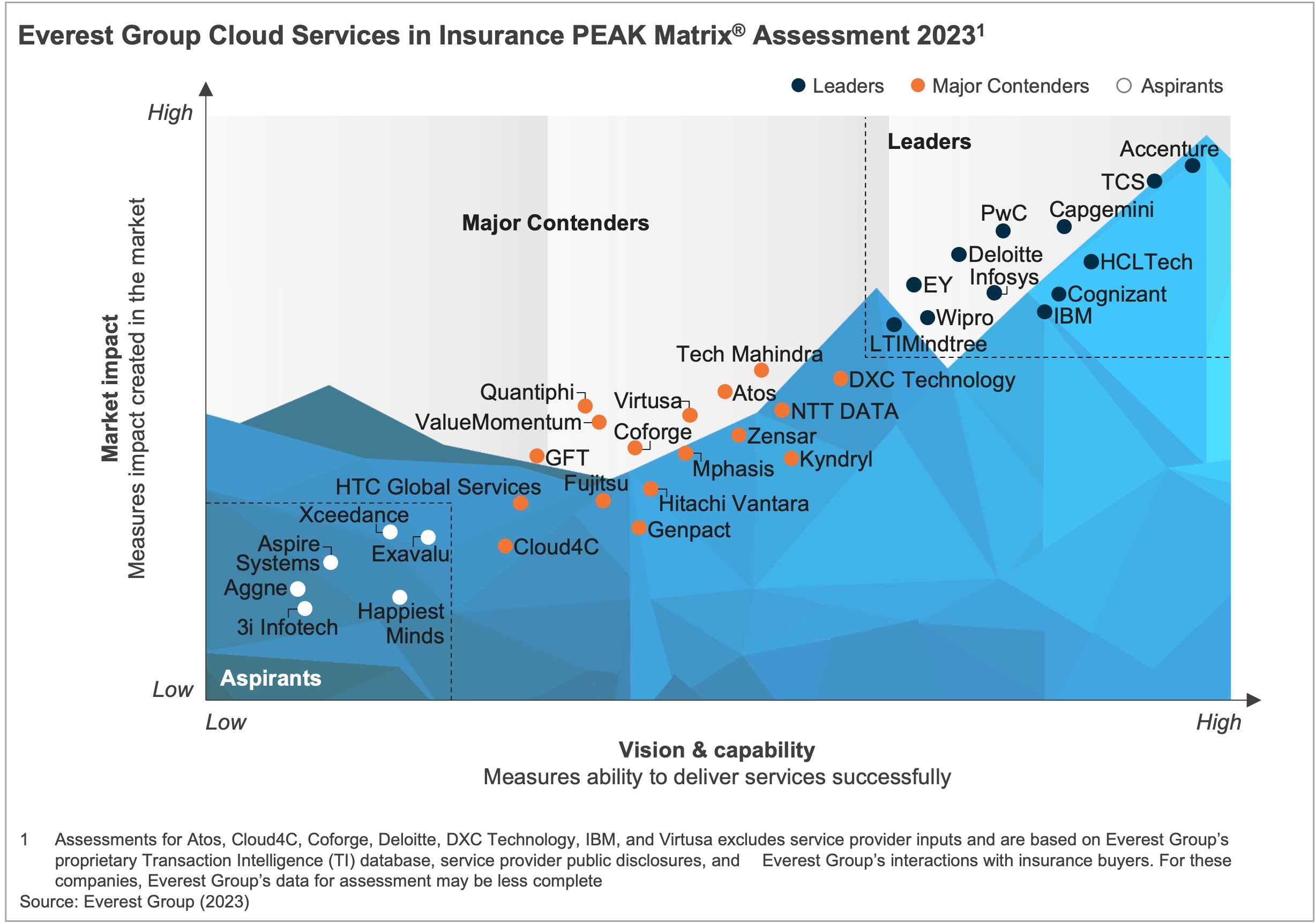

The insurance industry has been relatively slow in adopting digital measures due to regulatory constraints and product complexities. However, carriers are embracing the change to become risk mitigators. With the exponential rise in claims costs and unprecedented levels of underwriting losses during these challenging times, the need for value maximization, resource optimization, and achieving agility and scalability has become increasingly urgent.

In the past, insurers have embraced cloud technology as one of the prominent technologies. They are aware of the cloud’s potential, which has prompted them to strategize and build new business models that can withstand an unpredictable future. As insurers embark on their next growth phase, the cloud industry is expected to drive cloud spending to future-proof the technology estate, monetize data to generate alternate revenue streams, and rethink value delivery to end customers.

In this report, we:

Scope

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

As enterprises become more sustainability-driven, traditional approaches to measuring success, such as Key Performance Indicators (KPIs) and Service Level Agreements (SLAs), are no longer practical methods for determining objectives and measurable outcomes for pressing sustainability issues – like climate change and inequity.

Objectives and Key Results (OKRs) are a dynamic framework that offers a fresh perspective on delivering impactful metrics.

Watch as our sustainability experts discuss how enterprises can leverage OKRs for their sustainability initiatives and transition from the conventional KPI and SLA approaches to an OKR-driven methodology.

What questions does the webinar answer for the participants?

Who should attend?

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields