The Great Debate: Global Business Services Versus Outsourcing | Blog

During Shared Services & Outsourcing Week (SSOW), March 20-23, in Orlando, “The G6 BPO Debate” tackled thought-provoking and challenging questions associated with BPO’s impact on GBS. Keep reading for the perspectives of Everest Group Partner Rohitashwa Aggarwal, who attended the event. Reach out to us to learn more.

Are you entrenched in the ongoing battle between Global Business Services (GBS) and outsourcing? If so, you will relate to this. And if not, maybe it’s time to put down those piña coladas and engage in a discourse that could reshape your perspective.

Before delving further, let’s address a glaring contradiction. GBS encompasses in-house/captive and outsourced models. However, this blog explores the the in-house GBS versus Business Process Outsourcing (BPO) debate. Let’s set aside our perfectionist tendencies momentarily and dive into the fray. While I may not share all the opinions presented here, they contribute to a broader dialog. So, read on, keep note of your reactions, and share your insights at the end.

The G6 BPO debate moderated by Deborah Kops, Founder of Sourcing Change, at SSOW aimed to take global BPO leaders out of their comfort zones and into a “not-so-safe space.” True to its promise, the panelists addressed hard questions and pushed the boundaries on what BPOs mean to Global Business Services.

Discussions covered the following five areas, as recapped below:

Round one: unveiling the top challenges for global business services

From the myriad of discussions, four messages resounded loudly:

- GBS is not considered the most desirable career path

- Not all GBS leaders possess the necessary skills to drive change

- Relying solely on a do-it-yourself approach is insufficient for GBS success

- GBS often struggles to translate lofty aspirations into tangible achievements

Before raising objections, pause and reflect on how often you’ve encountered these challenges within your teams. It’s food for thought, indeed.

Round two: global business services against business process outsourcing – survival of the fittest

In a world where Darwinian principles hold sway, who emerges victorious in the battle for supremacy? The panelists extensively discussed the advantages of scale, speed, and financial prowess. However, the potential of GBS/SSC collaborating with outsourced entities in a combined “AND” model was surprisingly absent in the conversations. The true value of GBS/SSC lies in their ability to align with organizational objectives, and it is worth examining how leading providers cultivate this trust.

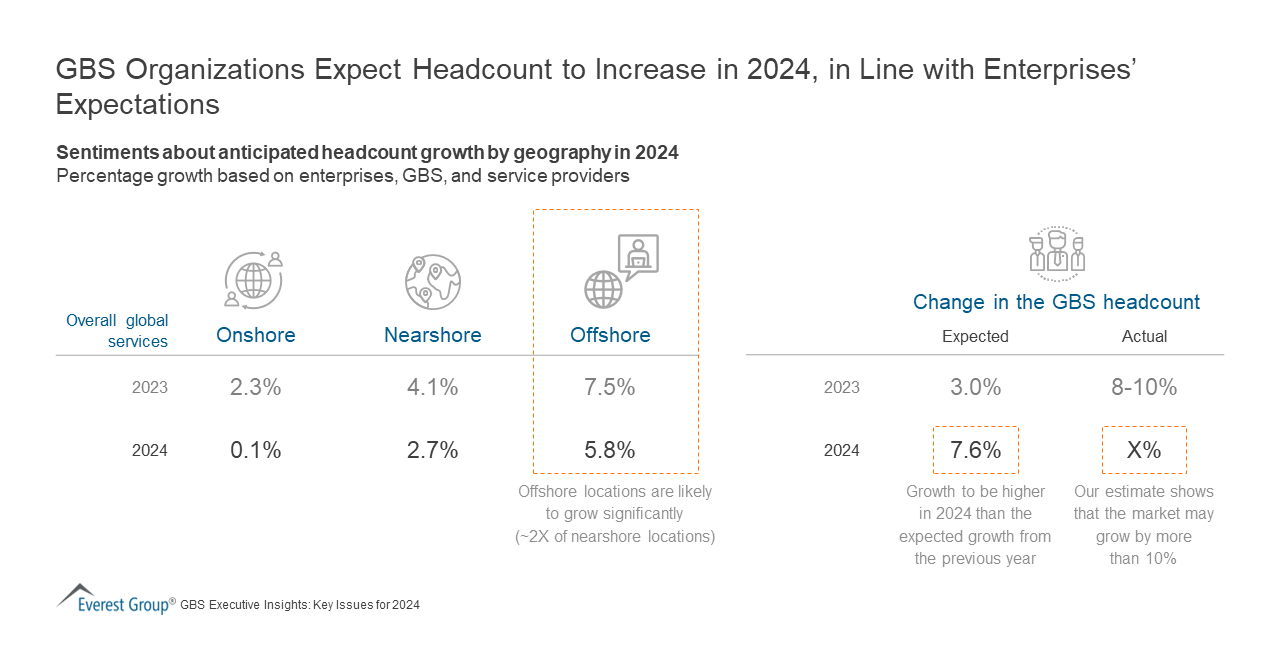

Everest Group research shows that GBS is increasingly embracing hybrid models. They prefer to move select work to vendors, use build, operate, transfer (BOT) setups more frequently, and directly engage vendors/outsourcing providers for various transformation, consulting, and staff augmentation needs.

Our research also counters a comment made during the discussion that insourcing is not increasing. Over the past 15 years, in-house delivery models have grown from 20% to 30% of the mix, although outsourcing remains prevalent. We have seen a consistent insourcing trend among leading global banks, insurers, consumer packaged goods firms, healthcare and life-sciences companies, and manufacturers.

Increasingly, mid-cap companies and others are setting up in-house centers, with more than 2,000 new in-house centers established in the past decade. However, this should not be misinterpreted as the death of outsourcing.

To share three data points:

- The outsourcing market has grown by 25% over the five years

- The number of GBS/SSCs using a hybrid model (versus a pure captive model) has increased to almost 1.5X in the last five to seven years. This is expected to grow further

- In the last five years, 40-50 in-house centers or entire GBS organizations have been dismantled partially or completely. This number could be even higher. Remember, not everybody survives in this industry

To conclude this point, an “AND” model must be used. Anybody who maintains a myopic view of GBS versus BPO misses the opportunity.

Read Deborah Kops’s recent article for more insights on why GBS get deconstructed and why they shouldn’t.

Round three: gen AI – gamechanger or dodo?

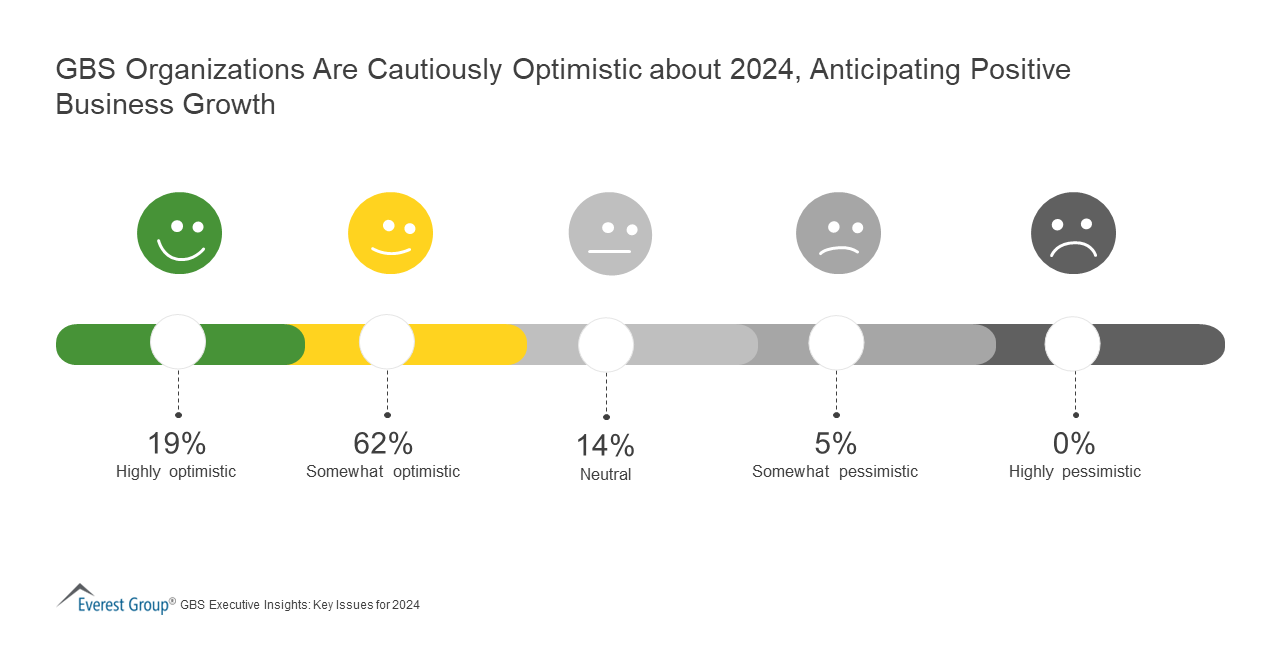

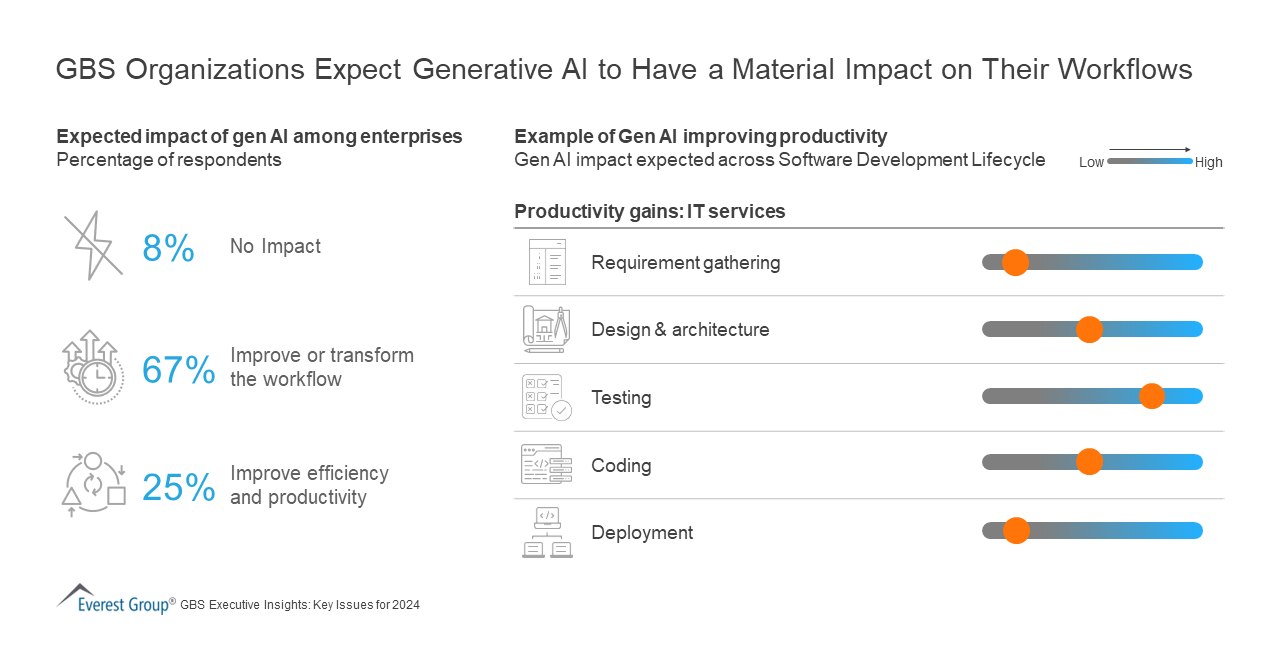

The debate surrounding generative AI (gen AI) was spirited but lacked definitive answers. While its transformative potential is undeniable, realization at scale remains elusive. Integration across organizational functions is imperative for maximizing gen AI’s impact.

Gen AI will undoubtedly impact the services industry over the next few years. It is important to remember:

- The full stack of automation and AI capabilities will drive this change

- To reach its full potential, AI solutions must be integrated end-to-end across the retained organization, GBS/SSC, and outsourced teams

GBS leaders should focus on implementing AI or other solutions in the right areas quickly and efficiently rather than building them from scratch. Vendor expertise should be leveraged to develop gen AI solutions (remember the “AND” model). With their vested interest and greater resources, providers will ensure expedited implementation and scalability.

Round four: decoding the success formula for GBS leaders

As expected, the panelists emphasized the importance of stakeholder management, change management, and adaptability. However, the crux lies in GBS leaders’ ability to earn the coveted status of “trusted advisor” to business counterparts. This requires a deep alignment with organizational goals that transcend the traditional service provider-client dynamic. Few GBS leaders can claim to have achieved this position. Link this to my point on the number one value proposition for GBS, and this becomes an imperative, not just an aspiration.

In an era marked by upheaval and turmoil (the pandemic, recession/slowdown, talent and trade wars, real wars, geopolitical tensions, increasing environmental concerns, and so on), GBS leaders’ ability to “meet business leaders where they are” will be a crucial success factor. And please don’t make this a turf war; an “us versus them” mentality is a recipe for disaster.

Round five: preparing for the future – a call to action

To sum up the points made during the debate, Global Business Services leaders must heed the following six imperatives:

- Enhance their business knowledge and understanding

- Communicate GBS value based on tangible outcomes

- Prioritize stakeholder experience

- Reengineer processes for efficiency

- Invest in talent upskilling. Remember, “AI won’t take your jobs; somebody who knows how to use AI will.”

- Embrace collaboration with vendors for mutual value creation

Now is the moment of truth for GBS leaders: Seize the opportunity to drive value or risk being sidelined. As Yoda sagely proclaimed, “Do or do not. There is no try.”

Do these insights resonate with you? Share your thoughts by contacting [email protected].

Hear more from Everest Group Partner, Rohit Aggarwal, in the LinkedIn Live series, Conversations with Leaders, Episode 9.

is the consolidation of various business support functions into a centralized service delivery model. Although the model is generally global for most companies, establishing multiple sites has primarily been needs-based rather than carefully planned as an integrated strategy.

is the consolidation of various business support functions into a centralized service delivery model. Although the model is generally global for most companies, establishing multiple sites has primarily been needs-based rather than carefully planned as an integrated strategy.

The benefits of integrating multiple sites into a GBS model

The benefits of integrating multiple sites into a GBS model