Real Diversity, Equity, Inclusion, and Belonging (DEIB) in Your Supply Chain: Advancing Gender DEIB with Impact Sourcing for the Workforce of Tomorrow | Blog

Organizations that have a diversified workforce and prioritize providing opportunities to all will ultimately contribute to building a stable global economy. While gender equity and inclusion have improved over the last decades, many challenges remain, including discrimination/bias, underrepresentation in leadership levels, and lack of access to education and employment opportunities. Impact sourcing is a business imperative that will not only help companies reach new talent pools but also offer opportunities to marginalized communities and populations, especially women.

Empowering women through impact sourcing

Impact sourcing is a business practice in which companies intentionally prioritize service providers that hire and provide career development opportunities to people who otherwise have limited prospects for employment.

Companies are implementing impact sourcing models to elevate excluded groups and improve gender equality through opportunities such as training and employment in various regions, especially where educational and career opportunities are not readily available to all. By including impact sourcing initiatives, organizations can begin to embed gender-responsive and ethical procurement practices into their business models, and, ultimately, affect social-economic improvements, such as decreased poverty and increased employment rates.

A response by the approximately US$215 billion1 global services industry to address social exclusion, impact sourcing is not a new concept but can make a significant impact. Considering that third-party services is one of the largest corporate sourcing/procurement spend categories, with companies often spending 5% of revenue on services partners, the practice has the potential to not just open up new talent pools, but also provide equal opportunities.

The gender gap in global services

According to S&P Global data, the percentage of women in the total workforce in developed and emerging markets has averaged around 35% over the past five years and has been exacerbated by the global pandemic. The proportion of women decreases progressively up the corporate ladder. However, in developed markets, the percentage of women in senior management is even lower than the number of women within boards of directors.

By investing in impact sourcing, companies can combat unequal treatment of women in the workforce with specific impact sourcing strategy goals. For instance, they can focus on closing the gender gap at the base of the issue rather than reporting on diversity indicators at the top, such as the number of women on boards or the percentage of women’s ownership. This is part of a growing movement to broaden supplier diversity to gender-responsive procurement, spearheaded by UN Women[1].

How impact sourcing aligns with the United Nations (UN) Sustainable Development Goals (SDGs)

Impact sourcing is one of the most credible and powerful ways to accomplish some of the 17 UN SDGs. As a result, it bolsters gender-responsive procurement, which is defined as the selection of services, goods, and civil works that consider their impact on gender equality and women’s empowerment.

Impact sourcing naturally aligns with UN SDGs in the following ways:

|

Goal 1 – No Poverty: Impact sourcing helps provide employment opportunities to marginalized groups, contributing to reduced income distribution gaps and eradicating poverty |

|

Goal 4 – Quality Education: The innovation in impact sourcing includes training, accommodation, recognition of unique talents, and career counseling for youth who may not have access to higher education |

|

Goal 5 – Gender Equality: Putting women at the center of economies will fundamentally drive more sustainable outcomes since individuals who identify as women are increasingly becoming part of the core workforce. Organizations can become more inclusive towards women by having a rigorous impact sourcing strategy |

|

Goal 8 – Decent Work and Economic Growth: Employment is at the core of impact sourcing, helping organizations offer good jobs to marginalized individuals |

|

Goal 10 – Reduced Inequalities: Growing inequality is one of the biggest roadblocks in achieving social progress and global stability. Impact sourcing can contribute towards inclusion and equal opportunities within and among countries |

With lower attrition rates and higher corresponding levels of employee engagement, which results in lower costs and higher productivity over time, impact sourcing also provides a diversified talent pool to companies.

Impact sourcing encourages companies to help underserved populations, like women, move out of poverty and transform their lives and provide for their families. Corporations can engage in inclusive hiring practices that promote equal opportunity, diversity, skill development, and equal treatment for women. A responsible hiring mechanism by organizations can effectively contribute towards increasing employment opportunities and career development for this socially impacted and vulnerable segment of society, creating meaningful change in the world and taking an impactful step in the fulfillment of the UN SDGs.

Additionally, as the LGBTQ+ community enters the workforce, organizations may expand the definition of “gender” to become more inclusive in their impact sourcing decisions.

Impact sourcing use cases with gender-specific goals

Televerde

Established as a US-based for-profit sales and marketing organization in 1994, Televerde provides on-the-job training to more than 200,000 current and formerly incarcerated women in the US. As a purpose-driven company, Televerde helps these women reintegrate back into their communities.

Televerde has a global workforce of more than 600 employees, 70 percent of whom sit behind prison walls, and about 60 percent of its staff is comprised of incarcerated women. In addition to being paid fair market hourly wages, they receive training for the required skills and can also achieve certifications in sales and marketing, while earning college credits for completing company-sponsored training programs.

Not only does the Televerde business model help these women, but it has enabled the company to generate more than US$8 billion in revenue for its clients.

In 2020, Televerde formed its non-profit unit Televerde Foundation to further empower incarcerated women and serve as a driving force to fulfill Televerde’s mission to change the lives of 10,000 disempowered people by 2030.

iMerit

A global impact sourcing specialist, iMerit was founded in 2012 in rural India to bring a diverse talent pool from underserved backgrounds into the digital workforce. Today, 52 percent of its workforce is female, and, interestingly, the company was founded by Radha Basu, a technology pioneer who rose through the ranks when very few women did. By embedding purpose objectives into its business model, the for-profit impact sourcing firm has raised US$23.5 million in funding since July 2021.

Today, iMerit employs more than 4,000 data enrichment and annotation experts in Bhutan, India, and the US. It launched one of its first all-women centers in Metiabruz, West Bengal, a region where women have traditionally lacked professional career opportunities.

Sama

A for-profit training-data company, Sama focuses on annotating data for artificial intelligence algorithms. As one of the pioneers in the impact sourcing space, it aims to reduce poverty, empower women, and mitigate climate change. The company combines its technology platform and worker training programs to increase economic opportunity for those in underserved communities.

Sama, a certified B Corporation, operates global delivery centers in Kenya and Uganda and was named one of the “Best for the World” for workers in 2021.

By 2019, Sama had helped over 50,000 people move out of poverty. Its impact was particularly strong for women during the COVID-19 pandemic, when Sama was able to create a remote working model, allowing them to continue working despite lockdown orders.

FiveS Digital

An India-based certified woman-owned business and impact sourcing company, FiveS Digital has a workforce of over 1,500 employees at seven delivery centers in India, with a presence in Europe and North America. It started as a pure-play BPO company in 2009 and has entered the digital technology services domain over the years.

FiveS Digital collaborates with several non-profit organizations and supports young professionals’ upskilling needs, especially women from Tier-2 or Tier-3 cities and rural areas. With diversity and inclusivity as one of its key focus areas, it invests in opportunities and leadership roles for women. As a result of its continued commitment and focus, it was recently certified as a Women’s Business Enterprise (WBE) by the Women’s Business Enterprise National Council (WBENC), the largest third-party certifier of women-owned and operated businesses.

Organizations are choosing suppliers that aim to help disadvantaged groups

An increasingly used type of gender-responsive procurement, impact sourcing helps organizations discover initiatives to improve gender inclusion at all levels by partnering with leading impact sourcing specialists like FiveS, Sama, iMerit, and Televerde, as well as mainstream providers.

Enterprises can make a difference by partnering with service providers that employ groups experiencing exclusion, whether as an HR practice or by subcontracting to impact sourcing specialists. As businesses increasingly reach into untapped geographies for hidden talent, they will help build a stable global economy and promote inclusivity – a true win-win scenario.

Discover more about the benefits of inclusivity in the LinkedIn Live event, Why Inclusivity is Essential in Building Your Tech Talent Workforce.

[1] https://www.unwomen.org/en/about-us/procurement/gender-responsive-procurement

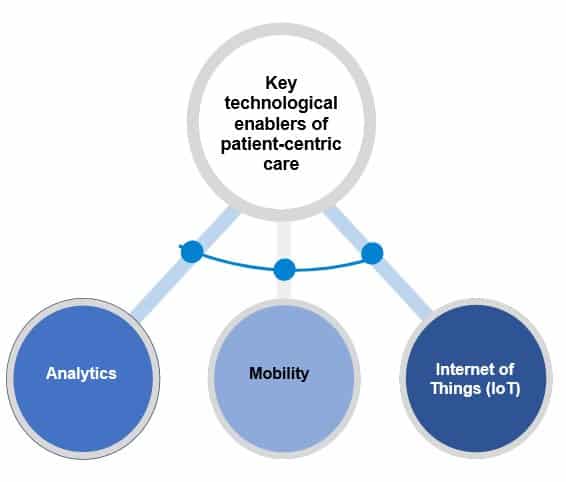

For example, under the NHS’s RightCare initiative, the NHS may look to accelerate the adoption of value-based care. Funding is focused on allocative value (how well assets are distributed to different areas of healthcare), technical value (how well resources are used to achieve valid outcomes), and personalized value (determined by how well an outcome matches patient expectation). Additionally, with increasing demand for telemedicine, NHS trusts will be on the lookout for providers that develop mobile applications aimed at remote healthcare management to support the growing importance of care at home for chronic conditions.

For example, under the NHS’s RightCare initiative, the NHS may look to accelerate the adoption of value-based care. Funding is focused on allocative value (how well assets are distributed to different areas of healthcare), technical value (how well resources are used to achieve valid outcomes), and personalized value (determined by how well an outcome matches patient expectation). Additionally, with increasing demand for telemedicine, NHS trusts will be on the lookout for providers that develop mobile applications aimed at remote healthcare management to support the growing importance of care at home for chronic conditions.