In an era characterized by continual change, evolving market dynamics, and an unwavering demand for progress, enterprises must embrace innovation while effectively managing change.

In this webinar, our analysts presented invaluable insights gathered from Everest Group’s 2024 Key Issues survey, specifically focusing on how issues will impact EMEA. The webinar addressed the challenges that companies in the EMEA region will face in 2024 and how they can think about addressing them.

Participants got a view into the perspectives of industry leaders in the IT-BP sector, heard the major concerns, expectations, and emerging trends for 2024, and learnt actionable recommendations.

What questions did the webinar answer for the participants?

Who should attend?

View the event on LinkedIn, which was delivered live on Wednesday, February 14, 2024.

In our recent 2024 Key Issues Survey, we discovered that price and cost pressures continue to be the top priority for enterprises. 💰

In this engaging LinkedIn Live session, our pricing experts revealed insights from the Everest Group Pricing Index™ report – a biannual overview of current and expected outsourcing pricing trends across various service types and delivery locations. 🌍

Participants learned valuable pricing insights and discovered the major current commercial themes influencing the market.

During this event, we explored:

✅ How pricing changed across key outsourcing functions and delivery locations in 2023 💡

✅ The pricing outlook for 2024, and how it can impact your outsourcing strategy

✅ How companies are using the Pricing Index to help with sourcing decisions 📈

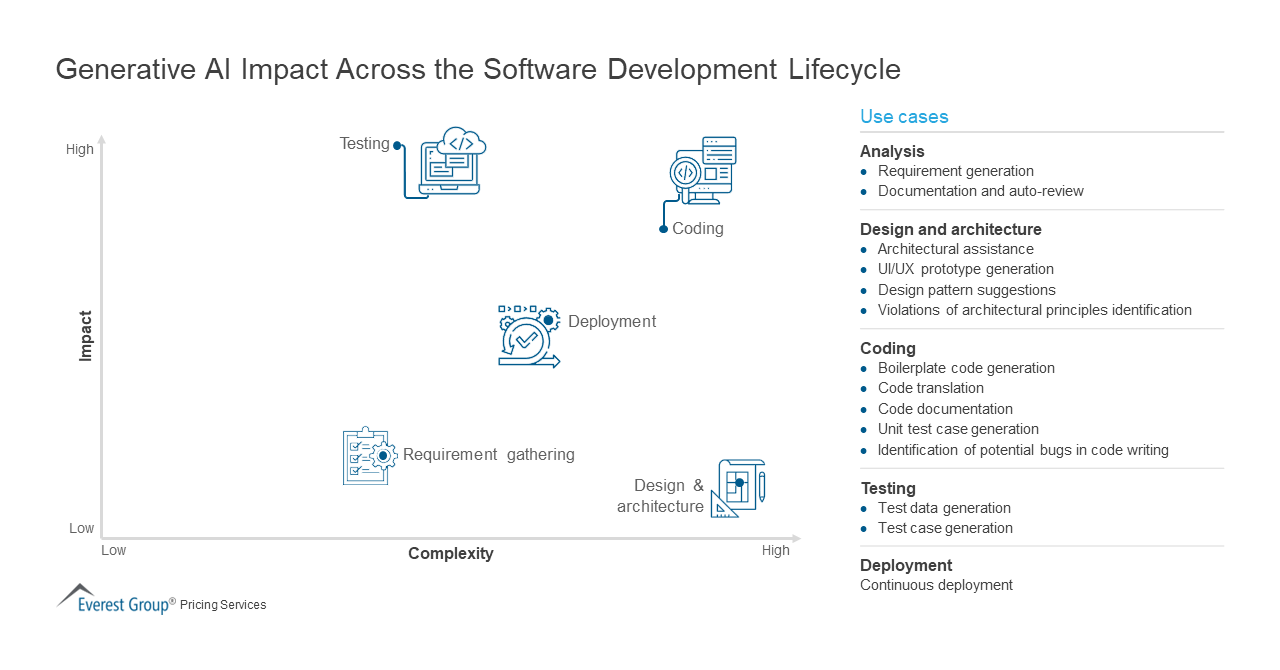

Software Development Lifecycle

Infrastructure Services

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields