May 20, 2020

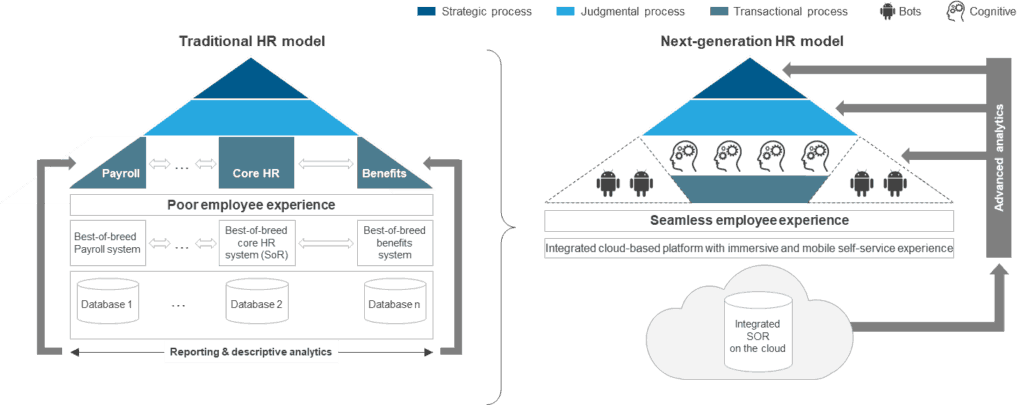

Over the past couple of years, the HR function has experienced drastic changes, particularly in the way employees work, learn, and communicate. The pace of change has been exponential, with enterprises pushing for digitalization. However, no one would have imagined that a single global event, the COVID-19 outbreak, would accelerate one of the greatest workplace transformations of our times.

Digitalization is crucial, as it will help companies enable their internal functions with collaboration and productivity tools for employees and improve operational efficiency with agile business continuity plans.

The acceleration can be credited to the urgency to support employees working remotely so the business can run as smoothly as possible and provide a superior employee experience amidst the panic and uncertainty. With businesses struggling to survive in the face of, what is likely, one of the harshest recessions to date, it’s vital to understand the changes that will be brought about by this global pandemic. These changes will be facilitated by newer technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and automation, and force companies to rethink their existing structures and guidelines

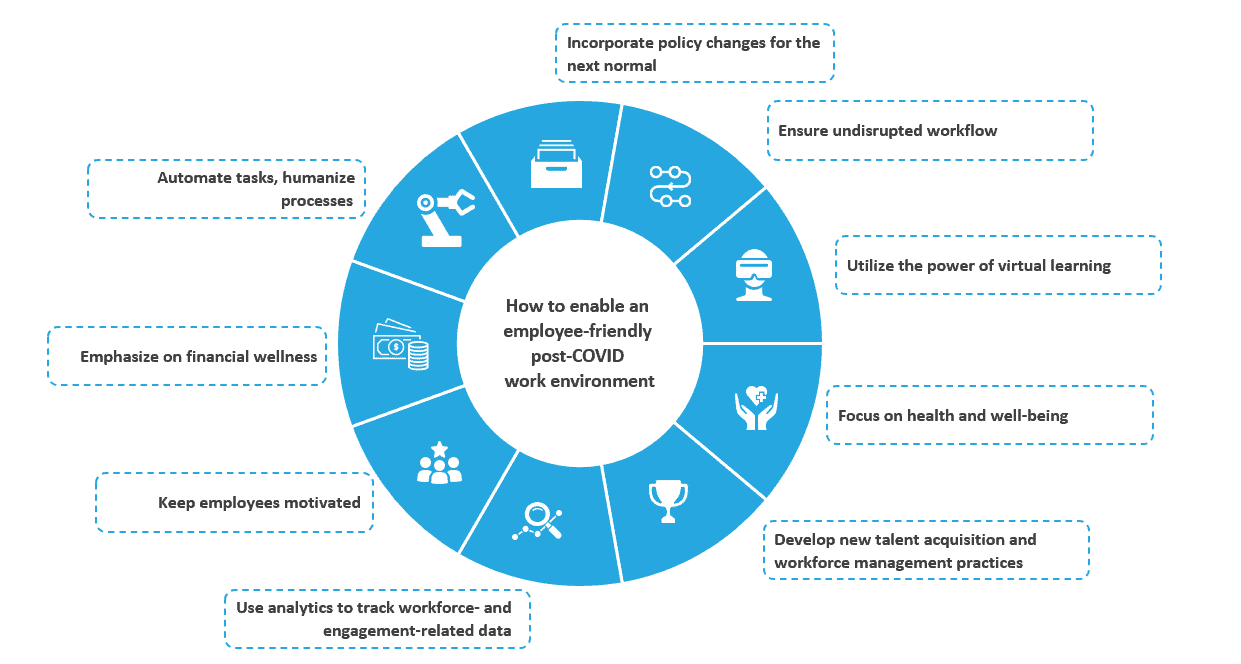

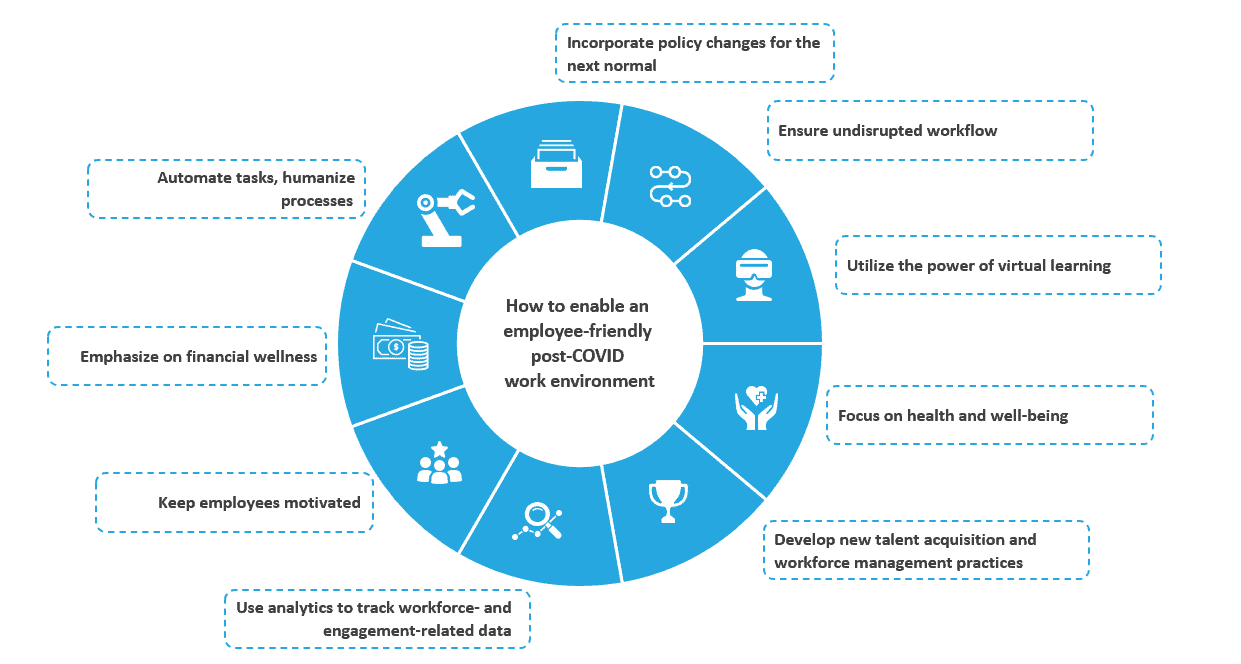

Here’s a look at how HR needs to change to ensure a great work environment in the next normal:

Incorporate policy changes for the next normal: With the strain of the coronavirus confining everyone to their homes, companies across the globe have mandated or are encouraging employees to work from home. And this model is expected to stay. Even after the pandemic ends and employees return to their workplaces, remote work will continue to hold significant relevance as enterprises realize its cost-benefit and commit to finding other methods to support business continuity. To ensure its success, companies will have to develop processes and inculcate policies that enable flexible working – establishing guidelines for working remotely, managing employee productivity in physical and digital workspaces, and formulating guidance for managers handling a distributed workforce. Further, the use of digital workers and bots will increase, which will, in turn, result in an urgent need to develop policies regarding cybersecurity, auditing, and redefining instances of human intervention.

Ensure undisrupted workflow: With the new and restructured workforce, companies are also looking to digitize the workplace and automating various processes and workflows to increase efficiency. Thus, HR solutions for automated employee onboarding, automated helpdesk, and productivity tools, along with communication and collaboration tools, are gaining traction in the market. For instance, the adoption of Microsoft Teams and Zoom have dramatically increased, and the uptake will continue.

Utilize the power of virtual learning: Businesses that have typically relied on face-to-face/classroom learning will have to develop a proof of concept for learning using the latest online technologies. The remote working model and increased leverage of digital technologies will also increase the need to upskill and reskill the workforce. In light of COVID-19, enterprises have become extremely cautious with their spending and are seeking cost-effective solutions for their workforces, which adds to the appeal of remote learning. To derive maximum benefit, organizations will have to look not only for relevant skills and talent but also for tools to enable smart learning, as well as enter into partnerships with traditional and non-traditional learning organizations.

Focus on health and well-being: COVID-19 has brought the importance of employee well-being, which encompasses physical, mental, and emotional health, to the forefront. The HR wellness agenda for the future will have two facets: One, the employee side, which includes tools and policies that help employees plan their day-to-day activities, particularly when working remotely and have to deal with increased stress and added concerns of changing benefits ranging from health and hazard to leave policies; and, two, the operations side, which includes tools that track employee sentiment and help improve employee support, thereby ensuring better employee engagement.

Develop new talent acquisition and workforce management practices: Every process in the acquisition value chain will be overhauled to make it more efficient – from the use of AI and Machine Learning (ML) algorithms to source and screen candidates to the use of video interviewing tools to enable remote presence, and chatbots to ensure a superior candidate experience and engagement. Following the COVID-19 crisis, the job market is also set to undergo massive changes; while the demand for some jobs will increase, the overall job market will slow. Enterprises will need to conduct powerful workforce planning to ensure their access to the right talent, and strategically structure existing talent to ensure maximum engagement and productivity.

Use analytics to track workforce- and engagement-related data: As the workforce becomes increasingly (and literally) spread out, and as new ways of working emerge, HR leaders will have to keep track of their organizations’ pulses. Efficient data collection and mining tools will be key to understanding the nature of changes. Organizations will increasingly adopt tools that track how employees work, perform, collaborate, and feel to derive insights to improve operations and engagement. These tools, along with advanced AI capabilities, will also deliver actionable insights for more informed decision-making in a shorter time.

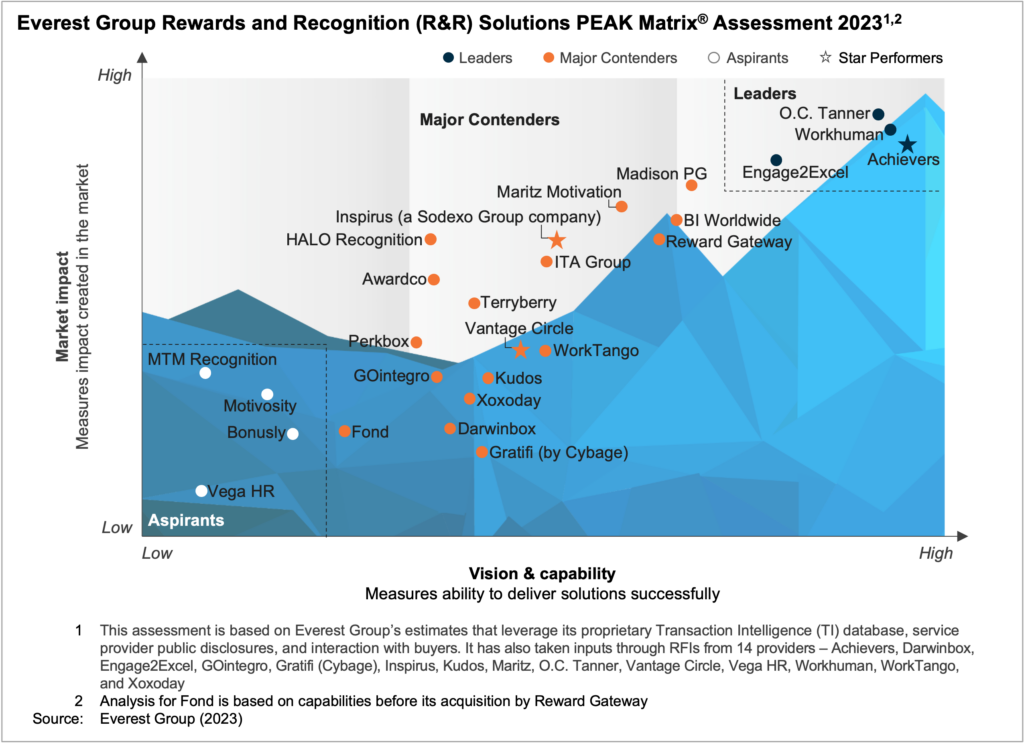

Keep employees motivated: With increasing instances of pay cuts and the uncertainty of the current situation, enterprises are looking for effective strategies to keep their employees engaged and motivated. Deploying a robust R&R solution that quickly recognizes and rewards valuable employees for their effort and commitment to work can help organizations mitigate some of the impacts of the ongoing pandemic and the slowdown, and as a result, boost employee morale.

Emphasize on financial wellness: With the increasing number of layoffs, instances of pay cuts, and market fluctuations, financial security is a significant concern for many employees. To curb these types of fears within the workforce, companies can provide employees with financial wellness options. Features such as budget management tools, financial coaching, and financial stress management tools, as well as the offer of paid leave, on-demand paychecks, and pre-paid cards, can help during these unprecedented and trying times.

Automate tasks, humanize processes: While HR must redesign processes to make them more efficient, it is far more important to keep the employee at the center of these processes rather than the function. This crisis is an opportunity to redesign around the central stakeholder – the employee.

These strategies will help enterprises survive in the new normal while keeping their employees engaged and satisfied, whether they develop them in-house or partner with service providers to deliver them.

Is your workplace future-ready? How do you see the HR strategies transforming? Share your inputs with Priyanka Mitra.