Argentina’s Dollarization Dilemma – Assessing Potential Implications | Blog

Implementing dollarization can help resolve Argentina’s economic woes and ongoing inflation, but it poses complex challenges for stakeholders. Read on to explore the opportunities, obstacles, and financial and operational impacts for global companies in Argentina.

Argentina’s chronic economic struggles, characterized by persistent inflation and macroeconomic instability, have reignited the debate surrounding dollarization – adopting the US dollar as its official currency. This alarming scenario of soaring inflation signifies the culmination of decades marked by fiscal mismanagement and monetary recklessness that have deeply impacted the country.

In 1991, Argentina implemented a currency peg between the peso and the dollar to combat inflation. Then-president Carlos Menem proposed fully dollarizing the economy in 1999. However, the dollar peg collapsed amid a severe recession, leading President Eduardo Duhalde to dissolve the 1:1 link in early 2002. During his winning campaign, Argentina’s newly elected president, Javier Milei, championed the dollarization proposal.

While dollarization holds the allure of offering a solution to the country’s woes and chronic inflation, it presents complex challenges for global companies, investors, and other stakeholders.

Potential benefits of dollarization

The potential benefits of dollarization are enticing and include:

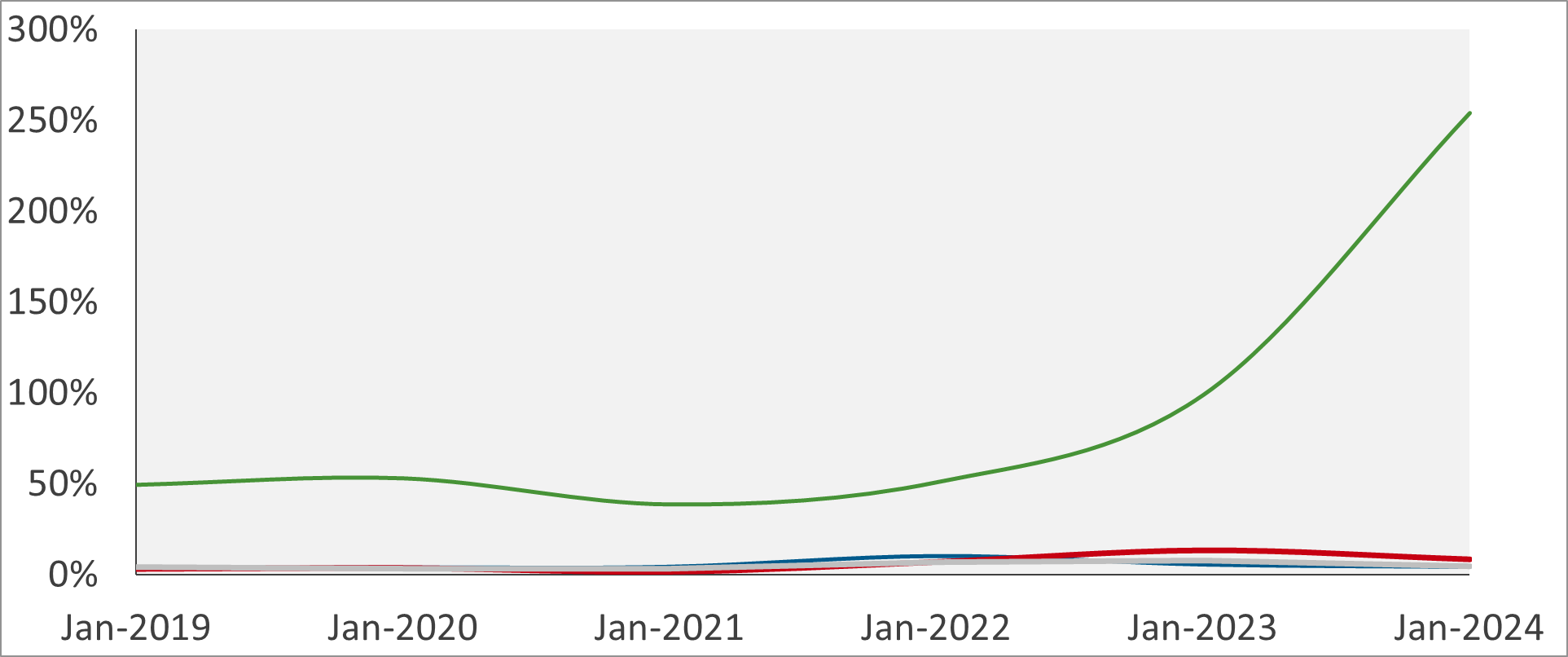

- Hyperinflation tamer: Argentina is experiencing its highest annual inflation rate in three decades (soaring to 254.2% in January 2024), eroding the value of the peso and crippling economic activity. By anchoring the currency to the relatively stable US dollar, dollarization could bring immediate respite from this inflationary ordeal

- Fiscal discipline enforcer: Fiscal discipline is paramount, and dollarization would eliminate the central bank’s ability to print pesos and fuel government spending. This could potentially lead to more responsible budgeting and reduce deficits

- Foreign investment magnet: A dollarized economy would eliminate currency risk, bolster investor confidence, and attract foreign investment. This influx of capital could stimulate economic growth and job creation

Risks of dollarization

While dollarization has the potential to control hyperinflation and stabilize the economy, adopting it also poses the following significant risks:

- Surrender of monetary sovereignty: By adopting the dollar, Argentina loses control over its monetary policy, a powerful tool for managing economic cycles and responding to shocks. This can limit the government’s ability to stimulate the economy during downturns

- Reduced export competitiveness: While dollarization may attract investments into the country, it is also likely to make Argentine exports relatively more expensive, hindering international market competitiveness. This could hamper overall economic growth, particularly in export-oriented sectors

- Heightened poverty: Reduced government spending due to fiscal constraints could stretch social safety nets thin for the already vulnerable two-thirds of the population below the poverty line. This could exacerbate social inequality and unrest

- Impact on relations with China: This proposed move brings to light a crucial but often neglected concern regarding the continuity of the currency swap line between the Central Bank of the Argentine Republic (BCRA) and The People’s Bank of China (PBOC). This swap line has recently played a pivotal role in averting default on Argentina’s obligations to the International Monetary Fund (IMF)

Dollarization has financial and operational implications for global companies operating in Argentina. Let’s explore these repercussions further.

Financial implications

During the transition to a dollarized economy, global companies may face challenges in hedging due to foreign exchange fluctuations, necessitating careful currency risk management and financial strategy adaptation to maintain profitability. As the currency strengthens, local costs (such as salaries, rentals, and other expenses) will increase, prompting a need to reconsider cost structures through automation or outsourcing to remain competitive.

Additionally, determining transfer pricing between the Argentine subsidiary and other branches will raise new challenges, requiring close compliance attention as tax authorities might scrutinize pricing strategies under the new regime.

Operational repercussions

The uncertainty surrounding dollarization’s impact in Argentina may lead global companies to postpone investments until the dust settles, potentially stalling short-term economic growth and job creation.

Moreover, exchange rate fluctuations during the transition could disrupt supply chains, impacting the seamless flow of goods and services. To address this, building resilient supply chains that incorporate local sourcing alternatives to mitigate potential disruptions effectively becomes critical.

Impact on the competitive landscape

Dollarization could potentially level the playing field for global companies compared to local competitors, as currency risk would cease to be a distinguishing factor. This would likely heighten competition and market consolidation. In the medium to long term, a stable currency environment may attract a wave of investors, further intensifying competition for existing global firms.

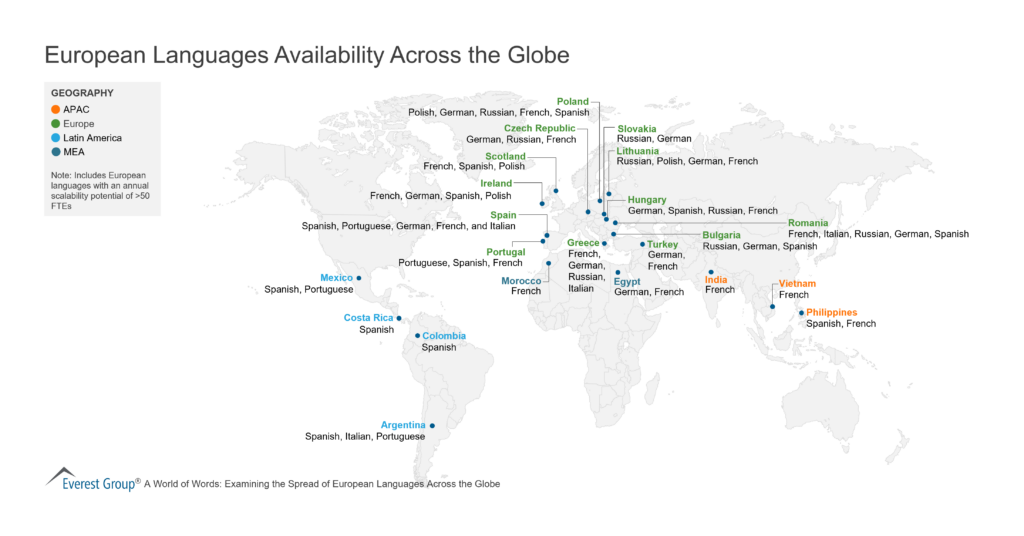

However, this stability may also pose challenges for talent retention, as the stronger currency could inflate the cost of retaining skilled employees. To counter this, global companies will need to offer competitive compensation and robust career development opportunities to attract and retain top talent amid changing economic dynamics.

Impact on investors

For investors, dollarization presents a multifaceted landscape. On the one hand, it offers the potential for reduced uncertainty through a stable currency environment, mitigating exchange rate fluctuations and providing greater predictability for investments.

Additionally, dollarization may attract skilled expatriates, thus adding diverse perspectives and enhancing the talent pool. Moreover, if successful, dollarization could pave the way for potentially higher returns on investments in the long run, fuelled by economic growth spurred by the new currency regime.

However, investors must also be wary of these challenges that come with dollarization:

- Firstly, an influx of foreign investors drawn by a stable currency could intensify competition in certain sectors, necessitating strategic adjustments and potentially impacting profitability

- Secondly, Argentina’s economic fortunes would become inextricably linked to US monetary policy, introducing new risks and potentially limiting the government’s ability to respond to local economic needs

- Finally, if not implemented carefully, dollarization could aggravate social tensions and inequality, impact overall stability, and create a less conducive investment environment

What lessons has history taught us?

Valuable insights can be gained by looking at Ecuador and Panama’s experiences with dollarization. While both countries adopted the measure to tackle economic instability, their experiences illustrate the differing potential outcomes of this complex policy.

Panama adopted the US dollar as its official currency in 1903, driven by political uncertainty and a desire for economic integration. Its dollarized economy has enjoyed remarkable stability and growth over the past century, albeit with ongoing challenges related to income inequality.

Ecuador adopted dollarization in 2000 following chronic inflation and currency devaluation. While it saw initial success in taming inflation and attracting investment, long-term challenges such as dependence on oil exports and income inequality persisted. Despite improved macroeconomic stability, Ecuador still struggles with high unemployment and poverty.

Other countries that have gone through dollarization include El Salvador, Zimbabwe, Cambodia, and Turks and Caicos.

The outlook for dollarization

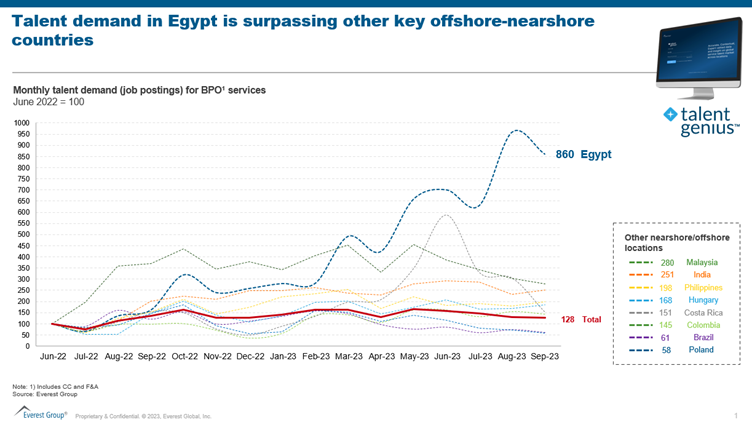

In June 2023, the average monthly salary for a software developer in Argentina was about 500,000 pesos, as reported by the country’s software and computer services observatory. At that time, this salary translated to over US$2,000. However, by January 2024, the equivalent amount decreased to US$650 owing to the peso’s depreciation.

To counter this, some private firms in Argentina have been partially paying employee salaries in dollars to retain skilled talent. Companies such as Mercado Libre, Accenture, and Globant offer partial salaries in dollars as the peso crashes. Along with this, some businesses have started to accept payments in dollars. For example, GoDaddy has stopped accepting pesos and only accepts US dollars in payments. However, this is the exception, not the norm, and everyone doesn’t share the enthusiasm to dollarize.

Investment bank JP Morgan, among other economists, has cautioned that Argentina lacks the necessary prerequisites for implementing the plan, which requires a substantial foreign currency reserve and significantly higher savings rates.

While dollarization promises to be a silver bullet solution if executed effectively, its potential adoption in Argentina presents a complex scenario with inherent risks. Adopting dollarization would entail relinquishing Argentina’s control over its economic policies, representing a significant gamble with long-term implications. It’s crucial to recognize that dollarization is not a one-size-fits-all remedy and does not offer a comprehensive solution to Argentina’s economic challenges.

Stakeholders must carefully weigh the potential benefits and drawbacks to ensure they are well-positioned to thrive in the evolving economic landscape. Seeking expert guidance can help enterprises navigate this intricate landscape and make informed choices that align with individual strategic objectives and risk tolerance.

To learn more about key market dynamics and related opportunities in Argentina, read our latest report, Location Spotlight – Argentina.

To discuss the global services industry in Argentina, please contact Parul Jain ([email protected]) or Harshit Mittal ([email protected]).

Explore Everest Group Talent Genius™, the AI-powered insights platform to guide IT and BPS location and workforce decisions.