Digital Transformation Success Is NOT Rooted in Technology | Blog

Here’s a sobering fact: Everest Group research found that 78 percent of enterprises fail in their digital transformation initiatives. Failure here can mean multiple things, including unsustainable returns, lack of user adoption, or, even worse, abandoned projects.

The following picture illustrates one of the key reasons they’re failing. What is it?

It’s a Steaming Pile of Technology – what we call a SPOT. And, unfortunately, it’s where most organizations start their digital transformation journey.

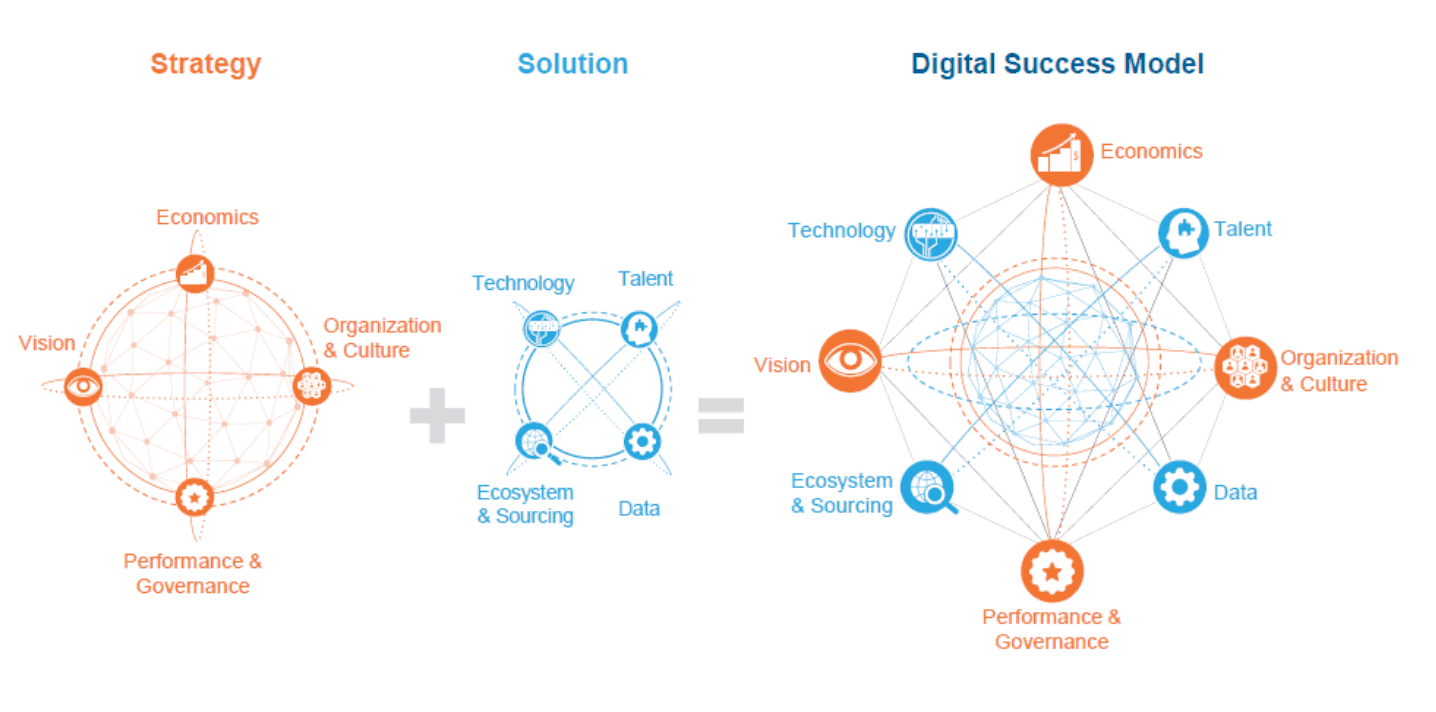

Why do I say unfortunately? The truth is that a technology-led approach won’t enable you to achieve the business value you expect from your digital transformation initiative. Indeed, as you see in our holistic, interconnected Digital Success Model, technology is only one of eight components that you need to get right to succeed.

Let’s take a quick look at all eight components, which we categorize under strategy and solution.

The strategy

With so much at stake, you have to begin your digital transformation journey by defining where you want to go and how you’ll get there. The four critical strategy components you must address at the very onset are:

Vision

This must clearly and concisely cover what you specifically want to achieve in both the short- and long-term. For example, is the initiative to drive revenues, cut costs, improve customer experience, extend competitive advantage, be compliant? The objective functions will fundamentally dictate your digital transformation journey’s “rate of spin.”

Economics

Typical funding models don’t work in digital transformation programs because they focus on achieving ROI in a short timeframe. Instead, you need to establish the right budget centers in the to-be-transformed business and functional unit/s, and the right funding mechanism – CapEx versus OpEx. Additionally, you should put in place funding gates to ensure your business objectives are met during interim check-points.

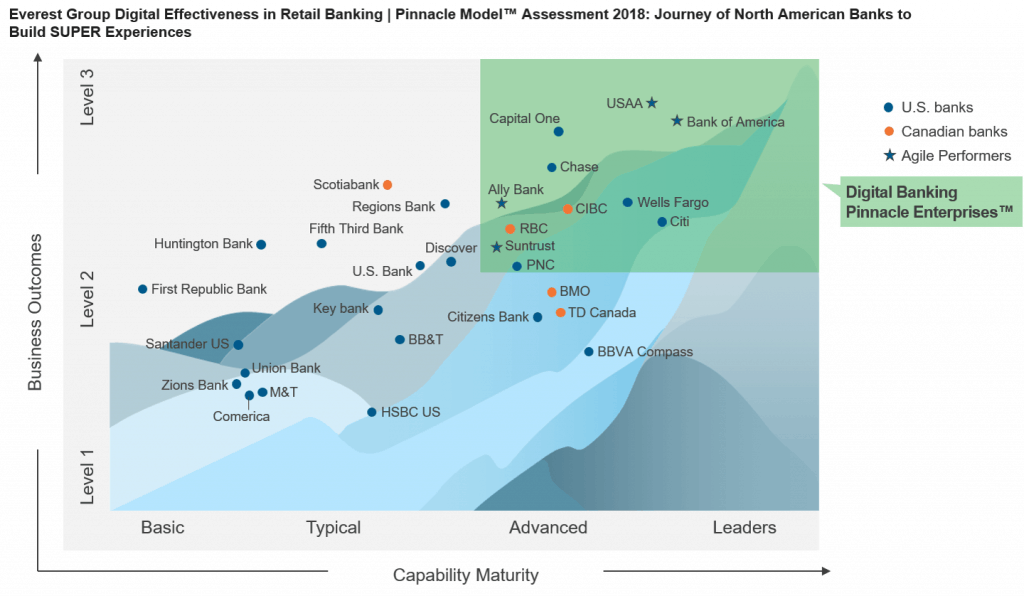

Organization and cultural

We consider organizational culture and change management the most important element of the digital strategy model. In order to succeed, you must create an empowered, cross-functional journey team that aligns the C-suite, business stakeholders, and IT stakeholders. Emphasis on agility, risk tolerance, and decision-making speed and flexibility are key. And to make sure your new culture takes hold and sticks, you need to adequately budget both time and money for a comprehensive change program.

Performance and governance

As management guru Peter Drucker said, “You can’t manage what you can’t measure.” To effectively manage the success of your digital transformation journey, you need to identify and measure metrics that tie back to your vision. You also need to establish interim milestones for these metrics to track progress, allocate funding, and drive any needed course correction. Many enterprises find that investing in a digital transformation Program Management Office can help them handle performance and governance on the operational, tactical, and strategic levels.

The solution

Once you have your strategy in place, you can move on to shaping the solution.

Technology

When selecting your technology, a “one-off, one and done” approach may deliver very short-term spurts of success, but it won’t deliver sustained business value. To achieve ongoing success, you need to embrace a platform-based operating model as the foundation for your digital transformation journey. What we call a Digital Capability Platform helps you look at all your users – your employees, your customers, and your partners – in the context of all the technological enablers to drive the customer experience, decisions, process efficiency, and scalability and performance.

Talent

The best strategy, funding mechanisms, technology, etc., can’t deliver to your expectations if you don’t have the right talent. Indeed, your ability to compete in the digital era depends on having the right talent, at the right time, in the right places. You need to prioritize using an elaborate sourcing ecosystem to find the talent you need today, and establish a robust resource management program to help you plan for future skill requirements.

Data

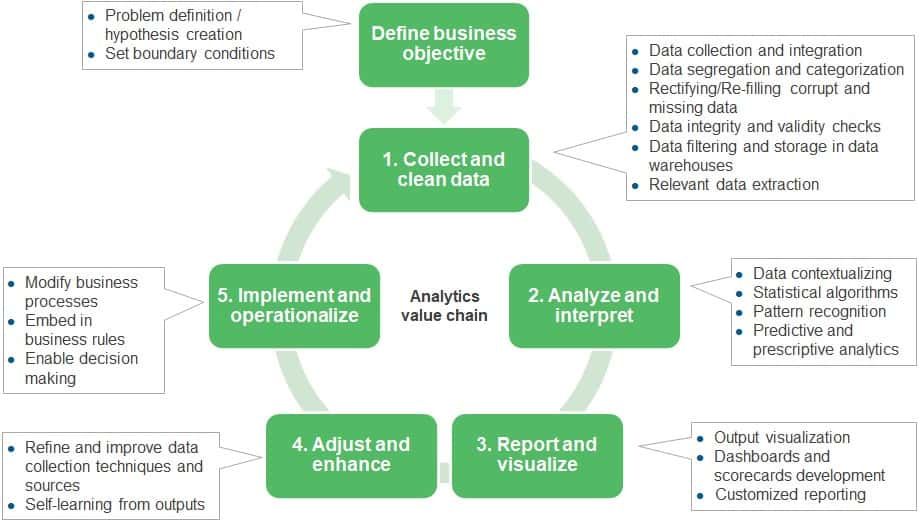

Not surprisingly, data is a key enabler of your digital transformation success. Consider this: our research found that 100 percent of successful enterprises use digital initiatives to collect data and perform analytics for better insights that drive better outcomes, and 94 percent use some form of data and analytical solutions to augment their strategic decision-making. You need to be able to convert your existing volumes of data into a high-quality, actionable enterprise asset to achieve longer-term digital transformation success.

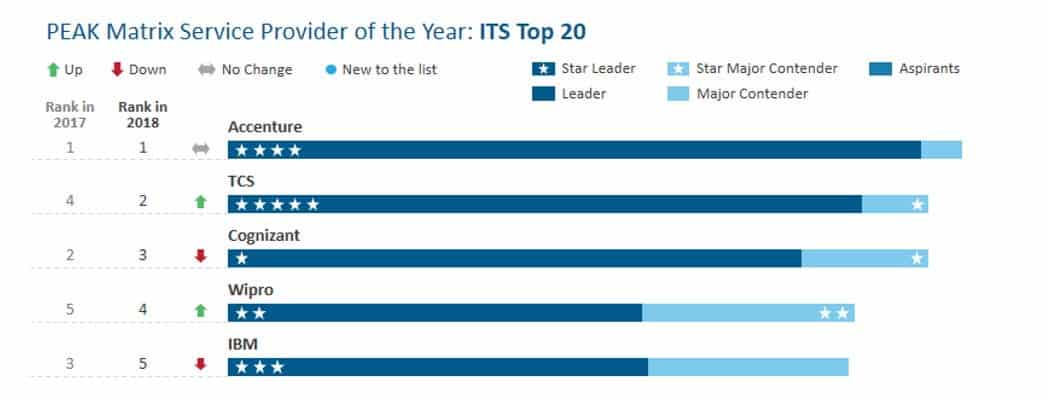

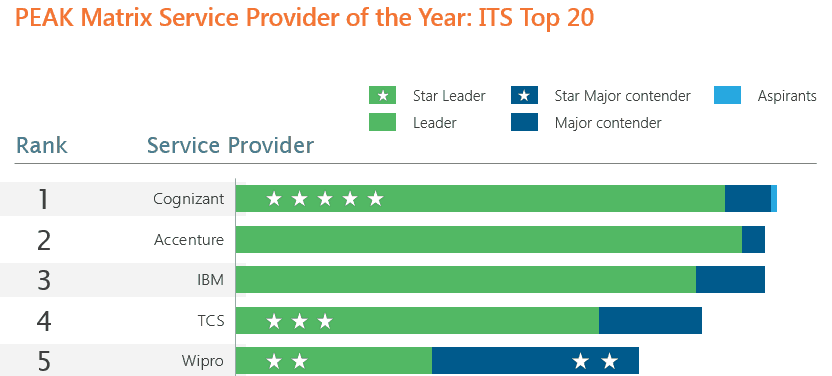

Ecosystem and sourcing

And finally, digital transformation cannot happen within the boundaries of your organization, or even the boundaries of the industry in which you operate. By partnering with start-ups, academia, government, tech vendors, staffing companies, transformation partners, orchestrators, and peers, you can unlock breakthrough value from your digital efforts.

This full-scale realignment of your digital strategy and solution ecosystem is challenging and can feel overwhelming. But it’s critical to your short- and long-term success. Our IT and digital transformation membership offering can help. To learn more, please click here.