Poland GIC Sector Growth: Unique or “Way-to-Go”? | Sherpas in Blue Shirts

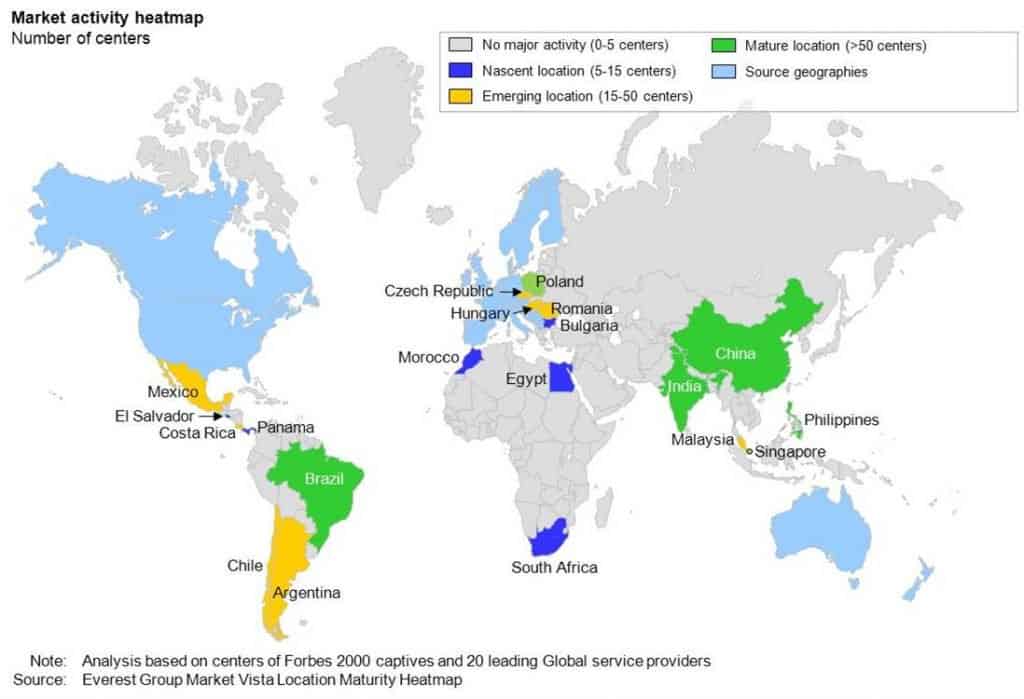

Everest Group recently published a report focusing on the Global In-house Center (GIC – our new term for captive center) market in Poland. During our analysis, we came across a very interesting fact: more than 40 percent of all GICs in Poland are based in Tier-2 and Tier-3 cities, while globally, the share of Tier-2 and 3 cities with GICs is only around 20 percent! This immediately raises some compelling questions:

- What does Poland’s GIC landscape look like? Where does most of the demand come from?

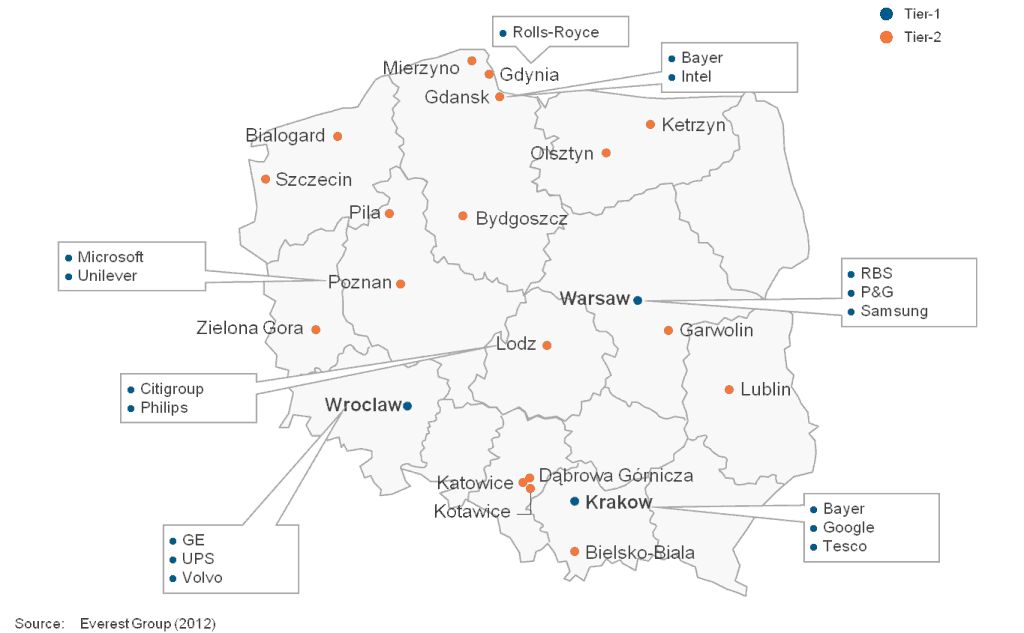

- What cities are we talking about? What companies are venturing / have ventured into Tier-2 and 3 cities?

- What factors make Tier-2 and 3 cities enticing to enterprises?

Let’s look at each of these questions individually to shed some light on what may be behind the Poland’s unusually high share of Tier-2 and -3 city-based GICs.

-

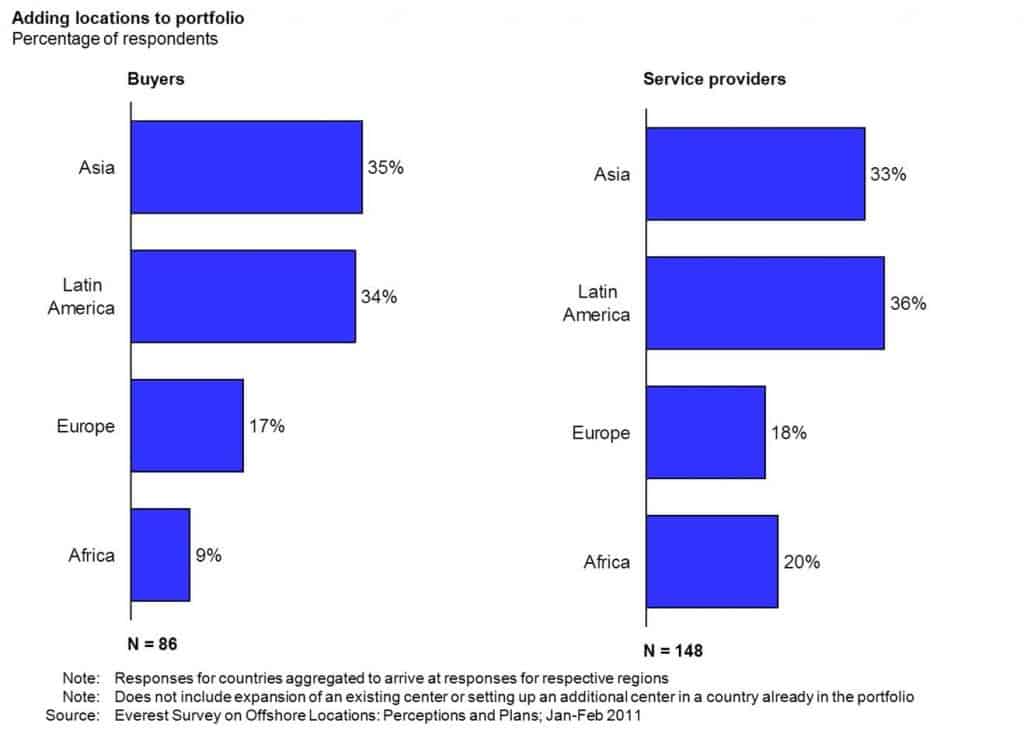

Enterprises based in Western Europe and European subsidiaries of U.S. enterprises dominate the Polish GIC landscape. In terms of industry verticals, manufacturing leads with ~40 percent share, followed by banking and technology.

Although Poland was initially leveraged primarily as an F&A BPO/shared services destination, the IT and engineering services / R&D functions have experienced a notable uptick. In fact, Poles’ aptitude for complex skills and cutting-edge technology is now well-known in global sourcing circles.

-

The figure below depicts Poland’s GIC growth story. As you can see, numerous Forbes 2000 organizations (e.g., Citigroup, GE, Microsoft, Samsung, and Unilever) have set up GICs in Tier-2 and 3 cities in the country.

-

A number of factors have led to the high share of Tier-2 and 3 cities in the Poland GIC market:

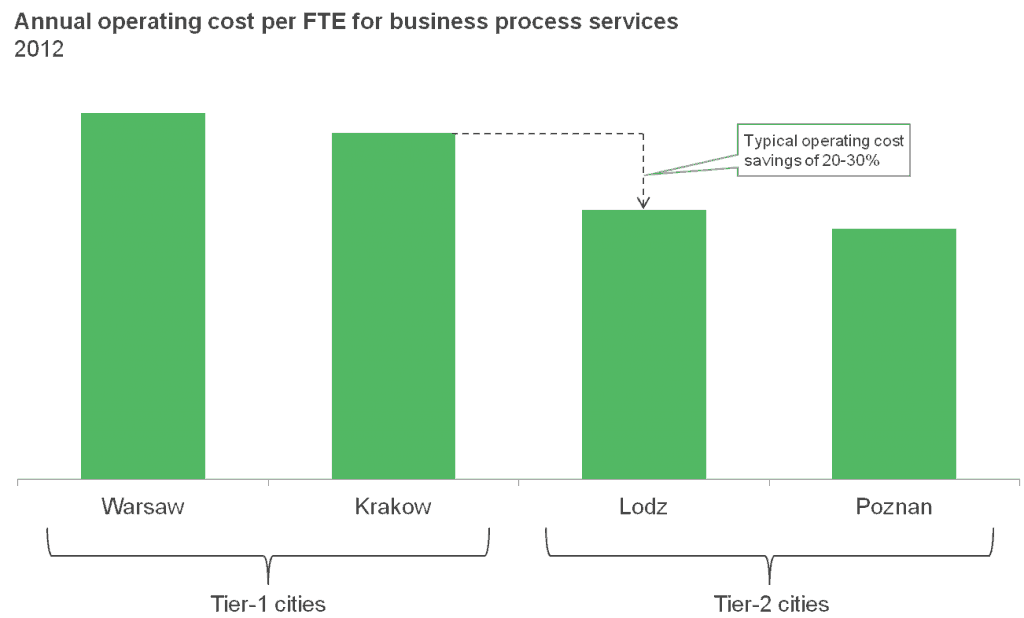

- Congestion and resulting high occupancy rates in Tier-1 cities sent office space and other operating costs soaring. Tier-2 and 3 cities provide ample office space, are not as congested as Tier-1’s, and costs tend to be lower

- High competition for talent in Tier-1 cities means higher attrition and wage inflation, while salaries and wage inflation levels in Tier 2 and 3 cities are comparatively lower

- Most Tier-2 and 3 cities are home to large universities that offer large pools of graduates. The presence of universities also allows companies to hire students as part-time employees, offering additional flexibility

- Most Tier-2 and 3 cities in Poland are well-connected by air, road, and rail, not just to its own Tier-1 cities, but also to the major business centers throughout Europe

The chart below provides a comparison of operating costs in Tier-1 and Tier-2 Polish cities. The presented cost savings do not account for any subsidies / financial incentives that governments at the city/state/federal level might be offering to investors.

However, we must here give perspective to a couple of points:

- Although Tier-2 and 3 cities are less congested, they may present lower scalability as compared to Tier-1 cities due to lower overall maturity and a smaller pool of experienced professionals. The average scale of GICs in Tier-1 cities is around 600 FTEs, as compared to approximately 300 FTEs in Tier-2 and 3 cities

- Each location offers a unique set of skills, e.g., Lodz is attractive for back office business processes, but is not scalable for IT

All this brings us to a profound question: is the Poland market model way ahead of others’ time? In other words, is this how other markets could operate if enabling conditions in Tier-2 and 3 cities were ideal? Or is Poland’s model just a result of a unique combination of factors/situations?

We’ll continue to provide our insights on this topic, but welcome our readers to weigh-in with their thoughts and perspectives!

For more information on Poland’s GIC landscape, please read our “Global Offshore Global In-house Center (GIC) Landscape and Trends: Focus Geography – Poland” report, and our newsletter edition, “Global Location Insights: October 2011 – Perspectives on Global Services Market in Poland.”

Photo by jaime.silva