The Equifax Data Theft: What if GDPR were in Force? | Sherpas in Blue Shirts

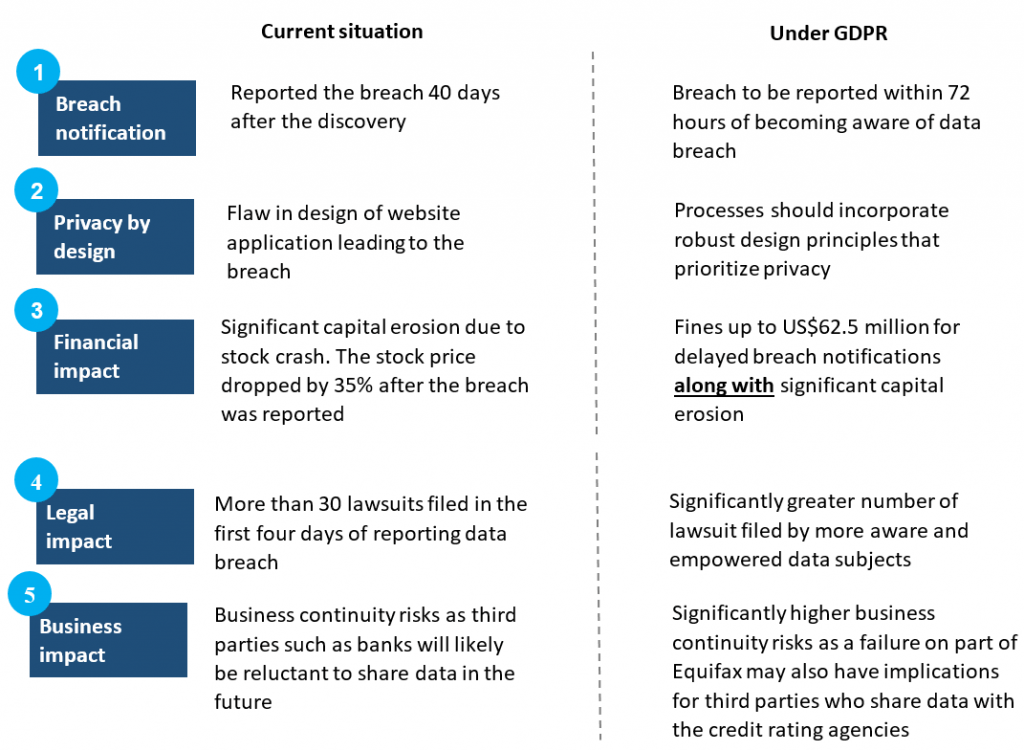

The high entropy data protection space has once again gained headlines after Equifax, the U.S- based consumer credit reporting agency, revealed that a July 2017 theft compromised more than 143 million American, British, and Canadian consumers’ personal data. The data breach incident, one of the worst cyber-attacks in history, was conducted by hackers who exploited a vulnerability in the company’s U.S. website and stole information such as social security numbers, birth dates, addresses, and driver’s license numbers. (Equifax maintains and develops its database by purchasing data records from banks, credit unions, credit card companies, retailers, mortgage lenders, and public record providers.)

Much about the situation would have been considerably different had this breach happened after May 2018, at which time the General Data Protection Regulation (GDPR) – a regulation by which the European Parliament, the Council of the European Union, and the European Commission intend to strengthen and unify data protection for all individuals within the European Union (EU) – goes into effect. Even though it is not headquartered in the EU region, Equifax would have come under the purview of GDPR, because it maintains and reports the data of British citizens. And the stringency of requirements and degree of implications would have been significantly higher for the credit rating agency.

Although not directly related to GDPR, another significant business impact is the sudden “retirement” of Equifax’s CEO less than three weeks after the breach was announced.

This massive cyber-attack is a wake-up call for the services industry. Starting today, operations and businesses must regard data protection regulations with the utmost importance. Non-compliance will not only harm firms financially, but also expose them to brand dilution and business continuity risks.

Some of the key imperatives for enterprises operating in the ever-so-stringent data protection space include:

- Know and understand the data security laws under which your enterprise falls, especially those such as GDPR that have far reaching impacts

- Redesign your business processes to incorporate privacy impact assessments to identify high risk processes

- Implement necessary changes in the contracts with third parties to incorporate the stricter requirements of consent

- Achieve process transformation to inculcate privacy by design; this includes risk exposure reduction by technological changes such as data minimization

- Appoint a Data Protection Officer to align the business goals with data protection requirements

- Make suitable changes in contracting and governance practices to ensure adequate emphasis on data protection

To learn more about the strategic impact of the EU GDPR on the global services industry, please read our recently released viewpoint on GDPR: “EU GDPR: Is There a Silver Lining to the Disruption.”

1 20 leading service providers across IT and BPS that

1 20 leading service providers across IT and BPS that