July 26, 2022

Measuring software value in a standardized way is not easy, but it’s critical to making good investment and budgeting decisions. While defining “value” might be a nebulous concept, our value benchmarking framework can help provide clarity. Learn how to value a software product in this blog.

How to value a software product

It has been said a software product’s real value is not defined by the needed functions or required user stories but rather by the performance improvement customers can get from using the product. Stated more simply, value is what the customer really wants and what they are happy to pay for. However, like beauty, value will always be “in the eye of the beholder,” and it tends to be subjective.

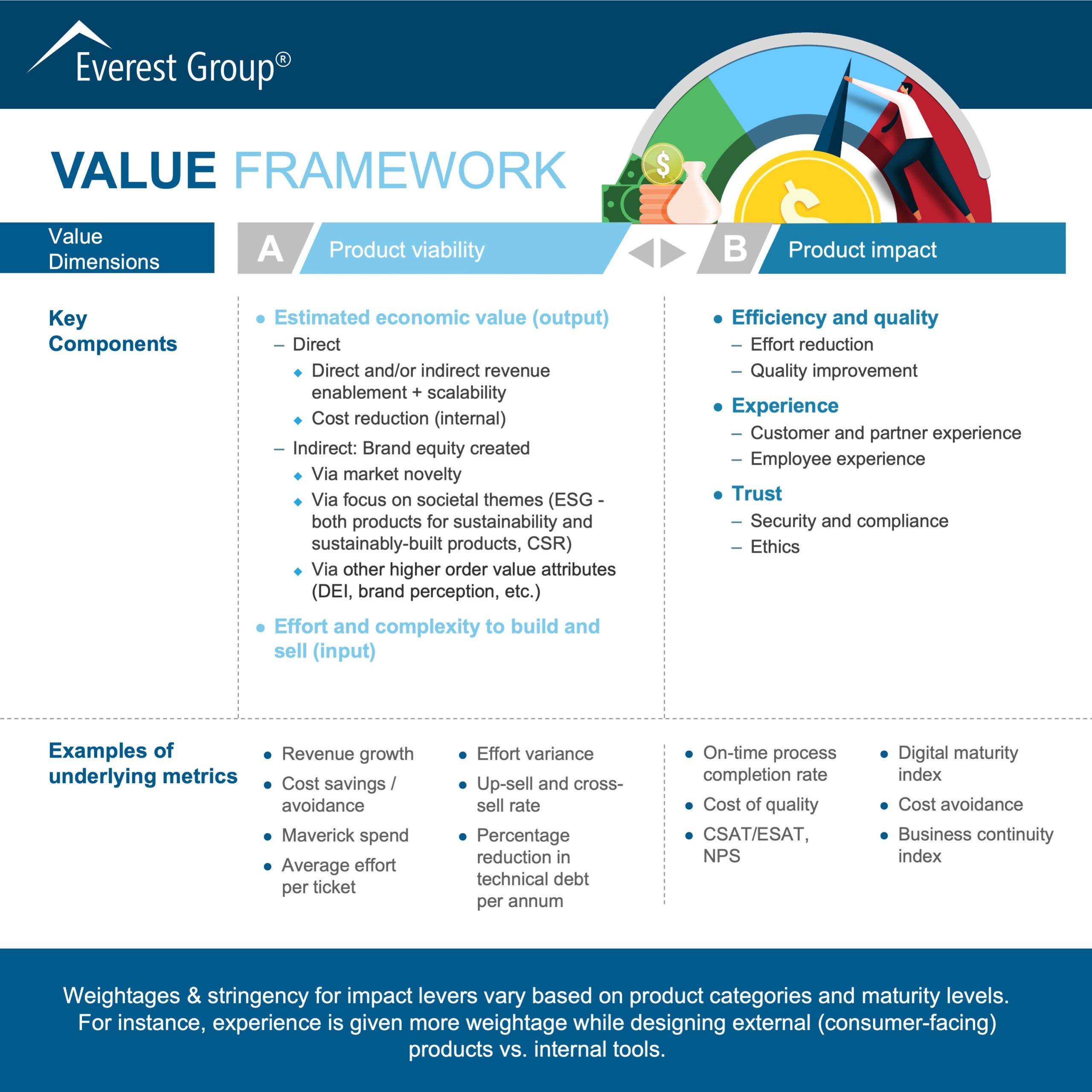

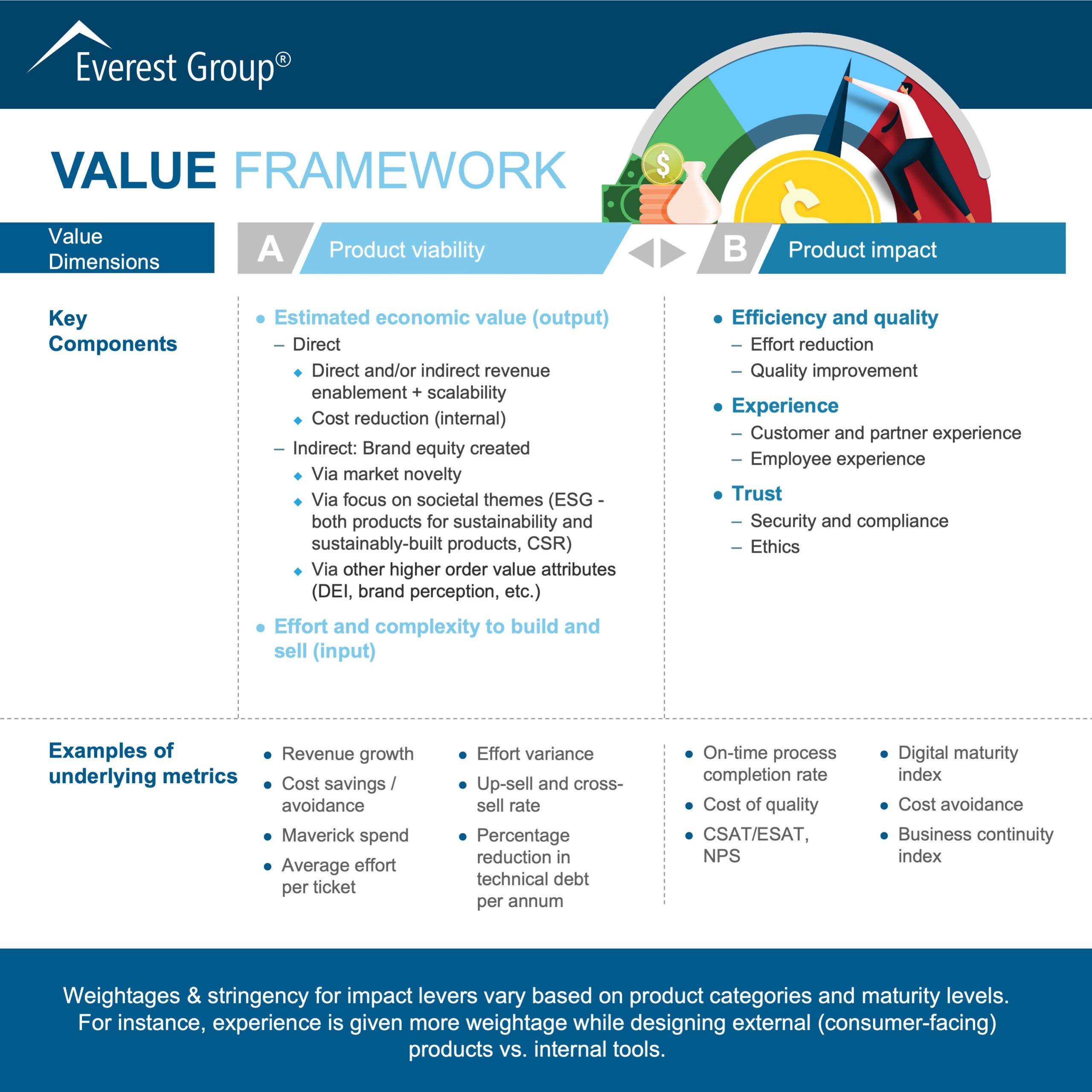

Still, finding a tangible way for all business and IT stakeholders to visualize software value to make meaningful investment decisions is imperative. To measure the value delivered by a software product in a standard way, enterprises need to gauge the incremental improvement in efficiency (effort reduction, quality improvement), stakeholder experience (customer, partner, employees), and trust (security, compliance, ethics).

Measuring software value in a standardized manner is an onerous task

Software development is only successful when the value delivered by the product goes beyond the overall investments and helps solve business needs. However, both revenue and investment effort/cost occur over time. While effort or cost is easier to track and forecast, enterprises are still not clear on how to effectively track and measure a software product’s value.

Enterprises face multiple challenges in defining and measuring the tangible value delivered by software products in a standardized manner. This is because of the disparity in multiple aspects like software type, the number of users, type of users (internal versus external), automation extent, the talent required, etc. It becomes increasingly difficult to formulate a framework that can be applied to all these software types while accounting for the different metrics/KPIs used to track value.

Software value and portfolio-level strategy

Though difficult, regularly tracking value is necessary to determine investments. The two most common metrics adopted are revenue impact (for direct value delivered) and incremental brand equity (for indirect value delivered). While revenue forecasting is somewhat difficult, brand equity calculations are even more complex, and enterprises typically use external marketing agencies to measure brand-equity impact.

Every software product also has a north star metric that defines its success and future investments. For example, the north star metric for Netflix is watch time. However, product budgeting decisions are not so simple.

Everest Group has developed a value benchmarking framework based on its work helping a leading enterprise client solve the software product value equation by assessing and building best practices for defining, measuring, and fine-tuning software value, resulting in more efficient investment decisions.

Let’s first understand how product portfolio decisions are made with the help of our value benchmarking framework.

At a portfolio level, products are categorized into core capability, aimed at bringing incremental revenue, and purpose-led products focused on building sustainable relationships. Objectives and Key Results (OKRs) are defined top-down and then product teams define the feature pipeline to meet those OKRs. Product differentiation, value chain (market) presence, and portfolio synergies are evaluated next to understand product value. Some advanced enterprises have started practicing value stream mapping to optimize the effort spent, eliminating non-value-added activities.

But how is the ideation done? Product ideas are derived from four key distinct sources:

- Coming up with ideas internally and scaling team-level initiatives

- Capturing trends through partners and market shifts

- Aligning with the market and capturing CXO inputs

- Resolving customer pain points

Product value framework

The below graphic can be used to visualize an approach to defining product value. Product viability is a direct measure of whether to invest or not and answers the basic question of Return on Investment (RoI.) If the incremental revenue and positive brand equity impact are tangibly greater than the effort needed, then going ahead with the investment makes sense.

The other dimension, product impact, is the outcome the product delivers in efficiency upliftment, experience improvement, and trust. However, it is worth noticing that impact parameters like efficiency, experience, and trust are used reversibly to make product viability calculations and vice-versa, as indicated in the below graphic by the green bidirectional arrow.

New-age operational KPIs such as agility index and Digital Maturity Index (DMI) are gaining traction among enterprises to help track efficiency. Experience is increasingly becoming more important in making product decisions, and enterprises leverage user surveys as leading indicators to understand future adoption levels. Tools like Adobe Experience Manager, Sitecore XM, etc., also are gaining popularity to capture experience across product lifecycles. Trust is seen more from a cost-avoidance angle and becomes the foundational design principle for technology companies like Microsoft, Google, Amazon, Salesforce, etc.

Sustainability is again more prominent than ever, and directly relates to positive brand-equity impact. Although these investments don’t bear any short-term direct revenue impact, they help create societal impact that opens up huge long-term revenue opportunities. Examples include Google’s Project Loon, aimed at increasing internet penetration in under-developed countries, and Salesforce’s Philanthropy Cloud, built to address employee engagement in a distributed agile set-up.

Investment strategy and budgeting approaches

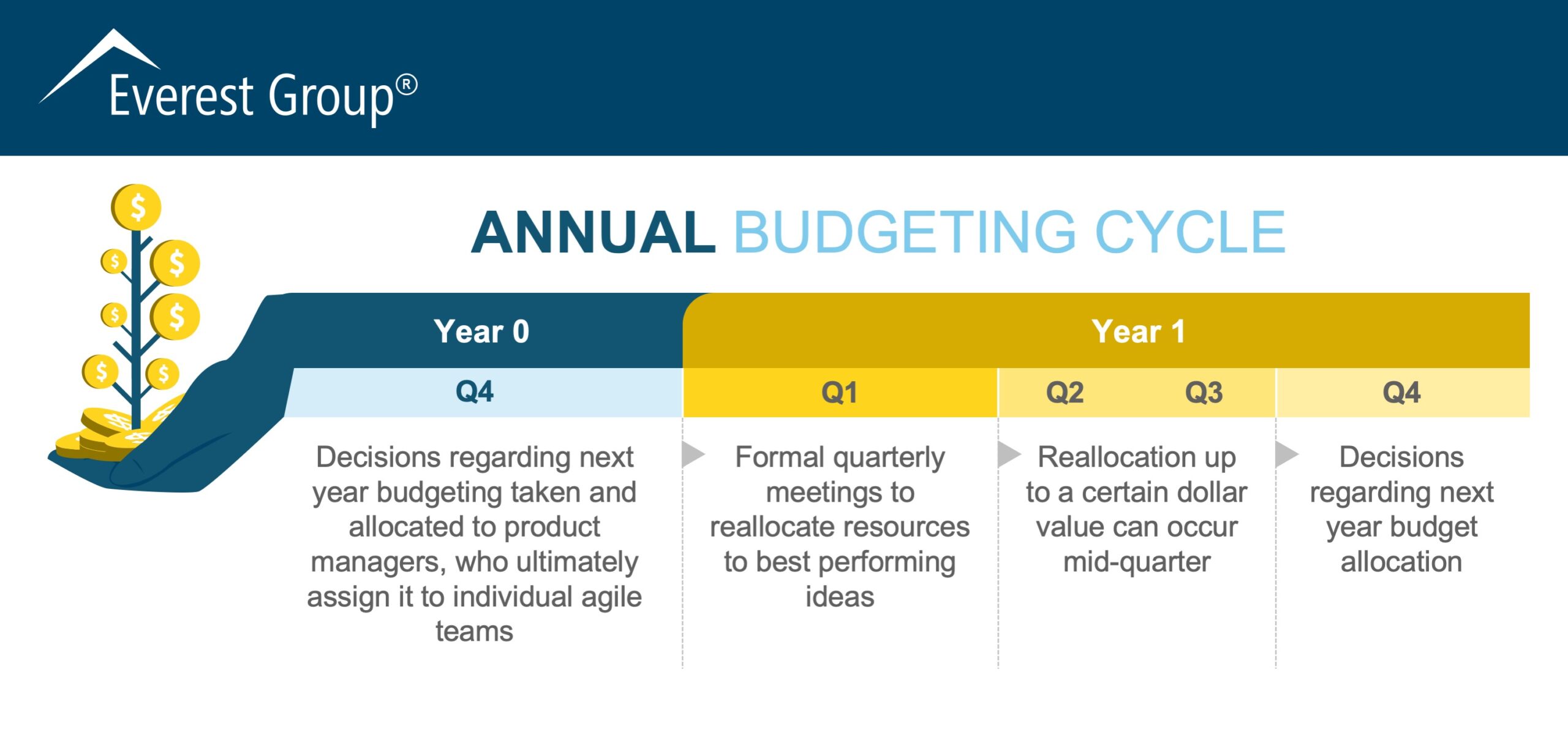

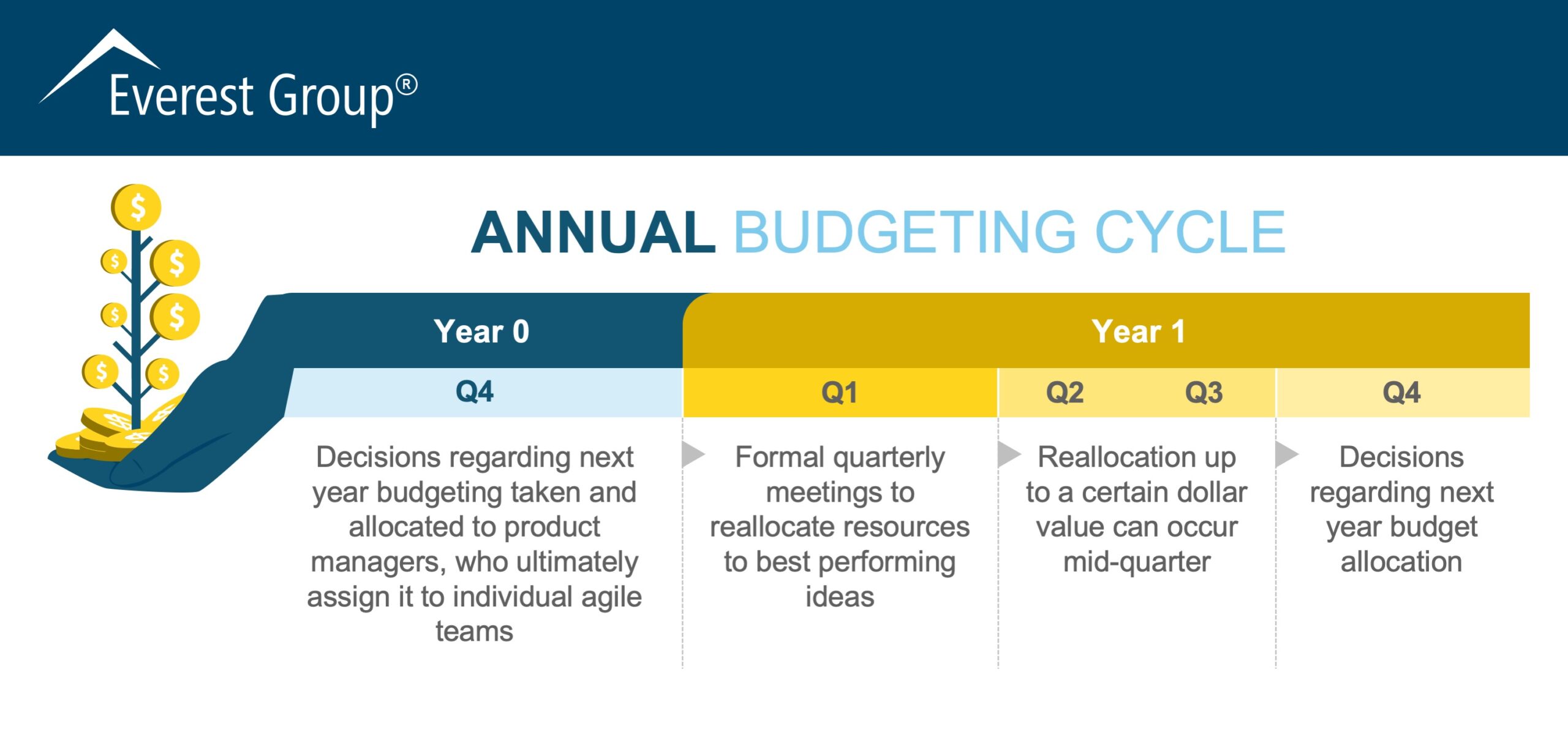

The next thing to discuss is how to use forecasted value to identify and make investment decisions. Enterprises are increasingly adopting agile budgeting practices to drive the trifecta of value, collaboration, and risk management. Value streams are used as foundational units to allocate and prioritize funding, helping enterprises to make best-performing and strategic investments.

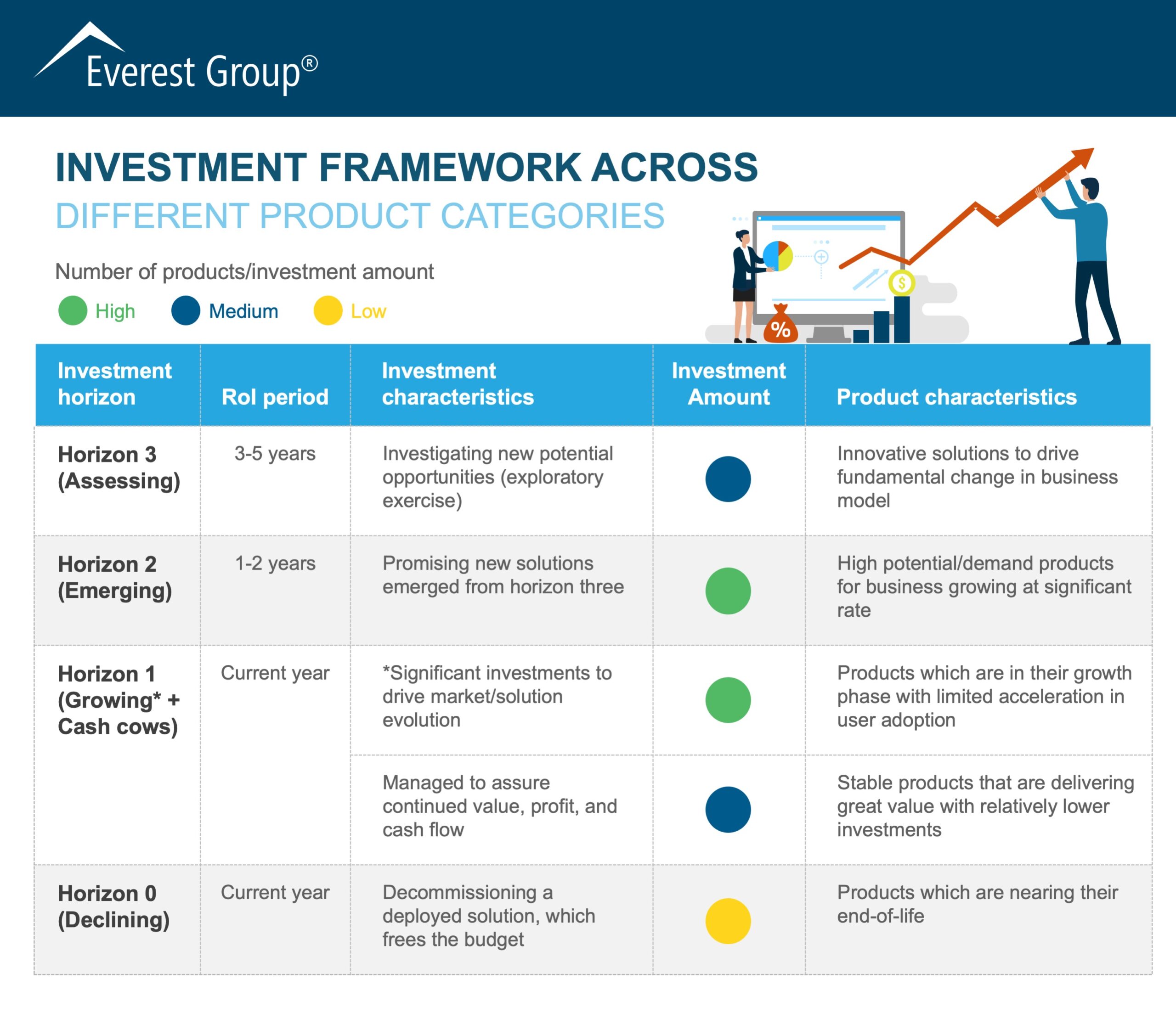

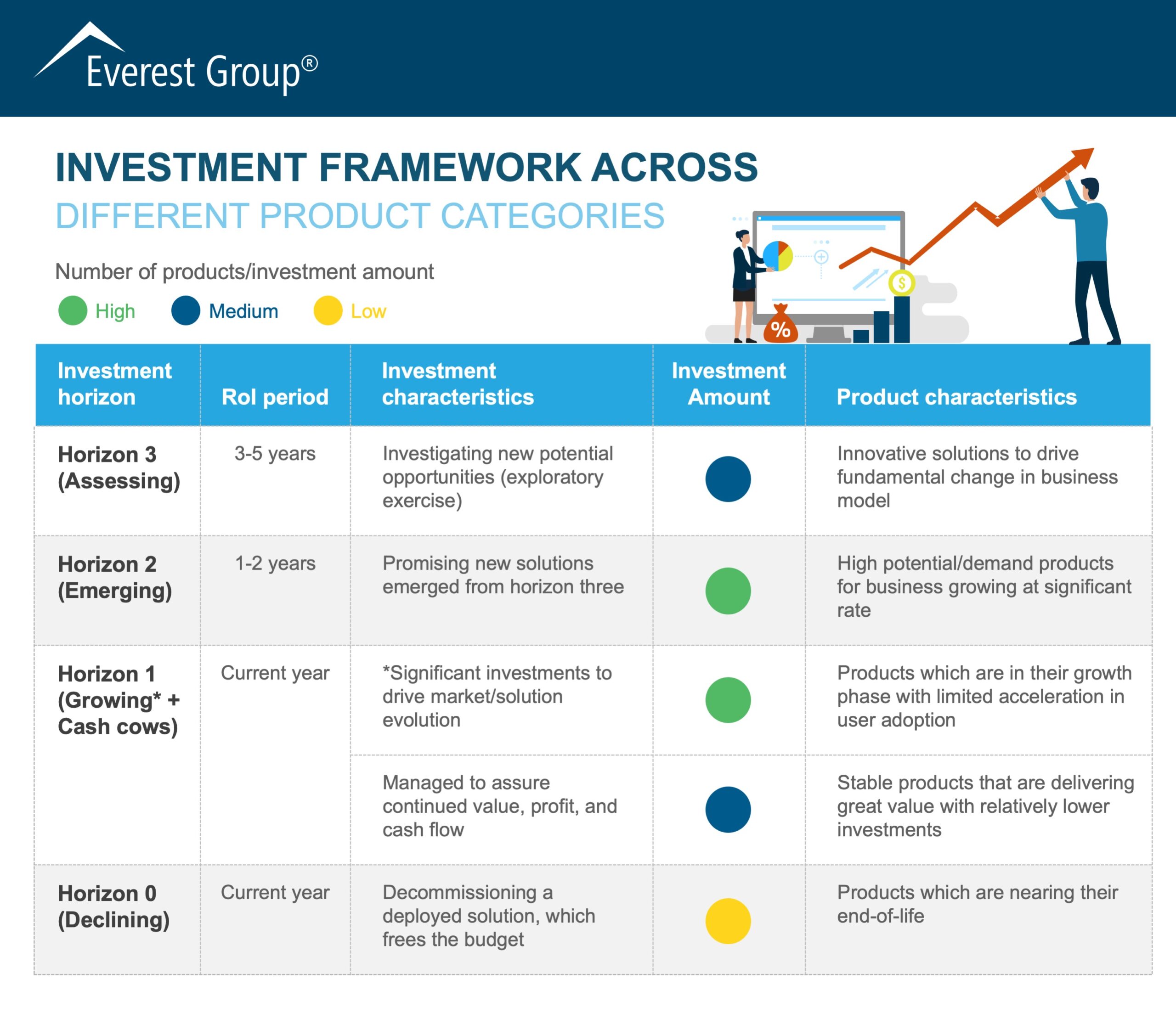

When making investment decisions, products are categorized based on horizons, as illustrated by the below graphic:

Participatory budgeting processes maintain a collaborative ecosystem and ensure the following:

- Alignment across concerned stakeholders before formal budget sign off

- Right-sized investments with a value-first ideology

Overall, enterprises need to adopt a venture capitalist mindset when funding agile projects. Investments should be staggered with the provision to reallocate funds to the best-performing areas, keeping aside around 10% of the budget for funding mid-year ideas.

The below graphic illustrates the typical annual budgeting cycle:

Following these best practices can help enterprises significantly improve RoI from their software product investments and help them better understand value.

To share your thoughts and discuss our research related to value benchmarking of global software products, please reach out to [email protected], [email protected], or [email protected].

Learn more about defining value in software in our webinar, Is Agile Working? Where Enterprises Are Going Wrong.