GBS: The New Epicenter for Driving Value and Transformation in Enterprise Finance Services | Virtual Roundtable

GBS: The New Epicenter for Driving Value and Transformation in Enterprise Finance Services

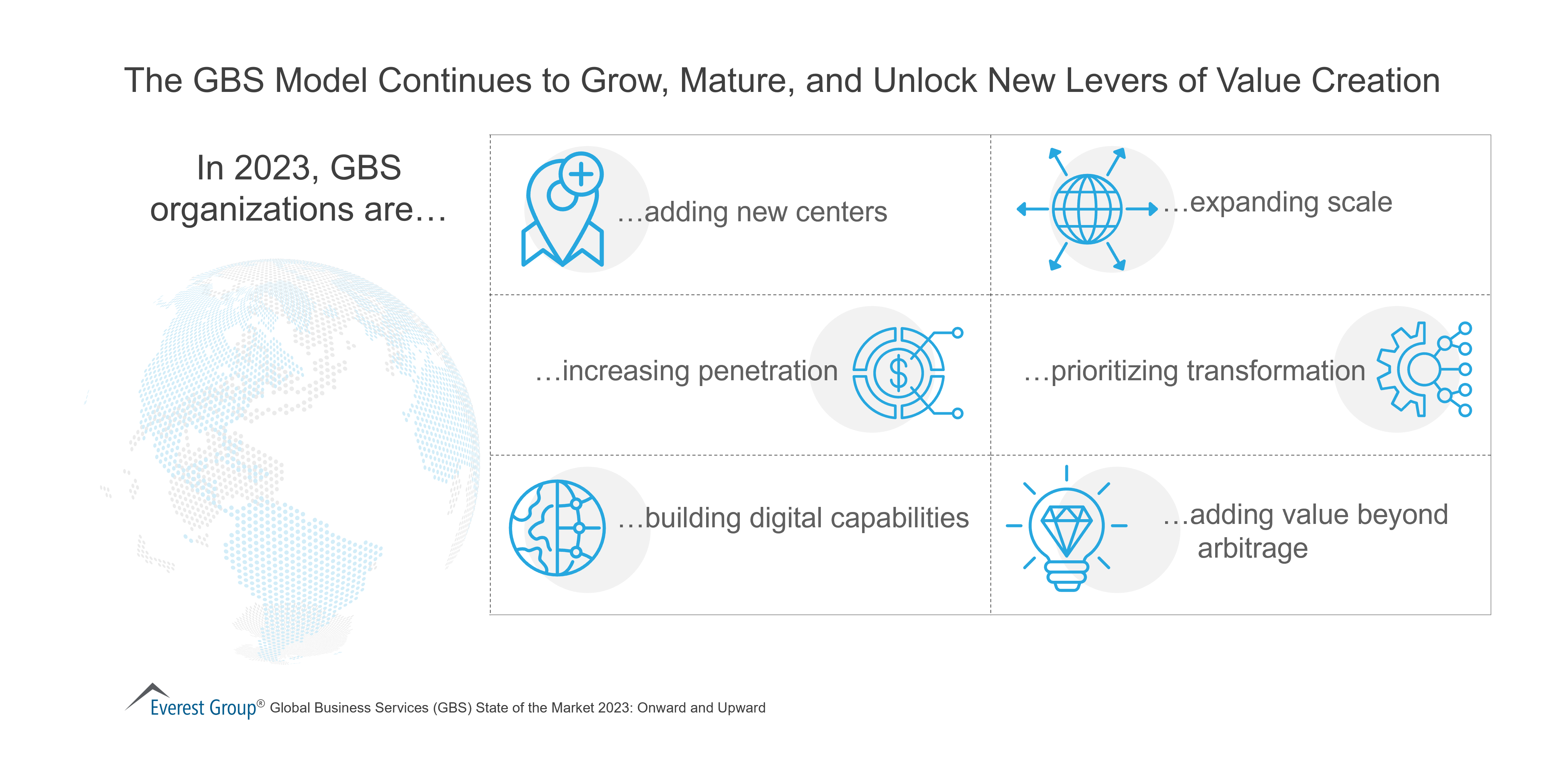

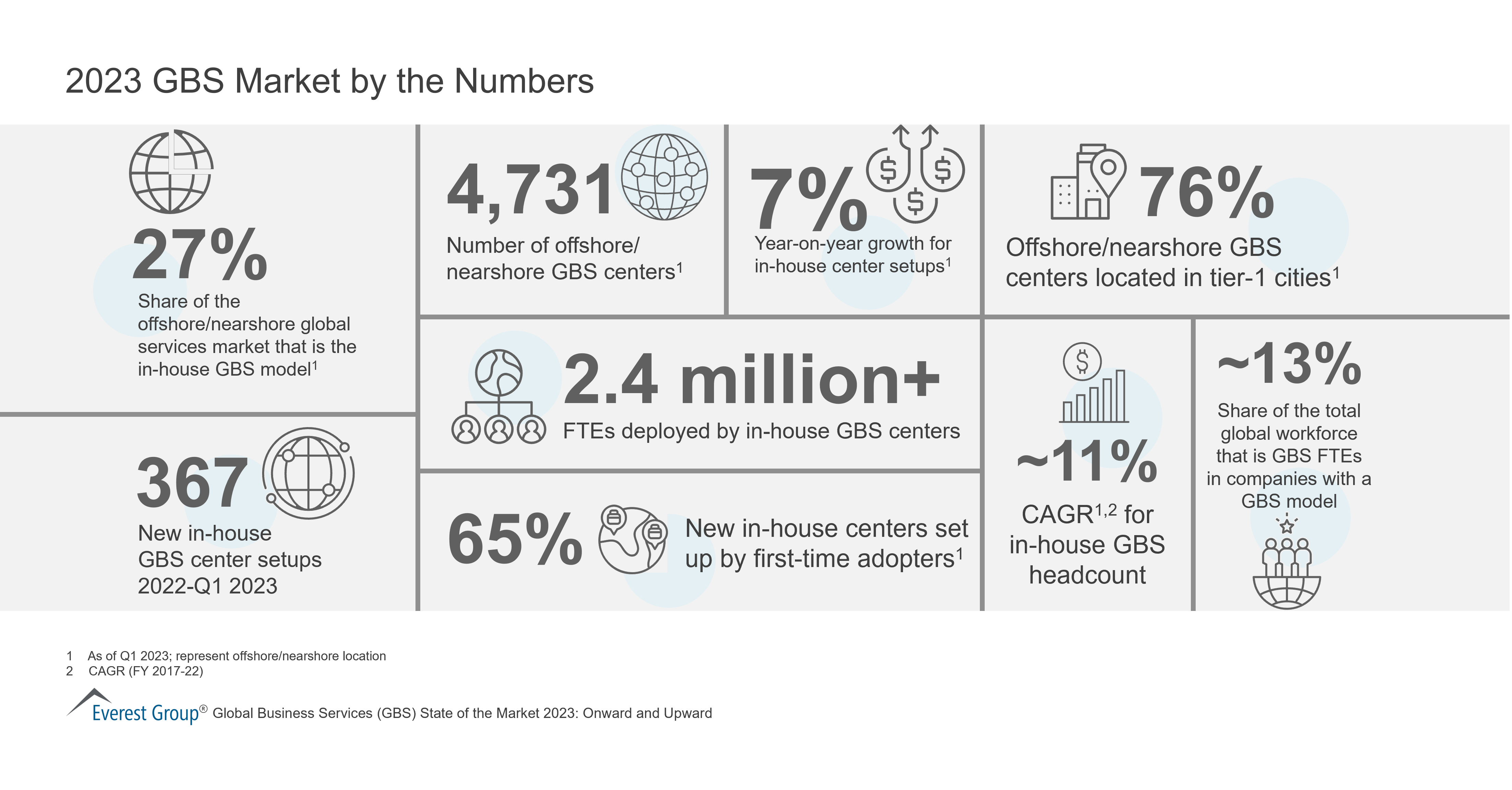

The GBS model has become a multifunctional platform with finance among the oldest of the capabilities established. However, our research shows that the overwhelming level of activity performed by both Finance Shared Services (FSS) and GBS organizations is transactional.

As companies increasingly hardwire the GBS model into the business, there is still vast potential to add more value. Finance in GBS can play a vital role in accelerating business growth and delivering greater insights across the enterprise.

Join this virtual roundtable, along with our expert analysts and industry thought leaders, for an engaging discussion on how FSS and GBS organizations can move up the value chain, drive innovation, and yield meaningful impact. We will also explore current challenges and prevailing opportunities for driving future success.

Participants will explore:

- How FSS and GBS can move up the finance value chain, and what is the breadth and depth of the services portfolio?

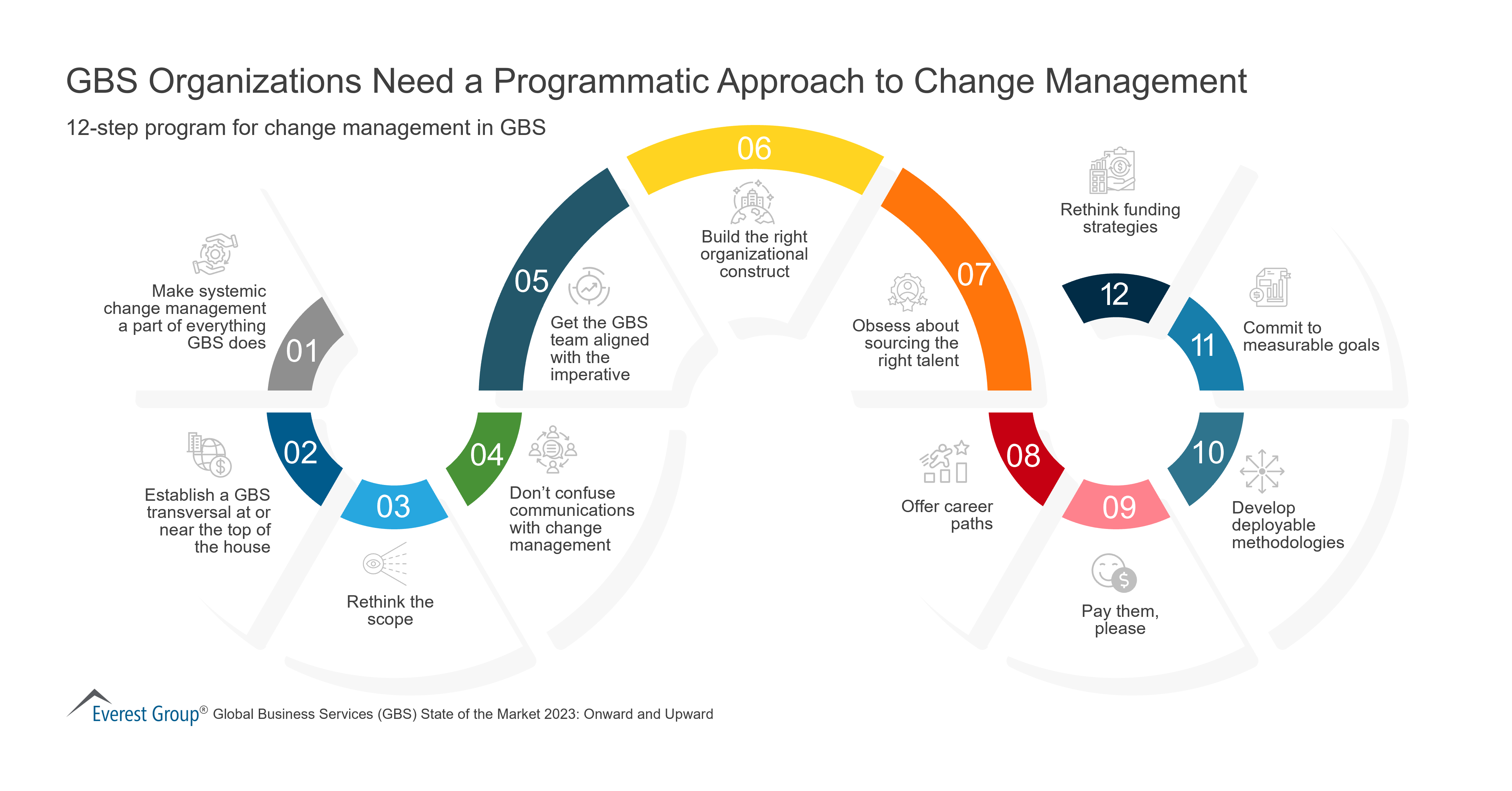

- What changes are required for GBS governance and operating models to enable growth?

- How can enterprises leverage FSS or GBS to create more value in the finance organization and for CFOs?

- Success stories from best-in-class peers

Who should attend?

- Finance leaders

- Global business services leaders

- GBS strategy leaders

- GBS site leaders

Virtual Roundtable Guidelines

The only price of admission is participation. Attendees should be prepared to share their experiences and be willing to engage in discourse.

Participation is limited to enterprise leaders (no service providers). Everest Group will approve each attendance request to ensure an appropriate group size and mix of participants. The sessions are 90 minutes in duration and include introductions, a short presentation, and a facilitated discussion.