July 13, 2022

Four-day weeks, on-demand pay, “rural” talent, and digital workers – in recent times, we’ve heard these ideas accompanied by seemingly teleological questions about work as a construct. With the work landscape rapidly evolving, questions arise about what the future of work will look like. Read on to learn more about how technology, location, and talent can be utilized to reconstruct our understanding of work, as well as gain positive lasting effects for companies.

With the rise of digital labor pyramid issues, the after-effects of a global pandemic, and the desire for more meaning in work and convenience through remote work, the work landscape is being met with a promising possibility of re-examining and perhaps reconstructing work for the new era. But, beyond the clarion call, what exactly does it entail? How do we understand the future of work trends and how do we design for them? Fundamentally, we can break it down into three distinct components: the how, the where, and the who. Let’s take a look at the trends shaping the future of work.

Nature of work – how will work be done?

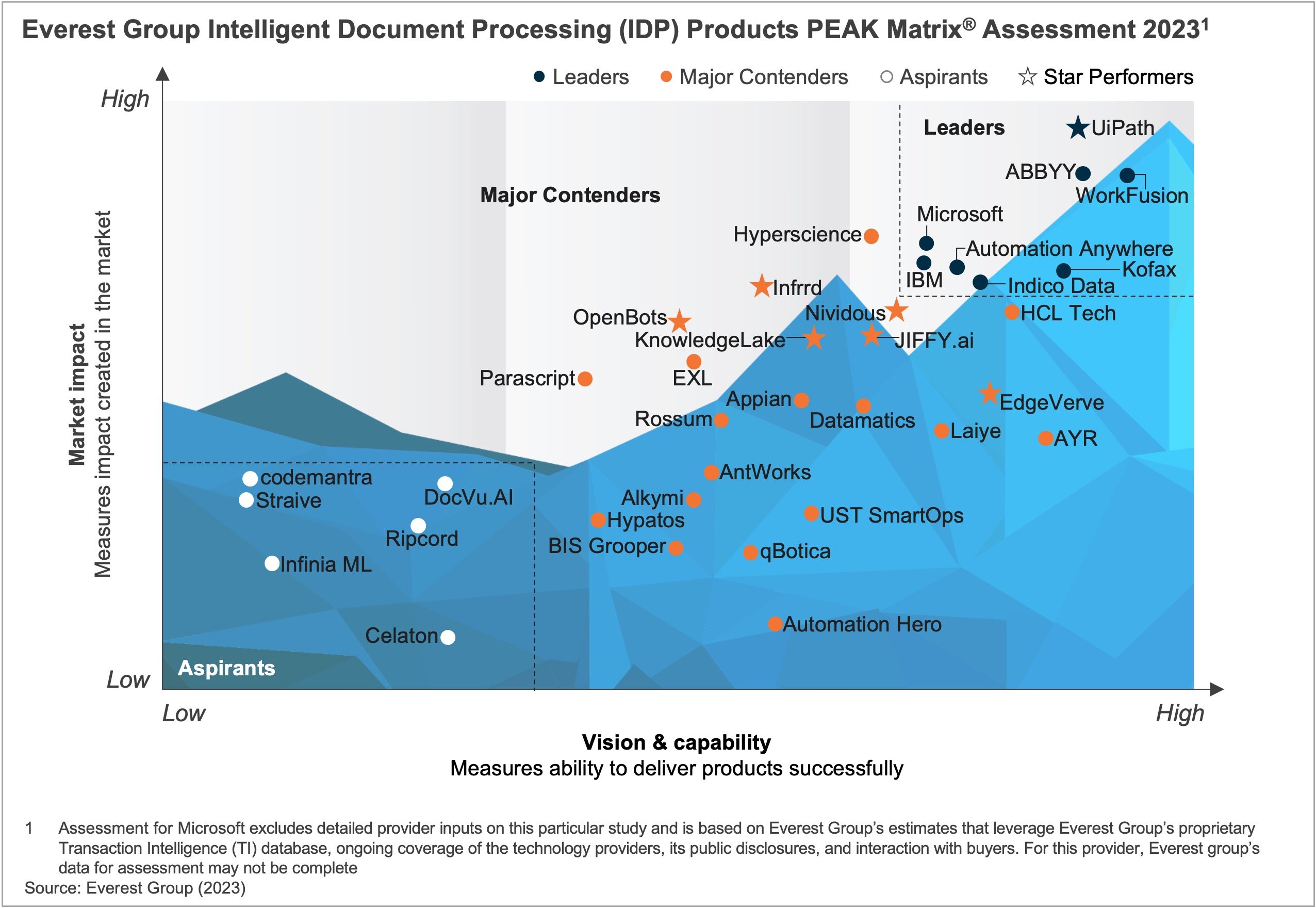

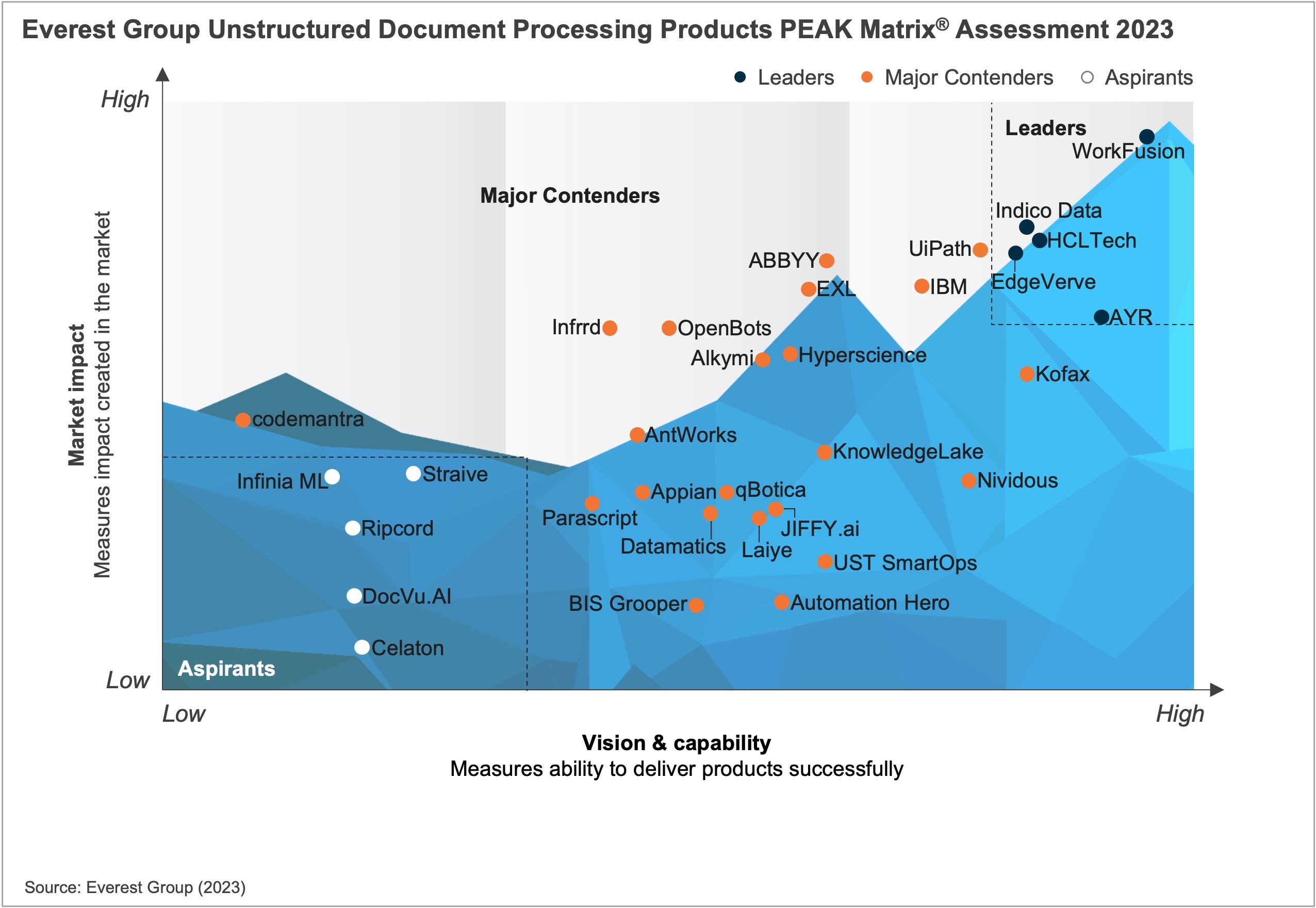

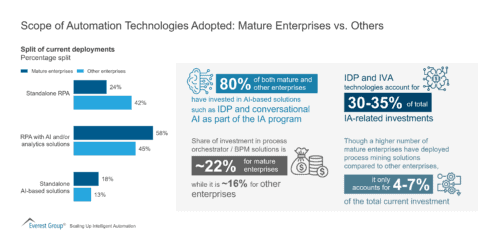

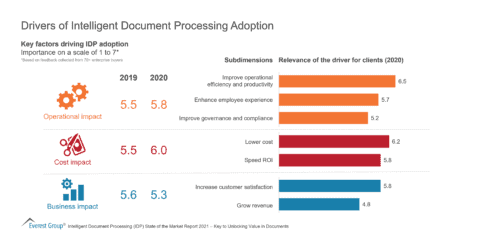

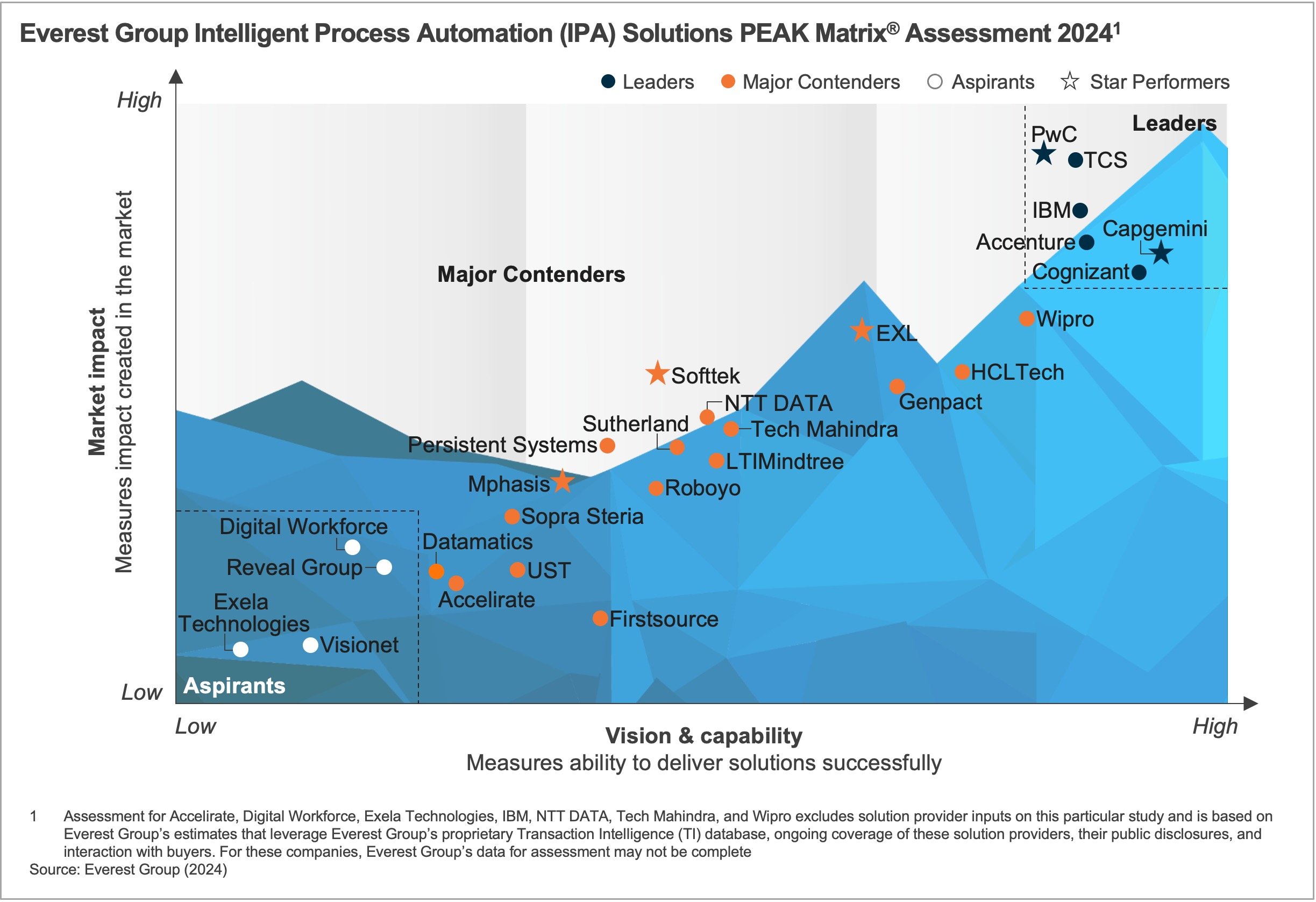

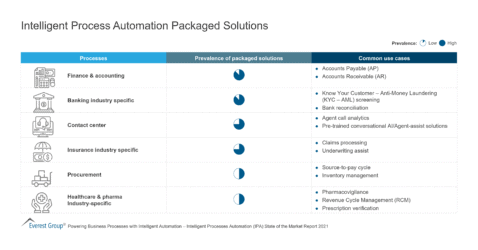

As we look at the adoption of cloud and AI technologies in the workplace, it becomes clear that the nature of work will change considerably. Robotic process automation (RPA) and Artificial Intelligence (AI)-based automation can significantly reduce the number of transactional tasks delivered manually, in addition to a few judgement-oriented tasks. The universe of tasks that can be automated or simplified will expand as these technologies mature and systems of record become more scalable, data pipelines are streamlined, and meaningful data itself becomes more accessible. This further enhances our ability to use data to derive insights and make informed decisions.

Everest Group’s future of work research shows adoption of these technologies has accelerated during the pandemic. More than 70% of organizations have invested in digital in the past 12 months, and about 50% expect to invest more in the next six to 12 months. Naturally, all of this has implications for the kind of work that then falls to the human workforce. With transactional tasks largely automated, judgement-, expertise-, and empathy-oriented tasks and related skill sets (including “soft skills”) become more important. But this is not a doom and gloom job-loss scenario; digital hardly ever is. Digital will also create jobs for talent who can acquire skills related to automation, AI, analytics, and the cloud.

In essence, the nature of work is changing. Enterprises will need to prepare for these eventualities by ensuring they have adequate skilling programs in place, starting by building skill taxonomies for the future, assessing current skill sets, and building out continuous learning, upskilling, and reskilling programs to enable a future-ready workforce.

Work location – where will work be done?

Our research indicates that over half of today’s enterprises expect more than 40% of their employees to continue to work from home over the next two years or so. The pandemic has dispelled certain notions about remote work while highlighting its challenges. No longer do we question if remote work is efficient or even a possibility; video calling and conferencing tools, collaboration technologies, and the potential of the metaverse have meaningfully reduced the friction that deterred work from home. Employees have benefitted from shorter commute times, greater flexibility, and proximity to family.

On the other hand, 55% of enterprises see employee engagement as a key challenge in a remote-only environment, and 50% see organizational culture as difficult to maintain with full-time work from home. The middle ground (hybrid work) seems destined to be lasting among the future of work trends. Enterprises need to redesign physical and virtual workspaces, embedding information security as needed and changing management styles to accommodate the hybrid working model.

As remote working has gained more acceptance and mature economies have aged, the time has also come to de-link talent from geographic locations. Beyond the US and India, emerging technologies such as AI and automation have sizeable talent pools in multiple countries across the world. The enterprise of the future should seek to leverage this talent, applying similar guiding principles as those for hybrid work with an additional focus on local compliance, managing cross-cultural teams, and customizing policies.

Talent model – who will do the work?

As work and workplaces evolve, so will the talent we need. We already spoke to the need for a geographically distributed and suitably skilled talent. The future workforce will also be diverse, equitable, and inclusive. Diversity will, in some ways, be necessitated by the need for a variety of in-demand skills sets and changing labor pyramids, but beyond that, it is a fairly well-established fact that diverse workforces simply do better and bring a variety of perspectives to the table, enabling enterprises to serve their clients better too. From this perspective, in the digital age, organizations will need to bolster their diversity, equity, and inclusion programs, define concrete goals and metrics, and mobilize internal and external resources to help meet these goals. DE&I will be among the trends shaping the future of work to watch for.

As we look to fulfill specific skillsets for future work, organizations will also do well to consider contingent or temporary workers in addition to traditional permanent ones. Contingent workers are in greater supply now and will offer a good pool of talent to tap into, particularly for in-demand and next-generation skills. This will require careful consideration on the part of enterprises, as not all roles will be suitable for fulfillment. Even among the contingent workers, some skillsets will be in higher demand.

Attracting talent also will pose a challenge for enterprises. Today, a large portion of contingent programs are run through procurement. A holistic program run by HR (including contingent and permanent workers) that can communicate the employer value proposition well, help with engagement, and leverage data to improve program management might just be needed as we transition to this new construct.

The future of work is neither esoteric nor mundane – it is somewhere in between, and it is here already. It will require us to question well-established paradigms, rethink the framing of work in our lives, and push us to redesign and reconstruct. Enterprises that move the needle now stand to gain a lasting competitive advantage.

To learn more about the future of work trends, contact us or reach out to Everest Group Partner, [email protected].

At Everest Group, we help clients navigate their digital transformation journeys and provide assistance in implementing digital technologies. Currently, we are offering assistance to companies that are launching Web 3.0 and Metaverse initiatives with a complimentary outline of definitions and use cases. Request a summary.

Everest Group experts will unravel real-world use cases that go beyond the hype, shedding light on how generative AI is making a tangible impact across industries.

Everest Group experts will unravel real-world use cases that go beyond the hype, shedding light on how generative AI is making a tangible impact across industries.