While the professional services market experienced a slowdown last year, engineering services emerged as a standout performer among other segments.

In this webinar, our analysts examined the past performance and future prospects of the engineering services sector. Participants gained valuable insights into the pricing outlook, commercial dynamics, market attractiveness, and evolving buyer expectations for engineering services. Finally, we explored emerging trends and future projections.

What questions did the webinar answer for the participants?

Who should attend?

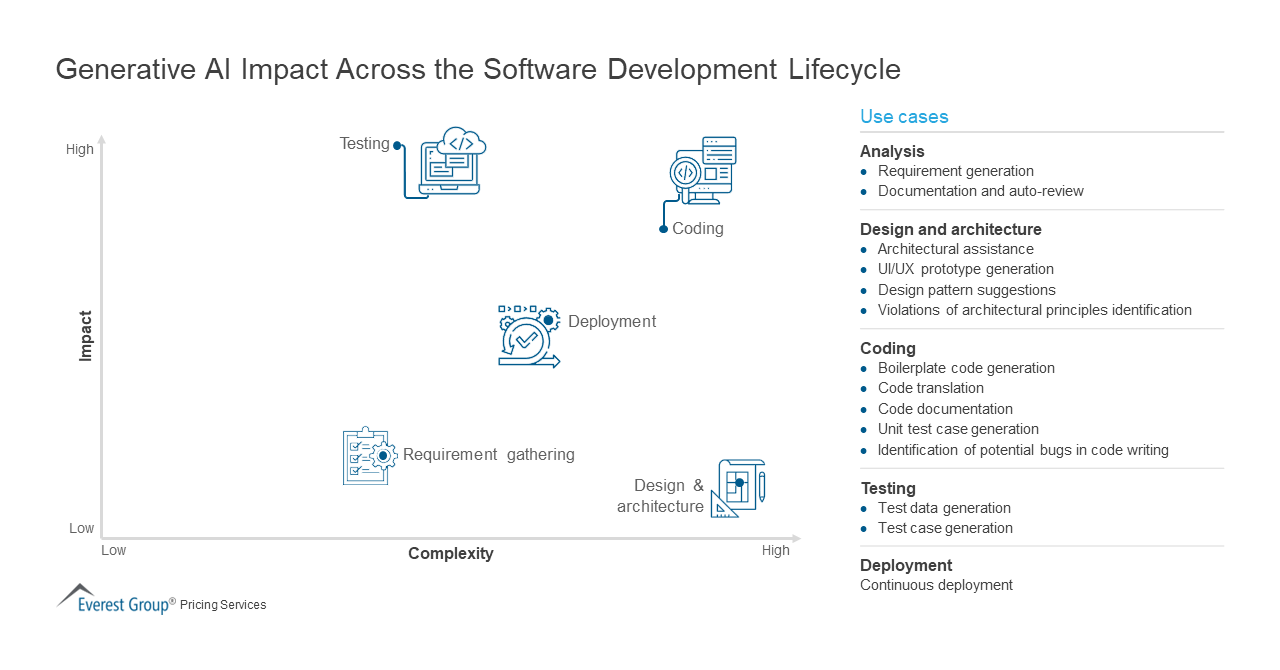

Software Development Lifecycle

Infrastructure Services

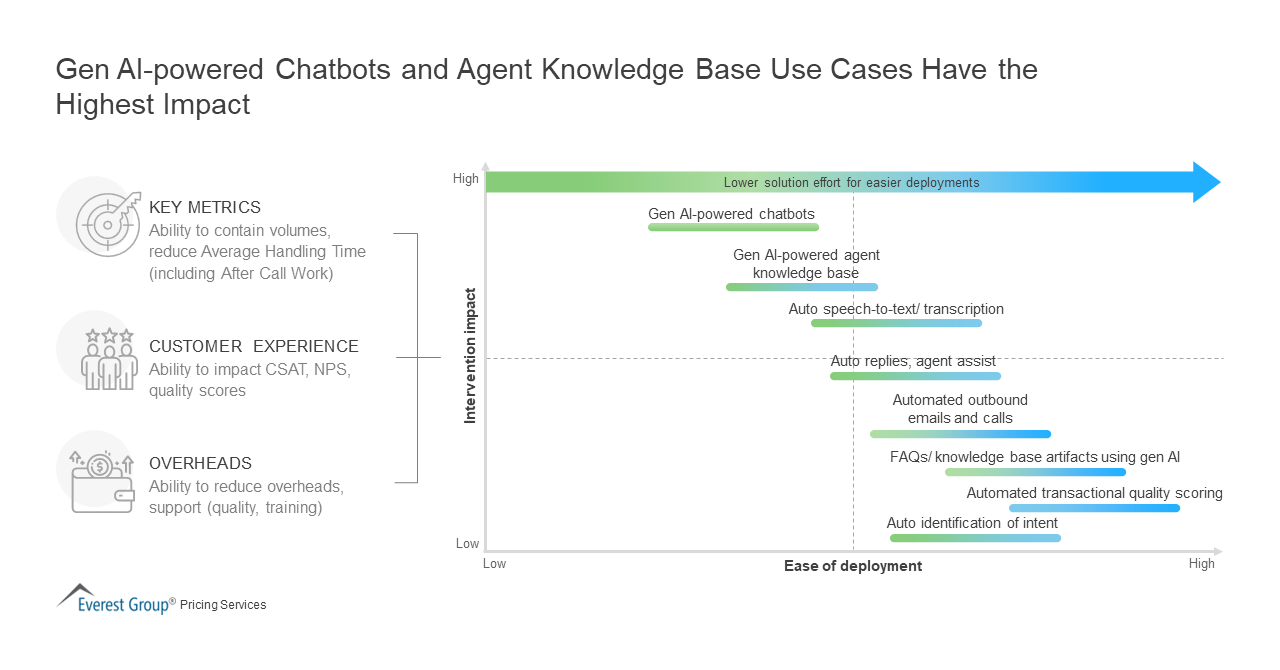

AI-powered Chatbots

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields