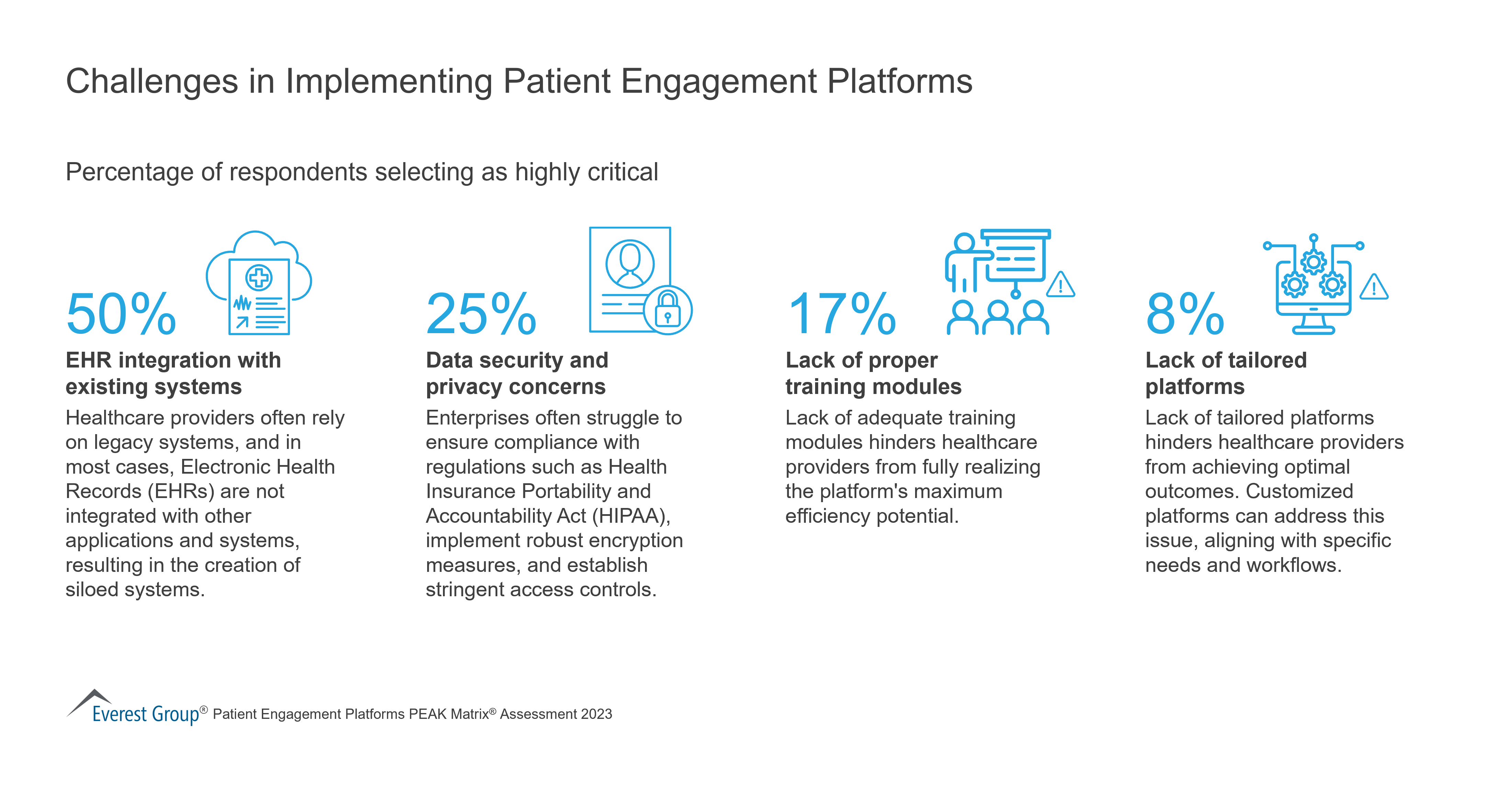

Challenges in Implementing Patient Engagement Platforms | Market Insights™

Patient Engagement Platforms

Patient Engagement Platforms

Patient Engagement Platforms

In the current healthcare landscape, patient engagement platforms play a vital role. They serve as a crucial link between patients and healthcare providers, promoting proactive healthcare management. As consumers increasingly demand personalized and accessible healthcare services, these platforms give patients real-time access to their medical information, telehealth options, and appointment scheduling. This not only enhances the patient experience and satisfaction but also plays a vital role in optimizing healthcare resources and improving outcomes. Furthermore, within a rapidly evolving digital health ecosystem, patient engagement platforms are essential in ensuring compliance with regulatory requirements and data security, contributing to healthcare businesses’ overall efficiency and success.

In this report, we:

Scope

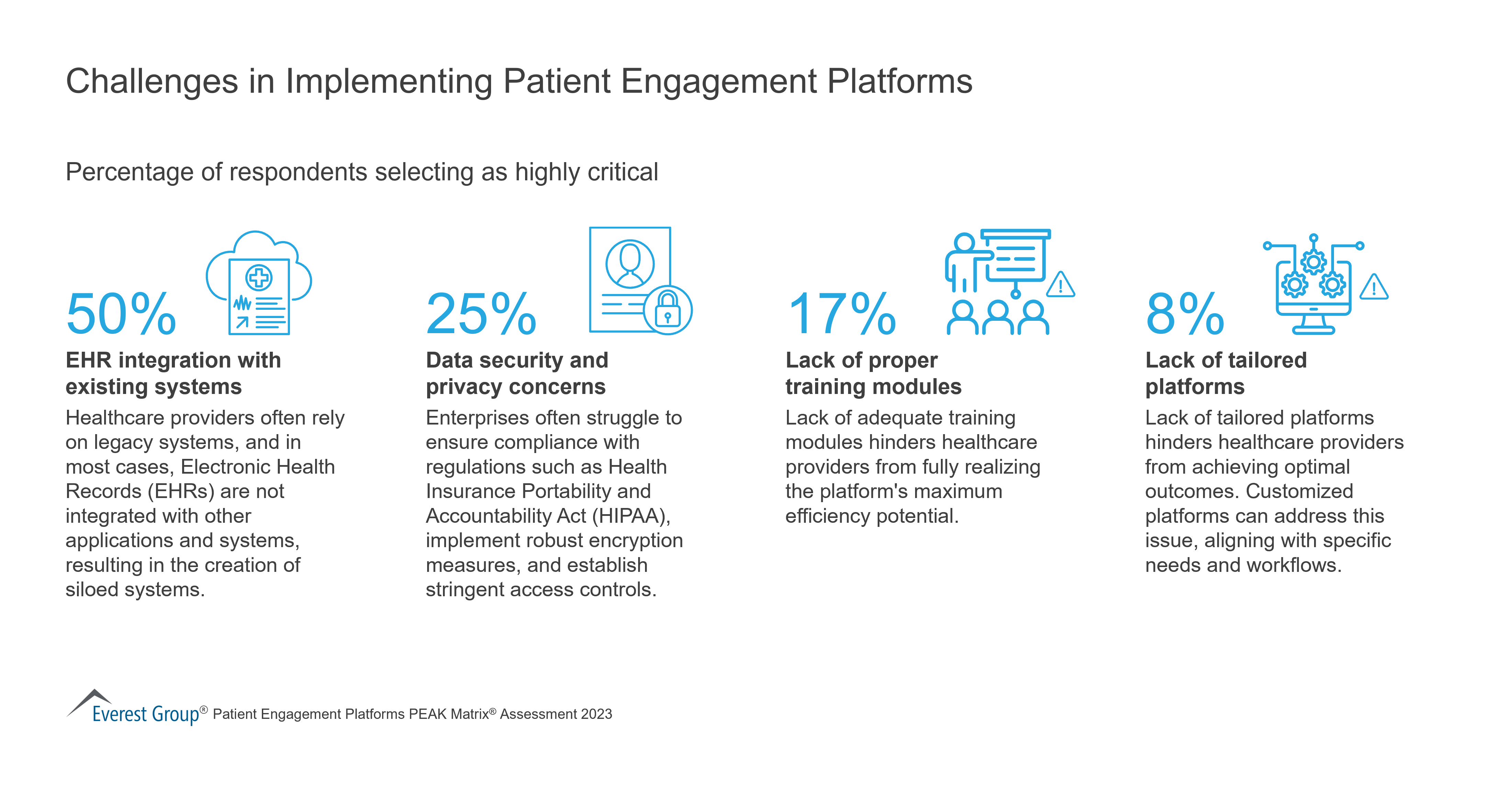

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

At last week’s Oracle CloudWorld and the Oracle Health Conference in Las Vegas, the company presented its new positioning, which includes leveraging its broad portfolio, making the next move in healthcare, and delivering lower-cost cloud technology. However, Oracle faces challenges such as not dominating any market, opaque pricing strategies, and the loss of competitive edge to a healthcare rival. Read insights from our analyst who attended these events about the company’s path forward.

Company leaders presented their vision for Oracle’s future, which is focused on the following three important areas:

Let’s explore each of the elements of their strategy and the challenges they present:

Oracle’s biggest challenge is that it lacks dominance in any one area. It is not the undisputed preferred choice in any of the markets it claims leadership in. Below are the leaders in market share or positioning in each of the segments where Oracle competes:

Oracle needs to double down and succeed on select growth bets that will help it reinvent its brand. ERP or databases cannot be those bets.

Cerner, with Oracle’s strong backing, should have stolen a march over Epic on both. Instead, Cerner was distracted by the integration with Oracle and lost considerable ground. Hence, instead of a duopoly, what we have is a market where you are either Epic or Not Epic.

While this might sound like a harsh takedown of Oracle’s positioning, these issues can be fixed and serve as critical paths to Oracle’s reinvention. Oracle is a true engineering firm, and each capability that it delivers has an engine under its hood. Clients can trust Oracle to provide fully developed products. To restore its shine, Oracle needs to bring the same rigor to its customer success initiatives, master a few key markets, and establish transparent and standardized pricing.

For more insights from Oracle CloudWorld and the Oracle Health Conference, please contact Abhishek Singh.

Everest Group Partner Abhishek Singh will be at the Oracle Health Conference 2023 and will speak in a panel exploring Oracle’s vision for clinical trials.

Everest Group Partner Ronak Doshi will also be onsite representing Everest Group’s financial services coverage.

Catch Everest Group Partner, Abhishek Singh, and other panelists in this webinar as he delivers insights into trends related to Intelligent Automation (IA) that will help participants craft a robust IA strategy and maximize ROI through a mix of business casing, playbook creation, and peer learning.

At its first analyst event under the leadership of CEO Ravi Kumar, Cognizant openly discussed the company’s past problems, emphasized its renewed focus on relationship management, shared clients’ success stories, and previewed new products. Read on for reflections based on the Everest Group team’s interactions with Cognizant leaders at the event.

Contact us directly for questions and or more information.

After a challenging past six years, the recent Cognizant event highlighted the company’s commitment to growth and improvement. The new leadership team demonstrated its awareness of issues that need repair and reinforced the company’s strong focus on bringing its core differentiator, relationship management, to the forefront. Compelling client success stories with renowned organizations like US Bank and Bristol Myers Squibb also were shared with the analysts and advisors who attended the event.

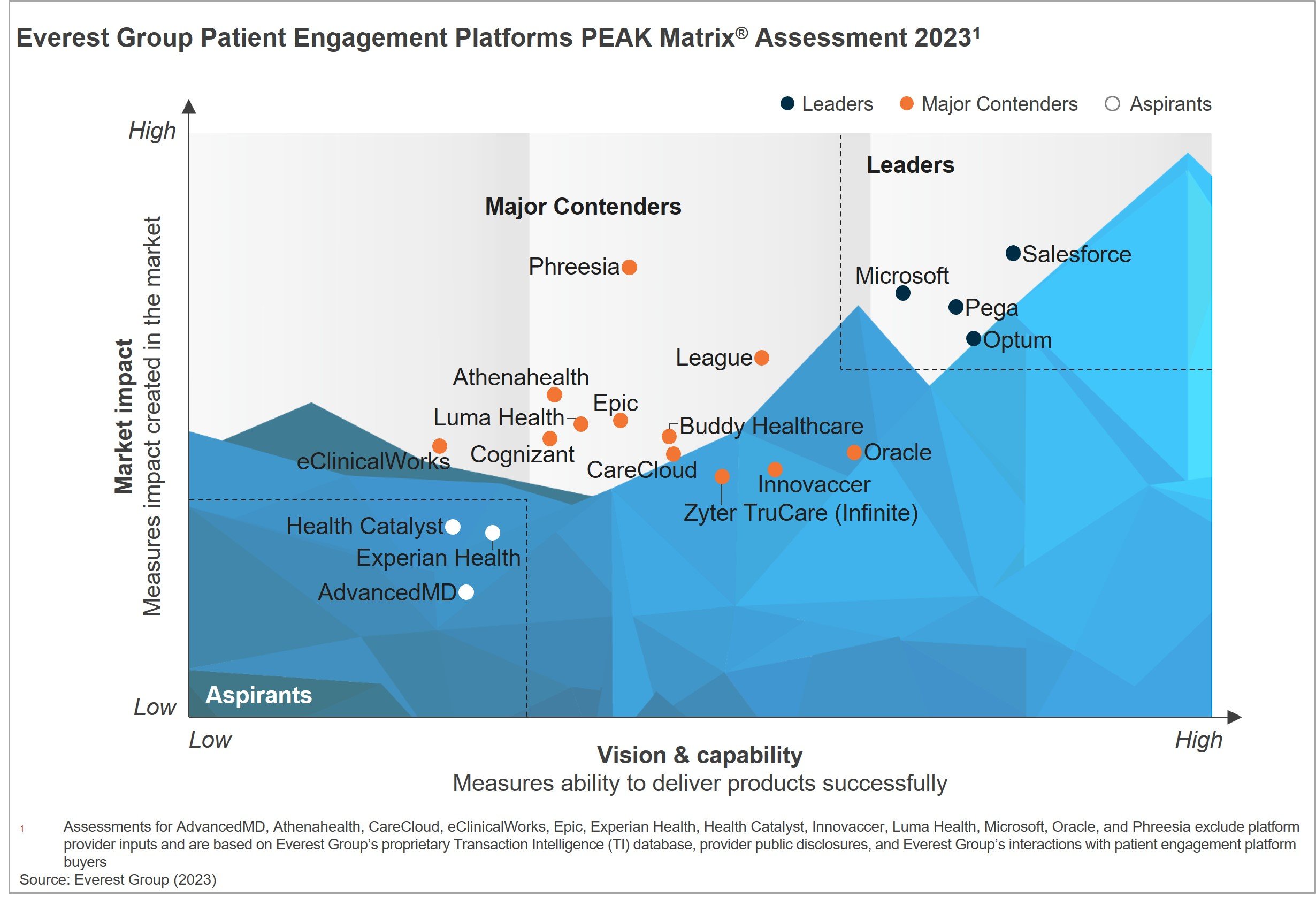

The context for the event was significant given the company’s struggles in recent years involving an activist investor followed by a slow growth period precipitated by misaligned priorities. Despite these issues, Cognizant ranked sixth in Everest Group’s latest version of the flagship leaderboard of global IT organizations – PEAK Matrix Service Provider of the Year 2023.

Even with the remaining issues that need to be fixed, the company has sound fundamentals. Here are our takeaways from the main points we heard from Cognizant’s leadership at the event:

The company’s self-awareness of the challenges it faced and its commitment to addressing them was a key theme that emerged from Cognizant’s analyst event. The provider acknowledged how several issues had impacted its performance and reputation in recent years. Rather than shying away from these concerns, it displayed a refreshingly transparent approach, recognizing the need for change and outlining specific actions to address the identified areas for improvement. This commitment to self-improvement demonstrates Cognizant’s dedication to delivering exceptional client experiences and driving sustainable growth.

Cognizant has long been recognized for its deep client relationships, which have been instrumental to its success over the years. The company emphasized the importance of relationship management as its core differentiator. Cognizant showcased a renewed focus on nurturing and strengthening these relationships, leveraging its vast expertise, industry knowledge, and client-centric approach. By reinforcing the significance of strong client partnerships, Cognizant appears to be picking the right battles.

Cognizant shared inspiring client success stories that showcased its ability to drive innovation and create value for its clients. One notable example was its collaboration with US Bank, where Cognizant leveraged its digital transformation expertise to help the bank enhance its customer experience, streamline operations, and drive cost efficiencies. Cognizant’s partnership with Bristol Myers Squibb was another example shared. Cognizant supported the global biopharmaceutical company in leveraging advanced analytics and data-driven insights to accelerate drug discovery and development, leading to improved patient outcomes. These successes served as compelling examples of Cognizant’s ability to deliver tangible business results through technology-driven solutions.

A crucial factor contributing to the sense of stability and confidence at the analyst event was Cognizant’s leadership team. Along with Kumar, the other executives speaking at the event included Surya Gummadi, Prasad Sankaran, and Ganesh Ayyar. The leadership team’s steady guidance has played a pivotal role in steering Cognizant through transformation and growth. Analysts and attendees noted leadership’s openness in addressing concerns and the confidence they exuded in their ability to guide Cognizant.

Lastly, Cognizant gave the community a preview of recent offerings such as Cognizant Neuro AI, its new, enterprise-wide platform designed to provide enterprises with a comprehensive approach to accelerate the adoption of generative Artificial Intelligence (GAI) technology.

By acknowledging areas for improvement and demonstrating a transparent and determined approach, Cognizant conveyed its commitment to growth and delivering exceptional client experiences. The emphasis on relationship management as its key strength reinforced the company’s focus. As analysts, we will closely scrutinize Cognizant’s progress in these areas and offer insights to buyers and investors in IT and Business Process Services.

Everest Group was represented at this event by CEO Peter Bendor-Samuel, and Partners Abhishek Singh, Achint Arora, Manu Agarwal, Ronak Doshi, and Shirley Hung. Contact this team with questions about IT and BP services markets, enterprise buying trends, and the role of vendors. Reach out to contact us.

From left, Ronak Doshi, Shirley Hung, Abhishek Singh, Ravi Kumar, Achint Arora, Peter Bendor-Samuel, and Manu Aggarwal

Watch our webinar, Welcoming the AI Summer: How Generative AI is Transforming Experiences, to learn why leading providers are entering the market with significant investments.

In the last couple of years, we have witnessed the frantic adoption of cloud by enterprises trying to keep up with innovation. During that time, the definition of cloud value was never standardized across different stakeholder groups, and today many enterprises believe they are not realizing the expected value from cloud. This phenomenon has been exacerbated by the current macroeconomic environment, which has added further pressure on enterprises to justify all investments and maximize value.

In this webinar, our experts will explore the unique opportunity for enterprises to align the definition of cloud value and execute their cloud value realization strategies while facing a constrained macroeconomic environment.

Our speakers will discuss:

Who should attend?

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields