Digital transformation: How to beat the funding challenges | Sherpas in Blue Shirts

Executives continue to struggle with how to fund digital transformation projects. Let’s examine three funding pitfalls and approaches that avoid them

In working with CIOs and other senior executives leading digital transformation efforts, the most frequent comment we at Everest Group hear is, “I don’t know how to get this funded.”

IT modernization and digital transformation are multiyear journeys that require enormous change to reinvent the business and create new value for customers, employees, and shareholders. Typical transformation initiatives aim to help an organization stay within the budget and complete projects on time. Although these goals help when you’re trying to achieve a return on investment (ROI) by performing a process better, these are not relevant goals when you’re aiming to do something different.

Digital Transformation Readiness

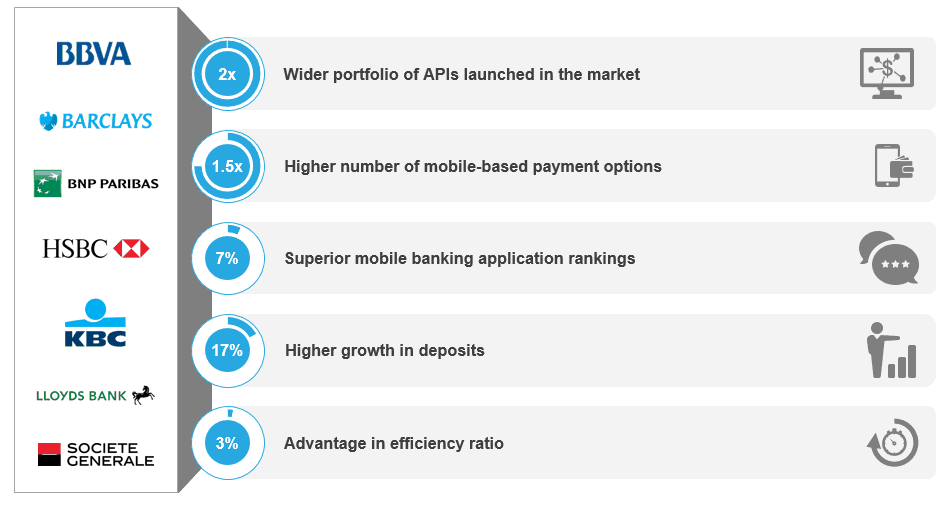

Everest Group’s study on digital transformation readiness reveals dramatic differences in value created by the most successful organizations, which we call Pinnacle Enterprises. (These 21 companies in our study achieved superior transformation results, by investing in resources including adequate funding for digital transformation.) Consider these outcomes, for instance:

- In 86 percent of the Pinnacle Enterprises, the IT organization enabled the enterprise to serve a new market or customer segment (versus 43 percent of the other enterprises we studied).

- In 85 percent of the Pinnacle Enterprises, the IT organization supported significant growth of current products/services (versus 33 percent of the others).

- The Pinnacle Enterprises invested in innovation labs (81 versus 36 percent), digital studios for new product development (71 percent versus 27 percent) and innovation funds to support start-up activities (76 percent versus 35 percent).