Personalized Medicines Have Promise But Face Headwinds | Market Insights™

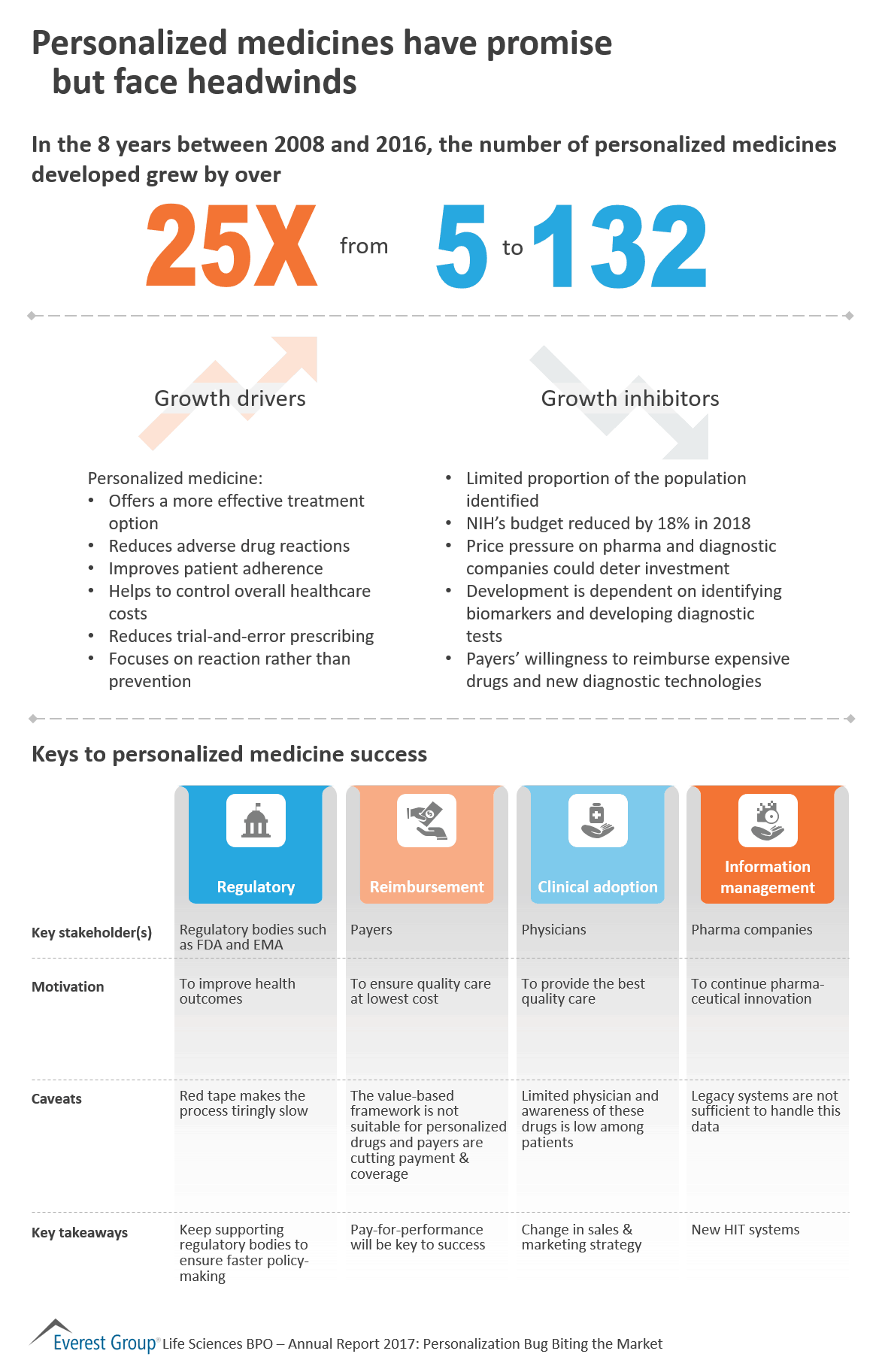

Personalized medicines have promise but face headwinds

Personalized medicines have promise but face headwinds

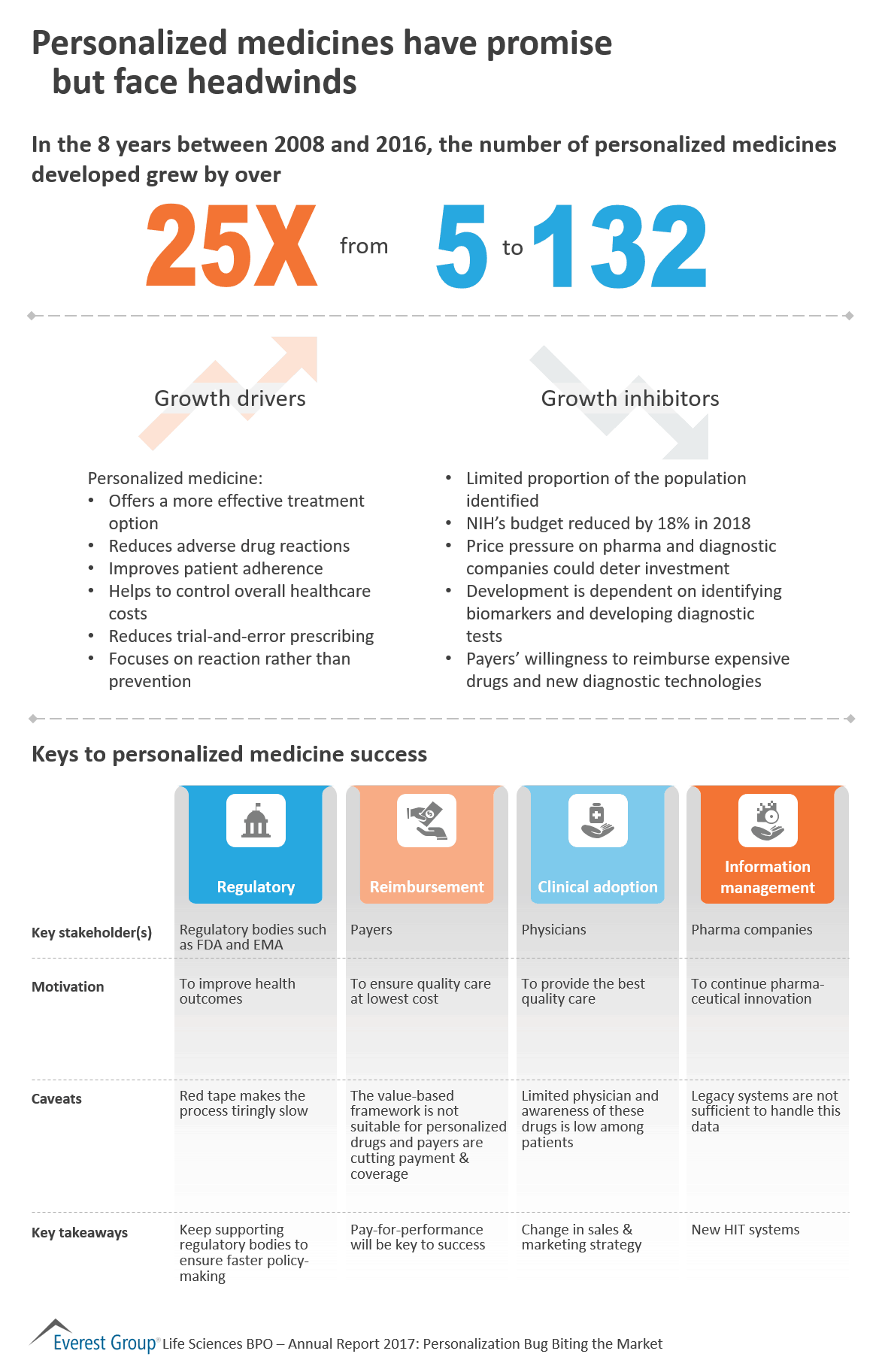

The life sciences industry is facing a series of major challenges; here are 4 solutions to address them

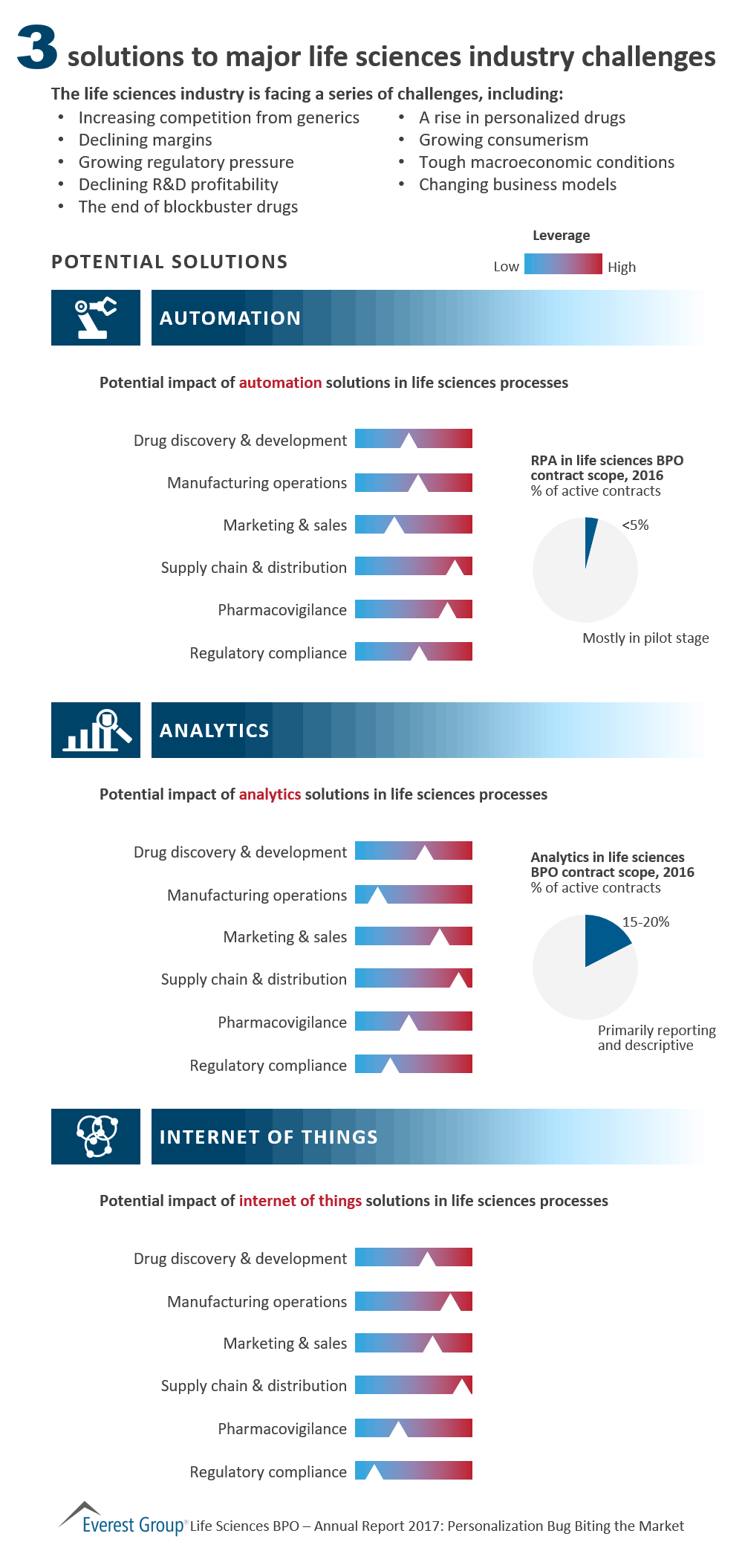

Delhi “smogged” out of India’s top global services location ranking. Health risks impact the NCR’s ability to attract companies to set up global services centers.

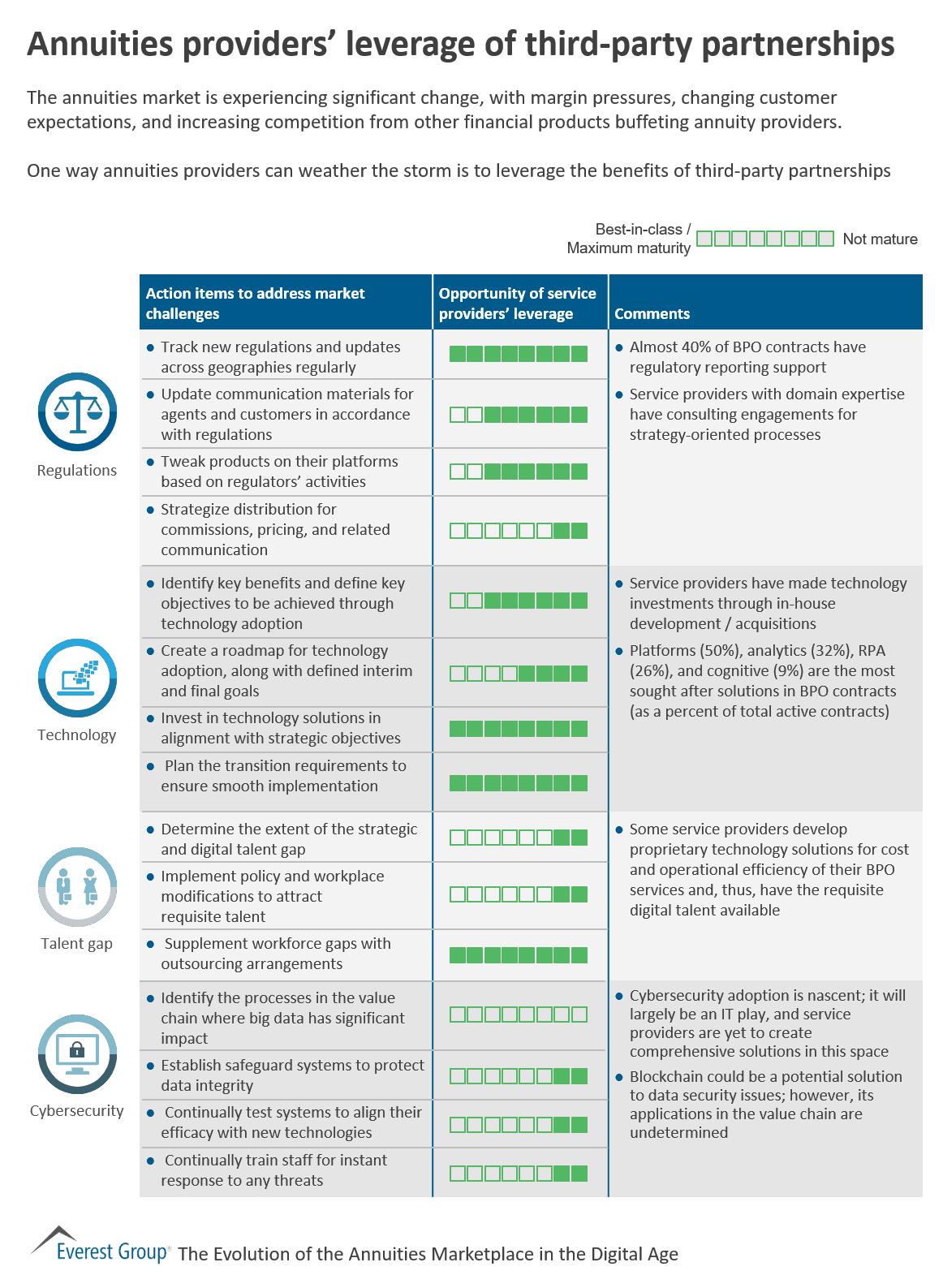

The annuities market is experiencing significant change, with margin pressures, changing customer expectations, and increasing competition from other financial products buffeting annuity providers.

One way annuities providers can weather the storm is to leverage the benefits of third-party partnerships

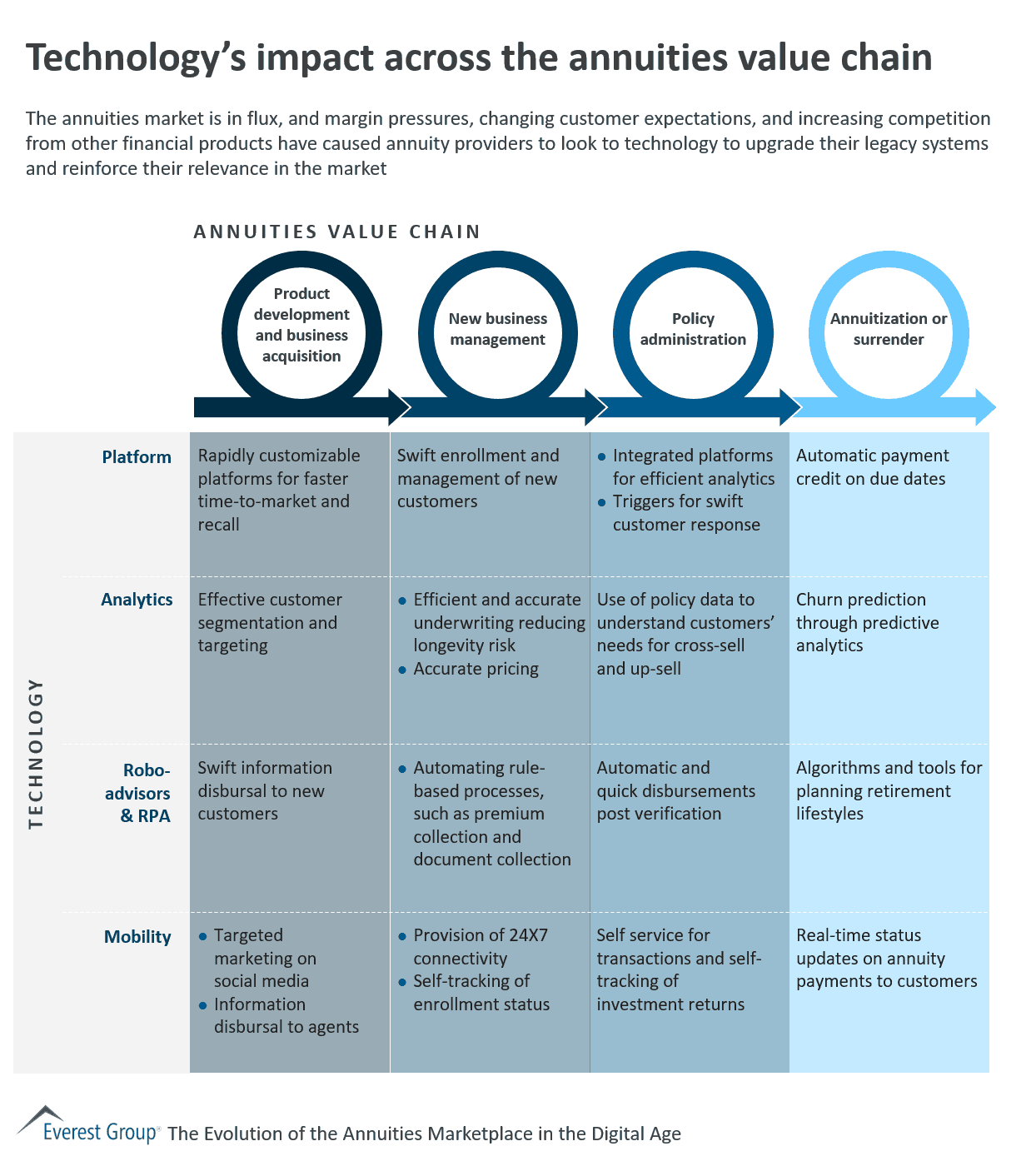

The annuities market is in flux, and margin pressures, changing customer expectations, and increasing competition from other financial products have caused annuity providers to look to technology to upgrade their legacy systems and reinforce their relevance in the market

Infosys’ new chief executive Salil Parekh should focus on building a strategy on top of the digital transformation approach that his predecessor began, and take advantage of being based in Bengaluru, the headquarters of the company.

“Given his past record and the board’s forward looking statements it seems likely that the general direction and strategy under Sikka will continue,” said Peter Bendor-Samuel, the CEO of research firm Everest Group.

Vice President of Research Anurag Srivastava will be a key speaker at a Poland-based event on December 11: Skills for the Future – Upskilling and Reskilling in Shared Services Centres.

At this event, Anurag will discuss the challenges and opportunities facing shared services centres (SSCs) in Poland in terms of human capital development. The discussions will be based on findings from a recent survey carried out by Everest Group in SSCs across Poland, India and the Philippines.

When

December 11, 2017

Where

British Embassy, Warsaw

Speaker

Anurag Srivastava, Research Vice President, Everest Group

Attendance to this event is by invitation only

Cost-savings, customer experience, and opportunity to steer top-line growth drive L&P insurers’ demand for next-gen technology, InsurTech partnerships

The global life and pensions (L&P) insurance business process outsourcing (BPO) market grew at an 8 percent compound annual growth rate in 2016, similar to 2015. Growth is expected to be at 9 to 11 percent over the next few years, according to Everest Group. This steady growth rate is buoyed by margin pressures on insurers who continue to find offshoring attractive for cost savings and is simultaneously dampened by the continuing political uncertainties in the United Kingdom, which leads the market and accounts for almost half of the global revenue.

Although the growth rate is steady, the L&P insurance BPO market is witnessing numerous changes:

“In the advanced insurance markets, premium growth has been stagnant but costs are rising, which puts considerable margin pressures on insurers. Further, for top-line revenue expansion insurers must now cater to the evolving needs of their customer base,” said Skand Bhargava, practice director, Business Process Services, at Everest Group. “In fact, the key value propositions for major service providers in 2016 were based on modern platform offerings and augmented customer service delivery capabilities. In 2018, we’ll see insurers bringing in more product innovations, leveraging partnerships with InsurTech firms.”

These findings are explored in a recently published Everest Group report: “L&P Insurance BPO: Move or Miss—Innovation, Execution and Adoption of Digital Insurance.”

This research examines the global non-voice, third-party L&P insurance BPO market. It provides detailed analysis of market size and growth, solution characteristics, emerging trends and the service provider landscape.

***Download a complimentary, 11-page abstract of the report here.**

Other key findings in the report:

Recently, Infosys appointed Salil S. Parekh, formerly a Group Executive Board member at Capgemini, as CEO and MD of Infosys. His selection was a surprising choice. He lacks the industry profile of Infosys’ prior CEOs and has no prior experience as a CEO. But I believe he is a talented executive who is well positioned to continue the existing Infosys strategy and is committed to building the next generation of Indian services. He understands all that an Indian talent base can offer while also understanding the need to broaden the global talent base and lead Infosys into a becoming a digital transformation leader. I believe the following perspectives are critical when evaluating the impact of this new leader at Infosys.

As I blogged in August 2017 when Vishal Sikka resigned as CEO, the new Infosys CEO will need to make bold, decisive moves to position the company for the future. Specifically, I think he brings the following advantages to Infosys:

I think Infosys chose an external candidate to lead the firm to avoid some of the friction and issues lingering from the friction among the board, management and founders. Infosys now needs a steady hand, a more low-profile approach to building its future. Although Sikka raised the firm’s profile in the digital transformation space, he didn’t manage to bring the founders and the rank-and-file employees along. Parekh has the skills to focus on executing on the digital strategy. He will bring a fresh perspective on how to continue Infosys’ drive to remake the firm into the next-generation of services companies based on digital technologies and business models. I also expect he will be instrumental in changing the board composition over the next 18 months to ensure he has a unified board and can heal any ongoing rifts with the firm’s founders.

The fact that Parekh will be based in Bangalore is significant, as it will better position him for deeper understanding of the Infosys culture and enable him to build internal support for the difficult journey ahead in a challenging and changing marketplace.

In Salil, Infosys has found a capable executive that fits the Indian culture, yet brings the consulting and global perspective the firm needs. Thus, he should be able to build alliances in and outside the firm without creating the pushback that Sikka experienced.

The industry and media are abuzz with speculation on the amount of executive turnover as a result of Parekh’s selection. Every new CEO brings in new executives, and he won’t be an exception to this rule. It’s important to realize that Infosys has plenty of room to remove executives without removing existing talent. Some in the senior ranks had stayed to create stability after Sikka’s departure, but they will now be free to move on. Other senior talent had stepped up on a temporary basis and can now move back to a more sustainable role. That said, I don’t expect a wholesale removal of the firm’s senior leadership. It will be a case of streamlining the leadership team and restructuring some layers.

Together, Parekh’s experience and the Infosys board’s forward-looking statements indicate that the existing digital direction and strategy that Sikka was driving will continue. I believe the firm is well positioned to participate in the consolidation of the legacy, high-margin labor arbitrage-based business. This is already taking place in the services industry, and I expect Infosys will capture a significant share of this work. However, I believe the primary goal is still to continue the digital transformation journey.

In the effort rebuild Infosys to lead in the digital marketplace, I suggest Infosys take the following five steps:

For all the above reasons, I believe Parekh is notably able to grow Infosys’ business. I don’t think he will bring clients with him, but I don’t think this is necessary. Infosys has all the clients it needs. The challenge for Infosys today is to become the digital transformation partner of choice for the clients it already has. If he can help achieve this objective, I believe Infosys will become a clear leader in the new emerging services market.

In many ways, Infosys has pulled a rabbit out of its hat by appointing Salil Parekh as its CEO and MD who will take over his new position on January 2.

A member of the Group Executive Board of the Euro 12.54 billion French consultancy major, Capgemini, Parekh was never seen as a front-runner for one of the most coveted jobs in the Indian technology space.

But his track record shows that Infosys couldn’t have picked a more suitable person to head the organization. Parekh was at the forefront of the acquisition of the company he worked for, Ernst & Young’s consultancy division by Capgemini in 2000 and was widely credited for bringing scale and value to the Indian operations of the consultancy firm. In 2015, he led from the front for the acquisition of i-Gate for $4 billion.

Peter Bendor-Samuel, the CEO of Everest Group, an advisory firm Capgemini told an Indian newspaper in 2015 that Capgemini has realized 10 times more growth than what Parekh had promised Pierre-Yves Cros, the chief development officer of Capgemini.

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields