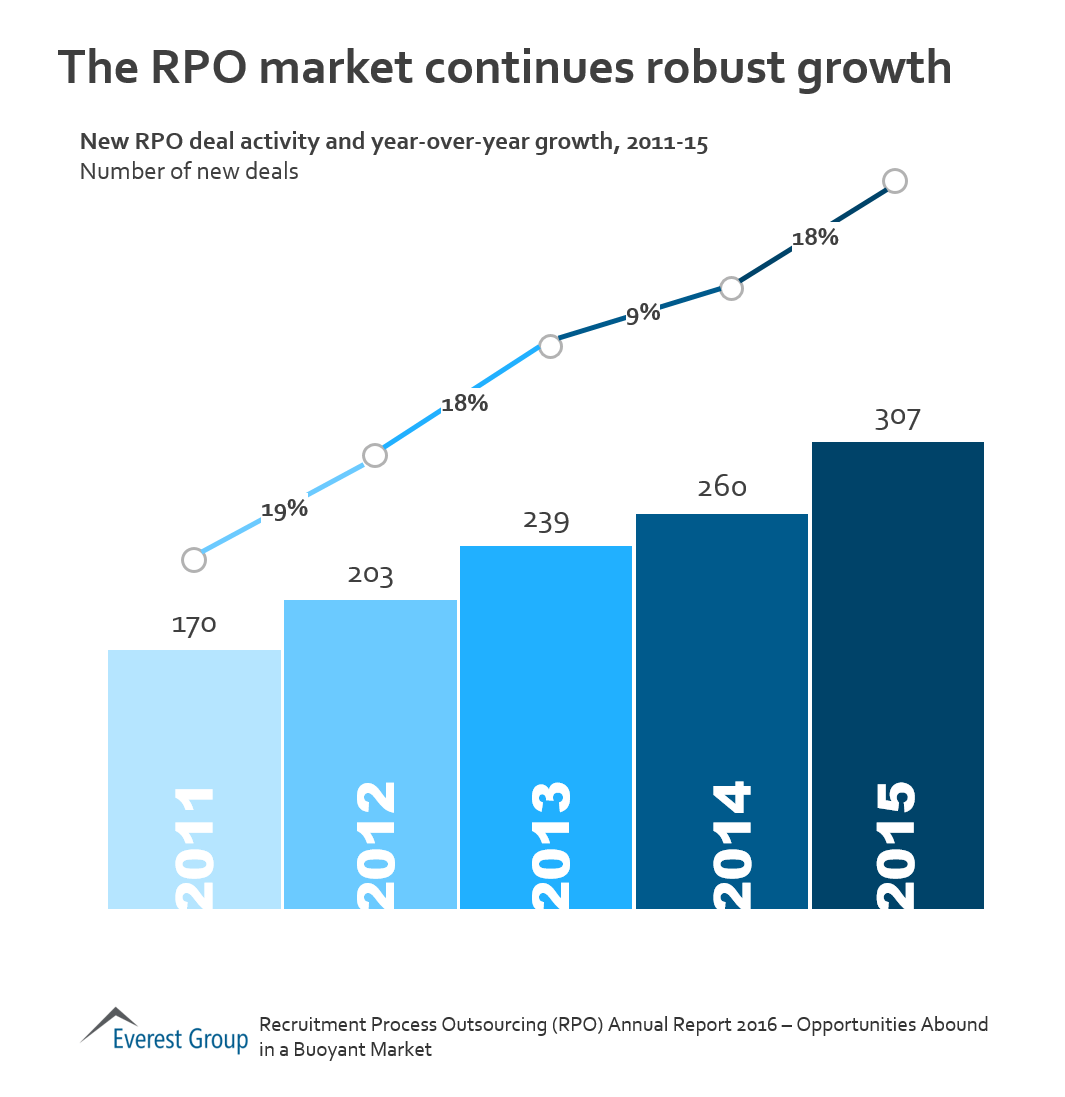

The RPO market continues robust growth

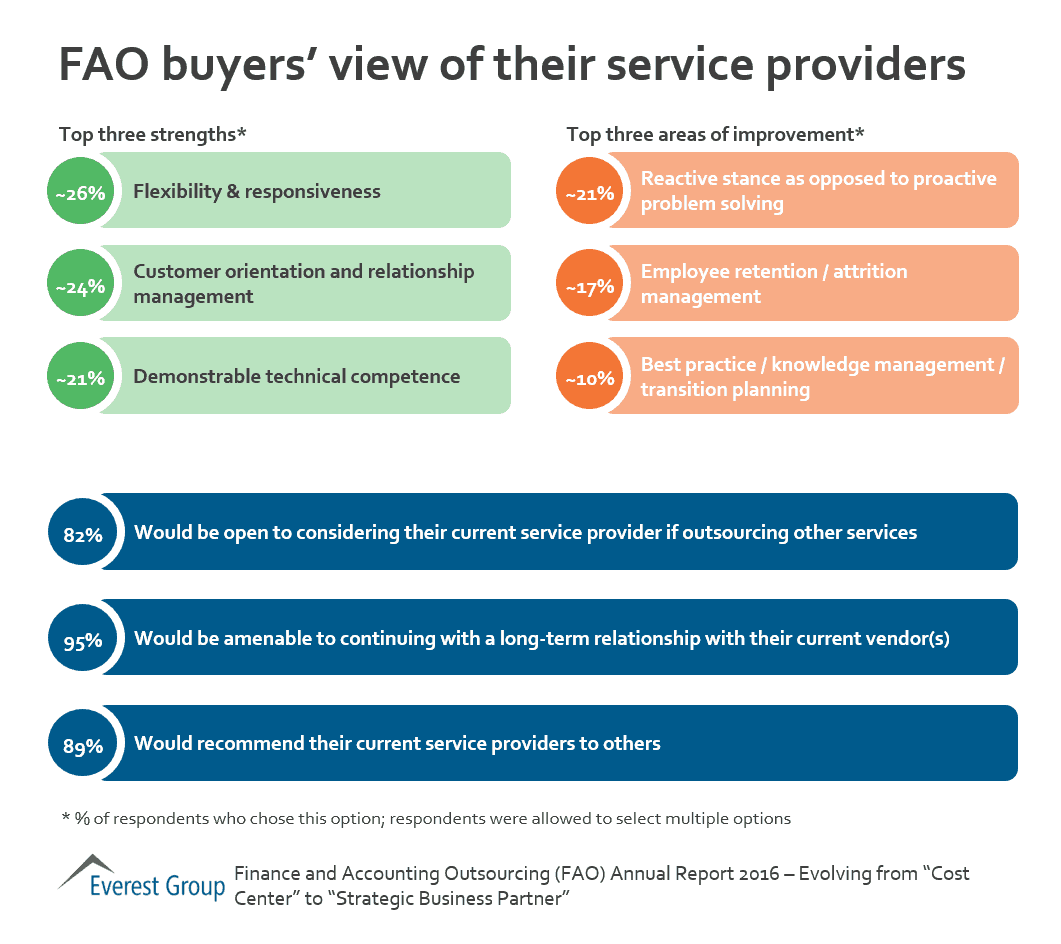

FAO buyers’ view of their service providers

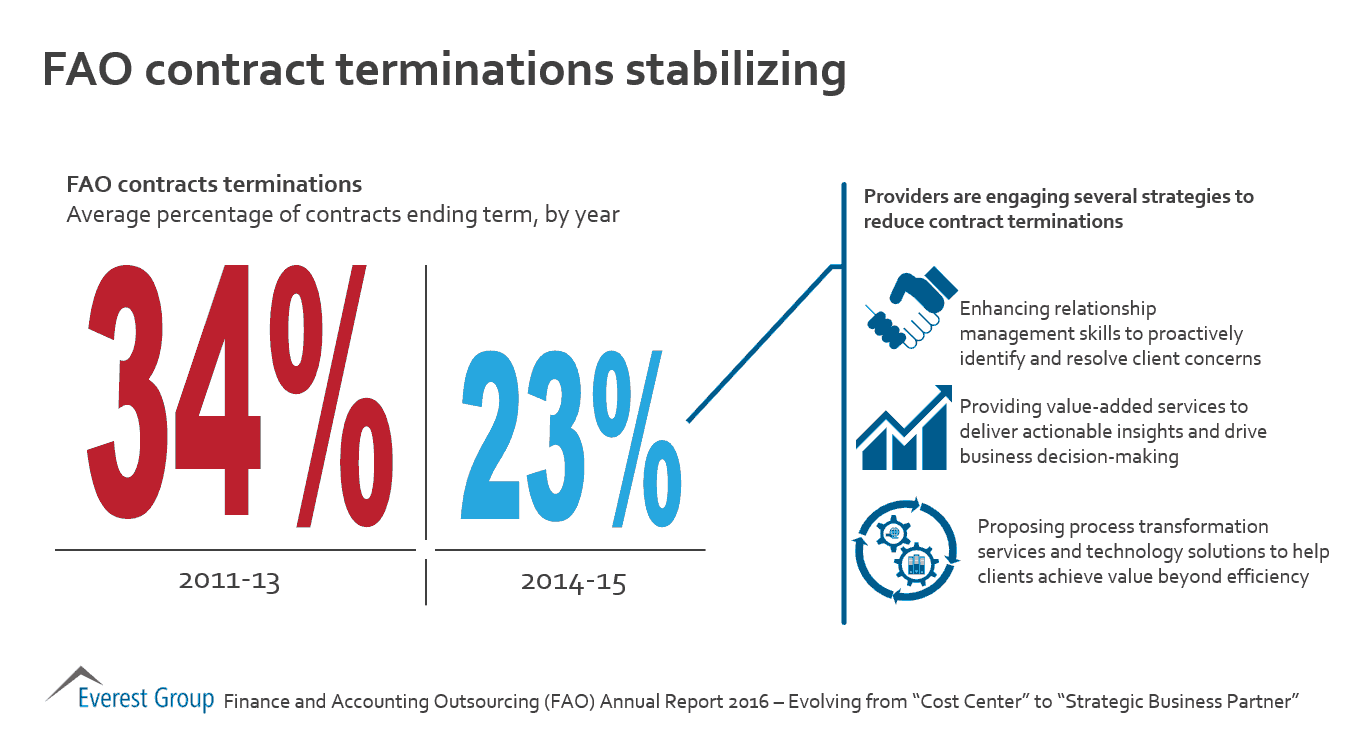

FAO contract terminations stabilizing

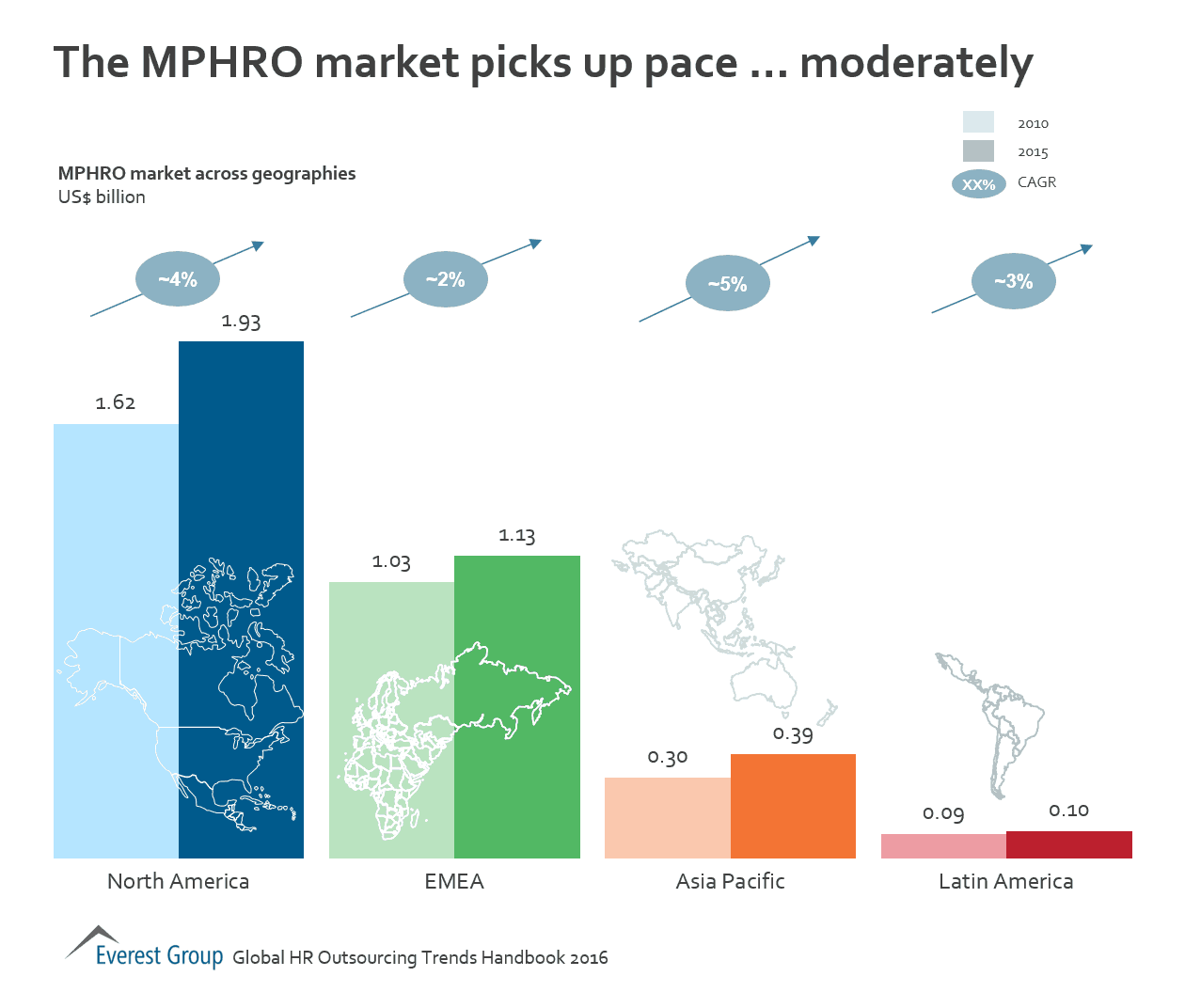

The MPHRO market picks up pace … moderately

The US is the biggest outsourcing destination with companies like Tata Consultancy Service, Infosys, Cognizant Technology Solutions and Wipro dominating this space.

Two years ago, a report quoting research firm Everest Group said US healthcare related contracts were expected to more than double to about $68 billion in 2020, from nearly $31 billion two years ago, largely due to Obamacare.

As the developed markets of North America and Europe mature, human resources outsourcing (especially in multi-process human resources outsourcing and recruitment process outsourcing) is pivoting towards the faster growing marking in Asia Pacific, according to the latest Everest Group research report.

Supply chain planning BPO is a relatively new entrant into the global services arena. Organizations are now turning to specialist providers that can deliver a range of services across delivery, master data management (MDM), aftersales, and reporting & analytics. A number of leading broad-based BPO providers have developed capabilities in this area to complement finance & accounting and procurement outsourcing offerings.

However, as is typical with a service that is not very tightly defined, supply chain planning BPO consist of completely different sets of underlying services, depending on the client context.

On one end of the spectrum, supply chain planning BPO services can cover relatively transactional activities such as:

On the other end, supply chain planning BPO services have been seen to cover quite complex activities such as:

Both sets of services have different skill set requirements, educational qualifications, staffing metrics, and talent management regimes. The transactional activities require basic numerical skills, some working knowledge of ERP systems, and good reporting capabilities. The complex manifestation of supply chain planning is much more judgement based, and requires operations planning skills, understanding of network planning/optimization tools, and excellent analytical abilities.

In a competitive or sole-sourced bid situation, any wrong assumptions could have significant implications on deal profitability for the service provider or pricing competitiveness for the buyer. Therefore, it is critical for both parties to understand and articulate where the specific service lies on the complexity continuum.

During the deal tenure, this poses additional challenges during a benchmarking or contract review/renegotiation exercise. We have often observed providers putting forth a “blended” rate covering the entire set of services, which limits the transparency and flexibility to objectively and accurately assess the pricing. Case in point: as part of a recent contract review, we had to go through the qualification and job description of each individual on the account to enable an apples to apples comparison. This led to the identification of significant value leakage due to a blended rate covering all kinds of supply chain planning activities that was higher than the fair market price for the complexity of the underlying services delivered.

It will be interesting to observe how the market evolves and service providers develop a tighter definition of these services to ensure there is no confusion during solutioning and pricing of contracts. If you were on the buy- or sell-side of a supply chain planning BPO deal, our readers would love to hear your experience!

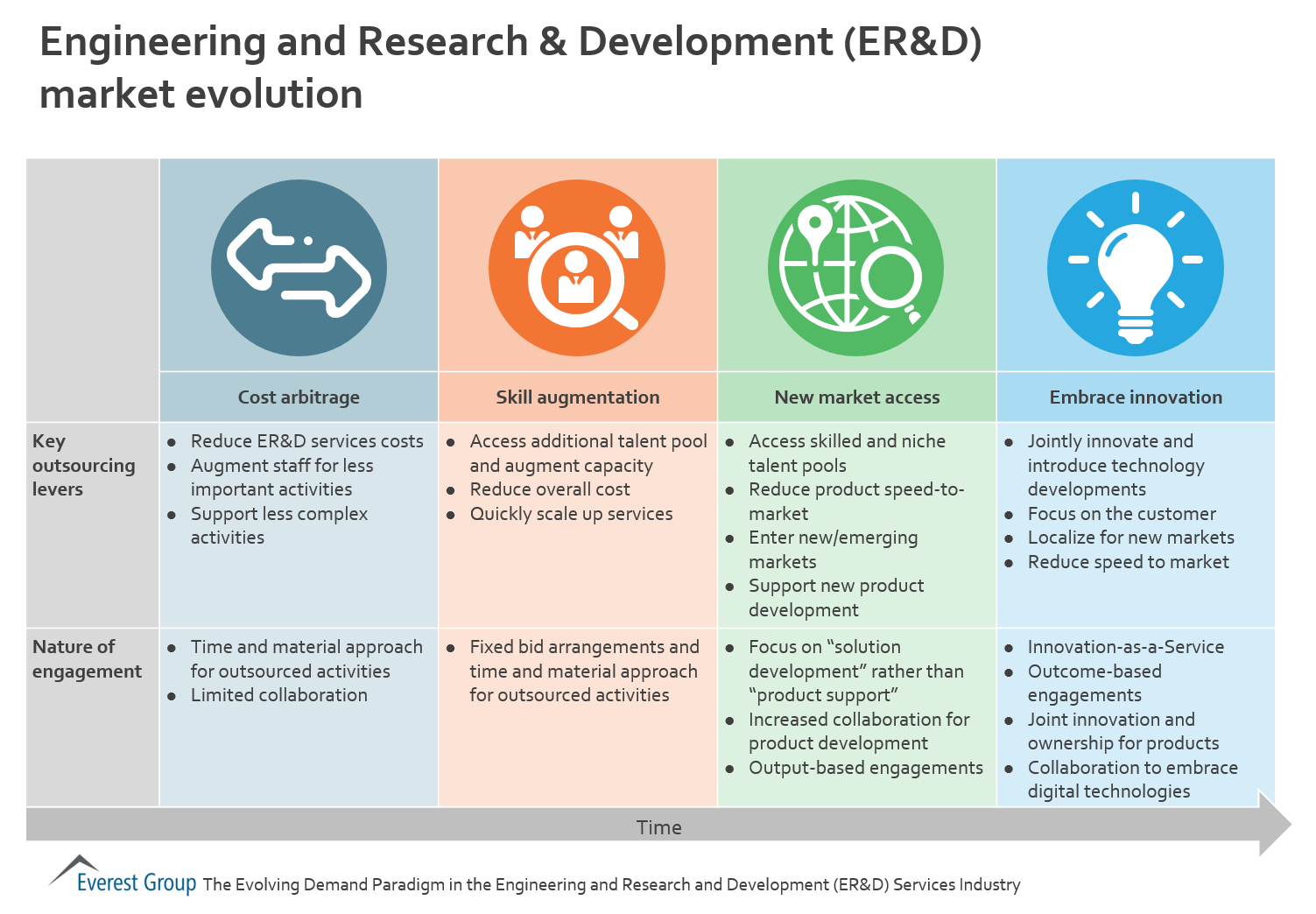

Engineering and Research & Development (ER&D) market evolution: key outsourding levers and nature of engagement

Accenture, Atos, HCL Technologies and IBM are named Leaders in Everest Group inaugural PEAK Matrix™ list of top Internet of Things service providers

Given the huge potential of the Internet of Things (IoT)—most of which is yet to be realized—enterprises are making significant investments in partnership with key service providers to explore new growth areas. As a result, Everest Group expects that the IoT services market will more than double in the next three years, reaching US$18 billion by 2020.

Enterprises are exploring ways that IoT can be used to achieve higher efficiency, enable data-driven decision-making and develop new revenue opportunities through customer-centric products and services.

**Read more about how enterprises are “Seizing the IoT Opportunity”**

With enterprises and service providers considering IoT as their next big opportunity, Everest Group has identified intriguing trends that are emerging from the current adoption pattern:

“Enterprises are increasingly adopting IoT to improve operational efficiency and create disruptive business models,” said Chirajeet Sengupta, vice president at Everest Group. “A number of players across the IoT stack are making huge investments to grab a larger share of the pie, but most fall short on expectations of a transformation partner. Service providers can use this opportunity to draw on their engineering and services expertise and embrace new engagement models to help enterprises with long-term innovation.”

The current use cases of IoT are dominated by the need of enterprises to drive operational efficiency. However, we do expect enterprises to leverage IoT to fundamentally transform their business going forward. In fact, Everest Group has identified four distinct classifications of enterprises based upon the business objectives they hope to accomplish through their IoT initiatives:

“Enterprises should adopt IoT across all categories, which will lead to new revenue streams and adoption of new business models,” added Sengupta.

Announcing the IoT Services Market Leaders

In its inaugural Internet of Things PEAK Matrix assessment, Everest Group explores the vision, services suite, scale of operations and domain investments of 16 IoT service providers. Everest Group has identified the following Leaders, Major Contenders and Aspirants:

***Download Complimentary 4-page PEAK Matrix™ Preview Here***

Trends in the IoT services market as well as detailed insights into each of the 16 providers listed above are provided in the 92-page report, “Internet of Things Services — PEAK Matrix™ Assessment and Market Trends — IoT: Bigger Than the Hype.” A preview report is available for complimentary download here.

*** Download Publication-Quality Graphics ***

High-resolution graphics illustrating key takeaways from this report can be included in news coverage, with attribution to Everest Group. Graphics include:

About the PEAK Matrix™

The Everest Group PEAK Matrix is a proprietary framework for assessing the relative market success and overall capability of service providers based on Performance, Experiences, Ability and Knowledge. Each service provider is comparatively assessed on two dimensions: market success and delivery capabilities. The resulting matrix categorizes service providers as Leaders, Major Contenders, and Aspirants. Companies that demonstrate strong upward movement in successive reports are recognized as Star Performers. Everest Group recently announced a recalibrated methodology, in which innovation, intellectual property and technology take center stage.

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields