September 5, 2017

When I visited India for the first time in the early 2000s, the country was largely unknown in terms of business. The airports were small and dingy. The upscale hotels were really nice but also scarce. That meant they could charge insanely expensive rates…I remember paying US$700 per night at the Leela Palace!

My U.S. colleagues and I were on a mission to visit largely unknown service providers like Infosys, TCS, and Wipro, all of which had around 10K employees. At the end of the trip, we concluded that this was going to be real, and big…very big.

So we, and the other industry analysts in the space, pulled out our crystal ball to see what specifics we could predict. How clear, or cloudy, were our sixth senses back then?

What we got right

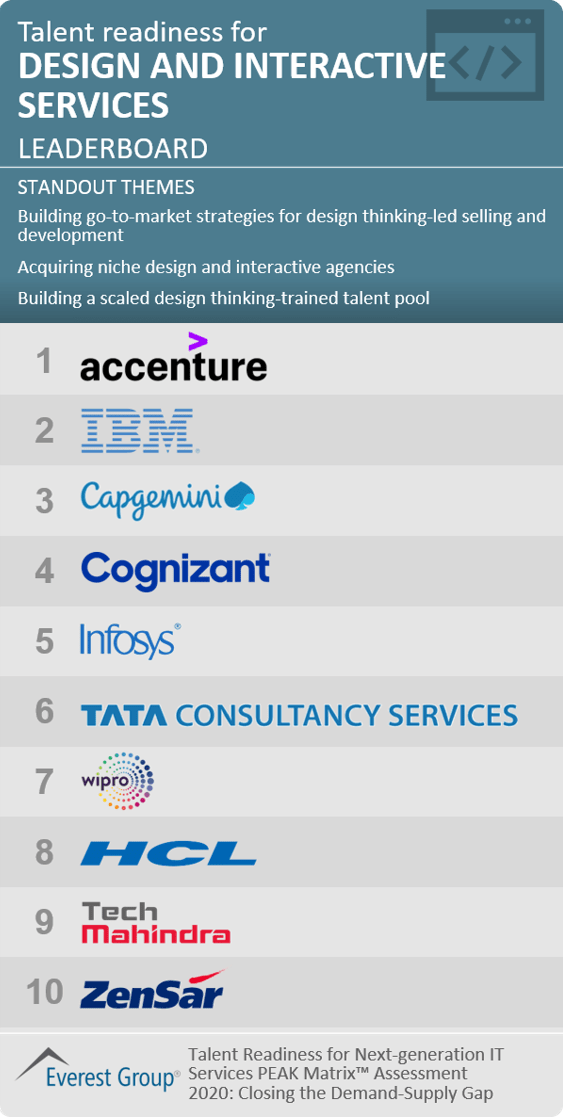

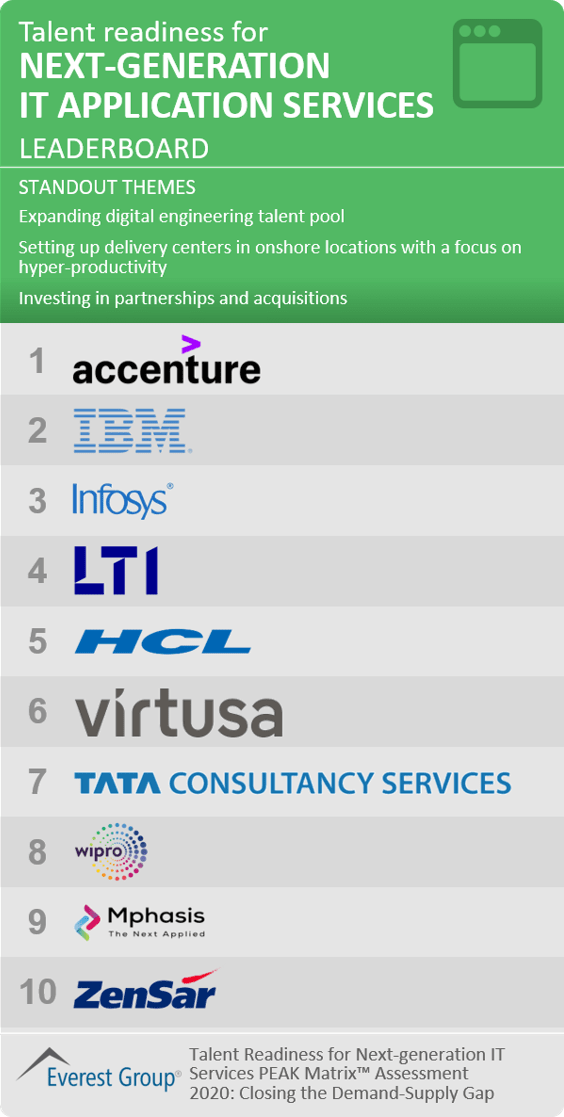

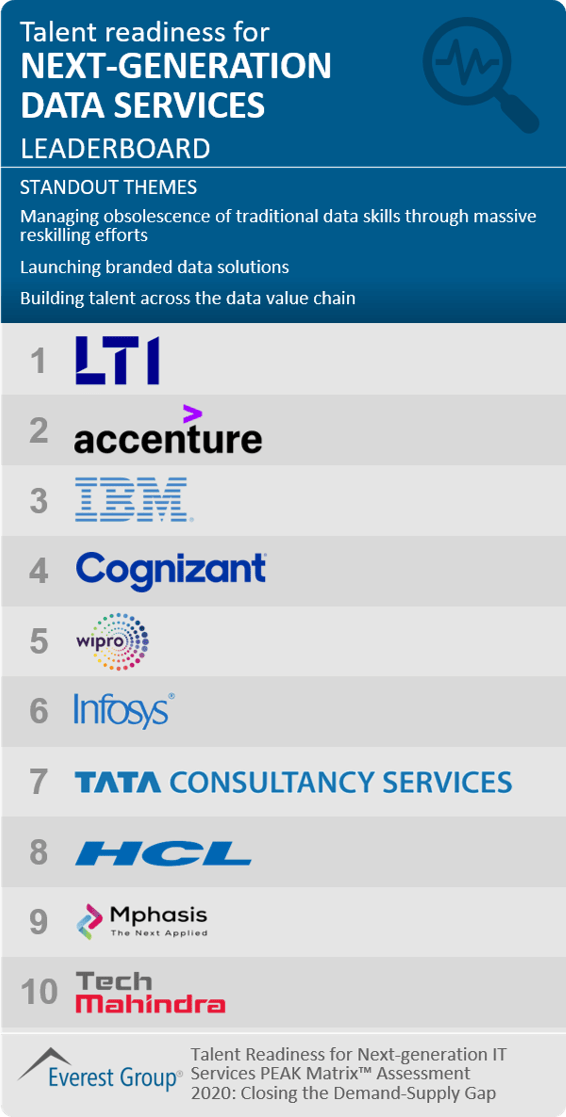

We did well in this category. India, along with many, many other low-cost locations, is absolutely capable of doing the global services job with scale. It’s also capable of doing many sophisticated processes (full disclosure: we might have underestimated this one a bit.) And those “unknown” companies I mentioned above? They’ve become truly global players, by some measures even surpassing the original powerhouses like Accenture, ACS, CSC, EDS, IBM, and HP (many of which have already consolidated).

What we got wrong

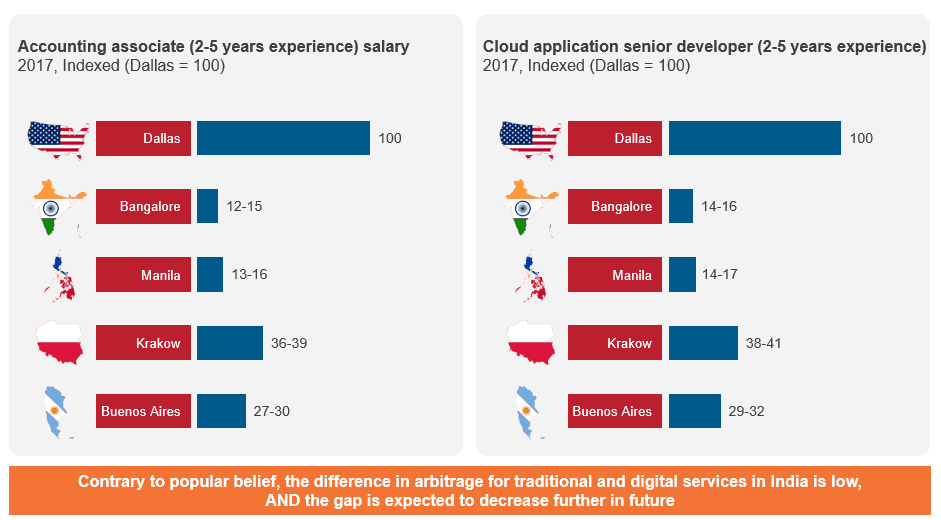

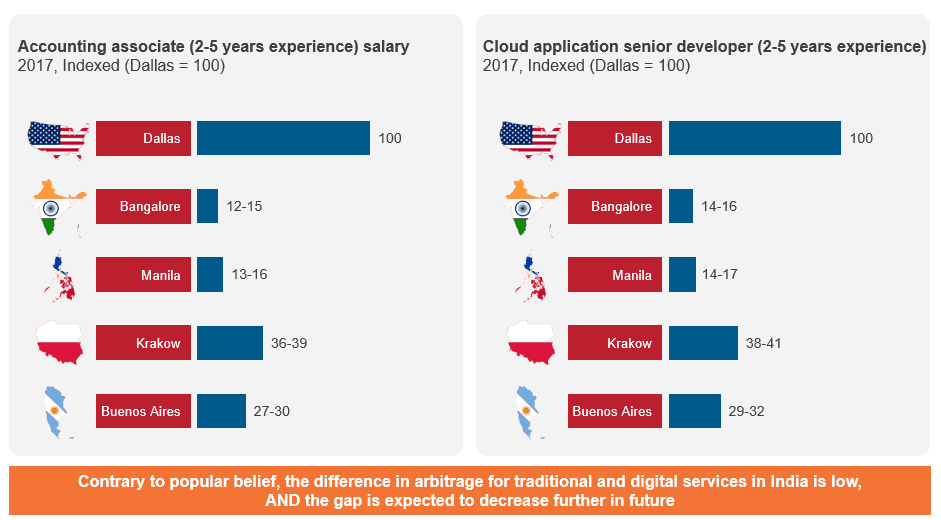

While inflation slowed in the U.S., it did even more dramatically in recent years in India. This, in turn, slowed the arbitrage difference, creating relatively smaller impacts on our models. And currency moves – such as a change from around 45 to 64 rupees – created a large positive impact, offsetting inflation by roughly 50 percent.

What we got really wrong

Labor supply was the biggie. All of us in the analyst community completely underestimated the impact of the available supply, which created an ongoing downward pressure on entry-level salaries. Using the best available data, the number of college students in India has risen from 13.6 million in 2008 to more than double that (28.5 million) in 2016.

While we didn’t predict it in the earliest years of the global services industry, by the end of the 2000s we were forecasting the end of labor arbitrage. India salaries were rising at double digit rates, and it seemed that it was only a matter of time before we reached parity (for offshoring purposes, 70 percent of U.S.-based salaries was considered parity.) As you see, we were miles off on that one.

What we got really wrong | Supply of labor

Increased labor in India as well as other locations have ensured limited salary increase, especially for junior roles

Looking forward (through our much more mature crystal ball) on the cost question

- Temporary shortages of key skills, particularly digital, will create upwards pressures on salaries. But as the education and corporate systems retool their training curriculums, I expect the resulting surge in available talent will allow a cap and perhaps drive down salaries. Still and all, India is still a viable place to get low cost labor, albeit not quite as good as it was 15 years ago. (Review our Executive Briefing, India Global Services Industry: A Look Back at the Last Decade and Our Future Outlook, to drill down into the supporting analytics for this analysis.)

- Many functions and processes have reached an offshoring saturation point. This doesn’t mean a complete stoppage of work moving offshore, just that many of the big, concentrated moves have already happened.

- New automated solutions like RPA are going to create significant process labor efficiencies, in turn increasing headcount pressures.

- The tipping point in this equation will go back to the supply side, where the ongoing wave of college students will keep pressure on wage advances far into the future, especially for the entry level positions.

Gazing forward to at least a 2040 – 2050 timeframe, other low-cost locations such as eastern Europe may get tapped out, since they don’t have as large a stream of graduates as does India. So, I say: advantage to India in keeping the wages compelling with its tidal wave of ongoing supply. But the looming question will be, what to do with all of those freshly minted grads?

My next blog will tackle the interesting another aspect of my looking back and looking forward retrospectives: “Are the India Heritage Services the new Global Leaders? The answer isn’t obvious. Stay tuned…