John Mellencamp Named Honorary Everest Group Analyst of the Month | Sherpas in Blue Shirts

“Well I was born in a small town

And I live in a small town

Prob’ly die in a small town

Oh, those small communities

All my friends are so small town

My parents live in the same small town

My job is so small town

Provides little opportunity”

— John Mellencamp, Small Town (1985)

Turns out Mr. Mellencamp was a pretty good analyst when it comes to assessing global services employment opportunities in small communities. So much so, that I am officially naming him as “Honorary Everest Group Analyst of the Month.”

No, I am not smoking something.

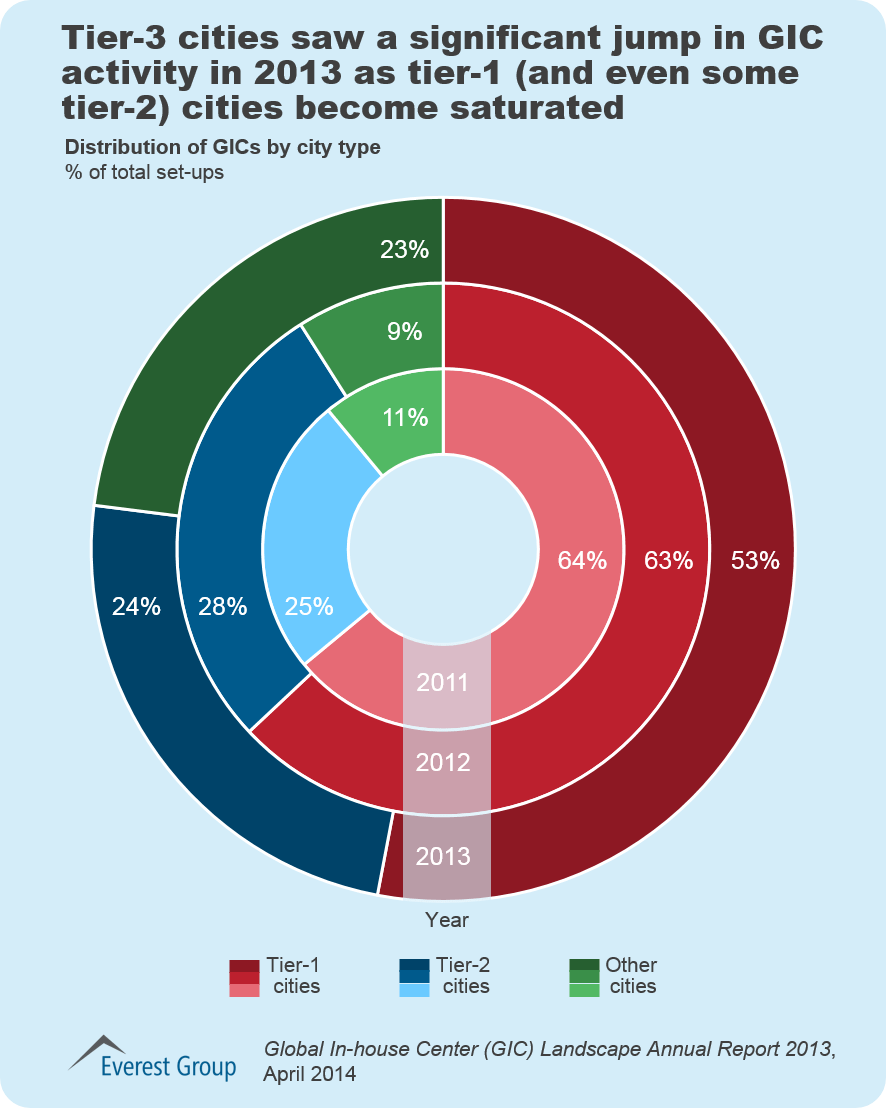

We just completed a first of its kind analysis of the U.S. Domestic Outsourcing location landscape for RevAmerica and finally have the key facts the industry has been lacking. In short, although smaller communities are sometimes used for service delivery, the reality is that the vast majority of the market is concentrated in larger communities with populations measured in the 100,000s vs. 10,000s. In particular, tier-3 cities are the sweet spot…the largest number of centers, the largest employment, and the largest centers.

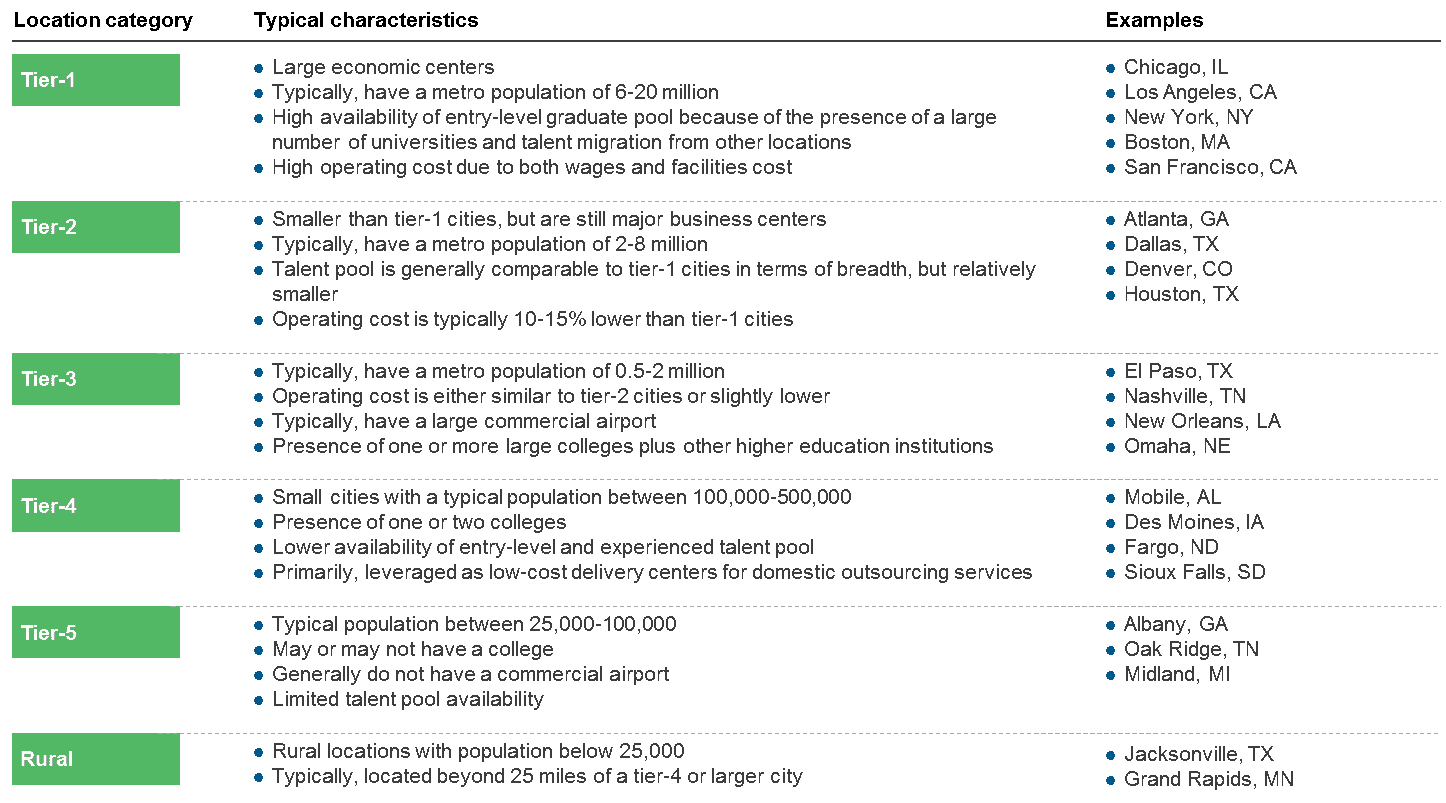

Defining the city tiers

In order to analyze approximately 250 metro cities, we segmented them into six groups – tier-1 through tier-5 plus rural. As indicated below, the city segments are characterized by differences in population size plus commercial and educational factors.

Although only one dimension of a city’s potential for service delivery, it is easy and revealing to look at the differences in average population size of the city tiers. Each city tier is 20-40% of the population of the next larger city tier, which leads to a dramatic difference in the profile of cities that are 2-3 tiers different from each other.

It’s good to be a tier-3 city!

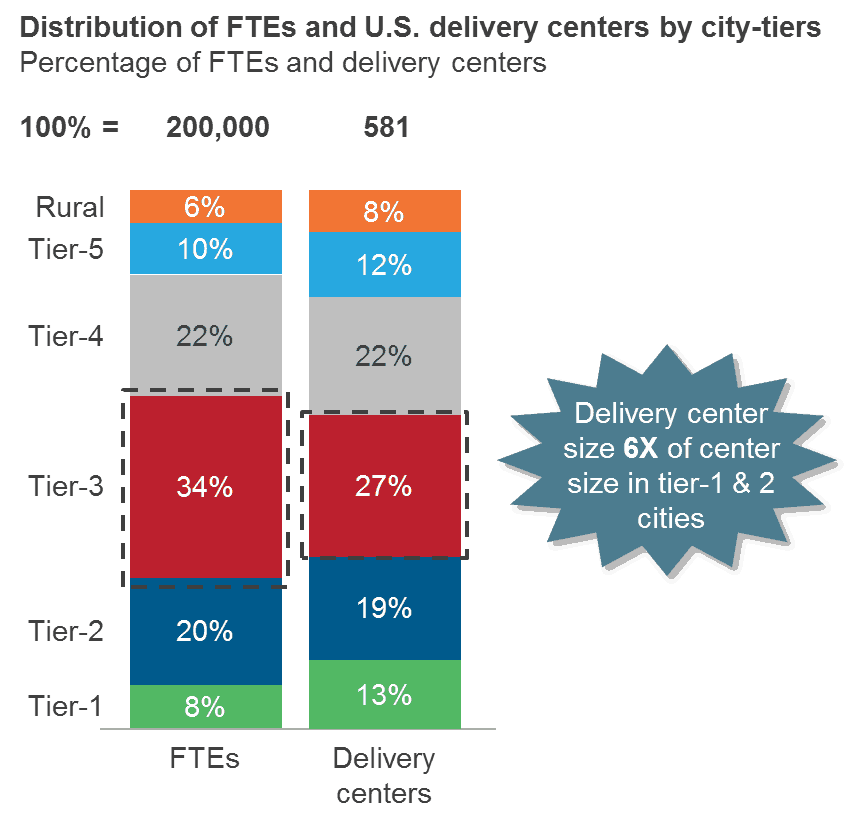

One of the most interesting findings from the research was the extent to which tier-3 cities dominate on almost every dimension. As shown in the exhibit below, they have the largest share of FTEs and delivery centers of all cities. Further, their centers are on average larger than any other city tier.

Additionally, tier-3 cities have the largest portion of multi-function centers (some combination of IT, business process, and contact center) and are the centers which are expected to grow the most in coming years.

Given that tier-3 cities average one million in population, most are surprised that cities of this size are driving the growth of domestic outsourcing delivery – many would expect smaller cities to be the primary forces. So why are tier-3 cities favored?

In short, we believe this is due to three factors which work in combination with each other:

- Sufficient cost savings: Relative to tier-1 cities, tier-3 cities offer 15-20% savings; moving to tier-4 cities may only offer 5% more savings and in many cases is either cost neutral or even higher cost than a tier-3 city.

- Enough talent: With nearly one million in population, the installed base of experienced talent is sizeable. Further, most tier-3 cities have large colleges which produce fresh talent for the entry labor force. Combined with the life style benefits of a larger city (airport, entertainment, shopping, etc.), tier-3 cities have the ability to both keep talent and to attract talent from other cities – either smaller or larger cities. Not everyone would want to live in New York, NY; similarly, many people could not imagine living in a town of Midland, MI (a town of roughly 50,000). However, many people could be comfortable in a city of one million.

- Accessible: Although the idea of a remote, small city may seem attractive in order to capture an isolated labor pool, this doesn’t hold up well when assessed in detail. First, even small communities have competition for talent plus limited talent pools – costs can quickly spiral up. Second, the practical logistics of transit to these small cities creates an inconvenience that most organizations wish to avoid (especially for IT service delivery, requiring more cross-center collaboration). Most tier-3 cities are connected by direct flights to other major business centers within two to three hours of flight time.

In other words, tier-3 cities have an attractive mix of cost savings and talent, while still being comparatively easy from an operational perspective. This is broadly true, but less true for pure contact center work which can more easily operate at scale in tier-4 cities and even some tier-5 cities due to the broad labor pool which can fill contact center roles.

So, would Mr. Mellencamp’s small town have been a viable service delivery location? He is from Seymour, Indiana, with a population of about 16,000 – clearly a rural community by our definition. Highly unlikely many organizations could operate an IT or business process center of 200 FTEs in Seymour, although a smaller contact center could be viable. So, yes, there might be jobs…but little opportunity…

Also check out my co-presenter Sakshi Garg’s top 10 takeways from RevAmerica.

Photo credit: Flickr