Five Mistakes that Enterprise Cloud Service Providers are Making | Gaining Altitude in the Cloud

A wide array of players is aggressively attacking the enterprise cloud infrastructure services market. The competitive landscape includes providers from a variety of backgrounds, including hosting companies such as Rackspace, GoGrid, and Tier3; telcos such as AT&T, Verizon, Telstra, and BT; and legacy enterprise IT service providers such as IBM, HP, CSC, and Dell. They’re all pursuing the same prize – providing CIOs of large enterprises a range of cloud-enabled, next generation infrastructure platforms, from managed or hosted private clouds to public cloud IaaS.

Although the market opportunity is undeniably large and growing, the problem is that many IT services players are not achieving their revenue and growth aspirations for enterprise cloud services. They’re finding it difficult to migrate existing customers to cloud platforms, expand cloud adoption beyond limited use cases, and use cloud services to win new customer logos. Why is growth falling short of expectations? While not exhaustive, following is a set of five issues and mistakes Everest Group commonly sees in the service provider community:

-

Underestimating Amazon: Enterprise providers almost universally discount Amazon AWS as not being “enterprise ready.” This is despite the fact that AWS is now forecasted to generate nearly US$4 billion in 2013 revenue and that enterprise customers will be driving a significant part of this revenue. While AWS enterprise use cases today are focused primarily on dev / test environments, web apps, and websites, AWS has recently rolled out a variety of enterprise offerings. These include everything from Redshift and data pipeline services targeting business intelligence (BI) and data warehousing, to vertical specific clouds including GovCloud and FinQloud. In fact, this iterative, incremental approach is part of its strategy for attacking the enterprise, with many competitors running the risk of becoming the proverbial “boiled frog.” The reality is, many service providers need to think hard about whether they are going to be able to compete in the enterprise public cloud IaaS space. Using AWS instead of continuing to invest in a native public cloud IaaS offering may be a better strategy for many of them over time.

-

Neglecting change management: While providers expect customers to make the cloud paradigm shift, many haven’t done so internally. Instead, a “build it and they will come” mentality tends to be pervasive. The expectation is that once the offers hit the market, customers will be clamoring to get on board. Unfortunately, experience is showing that’s not the case. Customers need help understanding the benefits, risks, and costs of cloud models, and where they make sense. Although helping customers understand the implications of cloud models is critical, many providers have dramatically underinvested in vital areas such as sales training. Too often, sales and marketing groups position and message cloud services in a legacy paradigm, which isn’t connecting with customers. While many providers are frustrated that sales teams aren’t making cloud quotas, they need to take a step back to make sure their go-to market teams are positioned and trained for success. To achieve sales effectiveness, they need to structurally change their incentive mechanism, account strategy, and planning exercises.

-

Selling sole-source: many providers are selling next generation infrastructure platforms – the ability to provide customers anything from dedicated or managed hosting to public cloud services. The problem is that’s not how enterprise customers are buying cloud today. They’re seeking to use the flexibility of the model to deploy specific use cases, and different use cases may require different platforms. Too many providers are trying to sell the “big bang,” sole source IT transformation story and telling CIOs they can provide all of their next generation platform needs. While there are CIOs driving cloud-enabled IT transformation, there aren’t enough of these opportunities yet to support the number of providers chasing them. In fact, many providers would likely be better off selling incremental or even transformational stories to business buyers.

-

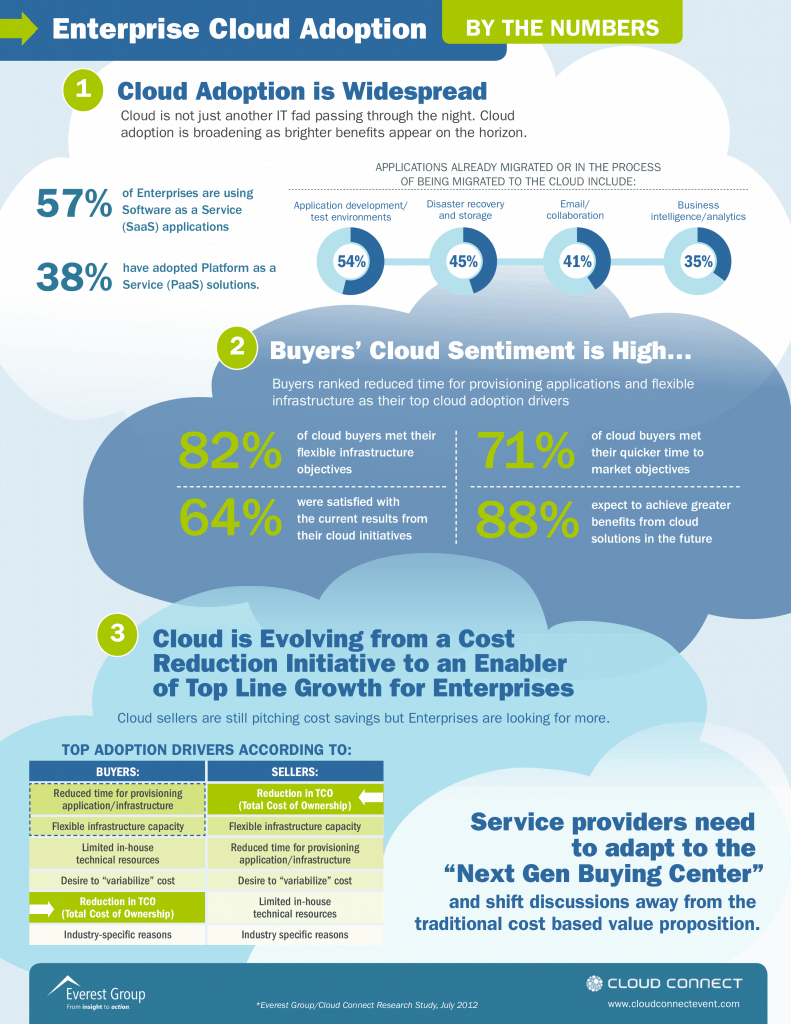

Omitting SaaS and PaaS: Cloud infrastructure service providers have little incentive to migrate customers to public cloud SaaS offerings such as Salesforce.com or Workday. For many customers, migrating legacy apps to SaaS models will be the right answer. Many enterprise cloud service providers conveniently omit this lever from their transformation story and lose customer credibility as a result. The fact is these providers need a better answer for SaaS migration and integration. Moreover, very few cloud IaaS providers are investing in creating an effective PaaS strategy. Enterprise buyers require flexible platforms hosted in an agile infrastructure environment to develop applications for the future. Service provider transformation stories need to closely integrate application development platforms with a cohesive IaaS offering.

-

Failing to differentiate: Many vendors position themselves as providing managed services that make cloud models ”enterprise ready.” The problem is that every other vendor is saying the exact same thing. Enterprise cloud service providers need to think harder about what their distinctive customer value proposition really is. Too many providers are trying to sell horizontal cloud technology platforms with little thought given to customers’ unique business drivers and how cloud can be used to drive business transformation. But there are plenty of potential opportunities to differentiate by vertical, use case, geography, target community, and other dimensions.

While all of these issues are fixable, they also are non-trivial. The good news for the provider community is that no one has truly yet cracked the code on enterprise and cloud infrastructure services.