Multi-country Payroll (MCP) Solutions PEAK Matrix® Assessment 2023

Multi-country Payroll (MCP) Solutions

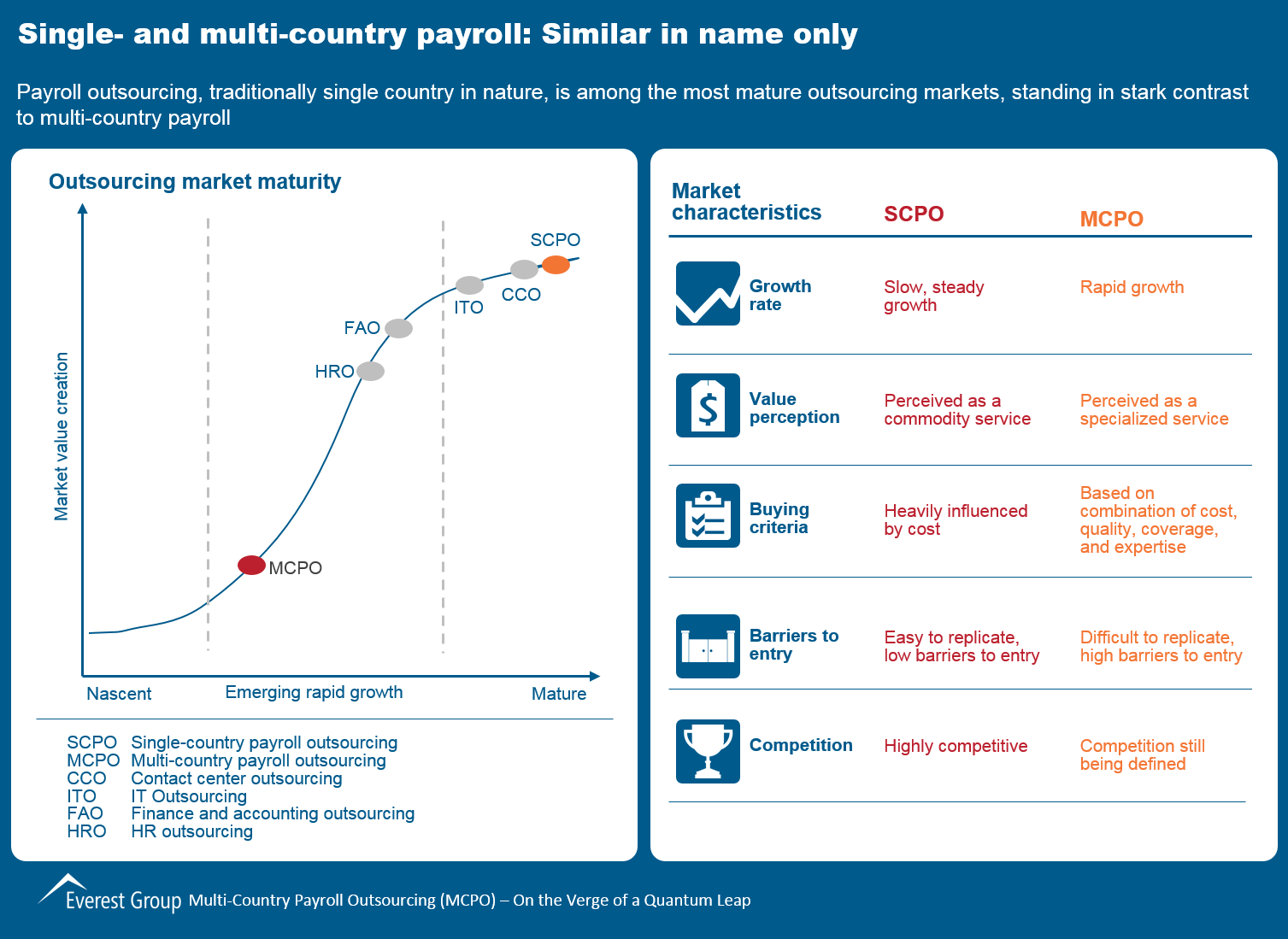

The Multi-country Payroll (MCP) solutions market has expanded steadily over the last few years. The economic uncertainty has made enterprises focus on cost reduction and resource allocation. Enterprises are now seeking assistance beyond just conventional payroll management.

In response to this demand, providers have evolved their portfolio by offering flexible pricing models and easy scalability. MCP providers are empowering enterprises by extending cost-effective, compliant, and strategic solutions.

Multi-country Payroll (MCP) Solutions PEAK Matrix® Assessment 2023

What is in this PEAK Matrix® Report

In this report, we examine the:

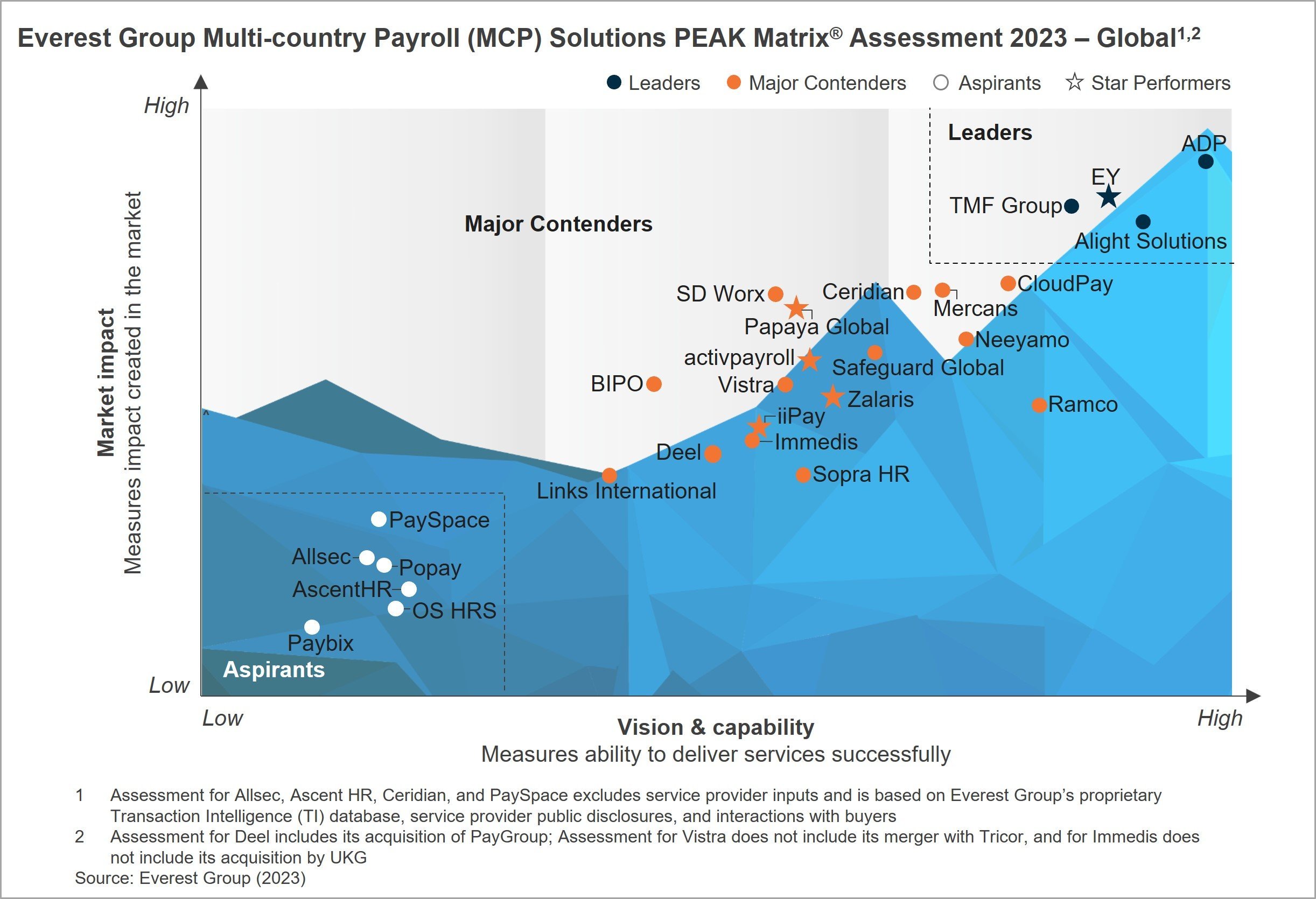

- Relative positioning of providers on Everest Group’s PEAK Matrix® for MCP Solutions across global, EMEA, and APAC regions

- Provider landscape

- Providers’ key strengths and limitations

Scope:

- Industry: MCP solutions

- Geography: global

- This assessment is based on Everest Group’s annual RFI process for the calendar year 2023, interactions with leading MCP providers, client reference checks, and an ongoing analysis of the MCP solutions market

Related PEAK Matrix® Assessments

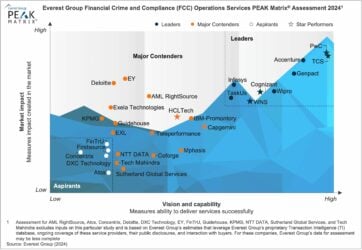

Financial Crime and Compliance (FCC) Operations Services PEAK Matrix® Assessment 2024

Our Latest Thinking

Navigating the CXM Outsourcing Landscape: A Comprehensive Guide for First-time Outsourcers

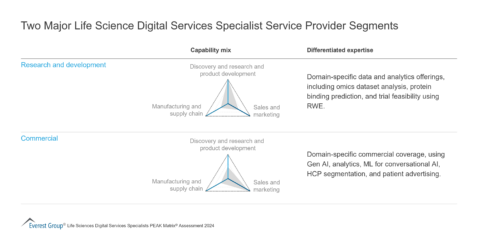

Two Major Life Science Digital Services Specialist Service Provider Segments

What is the PEAK Matrix®?

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.