Global Services Lessons Learned in 2023 and Top Trends to Know for 2024 | Webinar

Global Services Lessons Learned in 2023 and Top Trends to Know for 2024

As we move into 2024, business leaders stand at the intersection of uncertainty and opportunity. Macroeconomic and geopolitical landscapes, coupled with cost and margin pressures, pose potential speed bumps to the growth of global services in 2024.

Watch this webinar where our expert analysts presented the successes, challenges, and transformative trends that defined the global services industry in 2023 and discussed the opportunities that lie ahead for business leaders in 2024.

Attendees gathered valuable insights to shape a forward-looking strategy for their global services delivery and learnt successful approaches adopted by enterprises and service providers, including service delivery locations, sourcing strategy (in-house/GBS vs. outsourced), deal trends, talent strategy, and cost optimization strategy.

What questions did the webinar answer for the participants?

- How did the global services industry perform in 2023?

- What are the key trends and outlook for the global services market in 2024

- What are the observed trends across service delivery location strategies for enterprises and service providers?

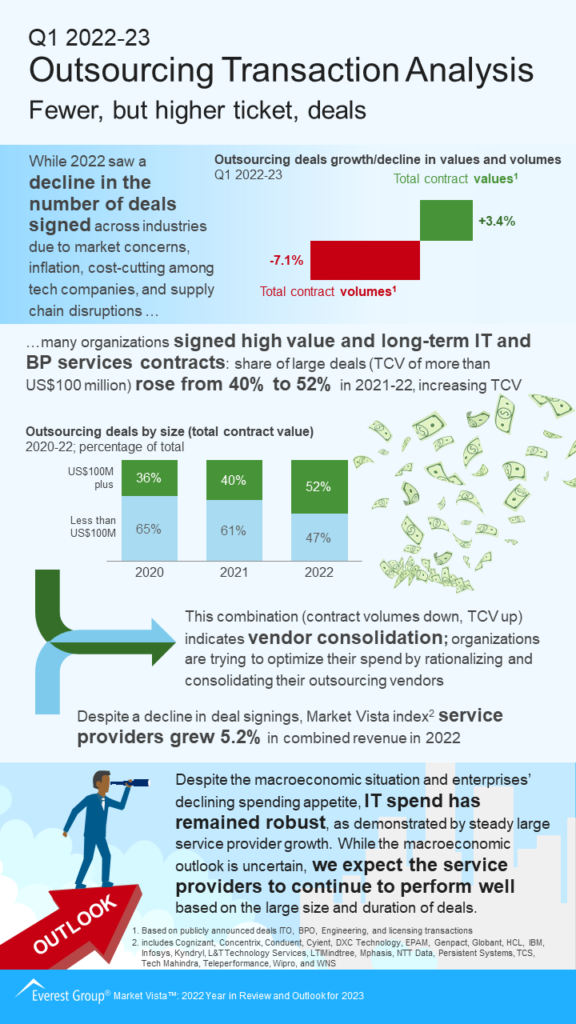

- How are sourcing strategies (in-house/GBS vs. outsourced), enterprises’ leverage of service providers, and the nature of deals expected to evolve?

Who should attend?

- CEOs and CXOs

- Buyers and providers of services

- Locations portfolio strategy professionals

- Leaders of workforce strategy

- Global sourcing managers

- Vendor managers

- GBS Leaders

Related Content:

- Key Issues for 2024: Creating Accelerated Value in a Dynamic World| On-demand Webinar

- Market Vista™: Q4 2023 | Report

- The State of the GBS Market: Opportunities and Success Strategies for GBS Leaders| On-demand Webinar

- Global Locations State of the Market 2023: Changing Locations Landscape in the Face of Economic Uncertainty | Locations PEAK Matrix® | Report

- Global In-house Centers (Captives) on the Rise and Challenge Core vs Non-core | Blog

- Trends Shaping the Talent Market in 2024: How Enterprises Can Create a Competitive Edge | On-demand Webinar