Health plans and payer organizations rely on core administration platforms as the foundation of their operations. These platforms facilitate the efficient execution of core operational and administrative functions such as benefits administration, claims processing, member enrollment, claims payment and adjustments, and product management for benefits and product lines. However, the legacy Core Administrative Processing Solutions (CAPS) are inadequate in keeping up with the rapidly evolving delivery and implementation options and IT systems integration. These systems have been stable and reliable for decades but are often highly customized to the client’s requirements and are hosted on the premises. As a result, there is significant inertia in transitioning from legacy solutions to modern cloud-based core administration solutions due to the associated risks and efforts required.

The healthcare industry is now seeking new vendor partnerships due to the rapidly evolving industry compliance and regulatory requirements, challenges and opportunities for payment reform, and the emergence of value-based care.

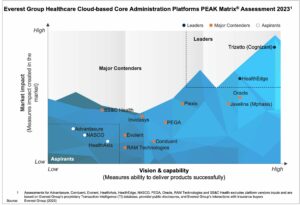

In this report, we assess 14 healthcare core administration platform providers and position them on Everest Group’s PEAK Matrix® as Leaders, Major Contenders, and Aspirants based on their vision and capability and market impact. The report also outlines the strengths and limitations of each provider.

In this report, we examine:

Scope:

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

A looming global recession may finally take its toll on payers who have escaped prior economic challenges. Let’s take a look at the healthcare trends influencing decision-making by payers, the markets most likely to be affected, and the actions payers can take with the uncertain outlook.

Wall Street predicts that the probability of a global recession in 2023 is 61%, well above the stable benchmarks. Although inflation has eased up marginally since the last quarter, tighter financial conditions and weaker global growth still indicate a potential downturn.

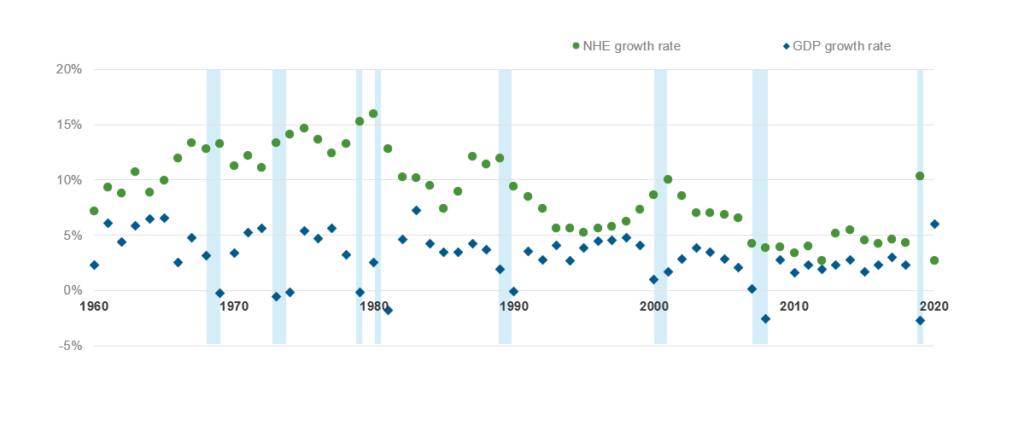

The healthcare industry historically has weathered economic collapses better than core industries that are generally more severely impacted. A Forbes assessment shows that while the US economy (as measured by GDP growth) plunged into recession eight times over a 60-year period from 1960-2020, healthcare expenditure growth never shrunk, often outgrowing gross domestic product (GDP) as illustrated in Exhibit 1.

This stability is primarily because impacted employees either opt for subsidized government programs or forego medical care, as applicable, pushing the healthcare cost to the future. As a result, health plans tend to be relatively less affected due to recessionary headwinds. In fact, reports suggest that earnings for healthcare payers declined only by 27% compared to a 77% decrease for the overall S&P 500.

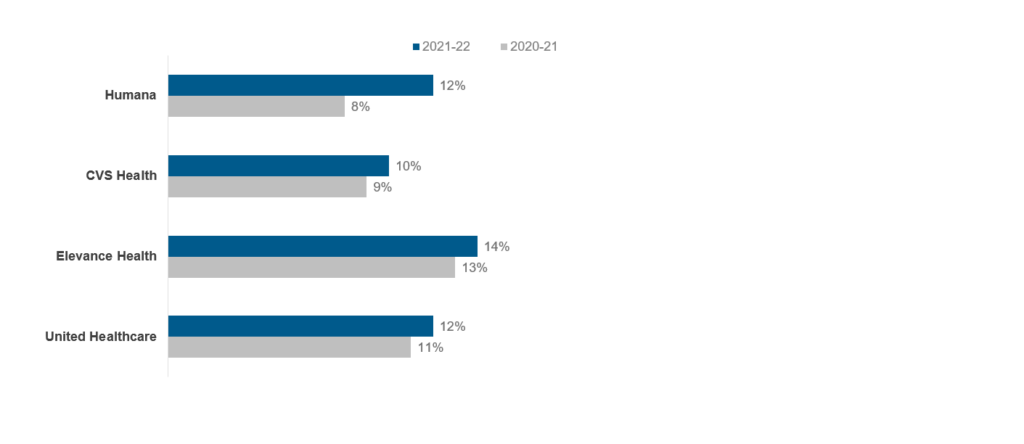

Although many healthcare payers posted strong growth rates at the end of fiscal year 2022 as shown below (Exhibit 2), the results may not be as positive in 2023, particularly for employer-sponsored or provider-owned health plans.

The overall impact on the payers in the fiscal year 2023, however, will be determined by several upcoming trends. Let’s look at some of these influencing factors in detail below.

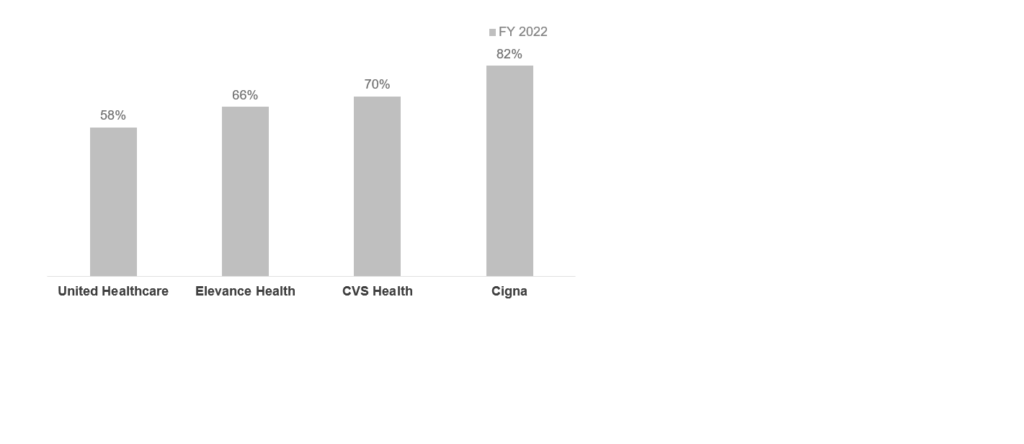

So, how specifically will payers be impacted? It’s hard to say, given the global inflation outlook improvement. But lessons from the past indicate that a sustained period of economic uncertainty will impact both the government and the private markets in the following key markets:

Lastly, the uninsured population may experience an uptick due to information asymmetry and administrative complexities. According to an assessment done from 2007-09, only some of the insurance loss from a lack of employer coverage was offset by added public coverage, leading to a 5.6 million rise in uninsured adults. While the Affordable Care Act (ACA) has lowered the uninsured population, an economic downturn potentially can add to the current uninsured coverage.

With the market unpredictability, healthcare payers will have to take calculated measures to prevent business impact. Here are four actions they can take:

These measures will require service providers to proactively engage with healthcare payers and focus on three levers – the right clients, the right capabilities, and the right value addition. This will enable service providers to aim for the right opportunities such as member engagement and preventive care and ensure sustainable growth in an uncertain economic environment. Finally, in a highly competitive market like payer services, service providers will have to offer targeted digital and traditional Business Process Outsourcing (BPO) services to serve the right client need and differentiate themselves with unique value propositions refined as per the prevailing market demand.

To learn more about healthcare payer and provider trends, contact Lloyd Fernandes or Vivek Kumar.

To learn about the changes in the pharmacy benefits management (PBM) industry, such as increased regulatory scrutiny surrounding pricing transparency and rebate-sharing rules, watch our video, Pharmacy Benefits Management: The Next Big Healthcare Opportunity.

You can also learn more about How to Deliver Hyper-personalized Customer Experiences in Life Sciences in this LinkedIn Live session.

Following the pandemic, enterprise adoption of technology and digitization significantly increased, drastically changing the landscape for both healthcare providers and patients. To streamline procedures, realize cost efficiencies, and improve patient engagement and care management, healthcare enterprises made digital adoption the cornerstone of their growth strategies.

To address enterprise demands, providers are expanding their capabilities through vertical-specific partnerships and acquisitions, investments in centers of excellence, and training, among other things.

In this report, we assess 27 healthcare ITS providers mapped on the Everest Group PEAK Matrix® framework, a composite index of distinct metrics related to a provider’s capability and market impact. We look at the providers’ digital services market size and growth, examine digital service themes for healthcare providers, share provider assessments on several capability- and market success-related dimensions, and provide our independent remarks on the providers to help enterprises make the right sourcing decisions.

The report features:

LEARN MORE ABOUT Healthcare Provider Digital Services PEAK Matrix® Assessment 2023

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

Rapid digitization of healthcare and evolving customer expectations are driving the need for personalized customer experiences across pre-care, care, and post-care interactions. To serve this need, healthcare enterprises are leveraging Customer Experience (CX) platforms to enhance patient and member experiences across multiple interaction touchpoints such as sales and marketing, services management, patient administration, care management, and billing and payments.

In this report, we assess 16 healthcare CX platform providers featured on the Healthcare Customer Experience Platforms PEAK Matrix®. The study will enable buyers to choose the best-fit provider based on their sourcing considerations, while providers will be able to benchmark their performance against each other.

In this PEAK Matrix® assessment, we:

Scope:

LEARN MORE ABOUT Healthcare Customer Experience Platforms PEAK Matrix® Assessment 2023

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

The pandemic drove the need for more virtual and digital interactions between life sciences enterprises and customers. Enterprises realized that life sciences-specific Customer Relationship Management (CRM) systems were not built to inherently support virtual and digital engagements on a large scale. Additionally, enterprise interactions with target customers were not aligned with customer needs and preferences due to suboptimal customer data management and disparate engagement channels, among other platform limitations, leading to inconsistent customer experiences.

Customer experience has become a top priority for enterprises today and is pushing organizations to explore more experience-focused solutions/tools to augment traditional CRM functionalities. Life sciences enterprises are increasingly leveraging Customer Experience (CX) platforms that enhance the customer’s experience across interaction touchpoints using customer data management, content management, sales and marketing, and real-time analytics and insights.

In this research, we assess 18 life sciences CX platform providers featured on the Life Sciences Customer Experience Platforms PEAK Matrix®.

Scope:

LEARN MORE ABOUT Life Sciences Customer Experience Platforms (CXP) PEAK Matrix® Assessment 2023

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields