April 12, 2012

Electronic Medical Records (EMR) has the ability to transform and enhance virtually all communications, transactions and analysis related to healthcare information. All 50 states are quickly adopting EMR, and the government has made adoption of EMR a cornerstone of the healthcare initiative. While EMR can have significant positive impact on physicians’ productivity, patients’ access to information, and insurance companies’ ability to reduce errors and claims administration costs, it must be implemented properly in order to achieve those benefits.

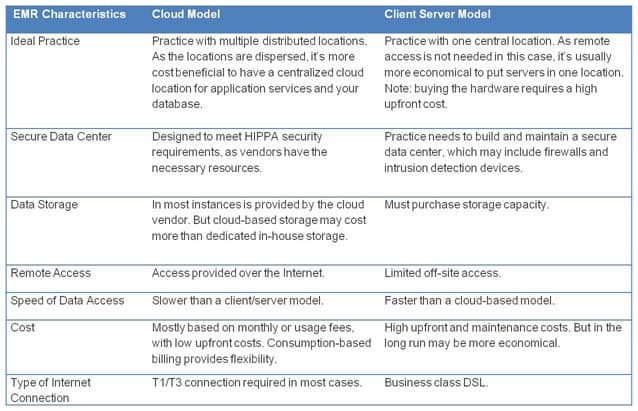

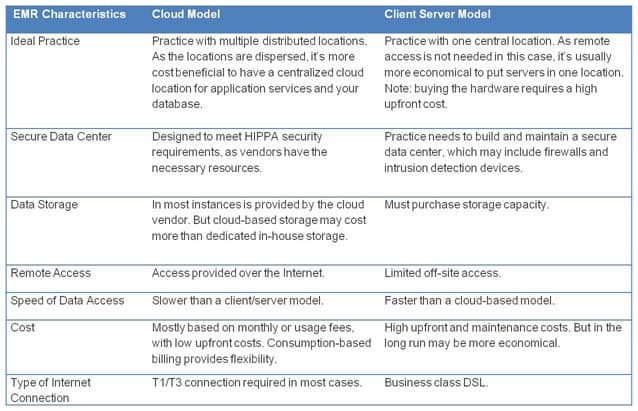

Much of the implementation solution answer lies in what delivery model is best for any given healthcare organization: a private cloud-based next generation IT approach or a client/server-based legacy approach.

Cutting through the hype, there are a number of advantages to adopting cloud-based EMR:

- No upfront software license purchase costs

- No hardware to purchase or maintain

- Better overall support, including for disaster recovery

- Typically stronger security and data protection mechanisms, and more likely compliance to HIPPA regulations, through host companies

- Accessibility for physicians on the move

Indeed, a private cloud may be the right EMR solution in many cases. Consider Beth Israel Deaconess Medical Center. It has 1,500 member physician practices and facilities distributed throughout 173 locations in eastern Massachusetts. The Beth Israel Deaconess Physician Organization (BIDPO) provides medical management services. By becoming a member of the BIDPO, physician practices receive reduced contractual rates from health insurance companies. But for compliance, those practices must be able to measure the quality of patient care and transmit those metrics electronically to the insurance companies.

As putting servers in each facility, per a client/server model, was not going to be an effective or cost efficient approach to the electronic transmission requirements, the Center instead adopted a private cloud-based model with a centralized database and application services. BIDPO selected VMware as the virtualization platform, Third Brigade as the security solution provider, and Concordant for the day-to-day operational management of the environment and help desk for the physicians. The solution it adopted is modular, enabling it to grow as more facilities are migrated to the system.

On the other hand, there are numerous potential downsides to a cloud-based EMR solution:

- Latency or lag times

- Lack of availability of a robust and reliable Internet connection in rural areas

- Bandwidth limitations

- Constrained back-up and data accessibility

- Inability to access or work with data if the service provider’s network is down

Given these issues, a rural practice of five physicians who see 35 patients a day and want quick access to their medical records and prescription history, especially for those on multiple drugs that could cause adverse or allergic reactions, will fair far better with a client/server EMR model.

If you’re wondering which EMR delivery model is a better fit for your healthcare organization, the following table should help:

Private cloud-based EMR solutions do provide flexibility and scalability, and we will see more healthcare organizations following Beth Israel Deaconess Medical Center’s lead in the near future. But before you jump on the bandwagon, you must consider whether the cloud is suitable for your particular and unique situation.