September 25, 2023

At last week’s Oracle CloudWorld and the Oracle Health Conference in Las Vegas, the company presented its new positioning, which includes leveraging its broad portfolio, making the next move in healthcare, and delivering lower-cost cloud technology. However, Oracle faces challenges such as not dominating any market, opaque pricing strategies, and the loss of competitive edge to a healthcare rival. Read insights from our analyst who attended these events about the company’s path forward.

Company leaders presented their vision for Oracle’s future, which is focused on the following three important areas:

- Breadth and depth of offerings – The company offers a full portfolio in cloud, Generative Artificial Intelligence (GAI), Enterprise Resource Planning (ERP), Human Capital Management (HCM), Customer Experience (CX), Enterprise Data Management (EDM) and healthcare to name a few

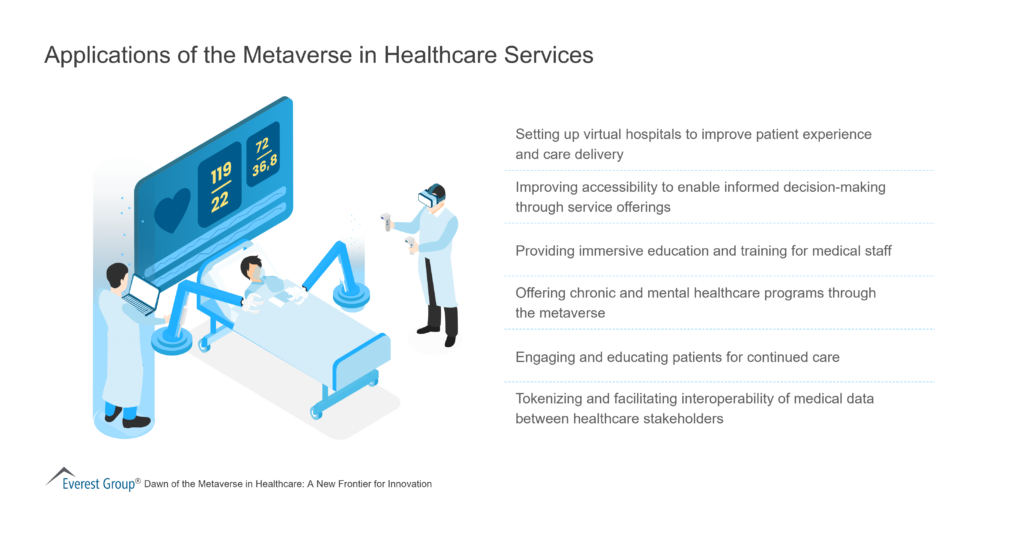

- Big bang positioning in healthcare – With its acquisition of Cerner, Oracle is placing a huge growth bet in this segment, like all tech players. The company talked about new opportunities in this area at the Oracle Health Conference

- Better cloud economics – While industry analysts previously called Oracle out for elasticity, security, and performance issues, it has moved to best-in-class in these areas

Let’s explore each of the elements of their strategy and the challenges they present:

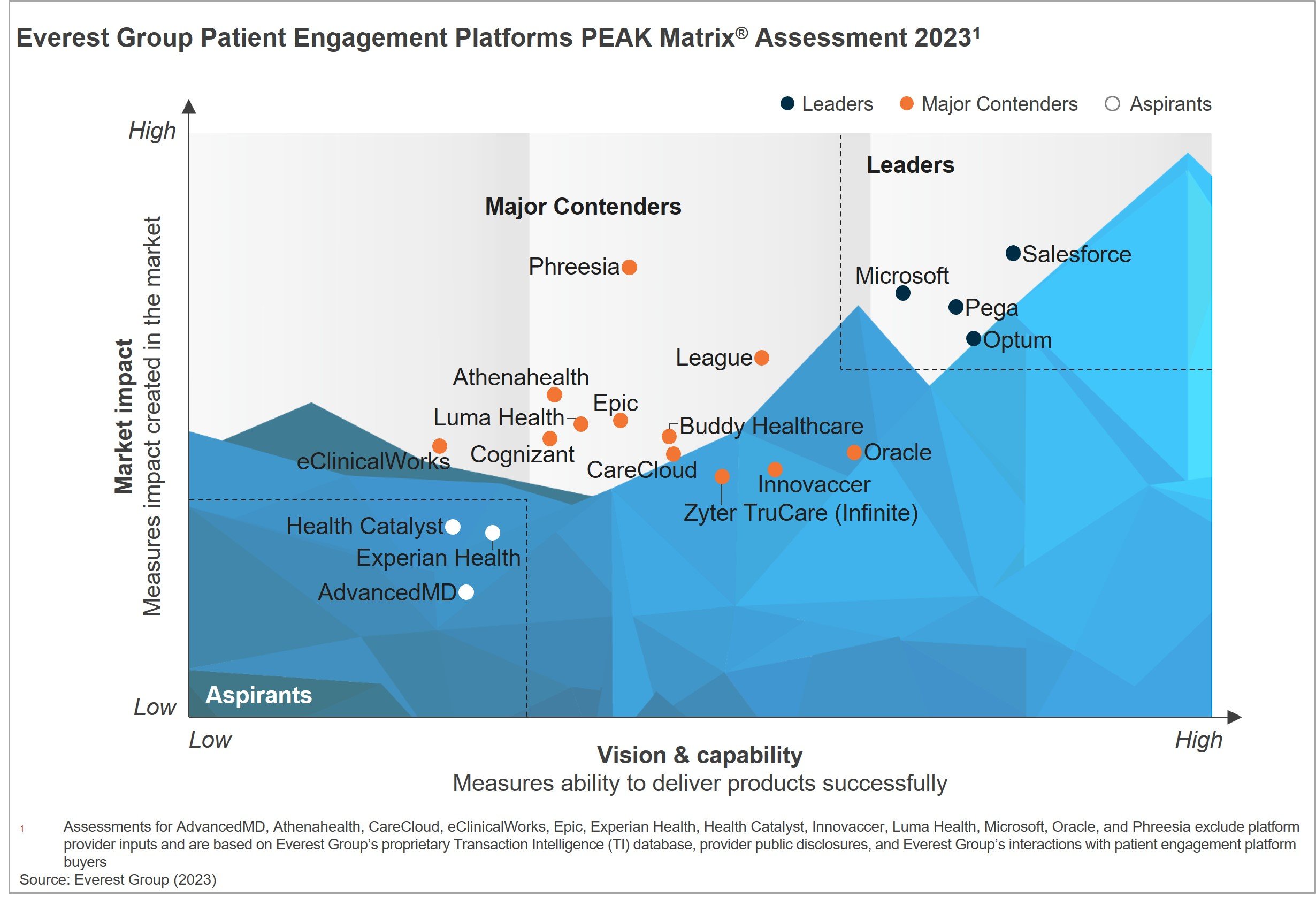

- Master of none: There’s no doubt about Oracle’s breadth and depth of coverage. Oracle has credible offerings for each area it competes with AWS, Salesforce, or Microsoft, whose market messaging in certain instances is ahead of product maturity in areas such as healthcare and CX. However, this is not enough.

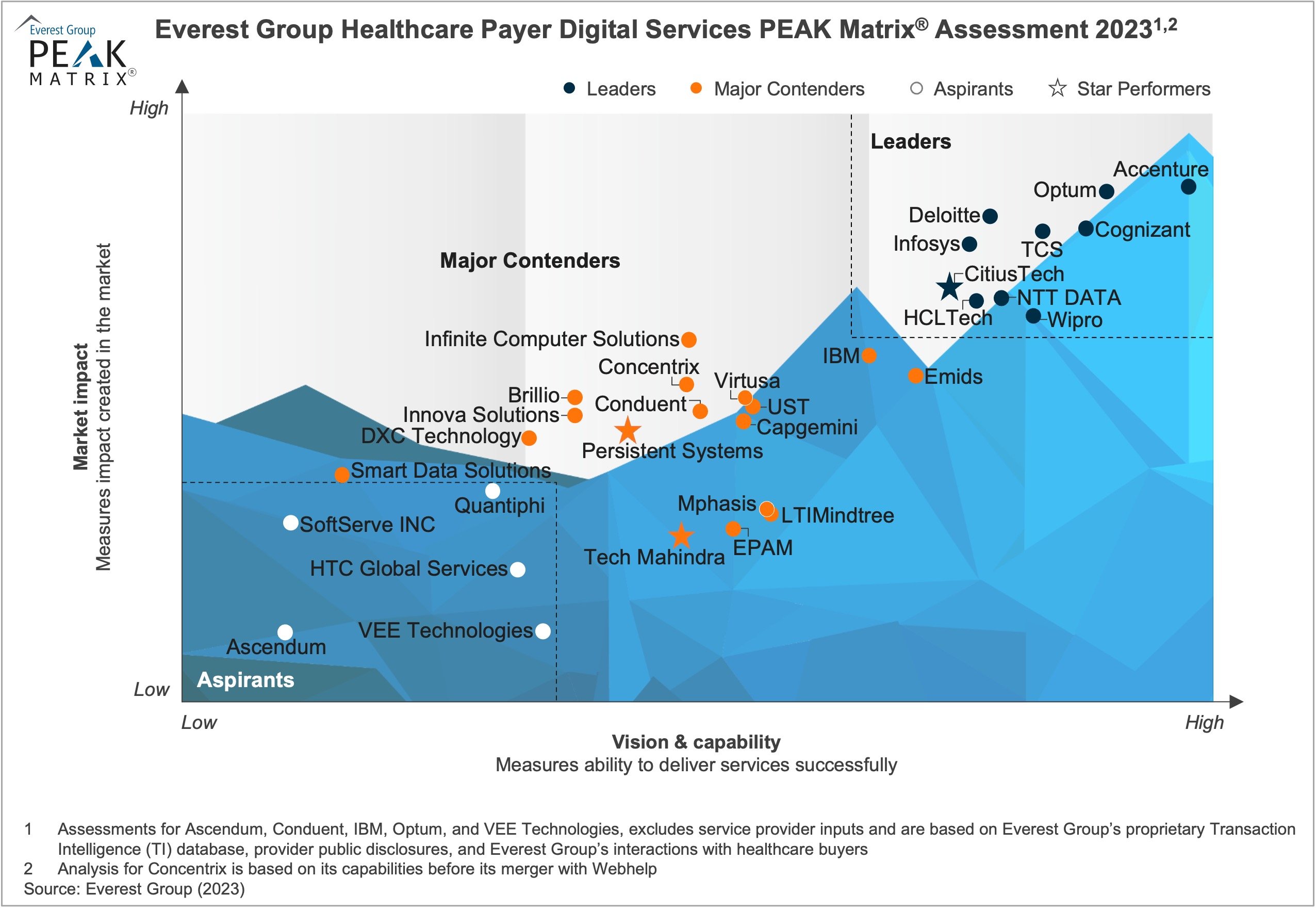

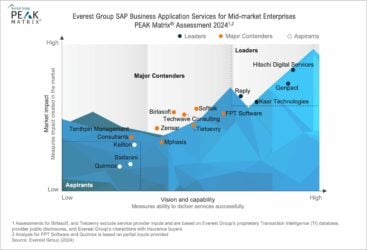

Oracle’s biggest challenge is that it lacks dominance in any one area. It is not the undisputed preferred choice in any of the markets it claims leadership in. Below are the leaders in market share or positioning in each of the segments where Oracle competes:

-

- Generative AI: Microsoft

- Cloud: AWS/Azure

- ERP: Oracle (in the US) but head-to-head with SAP everywhere else

- HCM: Workday

- CX: Adobe

- Enterprise Data: Snowflake/AWS

Oracle needs to double down and succeed on select growth bets that will help it reinvent its brand. ERP or databases cannot be those bets.

- Not Epic: At one point, the Epic and Cerner competition appeared to be headed toward a true duopoly. However, Epic has gained a significant advantage over competitors by taking aggressive actions on two fronts: swiftly moving to modern architecture by working with the cloud ecosystem and grabbing market share from tier-2 EMRs such as Athenahealth, Meditech, and Allscripts.

Cerner, with Oracle’s strong backing, should have stolen a march over Epic on both. Instead, Cerner was distracted by the integration with Oracle and lost considerable ground. Hence, instead of a duopoly, what we have is a market where you are either Epic or Not Epic.

- Opaqonomics: Oracle pitched they are “significantly cheaper than AWS or Google.” However, this claim cannot be consistently validated. While some enterprise clients indicate that Oracle Cloud is more affordable, others feel it isn’t. The difficulties lie in the following:

- Oracle cloud economics is incorporated with its app economics, making it very difficult to separate the two

- Pricing is not transparent or standardized. Inconsistent client feedback (some who feel it is cheap, others who don’t) impacts Oracle’s competitive positioning against other clouds

- This inconsistency is also visible in client experience. One client mentioned it took Oracle CIoud Infrastructure (OCI) “six weeks to provision additional compute when on paper, the promise of cloud is to do it over six seconds.”

While this might sound like a harsh takedown of Oracle’s positioning, these issues can be fixed and serve as critical paths to Oracle’s reinvention. Oracle is a true engineering firm, and each capability that it delivers has an engine under its hood. Clients can trust Oracle to provide fully developed products. To restore its shine, Oracle needs to bring the same rigor to its customer success initiatives, master a few key markets, and establish transparent and standardized pricing.

For more insights from Oracle CloudWorld and the Oracle Health Conference, please contact Abhishek Singh.