Economic Oasis: How Revenue Cycle Management is Emerging as an Investment Beacon | Blog

Amid healthcare providers’ ongoing struggles with Revenue Cycle Management (RCM) inefficiencies, a new wave of outsourcing is emerging, centered around value and technology-driven solutions like AI and analytics. This surge in demand is propelling significant growth in RCM operations outsourcing, presenting an attractive opportunity for investors and Private Equity (PE) firms and underscoring its potential for high returns in an economically turbulent environment. Explore the driving factors behind this trend and strategies for investors to capitalize on this burgeoning growth for optimal benefits. Reach out to discuss this topic.

Despite the economic uncertainty, the RCM operations outsourcing market has poised itself as a growth star, increasing at a compound annual growth rate (CAGR) of more than 12% from 2021-23.

New sourcing deals requiring providers to support multiple areas have continued to increase, driven by healthcare providers’ long-standing challenges of lower revenue collection, higher denials, and suboptimal patient experience. These issues have reduced margins and escalated providers’ workloads.

Research indicates that nearly 50% of providers witnessed an overall increase in denials in 2023 compared to the previous year, while patient collections sharply dropped to 47.8% in 2022 and 2023 from 54.8% in 2021.

Recognizing this pressure to optimize revenues, hospitals increasingly turn to RCM vendors that offer expertise to streamline administrative processes and help healthcare providers achieve much-needed financial stability while improving patient experience.

While multiple drivers beyond labor shortages are pushing providers to outsource, a few factors stand out. These include regulatory the push toward digital transformation of operations, enhancing patient experience and value-based care, and aligning with changing regulations as illustrated below:

- Regulatory push due to interoperability measures: Healthcare providers are increasingly turning to digital solutions to manage revenue cycles effectively while investing in interoperable systems. SC Health System recently invested $40M in Epic EHR Platform to enhance interoperability. Outsourcing to specialized vendors with compliance and digital solutions expertise enables healthcare providers to leverage advanced technology beyond their internal capabilities, increasing efficiency and financial performance

- Thinning hospital margins: While hospitals have witnessed slight top-line improvements due to pent-up demand, the squeezed margins resulting from excessive administrative spending still require strong cost optimization strategies to improve RCM efficiency

- Focus on patient experience and value-based care: The healthcare industry’s shift to value-based care prioritizes quality outcomes and patient experience. RCM vendors can play a crucial role by optimizing billing processes, minimizing errors, and enhancing patient communication. RCM providers can contribute directly to improved patient experiences and support providers in the value-based reimbursement mode

- End-to-end integration through AI/analytics: Hospitals with sizeable investments in legacy technologies are prioritizing platform-based end-to-end integration encompassing AI and analytics to futureproof their systems against regulatory, cybersecurity, or other shocks

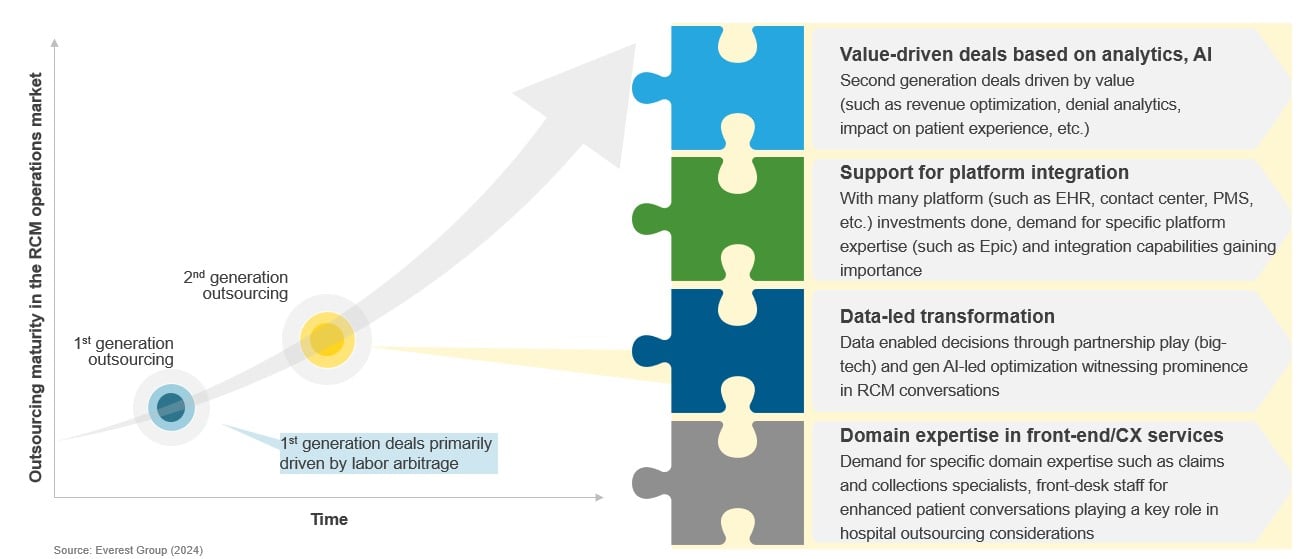

Driven by these factors, RCM outsourcing has matured into second-generation deals focused on value creation through advanced analytics/AI, support for platform integration, and data-led transformation, coupled with strong domain expertise.

Shift of the RCM outsourcing market towards second-generation deals focused on advanced analytics, AI, and transformation

Seeing the marketplace potential, firms started investing in the RCM ecosystem over the past few years, and the market is now ripe for a fresh wave of capital infusion.

Is RCM the next big thing? PE investors think so

In 2022, private equity firms took a significant interest in revenue cycle management companies, with RCM companies involved in 21 private equity deals – 18 add-ons and three buyouts.

The following three factors are driving this surge in PE interest:

- Stable revenues amid economic uncertainty: Due to the factors discussed above, the healthcare industry’s accelerating trend towards RCM outsourcing has resulted in the emergence of fast-growing RCM vendors. For private equity firms seeking predictable returns, especially with economic fluctuation, these vendors with recurring billing models and stable revenue streams have been a key area of interest

- Increasing leverage of digital tools to drive margin profiles: RCM vendors are actively investing in technologies like artificial intelligence, robotic process automation (RPA), and advanced analytics. These innovations streamline operations, reduce costs, and improve efficiency, ultimately enhancing profitability margins. R1 RCM’s acquisition of Cloudmed in 2022 to advance its revenue intelligence and automation capabilities is one of many examples. PE firms recognize the potential of these tech investments to drive maximum profits in shorter periods

- Consolidation opportunities: With a fragmented market ecosystem and many companies with specialized capabilities operating independently, the race to become an end-to-end vendor is real. PE firms see the potential to acquire and merge these companies to create powerhouse vendors with broader service offerings and a larger client base, promising rapid growth and scalability. An example is Veritas Capital consolidating Coronis Health and MiraMed Global Services to create a multi-specialty RCM platform providing end-to-end technology-enabled solutions to diverse clients across the US

Below is a recap of some of the private equity activity in RCM from late 2023 through this year:

- Aquiline Partners invested in Health Prime International and bought a stake from GPB Capital for US$ 190 million in 2024

- New Mountain Capital, an existing investor of R1 RCM, offered to buy out the remaining ownership at an offer of US$ 5.8 billion in 2024

- TA Associates made a significant growth investment in Alpha II, a provider of RCM technology solutions to healthcare providers, in 2023

- Eclat Health Solutions, a portfolio company of Gulf Capital, acquired the Health Information Management (HIM) division of Excite Health Partners in 2023

- WellSky, a portfolio company of Leonard Green and TPG Capital, acquired Corridor from HealthEdge Investment Partners to expand its medical coding and RCM offerings in 2023

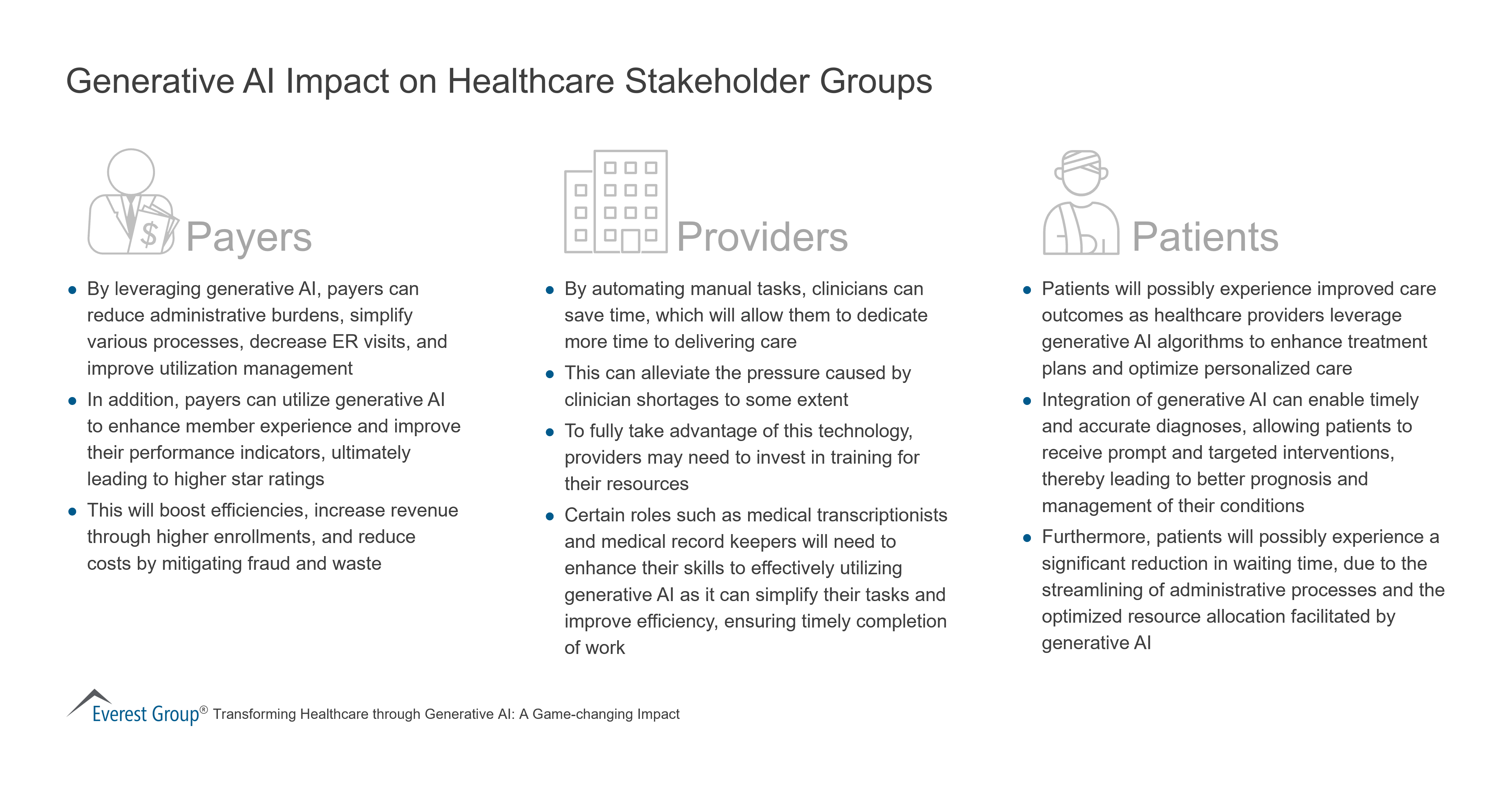

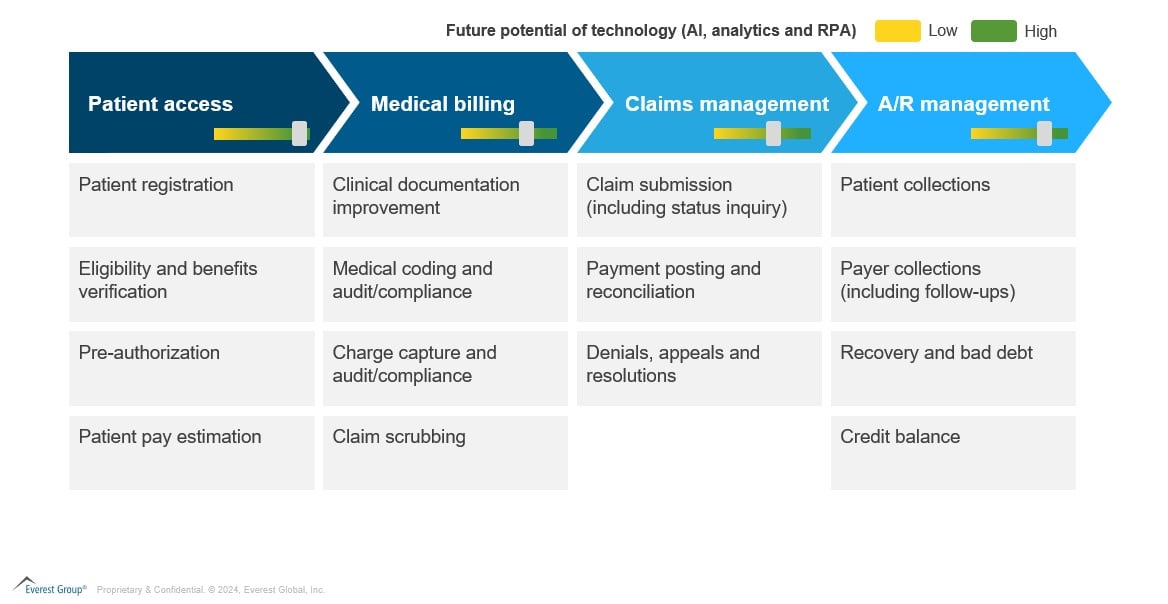

With RCM vendors accelerating toward advanced technologies like automation, advanced analytics, and AI, the adoption of cutting-edge technology will likely increase further. The potential of these digital elements in RCM processes is highlighted below:

Generative AI’s potential to unlock new revenue streams

Generative AI (gen AI) can disrupt the RCM industry and impact existing business models despite its nascent enterprise adoption. Investors remain interested in this segment even with the potential risks.

Investors and service providers should prioritize and plan portfolio updates in emerging opportunities like prompt engineering services, gen AI model training, and data contextualization. This will help future-proof their offerings portfolio and identify high-value use cases to deliver better services to clients from the existing RCM portfolio.

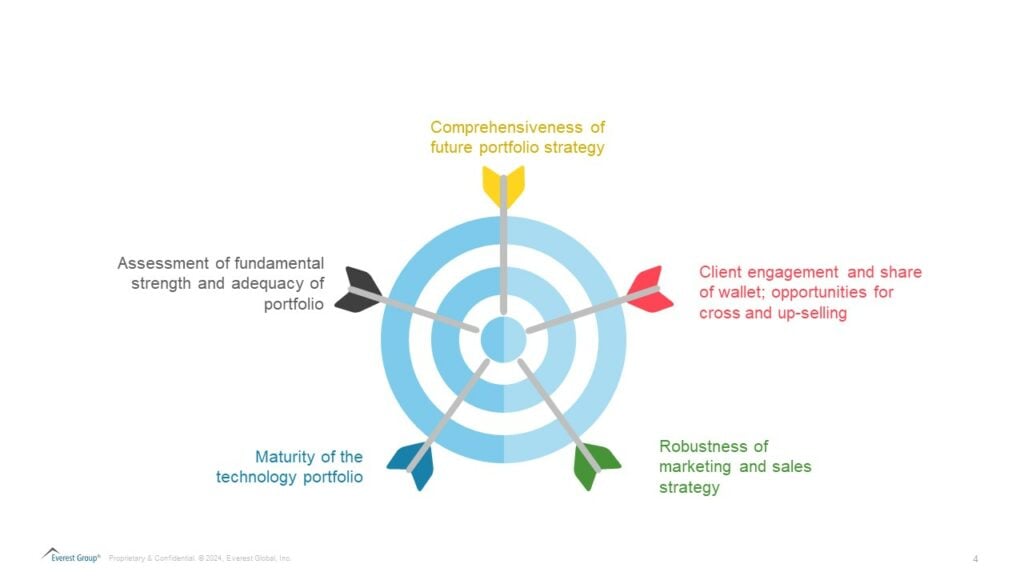

What key factors should investors consider for an RCM asset?

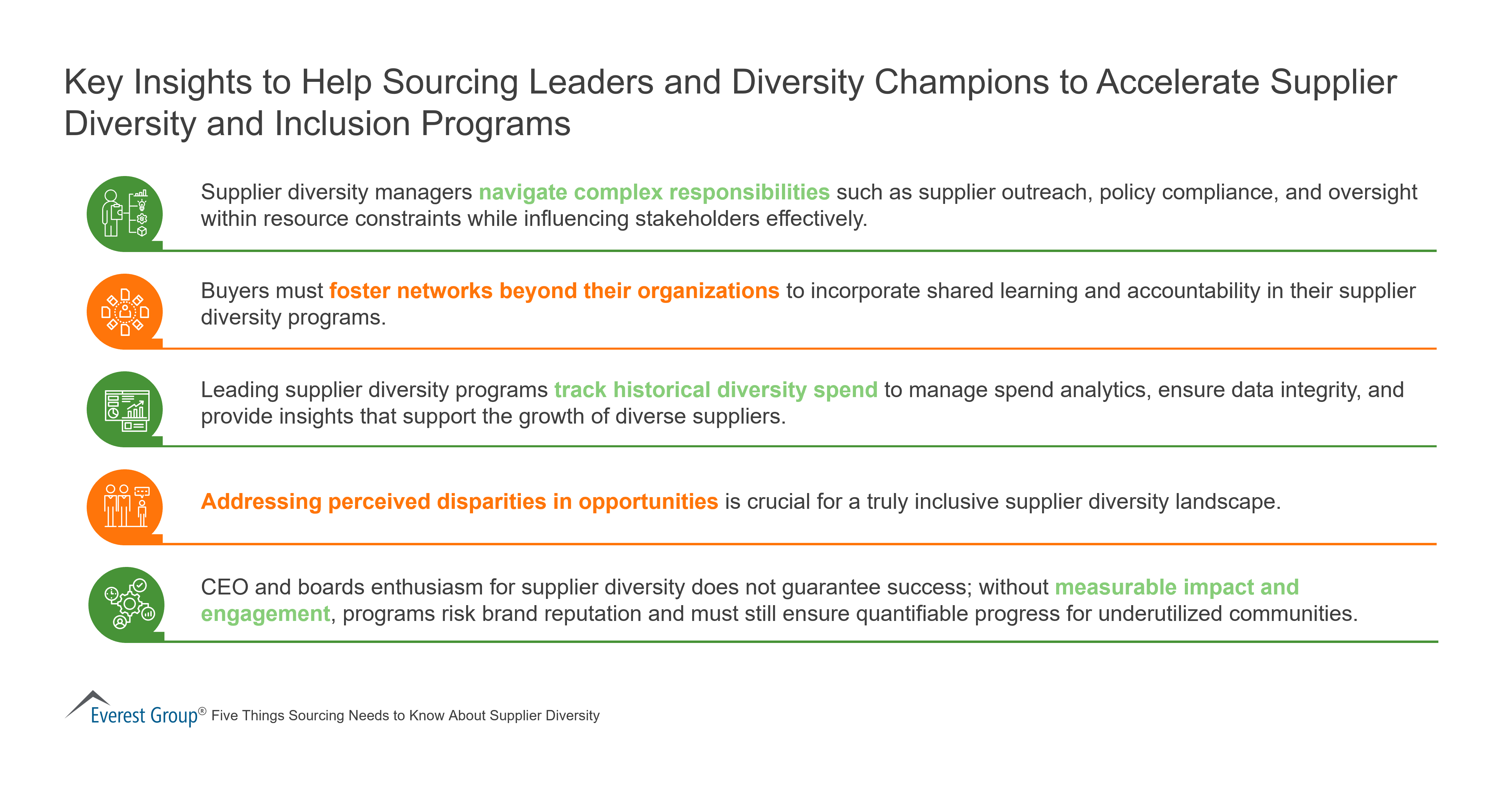

This influx of investments in the RCM space presents investors with numerous opportunities to kickstart their asset hunt. While a ripe opportunity, they must strategically approach investing in RCM. Beyond the financial and talent profile, investors should assess the following:

Let’s take a look at the major players involved in RCM operations and platforms:

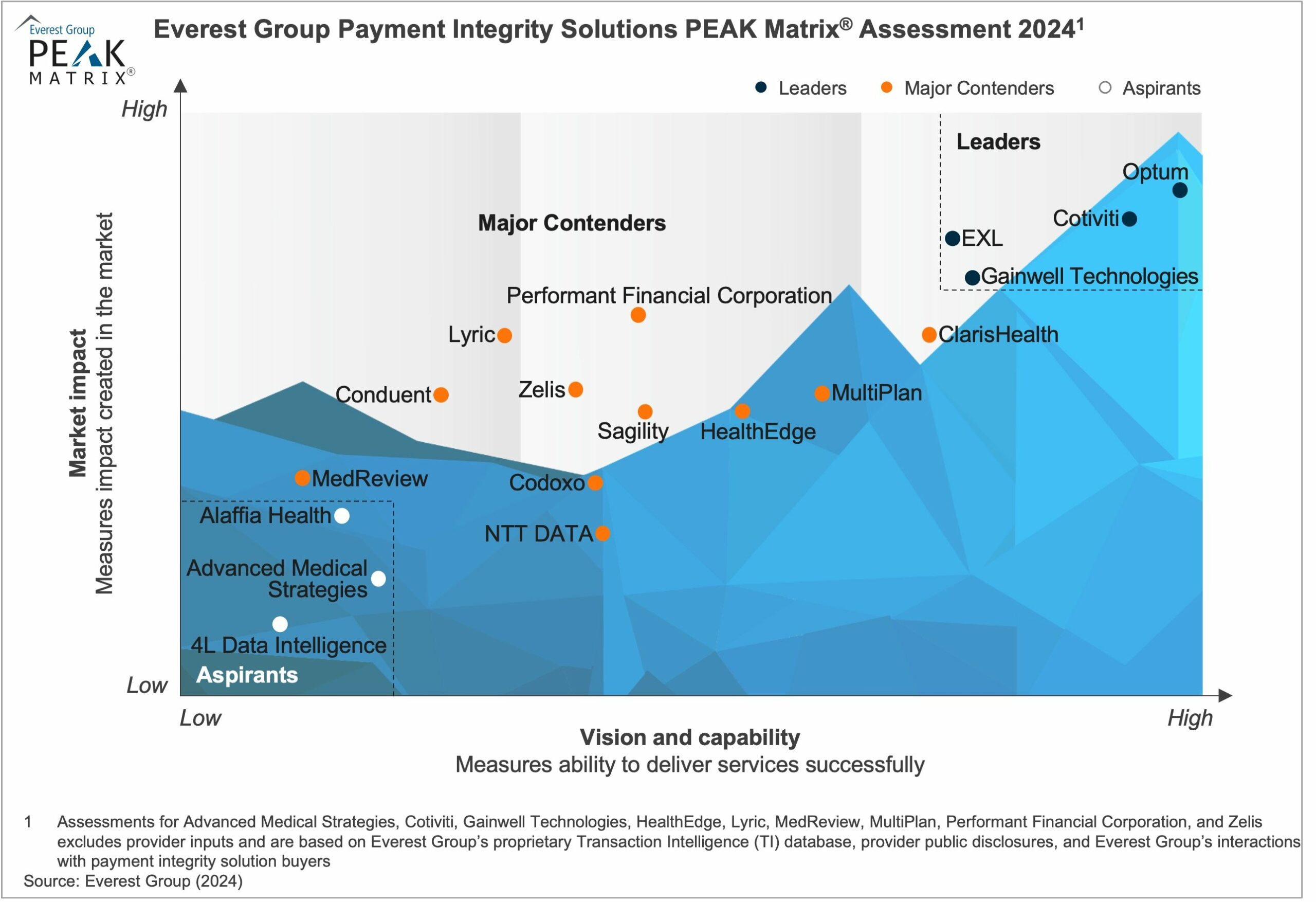

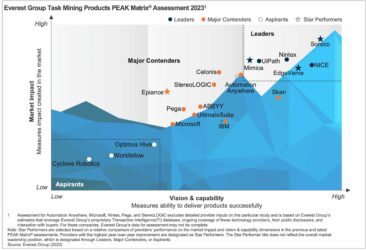

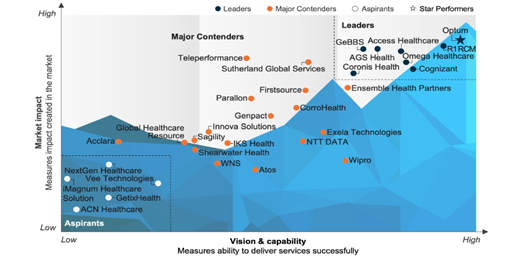

Everest Group Revenue Cycle Management (RCM) Operations PEAK Matrix® Assessment 2023

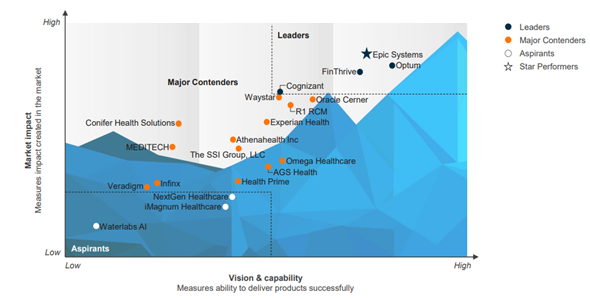

Everest Group Revenue Cycle Management (RCM) Platforms PEAK Matrix® Assessment 2023

The RCM industry is on the cusp of transformation as vendors push boundaries to differentiate themselves in a largely fragmented market. While this provides a ray of hope to all stakeholders, waiting and watching how the market progresses in the next couple of years is essential.

To discuss the Revenue Cycle Management outsourcing market, contact Abhishek AK, Ankur Verma, and Ishita Aggarwal.

See the RCM Platforms PEAK Matrix® Assessment 2023 and the Revenue Cycle Management (RCM) Operations PEAK Matrix® Assessment 2023 to see market trends for RCM platforms and the RCM platform providers in the market.

What are the existing pharma challenges around clinical data and analytics?

What are the existing pharma challenges around clinical data and analytics?