Outsourcing Demand Held Steady in Q4 2021 as Global Sourcing Industry Exhibited Modest Signs of Post-COVID Recovery | Press Release

Setups of Global Business Services centers increase in India and China, providing evidence of post-COVID economic recovery

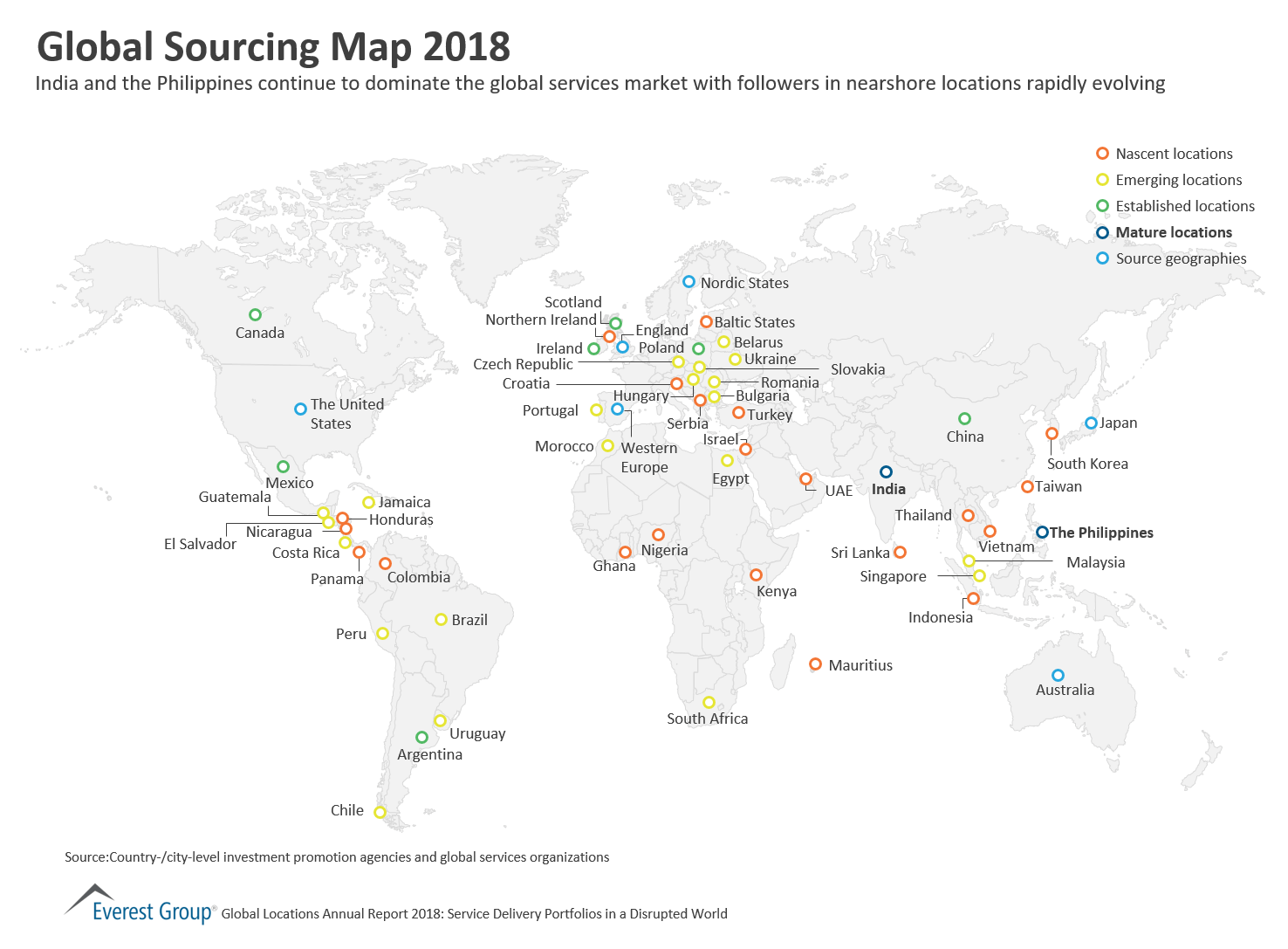

In its latest quarterly report on the global outsourcing industry, Everest Group revealed outsourcing demand held steady from Q3 to Q4 2021, with 404 transactions reported in each quarter. Activity in offshore locations experienced an increase, providing evidence of post-COVID economic recovery, particularly in India and China; however, offshore activity has not yet reached pre-COVID levels.

Notable Global Services Trends in Q3 2021:

- North America experienced a decrease in its share of outsourcing deals. “Rest of Europe” (excludes U.K.) and “Rest of World” (comprising Asia Pacific, the Middle East, Africa and Latin America) geographies recorded higher transaction activity compared to the previous quarter, due to an increase in deals across the energy and utilities sector.

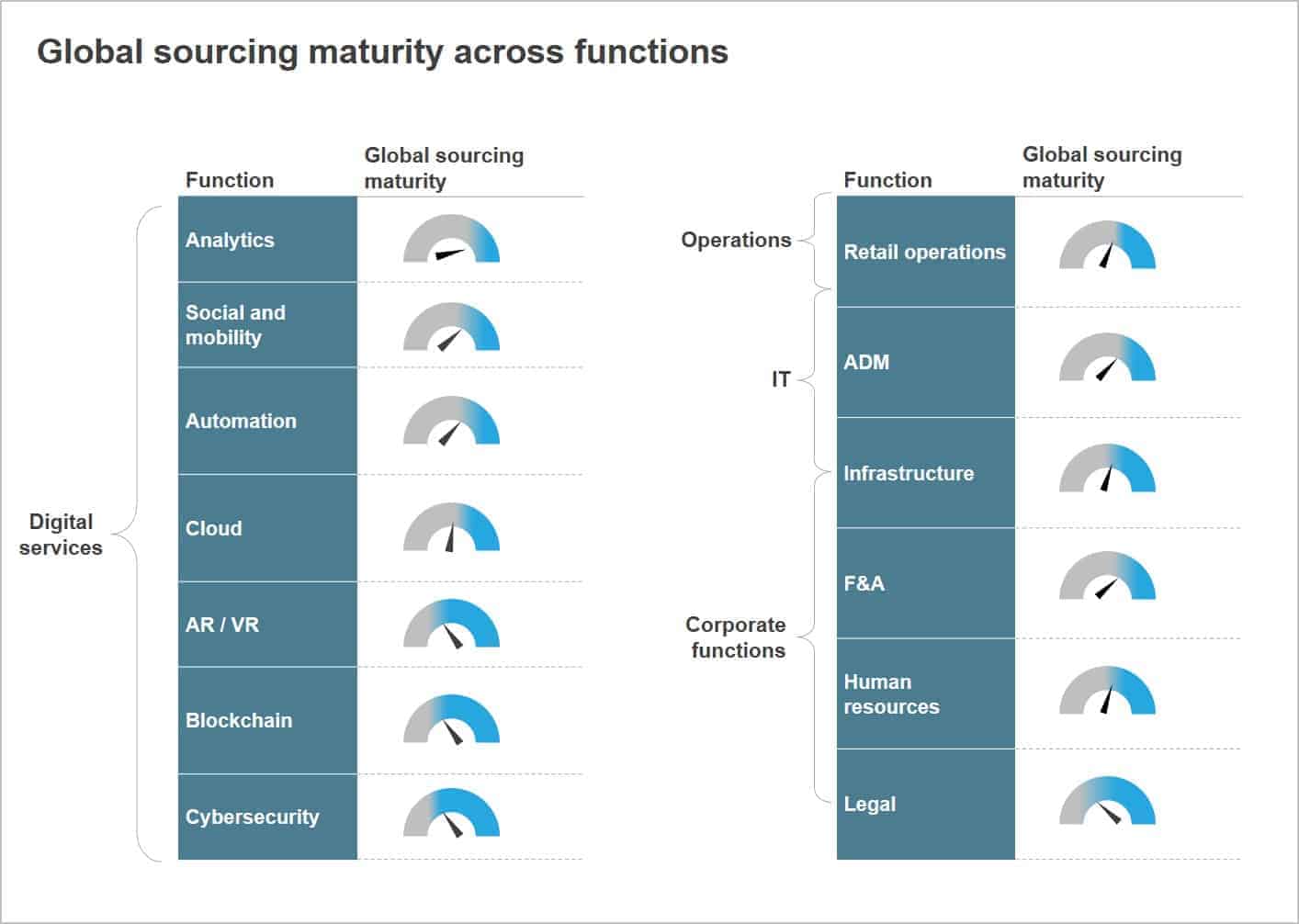

- The demand for digital services such as automation, blockchain, cybersecurity and Internet of Things (IoT) experienced an increase in offshore GBS centers, driven by cloud-based contracts as businesses continue to migrate toward cloud infrastructure.

- During Q4 2021 setups of new Global Business Services (GBS) centers in offshore/nearshore locations numbered 45 as compared with 37 in Q3 2021.

- Notably, GBS center setups increased in offshore Asia (primarily China), driven by companies in the manufacturing industry seeking to leverage engineering research and development (ER&D) services involving software development, systems integration and testing of autonomous, connected, electric and shared (ACES) mobility offerings.

- GBS activity also increased slightly in India, with 16 setups in Q4 2021 to deliver ER&D and digital services, compared with 15 setups in Q3 2021.

Key Service Provider Developments:

- Revenue for both global and offshore heritage service providers experienced a rise on a sequential and annual basis, but operating margin decreased in Q3 2021. In fact, the average operating margin of offshore heritage service providers is at its lowest when compared to the last two quarters. Although revenues have increased, an increase in employee, subcontractor and hiring costs as well as lower utilization of resources have negatively impacted margins.

- Merger and acquisition (M&A) and alliance activity among service providers experienced an increase, driven by heightened demand for digital-based capabilities, especially artificial intelligence (AI) and cloud. Forty-four acquisitions were documented for Q4 2021 as compared to 25 in Q3 2021. Alliances also experienced a significant increase.

- The number of setups of delivery centers by service providers remained similar to the previous quarter. Centers established in onshore regions decreased from 10 in Q3 2021 to four in Q4 2021; on the other hand, the number of new centers in offshore regions increased from four in Q3 2021 to 10 in Q4 2021.

- Service providers are now deriving 40-45% of automotive engineering services revenues from engagements involving ACES mobility services, a market which is expected to increase through 2025 at a rate of 20%.

Everest Group’s Market Vista Report

In its newly published report, “Market Vista™: Q1 2022,” Everest Group highlights the key trends and developments in the fast-evolving global offshoring and outsourcing market. The study provides data, analysis and insights on major outsourcing deals, Global Business Services (GBS) market dynamics, trends in offshoring from emerging destinations, and service provider developments (including latest developments on next-generation technologies such as digital services). The report includes assessments of 29 leading service providers, including 4 engineering services providers.

About Everest Group

Everest Group is a research firm focused on strategic IT, business services, engineering services, and sourcing. Our research also covers the technologies that power those processes and functions and the related talent trends and strategies. Our clients include leading global companies, service and technology providers, and investors. Clients use our services to guide their journeys to maximize operational and financial performance, transform experiences, and realize high-impact business outcomes. Details and in-depth content are available at http://www.everestgrp.com.