“Do More with Less” Will Be Driving Force for Enterprises in 2024 — Everest Group

The Everest Group 2024 Key Issues Study reveals revenue growth and cost optimization as the top-most business priorities of enterprise executives for the coming year. ‘Cost and margin pressures’ rank as the No. 1 challenge while talent acquisition drops to No. 8.

DALLAS, December 8, 2023 — 2024 will be the year of doing more with less, according to the results of the Everest Group 2024 Key Issues Study of enterprise executives. Top priorities for enterprises for the year ahead are revenue growth and a continued emphasis on cost optimization. Talent acquisition, which dominated enterprise concerns just two years ago, is no longer among the Top 5 expected challenges, falling to No. 8 from previous No.1 and No. 3 positions in expectations for 2022 and 2023, respectively.

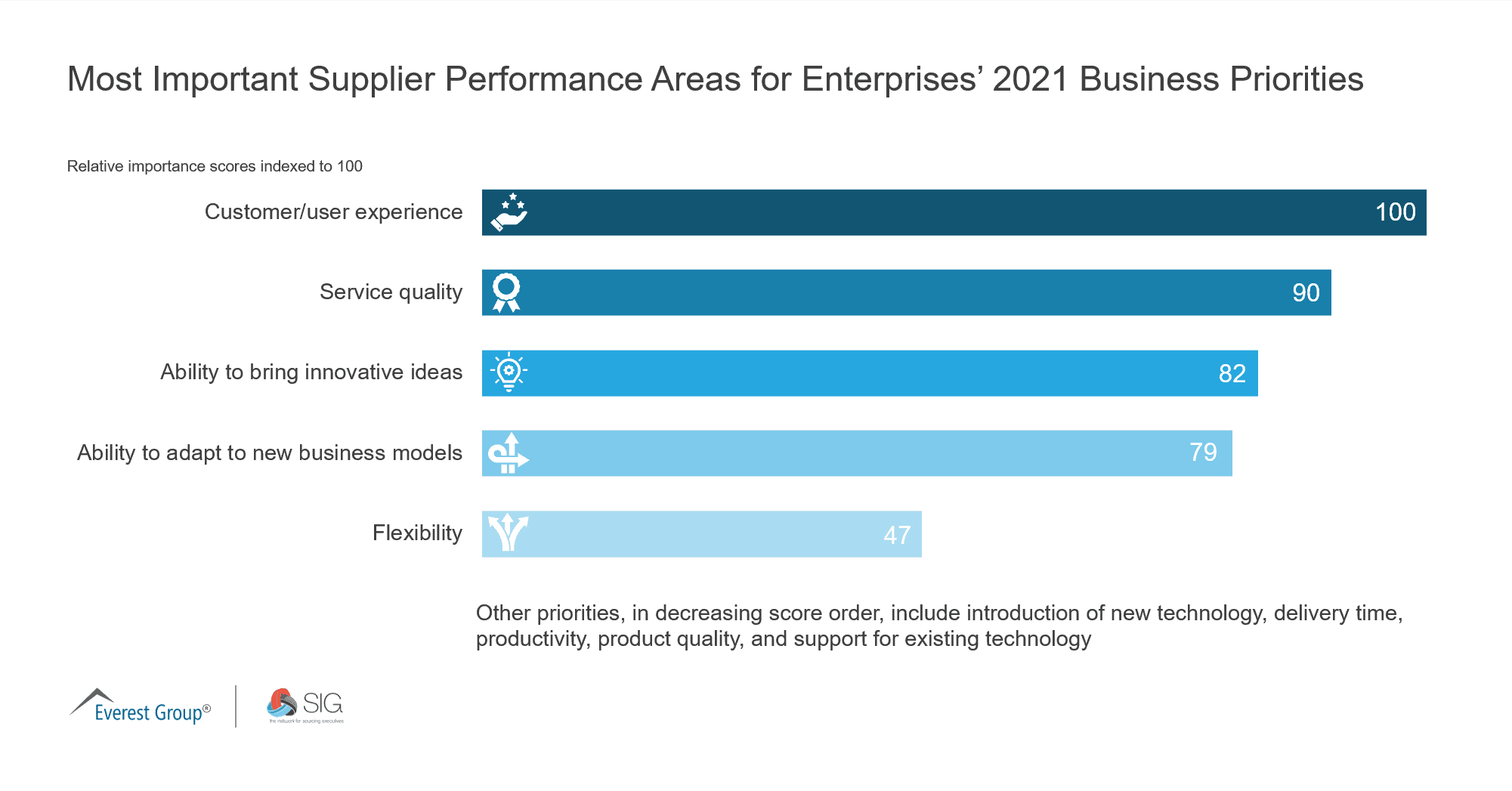

“’Do more with less’ will be the mandate in 2024 for both enterprises and service providers,” said Hrishi Raj Agarwalla, vice president at Everest Group. “Enterprise leaders in our 2024 Key Issues Study are clearly focused on lowering costs and increasing profitability and will be placing high expectations on service providers with little room for rate increases. Enterprise spending in 2024 will be directed toward modernizing technology, data analytics and process optimization. We’ll certainly see a ramp-up in GenAI investment as organizations continue to explore use cases and try to keep pace with the rapid changes AI is bringing. Overall, our research indicates that 2024 will be a ‘nose to the grindstone’ year of improving operational efficiency.”

***Webinar: Key Issues 2024: Creating Accelerated Value in a Dynamic World***

Everest Group will present the findings of its 2024 Key Issues Study in a December 12 webinar. Everest Group experts will discuss the major concerns, expectations, and trends for 2024 and provide recommendations on how to drive accelerated value from global services – helping position organizations to plan and align goals and succeed in 2024. ***Register for the webinar here.***

Following are a few of the findings from the 2024 Key Issues Study that will be discussed in the webinar:

New Technologies Drive Optimism

Although “bullish” may be too strong an adjective to use about enterprise expectations for 2024, the majority of enterprise executives are optimistic about the evolution and adoption of new technologies (76%) and positive changes in customer interest and purchasing behavior (52%). However, 75% of executives believed global macroeconomic conditions will have a negative influence on their business in 2024. Similarly, 68% of executives believe the geopolitical environment will pose challenges in the year ahead.

The Global IT-BP Services Industry Will Continue to Grow and Shift

A vast majority of enterprises (82%) expect their global services budgets either to remain flat (39%) or increase in 2024 (43%). The headcount growth is also expected to be lower than 2023. Further, enterprises expect to increase the leverage of Global Business Services and offshore locations.

New Investment Priorities

The key levers executives plan to use to achieve their business goals in the coming year include operational levers such as:

- Technology modernization

- Data analytics and insights

- Process optimization and operational efficiency

Productivity and Resilience Will Drive Technology Investments

Executives ranked cybersecurity as the highest priority technology investment for the next six to 12 months, followed by cloud solutions, advanced automation, big data analytics and generative AI (GenAI). Enterprises are still early in their GenAI adoption cycles. Due to a lack of in-house capabilities, many enterprises are turning to service providers for help in integrating GenAI into their operations. Most executives (67%) expect GenAI to improve or transform workflows in functional areas.

About Everest Group

Everest Group is a leading research firm helping business leaders make confident decisions. We guide clients through today’s market challenges and strengthen their strategies by applying contextualized problem-solving to their unique situations. This drives maximized operational and financial performance and transformative experiences. Our deep expertise and tenacious research focused on technology, business processes, and engineering through the lenses of talent, sustainability, and sourcing delivers precise and action-oriented guidance. Find further details and in-depth content at www.everestgrp.com.