Digital Delivery in the Global Services Market | Market Insights™

Digital Delivery in the Global Services Market: geographies, services, and sourcing models

Digital Delivery in the Global Services Market: geographies, services, and sourcing models

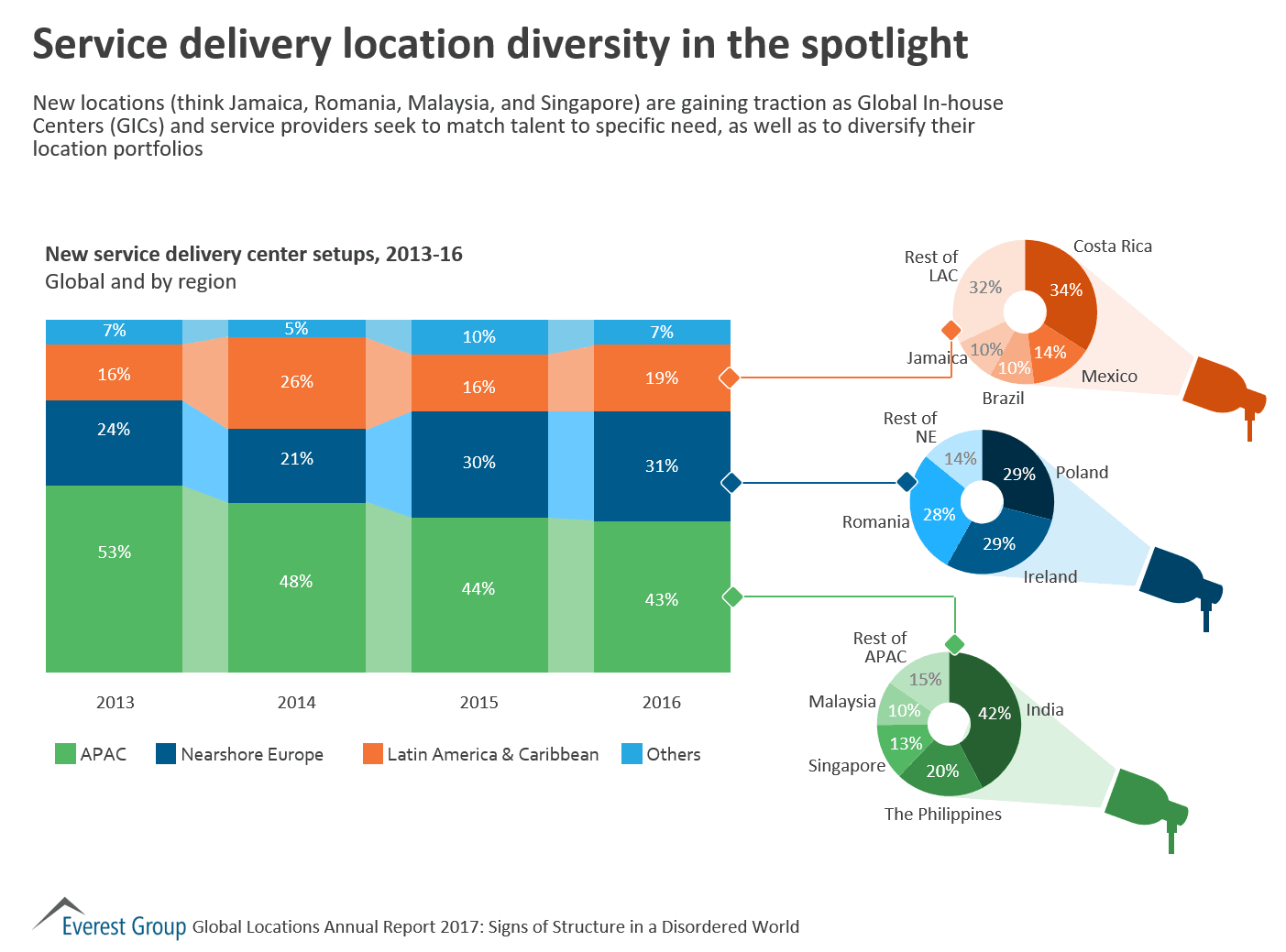

New locations (think Jamaica, Romania, Malaysia, and Singapore) are gaining traction as Global In-house Centers (GICs) and service providers seek to match talent to specific need, as well as to diversify their location portfolios

Given how long the outsourcing model has had to mature, the lion’s share of “traditional” (read: not including digital labor) contracts today are realizing the expected benefits for both buyers and providers. But when unplanned levels of variation in the internal demand for outsourced services enter the picture, serious quality, satisfaction, and cost issues can quickly rear their ugly heads.

Effective demand management – whatever the reason for the unplanned level – entails meeting internal customers’ demand and service level expectations while maintaining adequate control over the total outsourced spend.

Everest Group recommends buyers embrace three methods for managing demand variation in outsourcing contracts.

Periodic adjustment of baseline or band pricing

Buyers typically opt for baseline or banded pricing to manage volume changes. While both mechanisms provide for some demand flexibility, they expose service provider risk and trigger a risk premium in service pricing. And although volume baseline/band definition is standard in new or renewed contracts, high variation or significant demand shifts can render them obsolete. A solution to these challenges is establishment of a periodic pricing adjustment in which the buyer and service provider agree to review volume in specified periods and set the baseline at the six-month rolling average.

Appropriate outsourcing agreement structuring and clear resource unit definitions

In order for an outsourcing agreement to be mutually beneficial, the buyer and service provider need to share responsibility for demand management. Devising an agreement structure and resource unit definitions that increase the service provider’s stake in managing demand is a way to accomplish this goal. For example:

Comprehensive benchmarking of both per-unit prices and pricing metrics

When demand variation is high, or when volumes consistently increase and decrease, benchmarking per-unit prices alone can result in sub-optimal financial performance for the buyer. Comprehensive benchmarking, including both the per-unit price and the relevant pricing metrics as below, is a valuable solution.

Baseline pricing metrics

Banded pricing metrics

By employing these mechanisms to manage demand variation, buyers and suppliers can avoid issues in their relationship, achieve the full potential of the contract, and experience a win-win situation.

To learn more, please read Everest Group’s viewpoint entitled, “Demand Variation in Output-Based Pricing Contracts.”

Offshore delivery center set-ups are rising exponentially as both Global In-house Centers (GICs) and service providers realize value and increasingly see the benefits of location diversification for access to talent and risk management

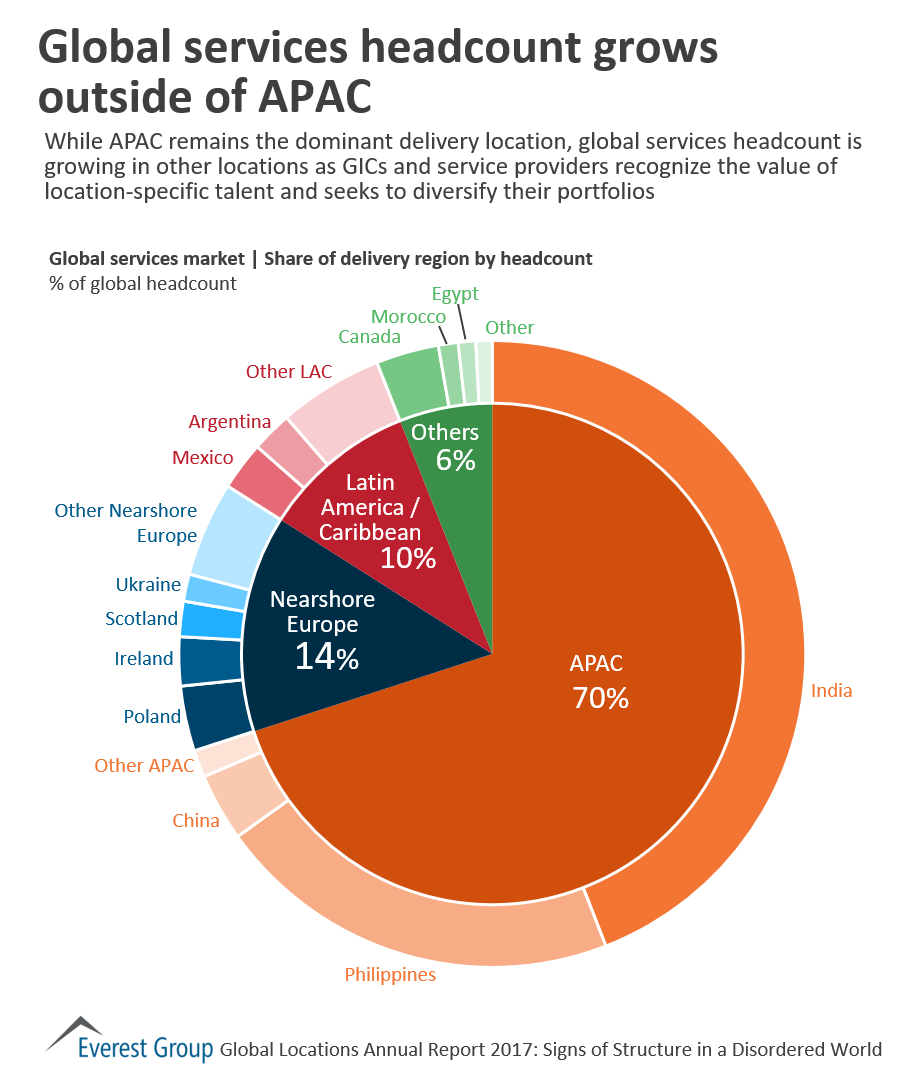

While APAC remains the dominant delivery location, global services headcount is growing in other locations as GICs and service providers recognize the value of location-specific talent and seeks to diversify their portfolios

While the APAC region remains dominant, other regions are growing on the back of digitalization, risk diversification, increasing regulation

To enable the growing adoption of automation, CCO providers are offering more advanced analytics options to their clients. Investments in predictive and prescriptive analytics now make up more than half of all analytics investments.

Though comparatively low as a percent of the total, multi-region CCO contracts are on the rise as enterprises seek to consolidate their portfolios and ensure a consistent customer experience across regions.

As more Multi-National Corporations (MNCs) target additional geographies for growth, the number of multi-region contracts will continue to grow in the coming years.

Mobile growth is 3X digital growth among large U.S. banks

Design Thinking: Why, What, and How

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields