June 30, 2015

Large CCO specialist service providers continue to lead the market, but BPO pure-plays show the fastest growth rates and innovative value

DALLAS, JUNE 30, 2015 — The Contact Center Outsourcing (CCO) market grew at 5 percent in 2014 to reach US$70-75 billion, which still represents only 20 to 25 percent of the total global contact center spend of US$300 to $350 billion.

Service provider consolidation is noticeably taking shape. Over a two year period from 2012-2014 the number of CCO contract terminations increased from 69 a year to 120 a year, for the first time outpacing the number of renewals. However, renewals and new contract signings continued at an active pace, growing by 16 percent and 8 percent respectively. As further evidence of this trend, the inclusion of value-added services jumped from 64 percent to 75 percent of renewing engagements. This indicates that buyers are not abandoning CCO but rather switching providers and/or consolidating spend with fewer providers.

These results and other findings are explored in a recently published Everest Group report: Contact Center Outsourcing Annual Report 2015: Incumbents Beware—There’s No Place for Complacency.

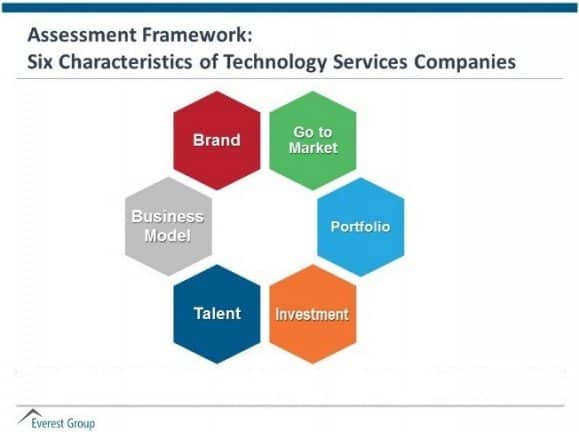

“Buyers are looking beyond service performance, expecting service providers to successfully address multiple aspects of their changing business needs and thus leaving no room for complacency amongst incumbents,” said Katrina Menzigian, vice president of research relations at Everest Group. “Providers are reacting to this changing landscape of buyer requirements by adapting their offerings, particularly in the areas of onshore delivery, multi-channel solutions, value-added services, technology, service delivery metrics and pricing models.”

Other key findings:

- CCO growth in markets such as the United States and United Kingdom flattened out, and new demand is being driven by Continental Europe, Middle East & Africa (CEMEA) and Asia Pacific.

- While telecom and banking, financial services and insurance (BFSI) are the leading adopters of CCO, industries such as healthcare, retail, and travel and hospitality are exhibiting high growth.

- Depth and breadth of inclusion of value-added services have continued to increase, with renewals witnessing higher inclusion.

- Share of non-voice channel continues to increase, driven by increased adoption of multi-channel solutions, especially chat and social media.

- North America and CEMEA witnessed the highest adoption of multi-channel contracts across all geographies.

- CCO specialists dominate the market but have recorded moderate growth. Business process outsourcing (BPO) pure-plays have witnessed higher growth based on their focus on innovation, analytics and multi-channel services.

- Atento, Xerox, Convergys and Teleperformance, are the top service providers in the space in terms of revenue. The leading service providers (in terms of market share) vary across geographies and industries.

***Download Complimentary 11-page Preview Report Here*** (Registration required.) This preview summarizes report methodology, contents and key findings and offers additional resources.

The full report analyzes the global CCO market, focusing on:

- Market size and buyer adoption

- Value proposition and solution characteristics

- CCO service provider landscape, comprising 20 CCO service providers: Aegis, Alorica, CGI, Concentrix, Dell, Firstsource, Genpact, HCL, HGS, HP, Infosys, Minacs, Serco, Sitel, Sutherland, Sykes, TCS, Tech Mahindra, Teleperformance, Transcom Worldwide, Wipro, Webhelp Group, and WNS

*** Download Publication-Quality Graphics ***

High-resolution graphics illustrating key takeaways from this report can be included in news coverage, with attribution to Everest Group. Graphics include:

- Signs of emerging anti-incumbency in Contact Center Outsourcing

- Contact Center Outsourcing contract TCV is both shrinking and growing

- Long live e-mail … in CCO!

- Three indicators of the increasing preference for onshoring in Contact Center Outsourcing